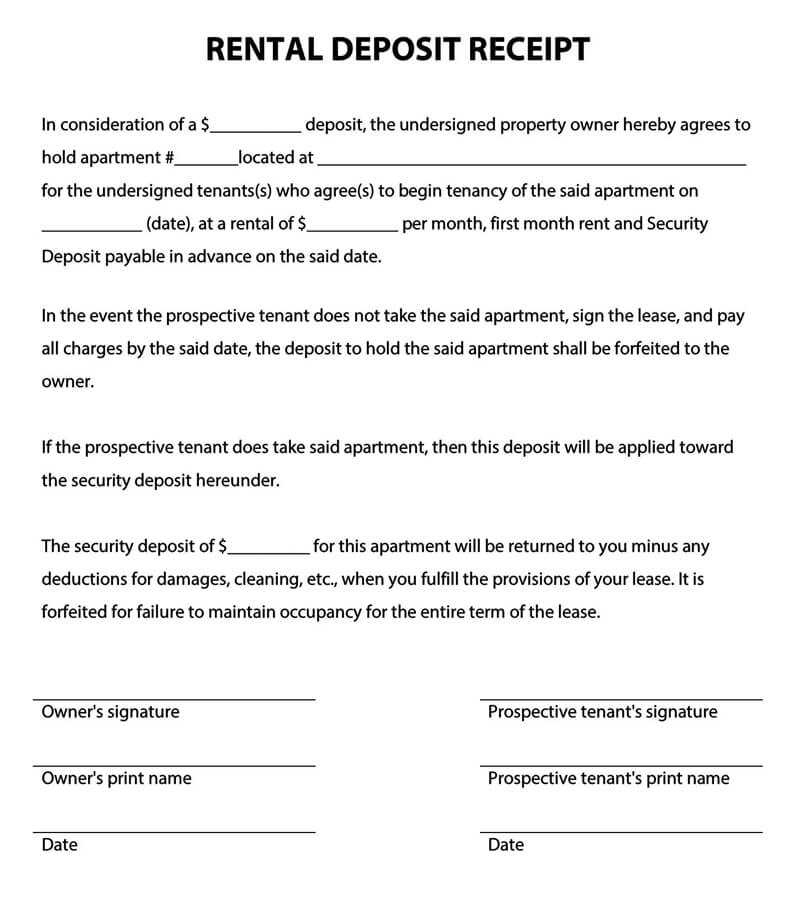

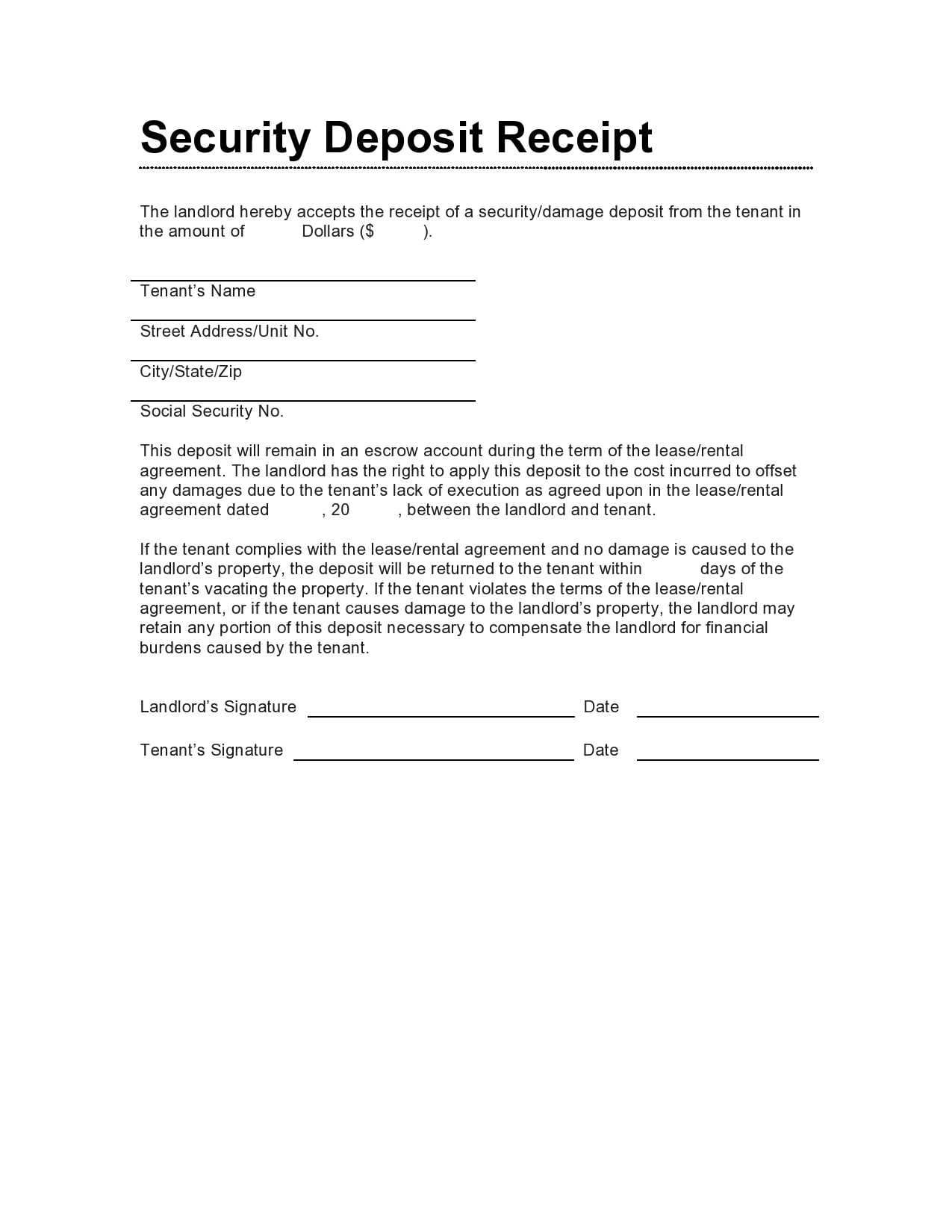

A lease deposit receipt serves as a critical document in rental agreements, confirming the receipt of a deposit paid by the tenant. It outlines the amount, date, and purpose of the deposit, providing both the landlord and tenant with a clear record of the transaction. This simple yet crucial piece of paperwork helps prevent future disputes by establishing mutual understanding of the terms related to the deposit.

When drafting a lease deposit receipt, make sure it includes the tenant’s and landlord’s full names, the property address, the date the deposit was received, and the exact amount paid. Additionally, specify the purpose of the deposit, such as security for potential damages or unpaid rent. If applicable, clarify the conditions under which the deposit may be withheld or refunded.

Incorporating clear terms and transparent conditions in the receipt protects both parties and ensures accountability. Using a well-structured template can make the process smoother and more organized. It’s recommended to keep a copy of the signed receipt for both the landlord and tenant’s records, offering legal protection should any issues arise down the line.

Here is the revised version without excessive repetitions:

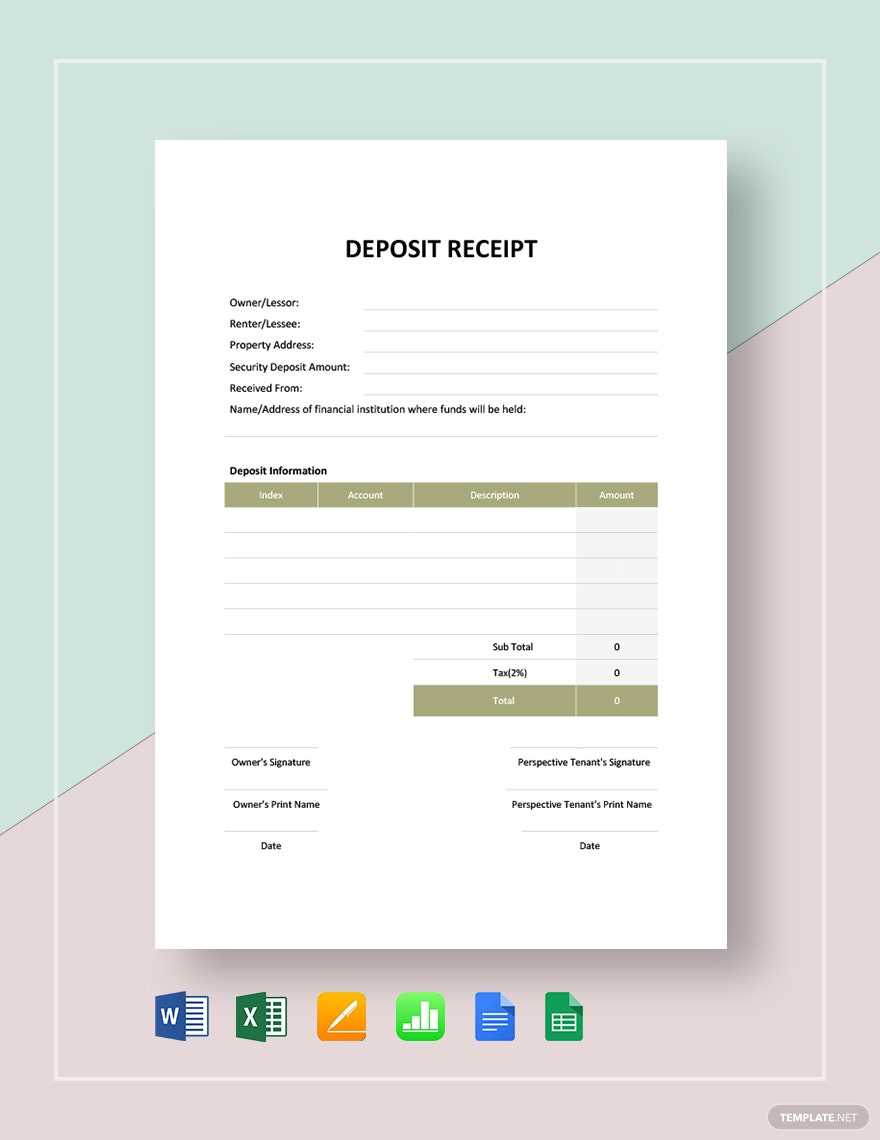

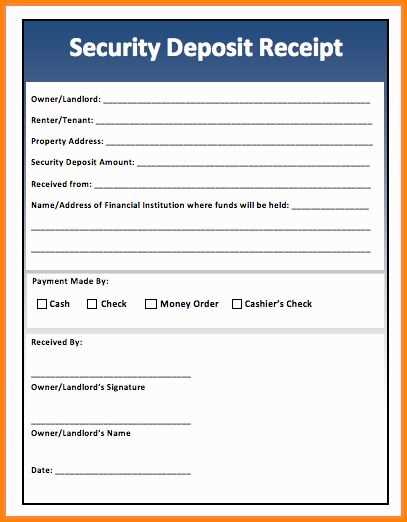

For creating a lease deposit receipt, ensure it includes the following details:

- Tenant’s full name and address

- Landlord’s full name and address

- Date of lease agreement and payment

- Deposit amount received

- Payment method used

- Property address

- Specific terms related to deposit return

- Signatures of both parties

Structure of the Lease Deposit Receipt

| Section | Details |

|---|---|

| Tenant Information | Full name, address |

| Landlord Information | Full name, address |

| Deposit Amount | Amount received for the lease |

| Payment Method | Details of how the deposit was paid |

| Lease Terms | Conditions related to the deposit return |

Final Tips

Ensure all required fields are completed. Both parties should keep a copy of the receipt for reference. This helps avoid any future disputes over the deposit return.

- Lease Deposit Receipt Template: A Practical Guide

To create a clear and professional lease deposit receipt, ensure it includes the following key elements:

- Receipt Number: Assign a unique number for each receipt for record-keeping.

- Tenant’s Information: Include the tenant’s full name and contact details.

- Landlord’s Information: Provide the landlord or property management’s name, address, and contact details.

- Property Address: Clearly state the rental property’s address to avoid confusion.

- Deposit Amount: Specify the exact amount paid by the tenant as a security deposit.

- Payment Method: Mention how the deposit was paid (e.g., check, wire transfer, cash). This ensures transparency.

- Date of Payment: Include the date the deposit was received to establish a clear timeline.

- Purpose of Deposit: Clarify that the deposit is being held to cover potential damages or unpaid rent.

- Signatures: Both the landlord and tenant should sign the receipt to confirm the agreement.

By including these points, both parties will have a clear understanding of the transaction and its terms. Use a simple, readable format, and ensure all fields are completed before handing over the receipt.

Formatting Tips for Clarity

- Use bold for headings and key terms to draw attention.

- Keep the layout clean, with enough spacing between sections for easy reading.

- Consider using bullet points or numbering for important details to improve readability.

Additional Considerations

- If applicable, include terms regarding the refund of the deposit at the end of the lease, specifying conditions such as property condition and any deductions.

- Both parties should retain copies of the receipt for their records.

Begin by clearly stating the names of both the landlord and tenant. This ensures that both parties are accurately identified. Include the full address of the rental property as well. Specify the deposit amount and the date it was received to avoid any confusion in the future.

Key Components of the Lease Deposit Receipt

List the purpose of the deposit, whether it is for damage protection, cleaning, or another specific reason. Indicate whether the deposit is refundable or non-refundable, and if refundable, mention the conditions under which it will be returned. Also, include the lease duration and any terms that may affect the deposit’s return.

Ensure Legal Compliance

Verify that your lease deposit receipt aligns with local rental laws. In some regions, landlords must provide receipts for deposits within a specific time frame. Make sure that the receipt includes language that adheres to state or country regulations regarding deposits and refunds. Keep a copy of the signed receipt for your records, and provide one to the tenant as well.

1. Failing to Specify the Exact Deposit Amount

One of the most common mistakes is not clearly stating the exact amount of the lease deposit. Avoid ambiguity by listing the precise figure. Both parties should know the amount paid and the total due for transparency and clarity.

2. Overlooking the Deposit Purpose

Clarify the purpose of the deposit. Whether it’s for damages, unpaid rent, or other expenses, defining its specific use prevents future disputes. Vague wording can lead to misunderstandings, so make sure to outline the conditions under which the deposit may be retained or returned.

3. Not Including the Payment Date

Always include the exact date the deposit was paid. This detail is vital to confirm the timeline and prevent confusion. It also helps if there’s a need to verify any payments against the lease terms.

4. Missing Tenant or Landlord Information

Ensure that both the tenant and landlord’s full names and contact information are correctly written. This may seem basic, but errors in this section can delay communication or cause problems when returning the deposit.

5. Forgetting to Outline Return Terms

The conditions under which the deposit is to be returned must be spelled out clearly. Avoid vague language; specify timeframes, any required inspections, and deductions. This prevents disputes later when it comes time for the deposit’s return.

6. Not Addressing Interest or Adjustments

If the lease requires that interest be added to the deposit or adjustments made for damages or repairs, include these terms. Not addressing interest or adjustments could lead to disagreements if either party expects these financial changes.

7. Ignoring Local Legal Requirements

Check your local regulations for specific rules regarding lease deposit receipts. Many jurisdictions have specific legal language or requirements that need to be included in such documents. Failing to comply could render the receipt invalid.

8. Using Inconsistent Terminology

Consistency is key. Ensure that terms like “deposit”, “security deposit”, and “advance” are used correctly and consistently throughout the document. Conflicting terms can confuse both parties and complicate enforcement of the lease agreement.

9. Leaving Out Signatures

The lease deposit receipt must be signed by both the tenant and the landlord. Without signatures, the receipt may not be legally binding. Make sure that both parties sign the document in order for it to hold weight in future legal proceedings.

Got it! How can I assist you today?

Make sure the lease deposit receipt clearly outlines the tenant’s responsibilities and the landlord’s obligations. This ensures both parties are fully aware of the conditions tied to the deposit.

Include Key Details

The document should include the exact amount of the deposit, the purpose of the deposit, and the date it was paid. Provide space for signatures from both parties to confirm agreement.

Specify Terms for Refund

Clearly state the conditions under which the deposit will be refunded. Include possible deductions for damages or unpaid rent. The terms should be transparent and easy to understand.