Use the OSCR receipts and payments template to track your organization’s financial activity. This straightforward template helps you clearly record all income and expenses, making it easier to stay compliant with regulatory requirements.

Ensure that you categorize each entry correctly. For example, group your income from donations, grants, or other sources separately from your operating costs like rent, utilities, or payroll. This will provide a transparent view of how funds are being used.

Regularly update the template to maintain accurate records. Doing this allows for smooth financial audits and provides an overview of your organization’s cash flow. Keep your entries concise and verify each detail for accuracy to avoid confusion later on.

By utilizing the OSCR receipts and payments template, you simplify financial tracking, stay organized, and help ensure your financial reports are easily understandable by stakeholders.

Here is the revised version of the text with minimized repetition:

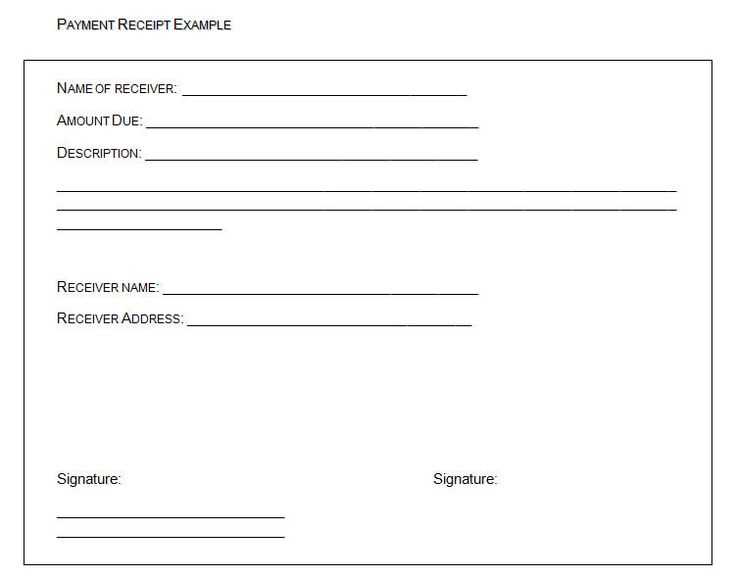

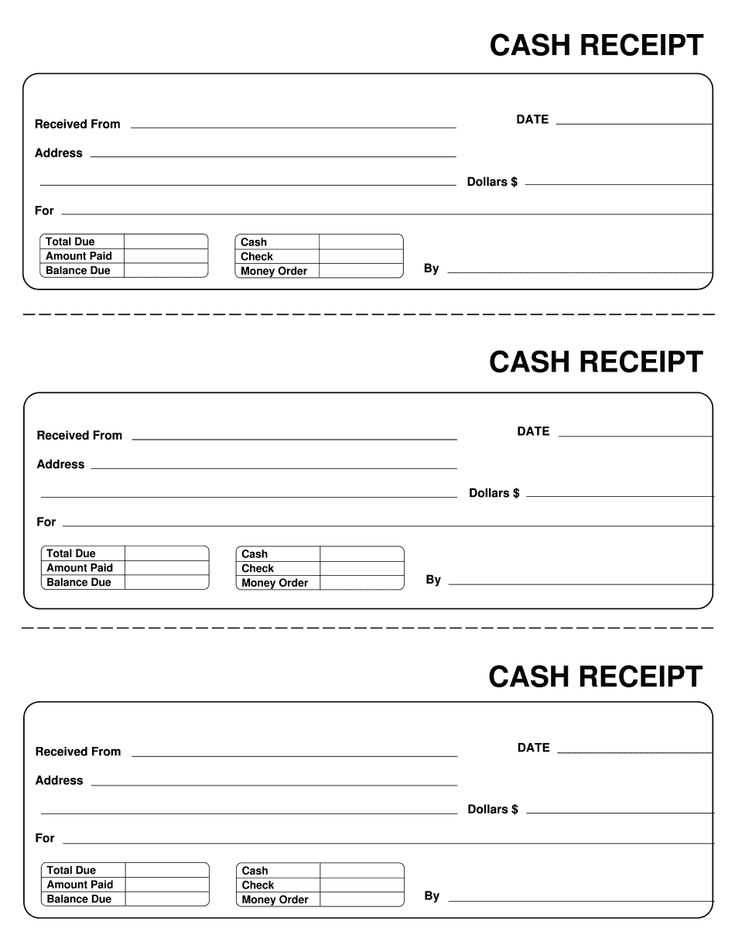

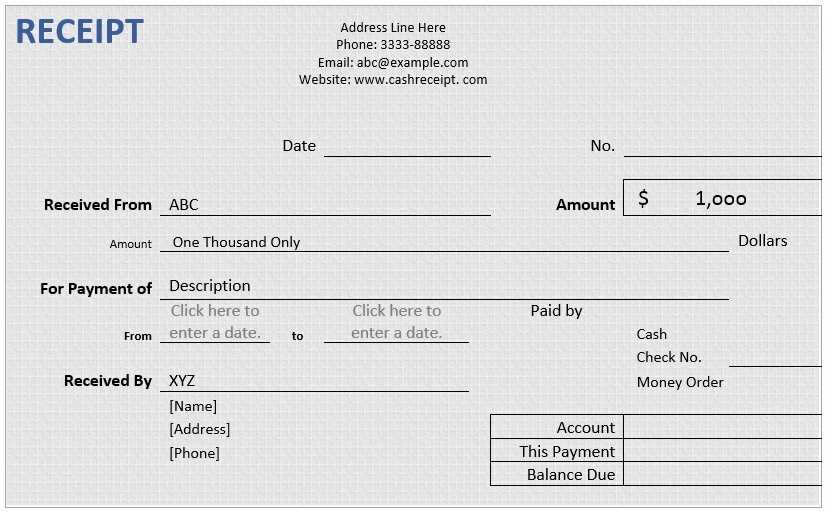

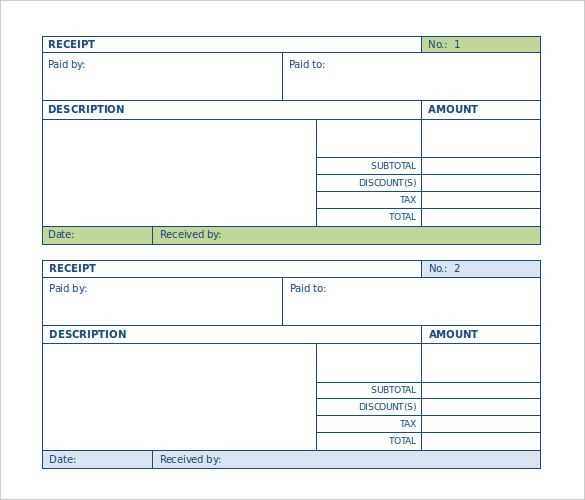

To improve the clarity and efficiency of your OSCR receipts and payments template, focus on simplifying the layout. Group similar transactions together, use clear headings, and provide spaces for necessary details such as date, amount, and description. This makes it easier to track payments and receipts, while reducing redundancy.

Clear Sectioning

Each category should have a dedicated section, such as “Receipts” and “Payments”. This ensures that the template remains organized and prevents mixing different types of data. Use bullet points for each entry to separate them visually, making it easier to scan the document.

Concise Entries

Write brief but informative descriptions for each transaction. Avoid long explanations or unnecessary words. For example, instead of saying “Payment for the services rendered during the month”, simply state “Service payment – January”. This reduces clutter and enhances readability.

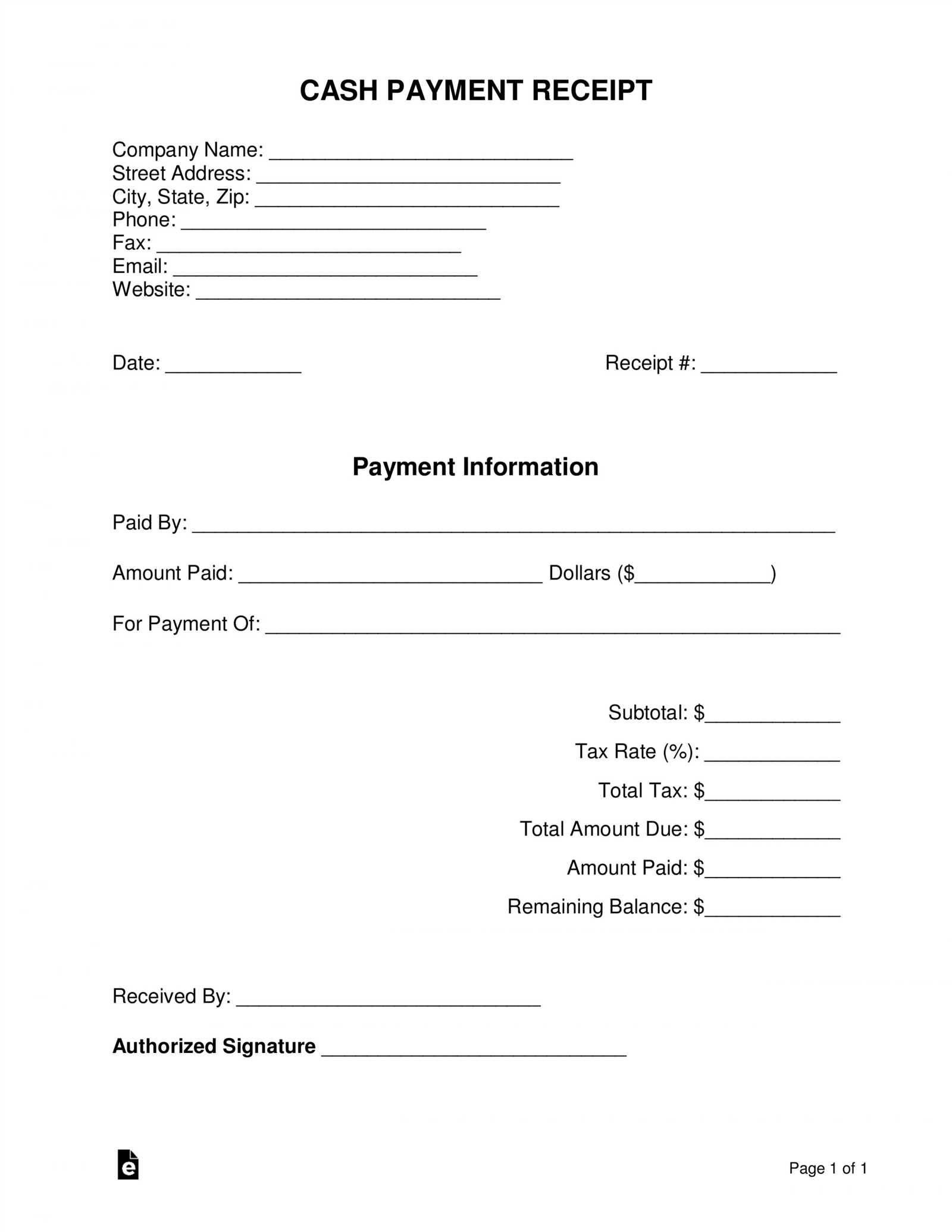

To further improve the user experience, consider adding a summary section at the end of the template that totals all receipts and payments. This allows quick reference and makes financial tracking more straightforward.

- OSCR Receipts and Payments Template

The OSCR Receipts and Payments Template is designed to provide a clear and organized framework for documenting your charity’s financial activities. It includes two main sections: receipts (income) and payments (expenditures). These categories ensure transparency in managing funds, which is crucial for maintaining trust with donors, funders, and the regulatory authorities.

To use this template effectively, start by recording every receipt (donation, grant, or fundraising income) with relevant details, such as the date, amount, and source of income. Similarly, document every payment (e.g., operational costs, salaries, grants) along with the date, recipient, and purpose. Keeping these records up to date prevents discrepancies during audits or reporting periods.

Ensure the template captures all required data in the appropriate columns: “Income” and “Expenditure.” For clarity, avoid combining receipts and payments in a single entry. For example, separate donations from operational expenses, even if they occur on the same date. If a transaction involves both a receipt and a payment (e.g., when a donation is used for a specific project), create two distinct lines for accurate reporting.

Remember to regularly review and update your financial records. This will help in preparing accurate and transparent annual accounts for submission to OSCR, ensuring compliance with their reporting requirements.

Begin by organizing your template into clear sections that align with the OSCR guidelines. Separate receipts and payments into distinct categories, such as income, expenditure, and assets. Within each category, use specific labels that match the details requested by OSCR, like restricted and unrestricted funds, grants, and donations. This keeps everything transparent and ensures compliance with reporting standards.

For accurate financial reporting, break down income and payments by type. For example, list donation income, fundraising, and grants separately under their relevant headings. Include the amounts for each source, and always match them with the corresponding expenditure if applicable. This method allows for an easy comparison between income and costs associated with different activities.

Ensure each entry is supported by adequate documentation. Include references to supporting records like receipts, invoices, and bank statements. Use these records to justify the amounts reported and offer clarity in case of audits. This practice helps maintain transparency and provides a solid foundation for each entry.

For restricted funds, create separate subcategories within the income and payment sections. This keeps track of how funds are allocated and ensures that they are used for their intended purpose. Clear tracking of restricted funds will avoid any confusion when it’s time to submit the report.

Regularly update your template to reflect the most recent transactions. Keep the format consistent, ensuring all sections are complete and current. This will not only help with accuracy but also save time during the reporting process.

One of the most common mistakes when using the OSCR template is failing to correctly categorize transactions. Make sure each payment or receipt is accurately assigned to the right category, as misclassifications can lead to incorrect reporting. Always double-check the categories for consistency.

1. Missing or Incomplete Information

It’s crucial to include all relevant details, such as dates, amounts, and descriptions. Incomplete entries not only affect the accuracy of your records but may also lead to delays in reporting. Double-check that every field is filled in properly.

2. Ignoring the Template’s Format

OSCR templates are designed with a specific structure to ensure consistency. Avoid altering the template’s format, as this can cause errors in calculations and make the document harder to process for reviewers. Stick to the provided fields and structure.

3. Failing to Include Supporting Documents

Always attach receipts or invoices that correspond to payments or receipts listed on the template. Leaving out supporting documents can raise questions about the legitimacy of your entries. Ensure all financial transactions are backed by proper documentation.

4. Overlooking Deadlines

Submitting the completed OSCR template late can result in penalties or delays in your financial reporting. Set reminders for submission deadlines and ensure everything is finalized in advance to avoid last-minute errors.

5. Not Updating Financial Figures Regularly

Regular updates to the financial figures are necessary to maintain accuracy. Don’t wait until the last moment to make adjustments. Keep the template updated as transactions occur to prevent discrepancies and missed entries.

6. Forgetting to Reconcile Accounts

Before finalizing your report, reconcile all accounts to ensure that the figures match your bank statements and internal records. Failing to do this can lead to discrepancies between your template and actual financial data.

7. Misunderstanding Tax Implications

Ensure that all receipts and payments reflect the correct tax treatment. Mistakes in this area can result in compliance issues or incorrect reporting of taxable income. Always consult with a financial advisor or accountant if you’re unsure about the tax classifications.

Begin by reviewing your organization’s specific reporting requirements. Identify all necessary categories that need to be included in the OSCR template, such as income types, expenditure categories, and asset declarations. Tailor these categories to match your financial practices and ensure compliance with legal or regulatory obligations.

Adjust Income and Expense Sections

Edit the income and expenditure sections based on your financial data. If your organization receives donations, grants, or other sources of income, customize the template to reflect each income type clearly. The same goes for expenses: list them in categories such as operational costs, program expenses, or fundraising costs to make the breakdown more accurate.

Customize Reporting Periods

Ensure the template reflects the correct financial year. Adjust the start and end dates for the reporting period to match your fiscal calendar. This ensures accurate reporting and alignment with your accounting practices.

Finally, review the formatting and make sure that the sections are easy to read. Clear headings, consistent font sizes, and well-organized tables will enhance the clarity of your report. If necessary, remove or combine sections that do not apply to your organization to avoid clutter and maintain simplicity.

Hey! How’s it going? What’s on your mind today?