Begin by setting up a clear format for your cash receipts journal. A template helps streamline tracking all incoming cash transactions, making it easier to manage finances and ensure accuracy. Start with basic columns such as the date, receipt number, source, amount, and account credited.

Ensure the template includes space for a brief description of the transaction. This will provide clarity on the source of the cash and any related details. Organizing these fields systematically will help prevent confusion when reviewing the records.

As you fill out the journal, focus on maintaining consistency with the format and regularly updating it. Keeping accurate records from day one makes it easier to spot discrepancies and keeps your financial documentation organized and transparent.

Sure! Here’s the revised version with minimal repetition:

To create a streamlined cash receipts journal, prioritize clarity and structure. Begin by organizing the journal into clear columns: date, description, amount received, and payment method. Use the description column to capture a brief note on the payment source, ensuring each entry is easy to identify.

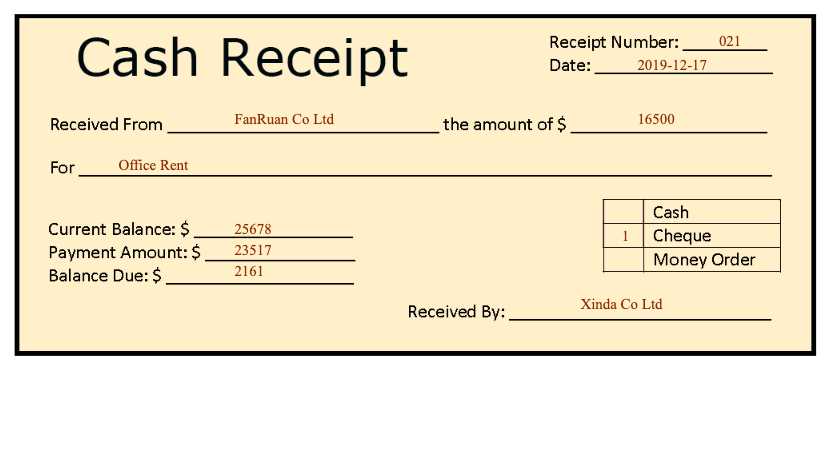

Each entry should be logged with the exact payment amount, avoiding any rounding or ambiguity. For tracking payments, include a unique reference number or invoice ID for each transaction. This adds accuracy and facilitates future reference.

Consistency in formatting is key. Use the same terms throughout the journal, such as “cash” for all in-person payments and “bank transfer” for electronic payments, to prevent confusion. This ensures quick understanding when reviewing the entries.

For accurate reporting, regularly update the journal and reconcile it with your bank statement. This helps maintain an up-to-date record and supports accurate financial reporting. Adjust entries promptly when needed to correct any discrepancies.

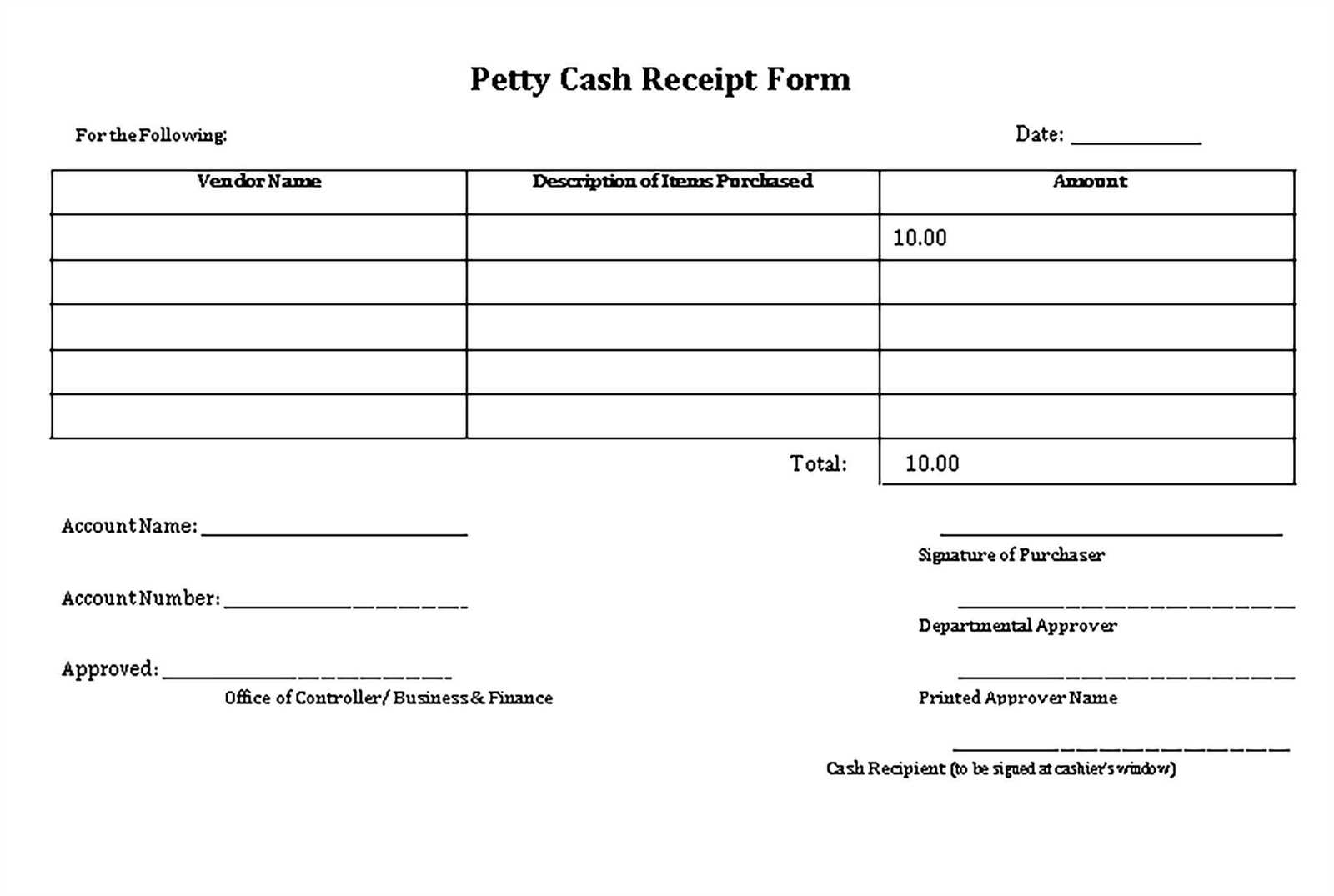

- Template for a Cash Receipts Journal

Design a cash receipts journal template with clarity and simplicity. Begin by setting up columns to record the following data for each transaction: date, description, amount received, and account credited.

Basic Structure

Ensure each entry has the following details:

- Date – Enter the transaction date.

- Description – Include the payer or the purpose of the transaction.

- Amount – List the total cash received.

- Account Credited – Identify the account receiving the payment.

Extra Features

Add optional fields like reference numbers or invoice numbers for better tracking. Keep your template flexible for daily or weekly use and ensure easy reconciliation with bank records.

Begin by determining the key categories for your cash receipts journal. The most common columns include Date, Description, Account Credited, Amount, and Receipt Number. These columns ensure that each transaction is properly recorded and categorized.

For the “Date” column, enter the date when the payment was received. This allows for accurate tracking and verification of all transactions in chronological order.

The “Description” column should briefly detail the source or nature of the payment. This helps in identifying the origin of each receipt without requiring additional investigation.

The “Account Credited” column records which account receives the payment. Be specific to ensure accurate financial reporting and auditing.

Next, the “Amount” column captures the monetary value of the receipt. Enter the full amount as per the payment record. This column is crucial for calculating total receipts and verifying balances.

Finally, the “Receipt Number” column is used to record the unique identifier for each transaction. This helps in referencing specific receipts and ensures the journal remains organized.

Ensure that all columns are clearly labeled and consistently filled out to maintain accuracy and reduce the risk of errors during reconciliation.

Ensure accurate and timely recording of cash entries by maintaining a systematic approach. Record each transaction immediately after it occurs to avoid omissions or errors. Consistently use clear, specific descriptions for each cash receipt to ensure transparency. Avoid generic terms that could lead to confusion later.

Documentation and Verification

Always include supporting documentation for each entry. Receipts, invoices, or bank statements should be attached or referenced for future verification. This documentation will not only help in accurate tracking but also in the event of an audit. Double-check each entry against the physical cash received to avoid discrepancies.

Regular Reconciliation

Perform regular reconciliations of the cash receipts journal with the cash account in the general ledger. This ensures that the records remain accurate and complete, minimizing the risk of errors. Set a fixed schedule for reconciliations, whether daily, weekly, or monthly, depending on the volume of transactions.

To reconcile receipts with bank statements, match each cash receipt recorded in your journal with the corresponding deposit or transaction on the bank statement. Start by reviewing the bank statement for deposits made during the period and compare them to your receipts. Ensure the amounts and dates align accurately.

Steps to Ensure Accuracy

1. Check if the amounts match exactly. Small discrepancies may result from bank fees or rounding.

2. Verify that all receipts listed in your journal appear on the statement. If any are missing, investigate if they were deposited after the statement was issued or if they were overlooked.

3. Pay attention to any adjustments or corrections made by the bank. These might not appear on your initial records, but they should be reflected in the statement.

Common Issues and How to Resolve Them

If discrepancies occur, check for errors in the receipt amounts or any deposits recorded twice. In case of a deposit error, contact your bank for clarification. If the error is on your side, update the records accordingly.

To structure your cash receipts journal correctly, ensure every entry is well-organized. List each transaction sequentially and include the following details:

- Date of transaction

- Source of cash (e.g., customer, loan, etc.)

- Amount received

- Account credited

- Reference number (if applicable)

Regularly update the journal to keep accurate records. Use consistent formatting, keeping columns clearly labeled and easy to follow for quick reference during audits. Store receipts in an orderly manner to support journal entries.