Keep your receipts organized with a tailored template designed specifically for truck drivers. This template helps track and categorize all expenses, making tax filing and financial planning straightforward. It offers a simple way to log fuel, maintenance, tolls, and other transportation-related costs without the hassle of paper clutter.

By using this tool, you can quickly organize receipts into clear sections. Each category ensures you won’t overlook any expenses. Whether you’re managing your truck’s maintenance costs or tracking fuel purchases, you can keep everything neatly in one place. Set up your system with fields for date, vendor, amount, and type of service to easily monitor your spending.

Maintaining accurate records will save time and reduce stress during tax season. A well-organized receipt template keeps you focused on the road, while managing your finances becomes a breeze. Customize the template as needed to fit your specific needs and ensure all relevant expenses are documented.

Truck Driver Receipt Organizer Template

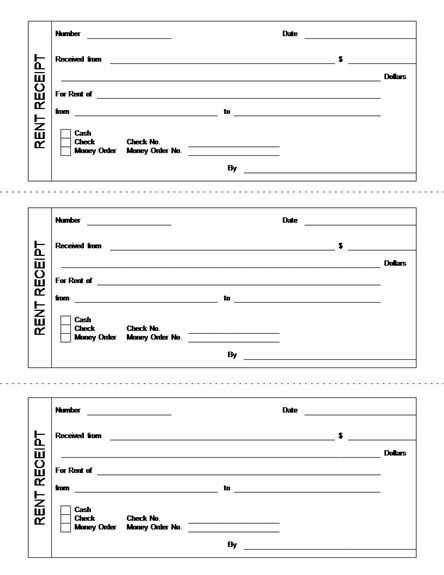

Use a clear and simple layout to track receipts. Create columns for the date, receipt number, amount, and description of the expense. This way, you can quickly reference any transaction without confusion.

Organizing Receipts by Categories

Divide receipts into categories like fuel, maintenance, tolls, food, and lodging. A well-organized system makes it easy to find specific expenses for tax or reimbursement purposes. Consider adding a section for notes to highlight any additional details like the purpose of the expense or the trip specifics.

Digital Tracking Options

If you’re moving towards a paperless system, use an app or software that allows scanning of receipts. These platforms often categorize and store receipts automatically, simplifying record-keeping. Ensure all digital receipts are backed up regularly to avoid data loss.

Regularly update the organizer to avoid backlog and maintain smooth tracking. Make it a habit to input data immediately after each expense, reducing errors and saving time.

Keep your receipts in good condition. Consider using a receipt protector sleeve for physical receipts, and regularly clean out your organizer to avoid clutter.

Customizing Your Template for Specific Expense Tracking

Tailor your receipt organizer to track key expenses more effectively. Focus on categories relevant to your daily operations, such as fuel, maintenance, tolls, and food. Creating dedicated fields for these categories ensures quick and accurate tracking, saving you time and effort during tax season.

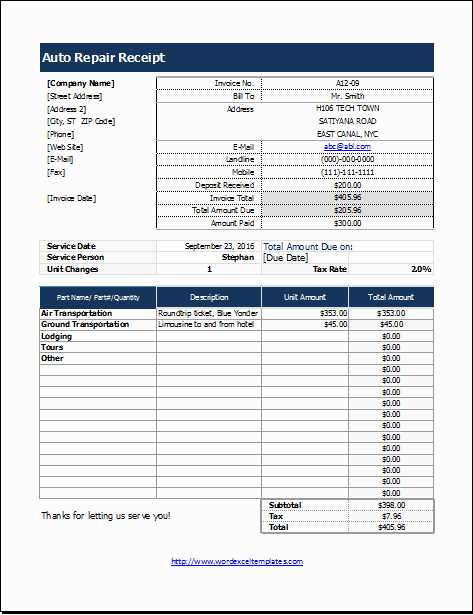

- Fuel: Include columns for fuel type, gallons/liters, price per gallon/liter, and total cost. This will give you a clear view of your fuel expenses.

- Maintenance: Add sections for routine and unexpected maintenance. Record dates, services performed, and costs, helping you keep track of ongoing vehicle care.

- Tolls: Designate a separate area for toll expenses. Make it easy to record toll booth locations, amounts paid, and dates to stay organized.

- Food: If you frequently track meal expenses, include a column for meal details and cost. Having it in the same template helps you keep everything in one place.

Each section should have space for the date, vendor, amount, and any notes to ensure every transaction is fully documented. Adjust the layout to fit the number of receipts you handle daily–don’t overcrowd the page, but provide enough space for clear and concise entries.

Finally, review your entries periodically. This allows you to spot patterns, assess where most of your budget goes, and optimize for better expense management in the future.

Setting Up Categories for Different Receipt Types

Create separate categories for each type of receipt you regularly handle. Use clear labels such as “Fuel,” “Maintenance,” “Tolls,” and “Meals” to keep track of your expenses. Grouping receipts by these categories allows quick access when reviewing your spending or organizing for tax purposes.

For receipts that don’t fit into a standard category, create a “Miscellaneous” section. This will prevent important receipts from getting lost and ensures you don’t waste time searching through piles of papers. Consider adding a subcategory for frequent one-time purchases that could later become recurring.

Label each category clearly in your organizer, whether it’s physical or digital. Include a small description or note for each receipt type to clarify its purpose. This helps maintain consistency and minimizes confusion during reviews or audits.

If you’re managing multiple vehicles or trips, create a section for each vehicle or trip destination. This allows you to track how each vehicle or route affects your overall expenses, making it easier to manage costs on a per-vehicle basis.

Using the Template to Simplify Tax Filing and Documentation

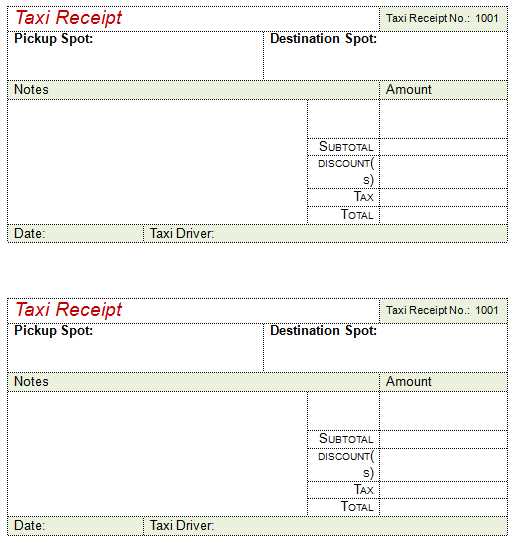

Organizing receipts for tax filing can become a seamless task with the right template. By categorizing receipts into clear sections–such as fuel, repairs, tolls, and meals–this method streamlines your process for both deductions and reporting. Each receipt entry should include the date, amount, and relevant categories to make tax calculations easier and quicker.

Organizing Receipts by Category

Keep a dedicated section for business expenses and another for personal costs. When tax time comes, it will be simple to distinguish deductible expenses from non-deductible ones. Include any notes or comments that clarify the purpose of each expense, such as “fuel for business trip” or “maintenance for work truck,” so you don’t miss out on any tax advantages.

Setting Up for Quick Access

Having the template in a digital format allows for easy access and updates throughout the year. Whether on your phone or computer, you can quickly scan new receipts, categorize them, and add the details. This eliminates last-minute scrambling and reduces errors during tax filing season. It’s a reliable way to ensure your documentation is always tax-ready.

When you organize receipts using a template, you can save time and reduce the stress of last-minute tax filing. By staying consistent and making small updates regularly, tax preparation becomes less of a hassle, leaving more time for other important tasks.