Creating a receipt template for your single-owner LLC is a straightforward task that helps maintain clear financial records. This template should capture key transaction details, making it easy for both you and your clients to keep track of business payments.

Include the business name, address, and contact information at the top of the receipt. This ensures transparency and offers your clients a direct way to reach you if needed. Add a unique receipt number for each transaction, which helps in organizing and referencing past payments.

For the transaction details, specify the product or service provided, along with the price. If applicable, include sales tax information. It’s also a good idea to note the payment method (e.g., cash, check, credit card) to provide further clarity. Lastly, provide a total amount due or paid, and include space for any additional comments or notes that may apply to the specific transaction.

Here are the corrected lines where word repetitions have been minimized:

Focus on simplifying the sentence structure while maintaining clarity. Replace repetitive phrases with more concise alternatives to improve readability.

For example, instead of saying “You need to provide your business details and information about your business,” revise it to “Provide your business details.” This eliminates redundancy without losing meaning.

Additionally, avoid using the same word multiple times in close proximity. For instance, instead of “The invoice includes the total amount due and the total amount due is payable immediately,” change it to “The invoice includes the total amount due, payable immediately.”

Always review your receipt templates for unnecessary repetitions and revise them for clarity and brevity. Clear, straightforward language creates a better user experience and ensures professionalism.

- Sample Receipt Template for Single Owner LLC

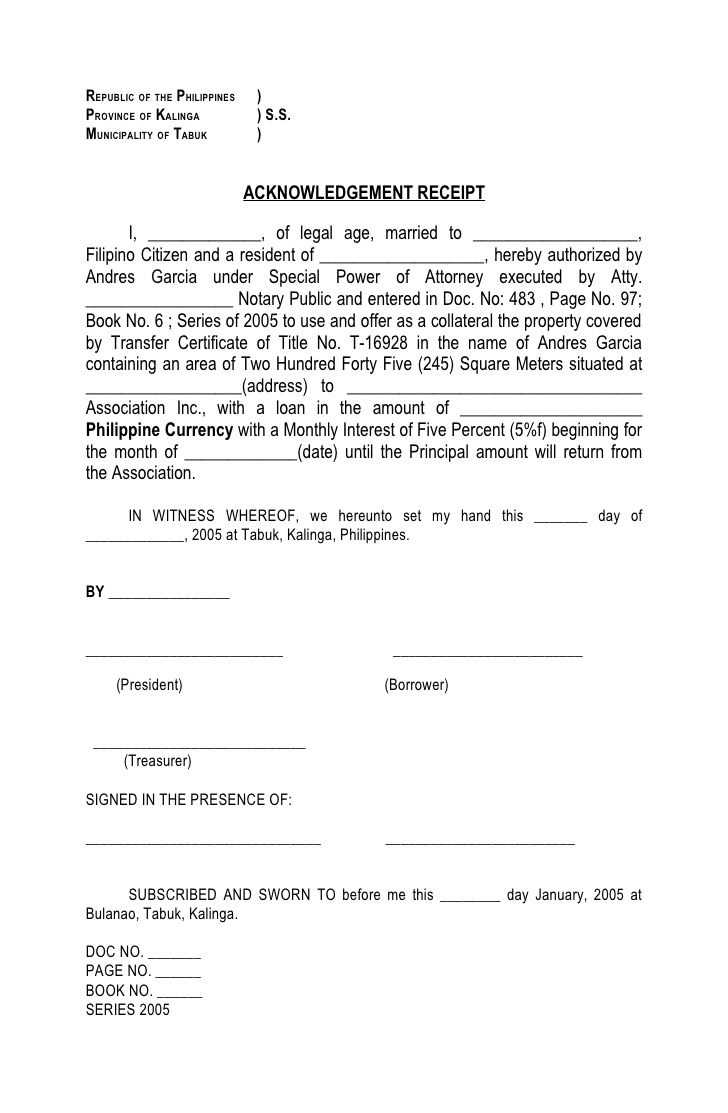

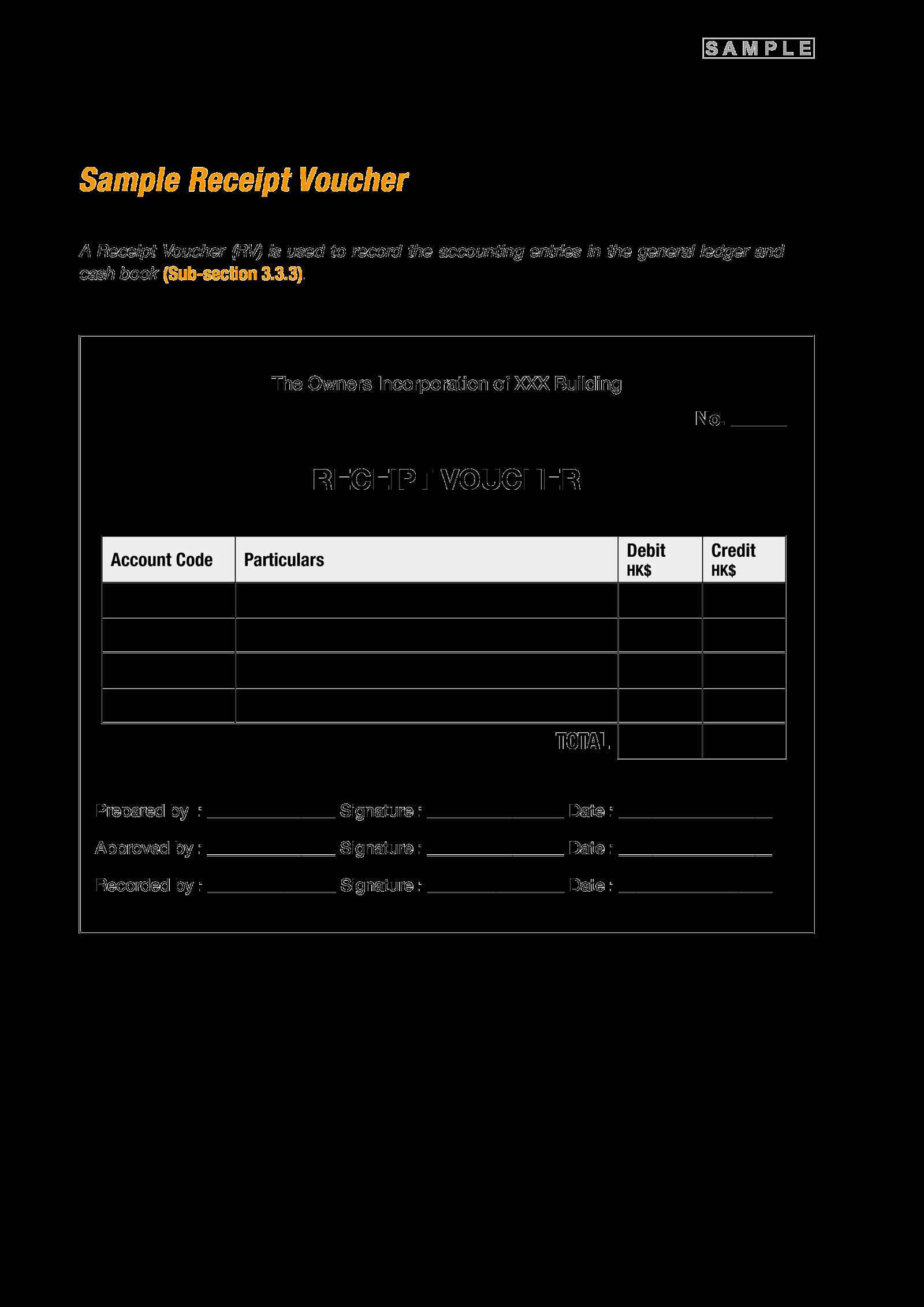

A receipt for a Single Owner LLC should clearly identify the transaction, the amount, and both the buyer and seller. Here’s a practical template to follow:

Receipt Template

Below is a sample format for a single-owner LLC receipt:

- Receipt Number: Unique identifier for the transaction.

- Business Name: Name of your LLC.

- Business Address: Include the physical address of the LLC.

- Seller’s Name: Name of the LLC owner.

- Buyer’s Name: Full name of the customer or client.

- Date of Transaction: Date when the transaction occurred.

- Item(s) Purchased: List each item or service, including quantity and price.

- Total Amount: Total cost for the transaction, including taxes if applicable.

- Payment Method: Specify the method (cash, credit card, check, etc.).

- Signature of Seller: Signature or digital acknowledgment by the LLC owner.

How to Use the Template

Ensure that all fields are filled out correctly and legibly. If using a digital version, consider adding a line for the buyer’s signature as well, especially for significant transactions. Each receipt should be stored for accounting purposes and available upon request from customers or for tax purposes.

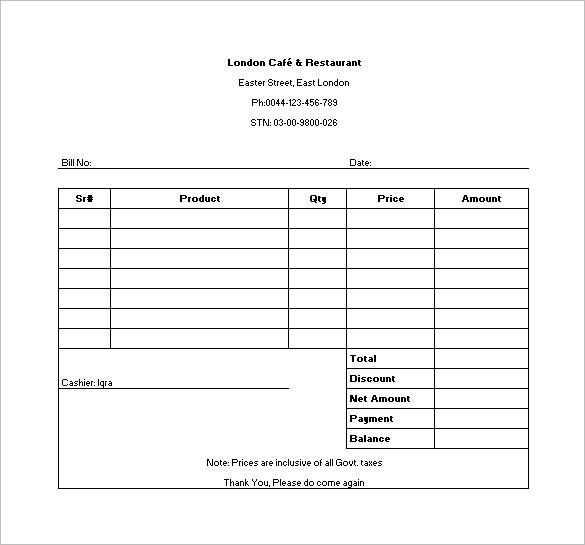

Begin by clearly indicating the transaction date and a unique receipt number. This helps both you and your client keep track of the records easily. A good format is: “Receipt No: [number] | Date: [MM/DD/YYYY].”

Include your LLC’s name and address at the top of the receipt. If you have a logo, it can be added to the header for a professional touch, though it’s not mandatory. Also, list your business tax ID number to confirm the legitimacy of the transaction.

Next, specify the transaction details. Provide a brief description of the goods or services exchanged, including quantities and unit prices, if applicable. Each line item should be clear and concise. For example, “Service Fee for [specific service] – $[amount]” or “Product X – [quantity] – $[amount].”

Follow up with the total amount paid. Ensure you clearly highlight the total to avoid any confusion. If applicable, list any discounts or tax amounts separately before arriving at the final total.

Lastly, include a section for payment method. Whether the transaction was made via cash, check, credit card, or other, specifying this provides clarity for both parties. It’s helpful to have a note about whether the payment is fully settled or if there’s a remaining balance.

Consider adding a thank you note or a brief statement such as, “Thank you for your business!” as a polite gesture. This adds a personal touch while reinforcing customer relations.

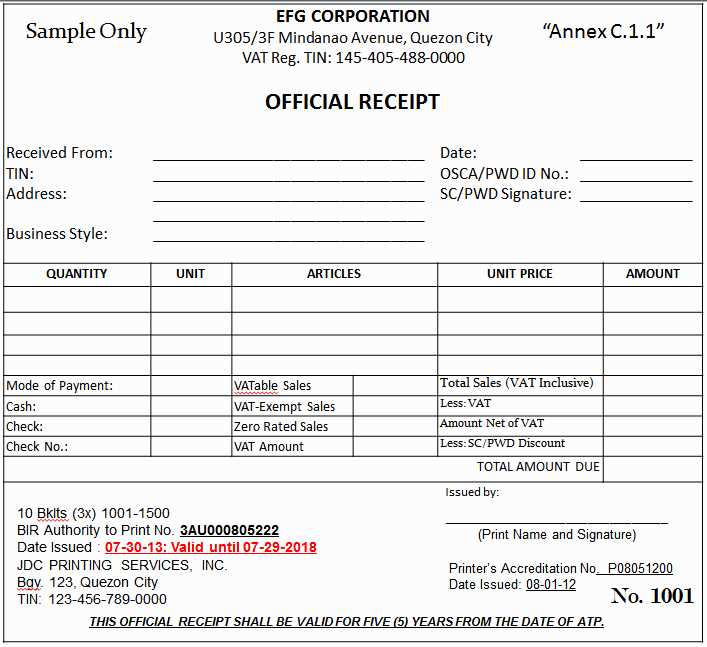

For legal and tax compliance, ensure your receipt includes key details to provide a clear and accurate record. This helps both the business owner and tax authorities verify transactions efficiently.

Business Information

Start by including the LLC’s legal name, the business address, and the IRS Employer Identification Number (EIN). These details link the receipt to the correct business entity and ensure proper tax reporting.

Transaction Details

Every receipt should specify the date of the transaction, a description of the goods or services provided, and the total amount paid. This is crucial for proper financial record-keeping and tax filing.

Tax Information

If applicable, include the sales tax rate and the total tax amount charged. This ensures transparency in the calculation of the total amount due and helps with tax deductions or reporting.

Payment Method

Clearly state the method of payment, whether it’s by cash, credit card, check, or another form. This detail is useful for both record-keeping and reconciling payments for tax reporting purposes.

Refund and Return Policy

If relevant, outline the refund or return policy on the receipt. This can help clarify any future disputes or questions from the customer about returns and taxes related to returns.

Table Example

| Information | Example |

|---|---|

| Business Name | XYZ Landscaping LLC |

| Address | 123 Green St, Springfield, IL |

| EIN | 12-3456789 |

| Transaction Date | February 12, 2025 |

| Description | Lawn Mowing Service |

| Total Amount | $75.00 |

| Sales Tax | $5.00 |

| Payment Method | Credit Card |

| Refund Policy | No Refunds After 30 Days |

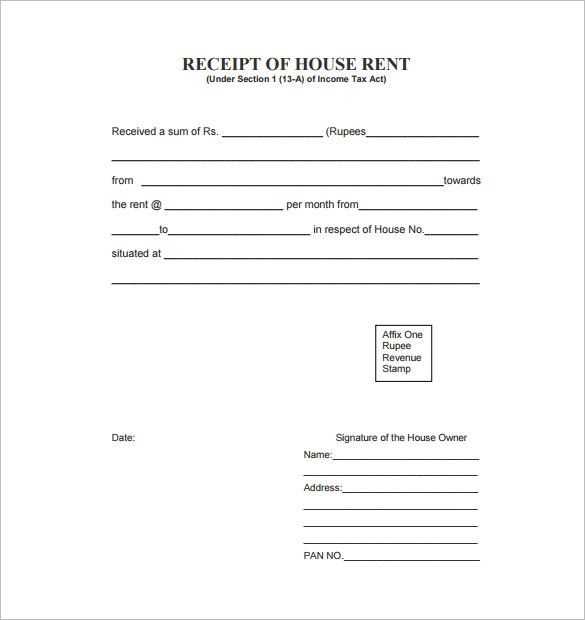

To make your receipt template reflect your unique business, focus on adding details that matter to your transactions. Include fields for your business logo, contact information, and website URL so customers can easily reach you. If you sell multiple products or services, break down the items in a clear, organized table that includes product names, quantities, and prices.

Include Tax and Discounts

If your business applies tax or offers discounts, add sections that automatically calculate and display those amounts. Make sure to include the tax rate and any discount applied, so customers know exactly what they’re paying for. This transparency helps build trust and prevents confusion.

Payment Method and Transaction Details

Provide clear payment details, including the payment method (credit card, cash, etc.) and transaction reference number. This information is critical for both you and the customer in case any issues arise with the payment later. For subscription-based services, mention the billing cycle and renewal dates to keep your customers informed about ongoing charges.

For single-owner LLCs, creating a receipt template that suits your needs is simple and ensures accuracy in business transactions. A receipt should always include specific details that clarify the transaction for both you and your client.

Make sure to add the date of the transaction to mark the exact moment of the sale. Including the name of your LLC and your contact information establishes your business identity. It’s critical to list the items or services provided, including clear descriptions and the corresponding amounts. This transparency builds trust and avoids any future confusion.

Be specific with payment methods–whether it’s cash, card, or check–along with the total amount paid. Consider adding a unique receipt number for tracking purposes. This can simplify your bookkeeping and help with tax filing.

If applicable, include tax information. If your LLC is required to collect sales tax, ensure it’s clearly stated, along with the rate applied. This keeps you compliant with local laws and shows your business is handling transactions correctly.

Lastly, always provide a thank-you note or statement of appreciation on the receipt. It creates a positive experience for your client, encouraging repeat business.