If you’re managing payments for drivers, creating a clear salary receipt is crucial. A well-structured template ensures both transparency and accuracy. It can also serve as a reference for drivers to track their earnings and for businesses to maintain proper records. A salary receipt should outline the amount earned, deductions, and any bonuses or incentives, leaving no room for confusion.

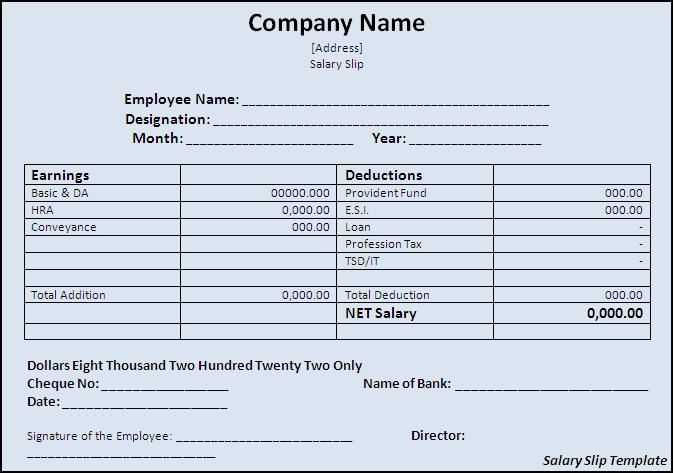

Start by including basic details such as the driver’s name, the payment period, and the company name. Next, break down the payment components: base salary, overtime, bonuses, and deductions like taxes or insurance. It’s also helpful to specify payment methods, whether it’s direct deposit, check, or cash. This clarity can prevent misunderstandings and strengthen the trust between employer and employee.

Finally, provide space for both the employer’s and driver’s signatures, confirming the agreement. This small but significant step validates the receipt and makes it a legal document. Make sure the template is easy to modify for different pay periods or adjustments, allowing for streamlined payroll management. A simple yet thorough receipt can save time and minimize errors in the long run.

Here’s the revised version:

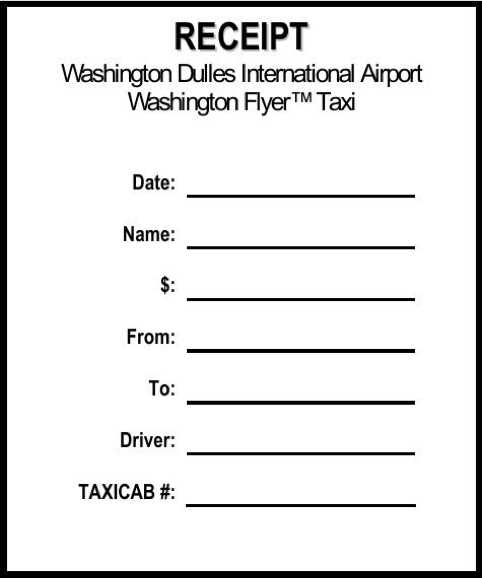

Start by including the driver’s name and the date at the top of the receipt. Make sure to clearly state the payment period, indicating the start and end dates. Below that, list the total hours worked during this period and the corresponding pay rate.

Breakdown of Payment

Detail the breakdown of the payment, including any deductions for taxes, insurance, or other fees. Make sure to highlight the net pay after all deductions, so it’s easy for the driver to understand the final amount received.

Payment Method

Specify the method of payment, whether it’s direct deposit, check, or cash. This provides clarity and transparency for both the driver and employer.

Finally, include a signature line for both the driver and employer to confirm the transaction. This serves as a record of agreement and ensures both parties are on the same page regarding the payment details.

- Driver Salary Receipt Template

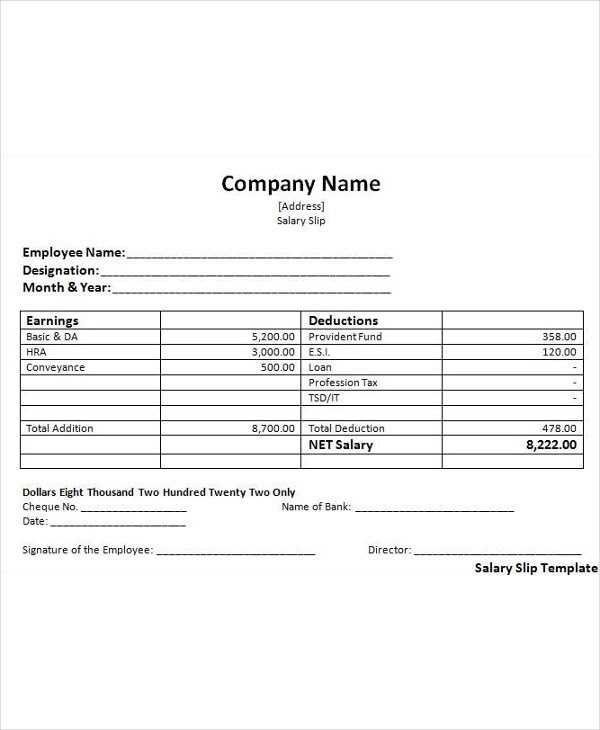

A well-organized salary receipt helps both employers and drivers keep track of earnings, deductions, and payments. Here’s how to structure a driver salary receipt template:

- Driver Information: Include the driver’s full name, contact details, and employee ID (if applicable).

- Employer Information: The name, address, and contact details of the employer or company.

- Receipt Number: A unique identifier for each receipt to ensure proper record-keeping.

- Date of Payment: Specify the date the salary was issued to the driver.

- Salary Breakdown: Provide a detailed list of the driver’s earnings, including base salary, bonuses, overtime, and any other incentives. Break down individual components.

- Deductions: List deductions such as taxes, insurance, or other withholdings from the driver’s earnings.

- Total Pay: Calculate the total salary after deductions and bonuses. This is the net amount the driver will receive.

- Payment Method: Indicate how the payment was made (e.g., cash, bank transfer, check).

- Signature: Include a section for both the employer and driver to sign, confirming the receipt details.

Ensure clarity and accuracy in every section to prevent confusion. Regularly update the template to reflect any changes in pay structures or benefits. A clear and precise receipt not only helps with accounting but also builds trust between the employer and employee.

Begin with a straightforward header that includes the driver’s name, the date, and the payment period. This will help both the driver and the employer quickly identify the relevant details for the salary statement.

1. List the Base Salary

The base salary should be displayed clearly as the first item. This represents the agreed-upon amount before any deductions or bonuses are added. Make sure to highlight this number for transparency.

2. Include Additional Payments or Overtime

If the driver worked overtime or earned additional pay, list it separately. Specify the hours worked and the rate paid for those hours. This ensures the driver knows exactly how their extra efforts are compensated.

3. Deduct Taxes and Other Contributions

Clearly show any deductions, including taxes, insurance, or retirement contributions. Label each deduction with its corresponding amount. This prevents any confusion about the final amount the driver will receive.

4. Provide the Final Amount

The final salary amount should be clearly marked at the end of the breakdown. This is the amount the driver will actually take home after all additions and deductions. Display it in bold or with special formatting to make it stand out.

Present the salary breakdown in a clean, easy-to-read format. This helps maintain clarity and trust between the employer and the driver.

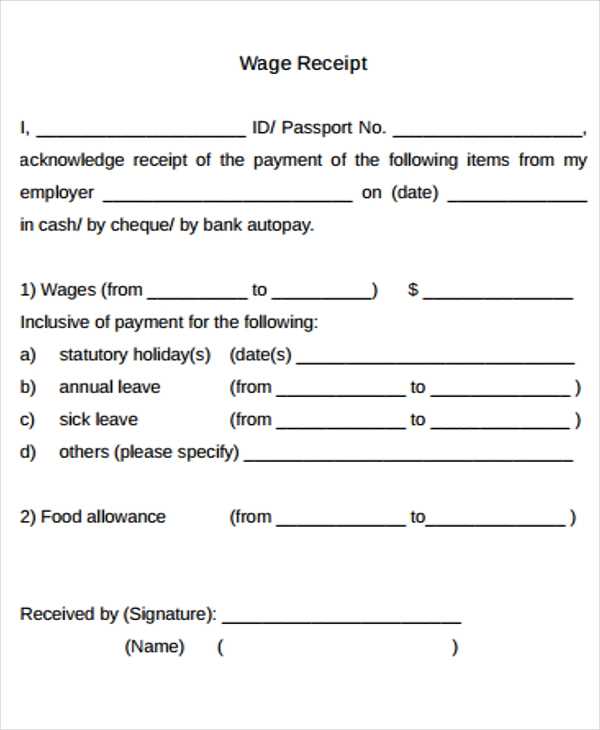

Ensure you include the following key legal and tax details in the driver salary receipt for clarity and compliance:

- Employer Information: Add the employer’s legal business name, address, and tax ID number. This confirms the entity responsible for the payment.

- Employee Information: Include the driver’s full name, employee ID, and tax ID number. This helps identify the individual receiving payment.

- Gross Salary: Specify the total earnings before deductions, including base salary, overtime, tips, or bonuses. This gives a clear picture of the initial amount before any reductions.

- Tax Deductions: Itemize all tax deductions such as federal, state, and local taxes. Include Social Security and Medicare contributions to comply with tax laws.

- Other Deductions: Note other deductions like insurance premiums, retirement contributions, or union dues, ensuring transparency of all reductions.

- Net Salary: Clearly show the final amount paid after all deductions. This represents the driver’s take-home pay.

- Pay Period: Mention the start and end date of the pay period covered by the receipt. This provides context for the payment cycle.

- Legal Statement: Include a statement that confirms compliance with local tax laws, labor regulations, and any other relevant legal obligations.

Including these details not only keeps the process transparent but also ensures both the employer and driver are aligned with tax requirements and labor laws.

Adjust the salary receipt template to include clear details for each payment method used by your company. For cash payments, list the amount handed over, along with the currency and any deductions made. For bank transfers, specify the bank details, transaction number, and date of transfer. Pay attention to the format of the bank account number, ensuring it’s easy to verify. If using mobile payments or e-wallets, indicate the payment provider, transaction ID, and time of payment. This ensures transparency and confirms that the salary has been transferred as agreed.

Bank Transfers

For bank transfers, include both the sender’s and recipient’s bank details. This could be the bank name, account number, and routing number, along with any intermediary bank information if applicable. Clearly note the payment method (e.g., wire transfer, ACH) and the confirmation number for tracking purposes. This allows both the employer and employee to verify the transfer history at any time.

Electronic Payments

For payments made through digital wallets or apps, include the transaction ID and the payment platform name. Mention the exact time of the transaction to ensure accuracy, as these methods may not be processed instantly. If the payment is split between different accounts or platforms, ensure each one is listed separately to avoid confusion.

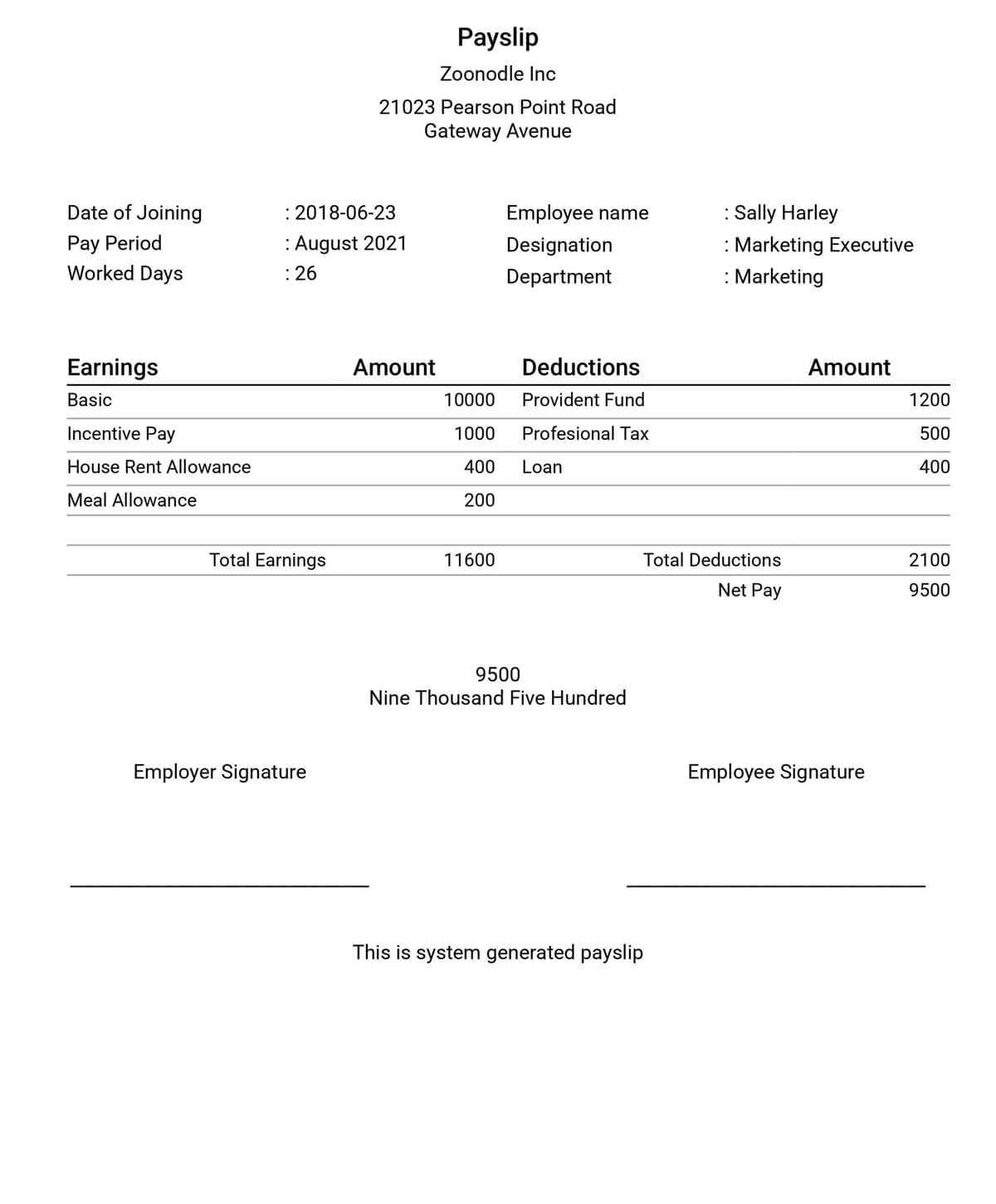

Driver Salary Receipt Template

Creating a salary receipt for drivers ensures transparency in payments and provides both the employer and employee with clear records. A well-structured receipt should include key details such as the driver’s name, payment date, salary breakdown, and any additional allowances or deductions. Below is a simple template for constructing a driver salary receipt:

| Detail | Description |

|---|---|

| Driver’s Name | Enter the full name of the driver. |

| Payment Date | Specify the date of payment. |

| Basic Salary | Amount paid as the driver’s base salary. |

| Allowances | Include any bonuses, tips, or travel allowances. |

| Deductions | Deduct any fines or advances from the total salary. |

| Total Salary | Sum of basic salary, allowances, and any adjustments after deductions. |

| Payment Method | Specify if the payment was made via cash, bank transfer, or other methods. |

This template can be adjusted as needed based on the company’s payment structure and any specific terms outlined in the driver’s contract. Keeping these details organized will prevent confusion and help with any future payment disputes.