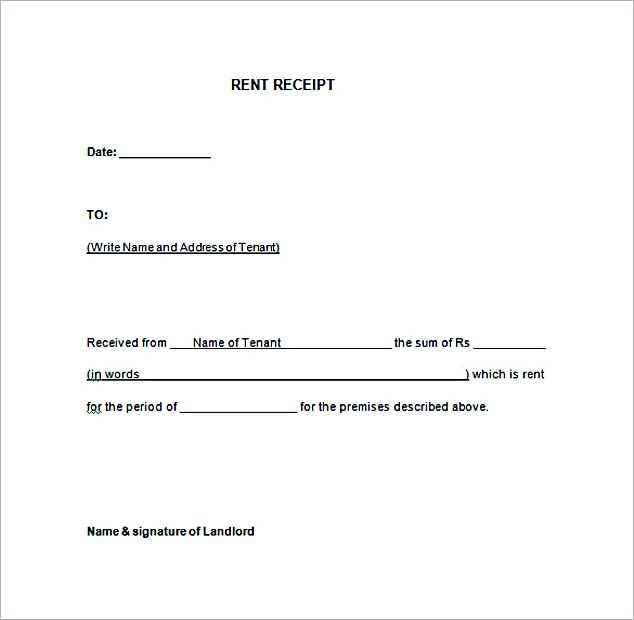

A well-structured rent receipt is a practical document for both tenants and landlords. This receipt serves as proof of payment and can be used for accounting, tax, or legal purposes. A simple rent receipt should include the payment date, amount paid, the rental period, and the property details.

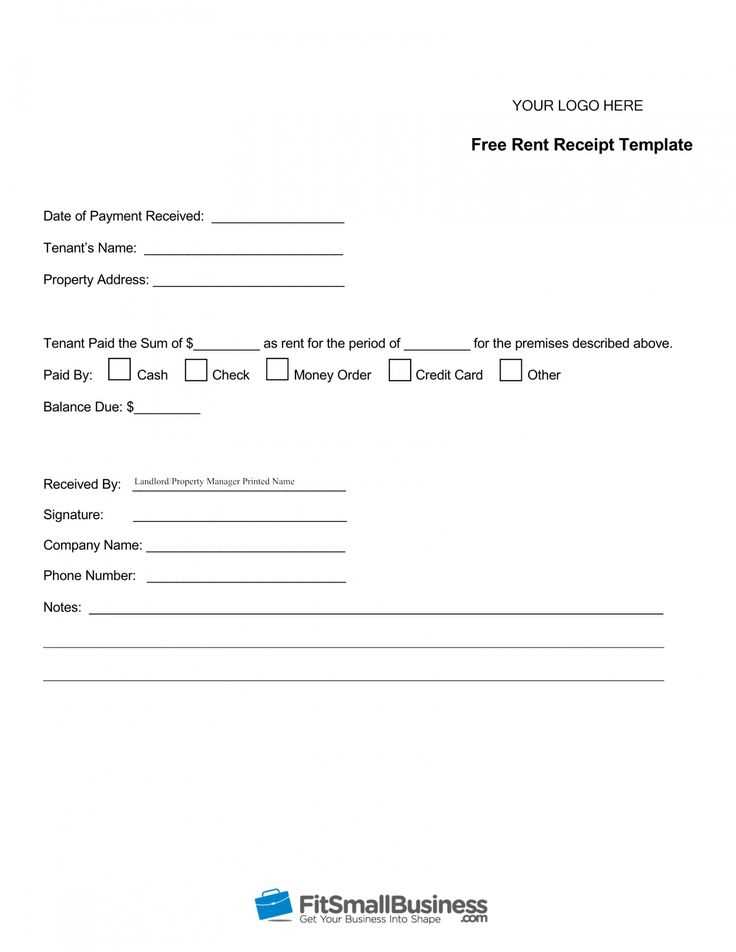

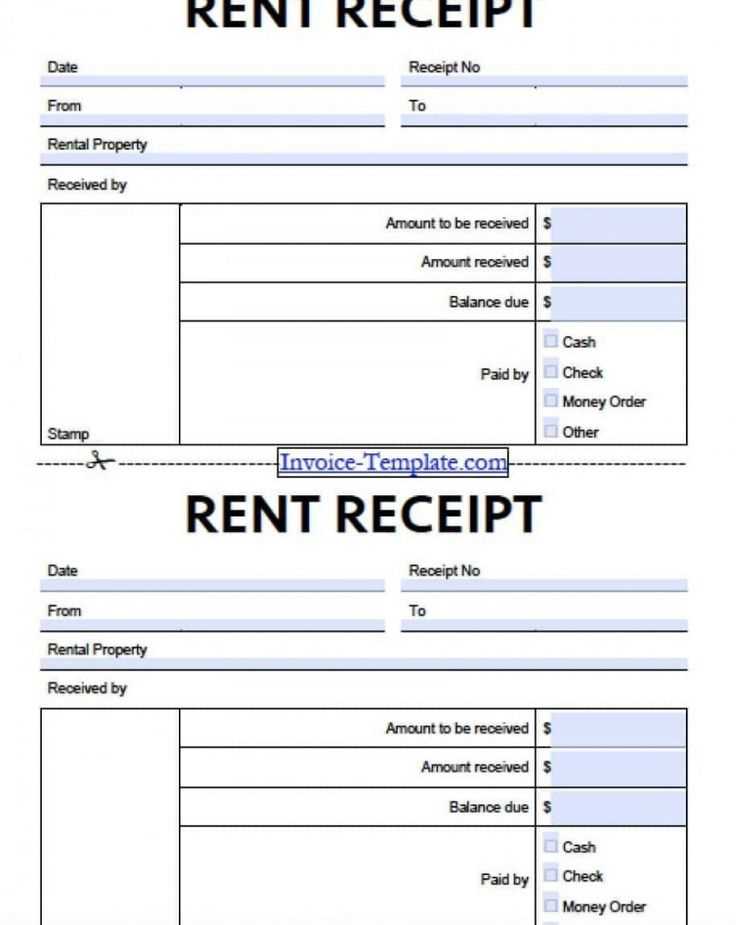

To create a clear and professional template, start by listing the tenant’s name, rental address, and the landlord’s information. Then, detail the rent payment amount, along with the payment method and the date received. Including a unique receipt number adds another layer of clarity and organization.

When drafting a rent receipt template, make sure it is easy to read and includes the necessary fields. This makes it convenient for both parties to track payments and ensures the document is legally sound if required in any dispute resolution.

Here are the corrected lines:

Ensure the tenant’s name is accurately listed with no abbreviations. Include their full legal name, as it appears on official documents. The address of the rental property must be clear and precise. Double-check the apartment number, street name, city, and postal code for accuracy.

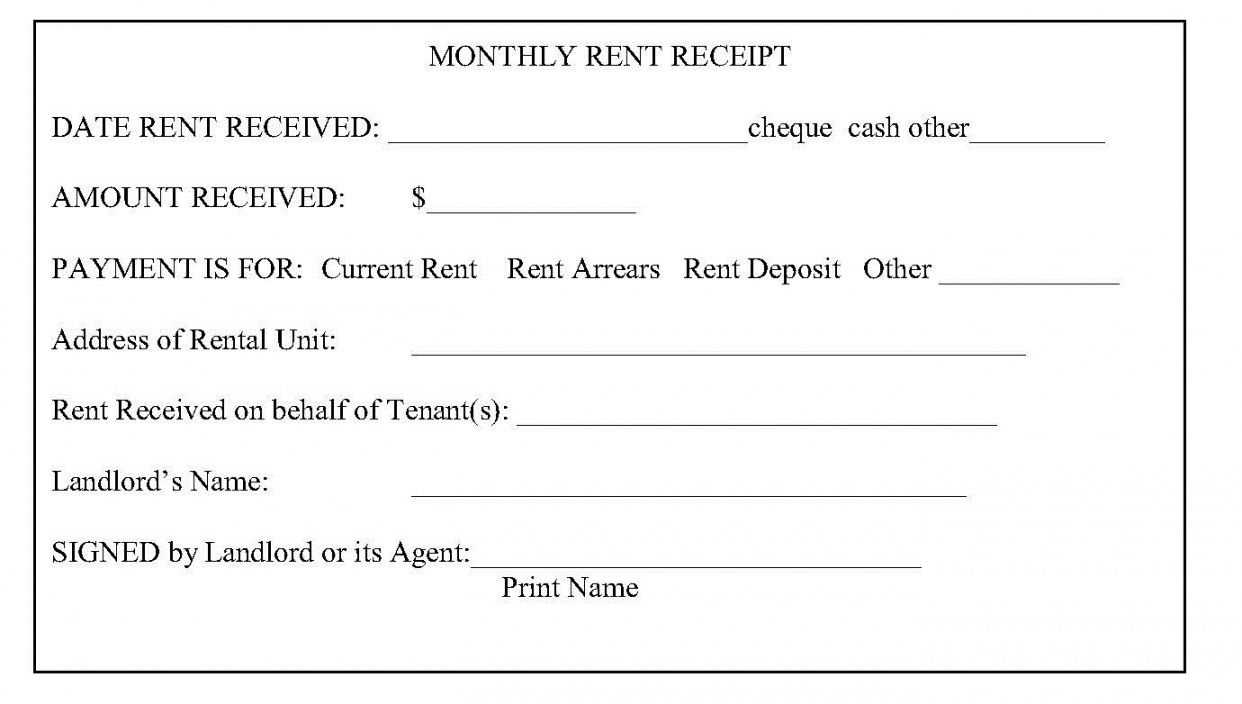

Next, clearly specify the rental period, including the start and end dates. This is important for tracking payments and resolving any disputes. For payment amounts, include both the total amount paid and the date it was received. Make sure to list the method of payment, whether it was cash, check, or online transaction.

Details on Rent Receipts

It’s helpful to include the landlord’s contact information for future correspondence. Include their name, phone number, and email address. If applicable, list any deposits or prepayments as separate line items. This prevents confusion and allows both parties to track financial transactions effectively.

Final Notes

Be sure the receipt is signed and dated by the landlord or property manager. This adds legitimacy to the document and ensures both parties acknowledge the transaction.

- Rent Receipt for Tenant Template

Providing tenants with a rent receipt is a simple but significant way to maintain accurate records for both parties. A rent receipt serves as proof of payment and can be crucial for tax purposes or any disputes. Below is a basic template for creating a rent receipt that you can adapt to your needs.

Key Details to Include

The following information should be present on the rent receipt to ensure it is complete and clear:

- Tenant’s name

- Landlord’s name and contact details

- Payment date

- Rental period covered by the payment

- Amount paid

- Payment method (cash, check, bank transfer, etc.)

- Any remaining balance, if applicable

- Signature of the landlord or agent

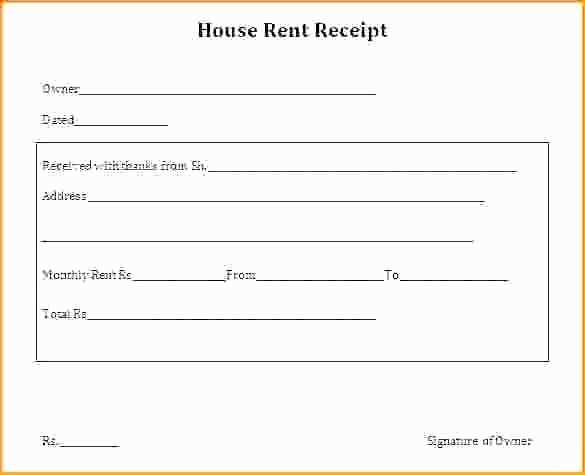

Sample Rent Receipt Template

| Tenant Name | Landlord Name | Date of Payment | Amount Paid | Payment Method | Rental Period | Balance Due |

|---|---|---|---|---|---|---|

| [Tenant Name] | [Landlord Name] | [Payment Date] | [Amount Paid] | [Payment Method] | [Rental Period] | [Balance Due] |

This format ensures that all necessary details are covered, providing clarity for both the tenant and the landlord. Customize the template as needed based on your specific agreements or requirements.

Begin by including the tenant’s name and the property address at the top of the receipt. Make sure to list the landlord’s name or business name as well. These details ensure that both parties are clearly identified. Next, add the date of payment, ensuring that it is accurate and corresponds to the payment period. The payment amount should be clearly stated, along with the method of payment used (e.g., cash, check, bank transfer). This provides transparency and confirms the transaction method.

Include Payment Details

Provide a breakdown of the rent amount, including any additional charges, such as late fees or maintenance costs. If a partial payment was made, be sure to document this, specifying the outstanding balance. This helps avoid confusion for both parties later on. Additionally, if the rent includes utilities or other services, list these separately, so the tenant understands what is covered in the payment.

Signature and Acknowledgment

Include a space for both the landlord and tenant to sign. The tenant’s signature acknowledges receipt of the payment, while the landlord’s signature affirms the details. This step is crucial for both parties’ records. Lastly, save a copy of the receipt for future reference. Having a digital or printed record will protect both parties in case of disputes.

Include the full name of the landlord and tenant to clearly identify the parties involved. This ensures there’s no ambiguity about who is receiving and paying the rent.

Clearly specify the payment date, making it easy to reference when the payment was made. Include the exact amount paid, stating both the numerical value and the currency, such as USD, EUR, etc.

Describe the rental period covered by the payment. This helps prevent misunderstandings about which time frame the payment is for, such as monthly or for a specific week.

Include the payment method (e.g., cash, check, or bank transfer). This provides clarity on how the transaction was completed and can be useful for both parties for future reference.

List any balance remaining, if applicable. If the tenant owes a portion of the rent, it’s helpful to note how much is left to be paid and any future due dates.

Incorporate a unique receipt number. This helps both the landlord and tenant track payments more efficiently and avoid confusion over multiple payments.

Include a clear statement about any additional charges, such as late fees or utility costs. This ensures all costs are accounted for and eliminates any future disputes.

Ensure that the receipt clearly states the full amount received, including any taxes or additional fees. It’s important to specify the breakdown of costs to avoid any misunderstandings later. Failing to do so may leave room for confusion and disputes.

Missing Date and Transaction Details

Always include the exact date of the payment. Without it, the receipt may lack legitimacy or be difficult to track, especially if there are multiple payments over time. The transaction type, whether it’s for rent, utilities, or other services, should also be detailed.

Incorrect Tenant Information

Double-check that the tenant’s full name and address are correct. Mistakes in these details can create problems for both the tenant and the landlord, especially if there’s a need to provide proof of payment in the future.

Always ensure that the payment method is accurately recorded, whether it’s cash, check, or bank transfer. Not doing so can make it harder to verify the transaction if questions arise later.

Don’t forget to provide a receipt number or unique identifier for easy tracking. This helps to organize records and simplifies future referencing for both parties.

To create a rent receipt for your tenant, make sure it includes key details to ensure clarity and proper documentation.

- Tenant Information: Include the tenant’s full name and the property address to avoid any confusion.

- Payment Details: State the exact amount received, the payment method, and the date of payment.

- Rental Period: Clearly specify the rental period for which the payment was made (e.g., from January 1 to January 31, 2025).

- Receipt Number: Assign a unique receipt number for tracking purposes.

- Landlord Information: Include the landlord’s name and contact details, ensuring both parties know who issued the receipt.

Formatting Tips

- Ensure the receipt is legible, with well-spaced lines for each detail.

- Keep the language clear and to the point. Avoid unnecessary words that could confuse the tenant.

How to Issue the Receipt

- Provide the receipt in a timely manner, ideally within 24 hours after receiving the payment.

- Offer both physical and digital copies for the tenant’s convenience.