Creating a cash receipt voucher template streamlines record-keeping for transactions involving cash payments. It provides a clear, standardized format that helps businesses and individuals maintain accurate financial records.

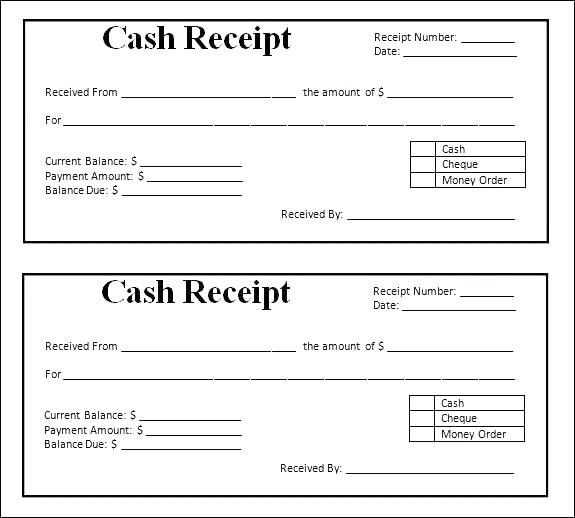

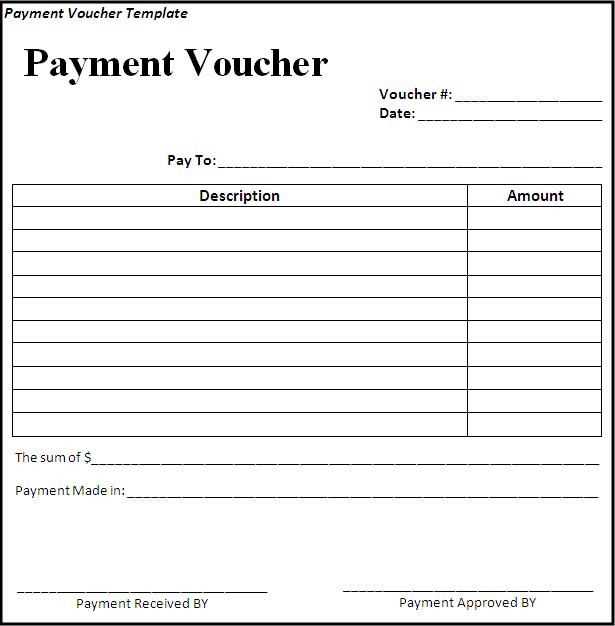

Design a simple structure by including the date, amount, payer details, and purpose of the payment. Each field should be easily editable, ensuring flexibility for various payment scenarios. This straightforward design allows quick generation of receipts without unnecessary complexity.

Incorporate a section for both payment method and receipt number, which aids in tracing the transaction back to its origin in case of audits. Ensure the template includes a signature space to verify authenticity. These elements enhance accountability and clarity.

Remember to keep the format consistent across all vouchers for seamless management. You can adjust the layout and fields based on specific needs, but maintaining a consistent approach supports better tracking and easier referencing.

Here are the corrected lines:

Ensure the template is clear and concise, with a straightforward layout. The sections should include the date, receipt number, and payment details. Use a clear distinction between the payer’s information and the receipt issuer’s details to avoid confusion.

Step-by-Step Corrections

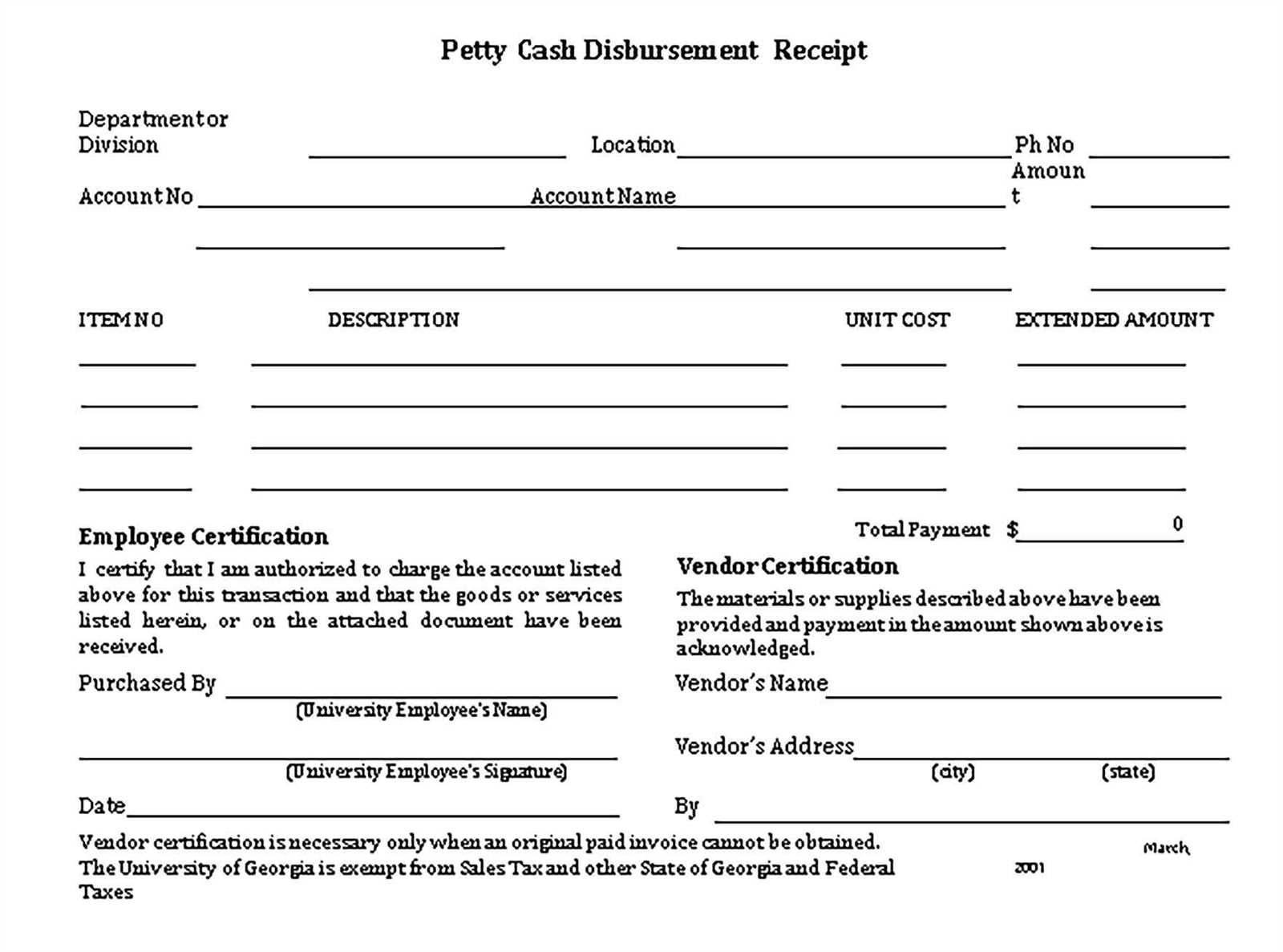

Start by formatting the payer’s information clearly. The full name, address, and contact details should be aligned on the left side of the receipt. This ensures easy readability.

Clarifying Payment Breakdown

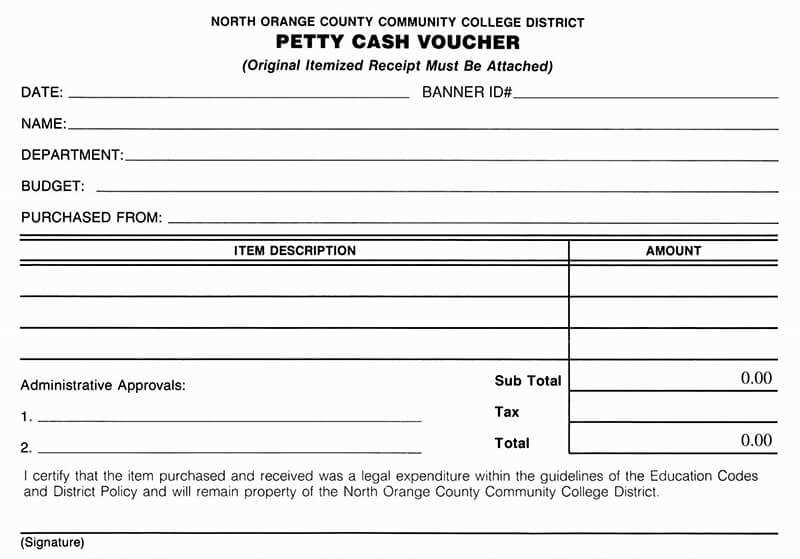

Include an itemized list for payments made, detailing the amounts and applicable taxes. This transparency helps both parties track transactions easily. Also, verify that all totals are calculated correctly to avoid discrepancies.

Double-check calculations before finalizing the template. A small mistake in numbers can lead to significant issues.

- Template for Cash Receipt Voucher

Include the receipt’s unique identifier at the top for easy reference. This number should be sequential and tied to the date of the transaction to avoid confusion. Below, list the payer’s details–full name, company name if applicable, and contact information. Specify the amount received in both words and numbers, ensuring clarity and preventing discrepancies. If applicable, provide a breakdown of the payment method (e.g., cash, check, electronic transfer) and any relevant transaction details. Include a clear space for the issuer’s signature, along with the date the receipt was issued. Always ensure the template adheres to your region’s accounting and legal standards, as some jurisdictions may require specific language or format.

Ensure that the template is simple, yet informative, with sections that are clearly marked and easy to fill out. Keep the overall layout clean and organized, and use bold text for headers or key sections like ‘Payment Amount’ and ‘Received By’ to make important details stand out. This helps with quick verification and provides a professional, polished appearance. Also, consider adding a disclaimer or notes section at the bottom, where additional terms or conditions of the receipt can be outlined, if needed.

Begin by establishing a clear structure for your receipt template. Ensure that essential details such as the business name, contact information, and transaction date are prominently displayed at the top. These elements create immediate recognition and trust. Next, include fields for the transaction description, quantity, price, and applicable taxes. Position these details in an organized grid format for clarity.

Incorporate Brand Identity

Incorporating your brand’s logo, colors, and font style can make the receipt feel more personalized and professional. Keep these elements subtle to avoid distraction from the essential details. Consistency with your brand’s identity reinforces your presence to customers.

Ensure Readability and Simplicity

Choose fonts that are legible and simple. Avoid decorative fonts that might impair readability, especially for the price or item information. Set an adequate font size, especially for numbers and totals, ensuring that the important information stands out without overwhelming the customer. Align the content in a logical flow, making it easy for someone to understand the transaction quickly.

A receipt voucher should contain the following critical elements to ensure clarity and transparency:

- Date of Issue: Specify the exact date the voucher was issued. This is necessary for tracking and validating transactions.

- Voucher Number: Include a unique identification number for each receipt voucher. This helps in organizing and referencing receipts efficiently.

- Payee Details: Clearly mention the name or entity receiving the payment. This avoids confusion in cases of refunds or disputes.

- Payment Method: Indicate whether the payment was made via cash, check, card, or any other means. This adds a layer of transparency to the transaction.

- Amount Paid: State the exact amount received. Use the appropriate currency symbols and ensure it’s easy to understand.

- Description of Goods/Services: Provide a brief but clear explanation of what the payment covers, making it easy for both parties to identify the nature of the transaction.

- Signature of Issuer: A signature from the person issuing the voucher serves as proof of authorization and accountability.

- Terms and Conditions (if applicable): Include any relevant terms regarding refunds, exchanges, or payment deadlines. This clarifies expectations for both parties.

By following these guidelines, you ensure that your receipt voucher is both legally sound and easy to reference in the future.

Double-check the details. Mistakes in the amounts or dates can lead to confusion. Ensure every entry matches the transaction exactly. Any discrepancy can create issues for both the customer and your accounting process.

Avoid missing crucial information like the company’s contact details or invoice number. These elements help ensure the receipt is traceable. Omitting them can make the document appear incomplete or unprofessional.

Be careful with the formatting. A cluttered or inconsistent receipt layout can make it harder for the customer to understand their purchase. Use clear sections for items, totals, taxes, and payment methods.

Don’t forget the payment method. Always specify whether the payment was made by cash, credit card, or other means. This ensures that both parties have a clear understanding of the transaction.

Incorrect tax calculations are a common problem. Ensure the tax rate applied matches the local regulations. Miscalculating taxes can create issues during audits or result in overcharging the customer.

Avoid vagueness in item descriptions. Be specific about what was purchased, including quantities, sizes, or colors. This prevents misunderstandings and potential disputes with customers.

| Common Mistakes | How to Avoid |

|---|---|

| Missing information | Include company details and invoice number |

| Formatting errors | Ensure a clean and organized layout |

| Incorrect tax calculations | Verify tax rates and calculations |

| Vague item descriptions | Provide specific details on items purchased |

Organize your cash receipt vouchers by structuring them in a clear, simple format. Use a numbered list for easy tracking of each item involved in the transaction. For example, list the transaction details such as date, amount, payer, and purpose in separate lines.

Listing Transaction Details

Start with a heading that identifies the purpose of the receipt. Below it, list the details one by one. Label each field clearly, such as:

- Date: The day the payment was received.

- Amount: The exact sum of the transaction.

- Payer: Name of the person or organization making the payment.

- Purpose: A short description of the transaction’s nature.

Verification and Confirmation

Before finalizing the receipt, ensure all details are accurate. If the voucher is being issued for an in-person payment, include a field for the cashier’s signature to confirm the transaction. This will reduce confusion during audits.