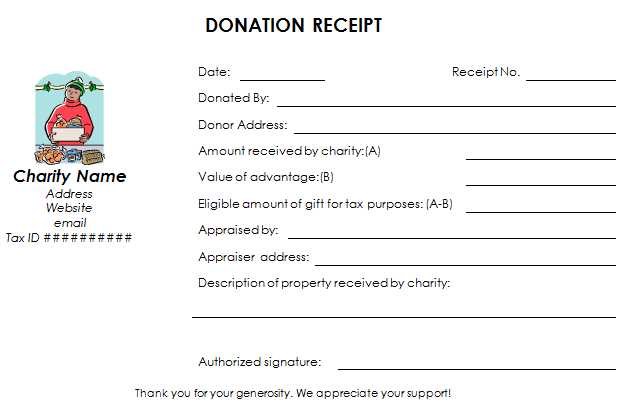

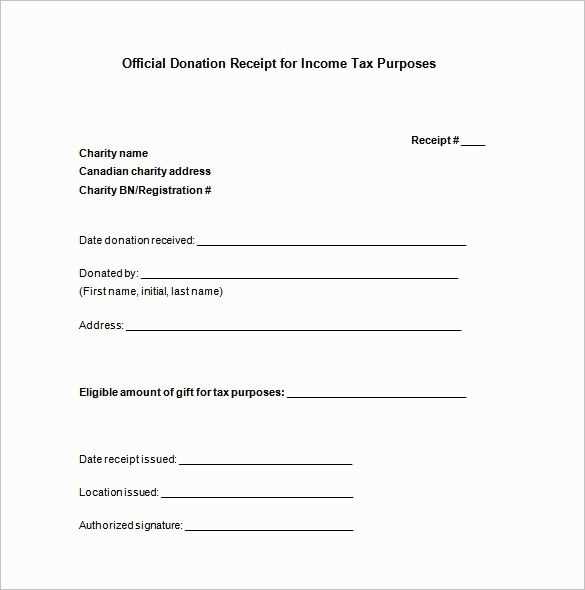

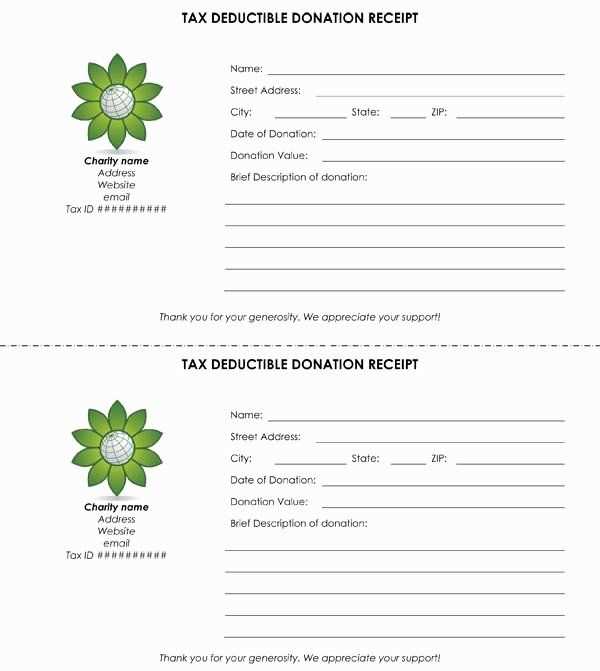

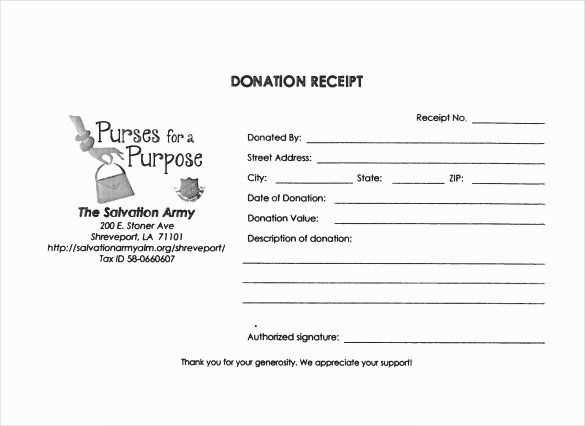

Creating a tax receipt for silent auction donations is a straightforward process, but it requires precision to ensure compliance and clarity. Start by clearly stating the name of the organization receiving the donation and their tax identification number (TIN). This is a critical step, as the TIN helps verify the legitimacy of the charity. Without this information, the donor may not be able to claim their tax deduction properly.

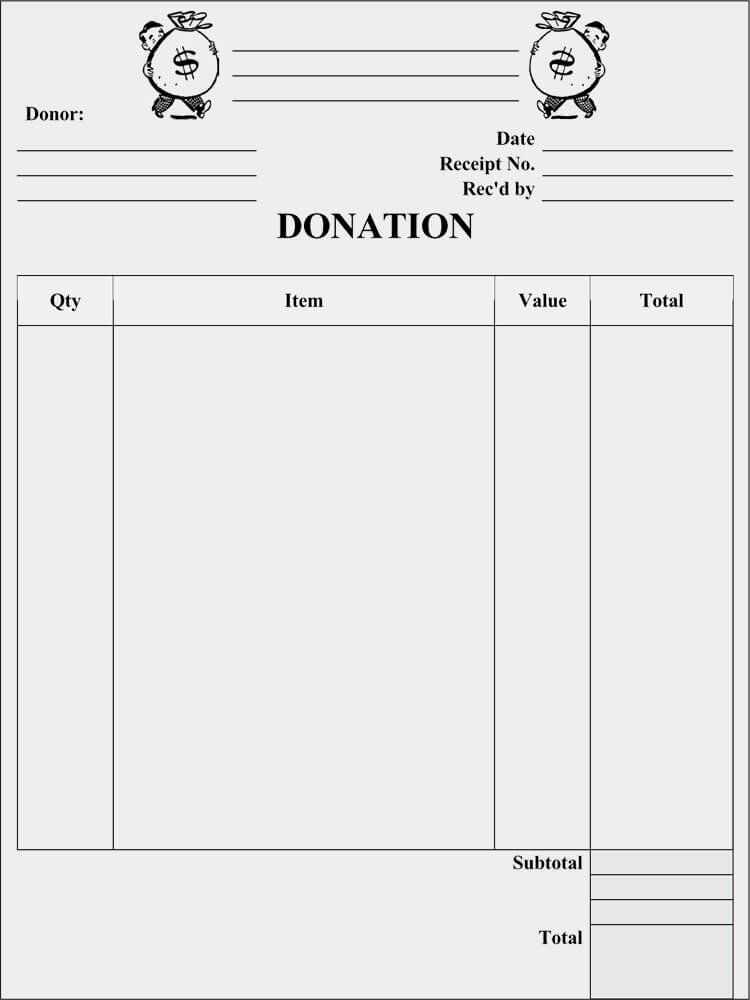

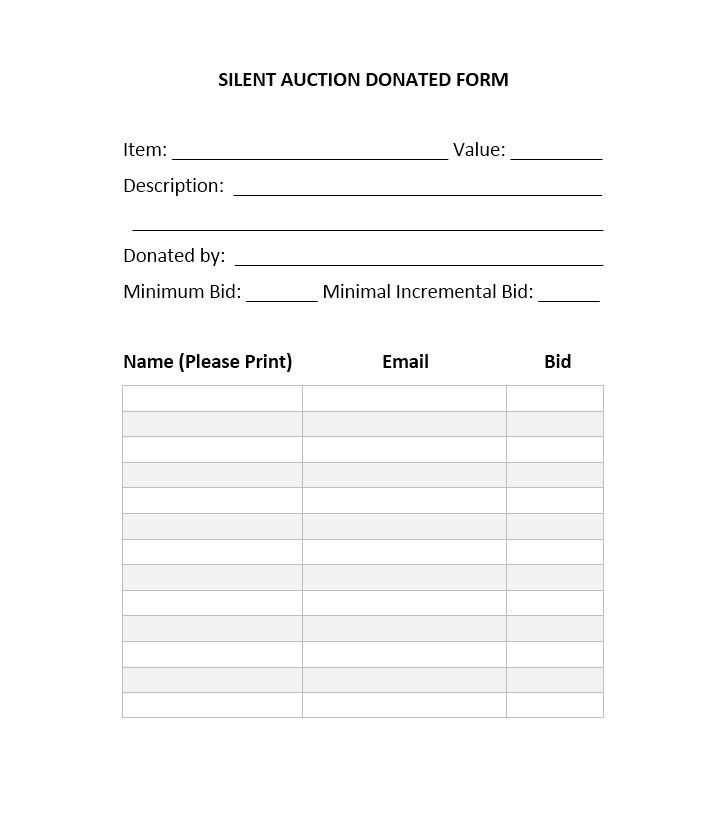

Next, describe the item or service donated. Be specific about what was given, including any unique characteristics that could affect the value. For example, if the item is artwork, provide details like the artist’s name, title, and medium used. This level of detail prevents misunderstandings and ensures transparency for both the donor and the recipient charity.

Include a statement clarifying the donation’s value. If the donor did not receive anything in exchange for their contribution, the value can be listed as the full amount. If there was an exchange, such as a discounted purchase, only the portion of the donation that exceeds the fair market value should be stated. To avoid complications, make sure this is clearly marked in the receipt.

Finally, don’t forget to provide a thank you message. Acknowledge the donor’s generosity and the impact their contribution will have. This simple gesture not only complies with legal requirements but also builds goodwill with supporters, encouraging future donations.

Here’s the revised version:

When creating a tax receipt for silent auction donations, ensure it clearly lists all necessary information to comply with tax regulations. The donor’s name, donation description, and the estimated fair market value should be stated explicitly. Make sure to also include a statement that no goods or services were exchanged for the donation if applicable.

Donor Information

Include the donor’s full name, address, and contact details. This is important for record-keeping and ensures the receipt is linked to the correct tax return. If possible, request the donor’s taxpayer identification number (TIN) for further validation.

Donation Details

Clearly describe the donated item or service. If it is an item, include its general description and the estimated fair market value (FMV). Be transparent in your valuation, and note that if the donor receives anything in return (e.g., a ticket or gift), the value of that benefit must be subtracted from the donation’s total value.

The following text should also appear on the receipt: “No goods or services were provided in exchange for this donation, except as described above.” This confirms that the donation is fully tax-deductible according to IRS regulations.

Lastly, ensure the organization’s name, address, and tax identification number are listed for verification. Provide space for an authorized signature to validate the document. Following these guidelines will help prevent potential issues with tax authorities and ensure your donors are properly acknowledged for their generosity.

- Silent Auction Donation Tax Receipt Template

A well-structured silent auction donation tax receipt is necessary for both your organization and the donor. It ensures that the donor can claim a tax deduction while maintaining transparency and compliance. Use this template to cover all the necessary elements:

Key Information to Include

- Donor’s Information: Include the donor’s full name, address, and contact details.

- Item Description: Provide a detailed description of the donated item, including its nature, quantity, and condition.

- Fair Market Value (FMV): Estimate the FMV of the item. This is the value the item would typically sell for on the open market. If unsure, consult an expert or appraiser.

- Donation Date: Clearly state the date the item was donated.

- Tax-Exempt Status: Include your charity’s tax-exempt number or registration details.

- Statement of No Goods or Services: Include a clear statement that no goods or services were exchanged for the donation, if that’s the case.

- Authorized Signature: Ensure that an authorized individual from your organization signs the receipt to validate it.

Best Practices

- Provide Receipts Promptly: Donors should receive their tax receipts shortly after their donations to avoid delays in tax filing.

- Keep Clear Records: Maintain a record of all donated items, their descriptions, and estimated values for your organization’s financial tracking and IRS compliance.

- Clarify High-Value Donations: For donations with a high FMV, consider getting an independent appraisal and providing detailed documentation for the donor.

By following these steps, you can ensure your silent auction donation tax receipts are correct, professional, and valuable for both donors and your organization.

To create a valid tax receipt for auction donations, ensure the following details are included:

1. Donor Information

Clearly list the donor’s name and address. This ensures proper attribution of the donation to the correct individual or entity. Include an email or phone number for follow-up, though it is optional.

2. Description of the Donation

Provide a detailed description of the item or experience donated, including any identifying features. Avoid appraising the item’s value; it’s important to only acknowledge the donated goods, not to assign a value for tax purposes.

3. Date of Donation

The date the donation was made must be included. This helps verify the donation for tax records and ensures it falls within the relevant tax year.

4. Statement of No Goods or Services in Exchange

Include a statement indicating whether the donor received any goods or services in exchange for the donation. If the donor did receive something, indicate the fair market value of that item. This affects the deductible amount.

5. Tax-Exempt Organization Information

Clearly display the name of your organization, along with your tax-exempt status number and the official address. This verifies that the donation is eligible for a tax deduction under applicable regulations.

6. Value of the Donation

If the donor has provided a specific valuation of the item, acknowledge it but do not claim or suggest that it is the official appraisal. If they did not assign a value, it’s important to avoid estimating the worth of the donation in the receipt.

After gathering these details, ensure the donor receives the receipt in a timely manner, as this will be essential when they file their taxes. The receipt should also follow any local or national tax regulations for non-profit donations.

Include the donor’s full name and address to ensure proper identification for tax purposes. This information helps verify the donor’s eligibility for tax deductions. Clearly state the date of the donation to mark the transaction’s timing. If the donation is in-kind, describe the donated item or service with sufficient detail to avoid confusion. Be transparent about the fair market value (FMV) of any items donated if applicable, since this affects the deductible amount. In addition, specify whether any goods or services were provided in exchange for the donation. If so, list their estimated value. Lastly, ensure that the receipt includes the charity’s name, address, and tax-exempt status number, along with a statement that no goods or services were provided in exchange for the gift if that is the case. This information is necessary for the donor to claim the donation on their taxes without issues.

Ensure your silent auction tax receipts comply with the guidelines established by the IRS and local tax authorities. These guidelines vary depending on whether the auction is hosted by a charitable organization or another type of entity. The receipt must clearly state the value of the donation and specify whether any goods or services were received in exchange for the contribution. Failure to provide this information may lead to the invalidation of the tax receipt.

Key Legal Requirements

The IRS requires that tax receipts for donations made to charity auctions include the following information:

- Donor’s name and address

- Date of the donation

- Description of the item donated

- Fair market value (FMV) of the item at the time of donation

- Statement that no goods or services were provided in exchange, or a description of the goods/services provided and their value

Accounting Practices for Silent Auction Receipts

From an accounting perspective, accurately recording the value of donated items is crucial. The fair market value (FMV) of the donated item should be determined before the auction. Be mindful that the FMV is not the starting bid or auction price but the reasonable price that an item would sell for in an open market.

In cases where an item is sold for less than its FMV, the difference cannot be claimed as a tax-deductible donation. If the item sells for more than its FMV, the donor may only claim a deduction based on the FMV, not the amount over the FMV.

Tax Receipt Template Example

Below is an example of how to structure a tax receipt for a silent auction donation:

| Item Donated | FMV of Item | Amount Paid at Auction | Value of Goods/Services Received | Net Donation for Tax Purposes |

|---|---|---|---|---|

| Item Description | $XXX | $YYY | $ZZZ | $YYY – $ZZZ |

Remember, the receipt should reflect only the net donation value, not the total amount paid at auction, unless there was no exchange of goods or services.

Review tax rules regularly to avoid any issues with tax receipts and ensure your charity remains compliant with all local regulations. Regular consultations with a tax advisor or accountant can prevent misunderstandings and streamline the process for future events.

Silent Auction Donation Tax Receipt Template

Provide accurate information on the tax receipt to ensure donors can claim their deductions. Here is what to include:

- Donor Information: Include the donor’s full name, address, and contact details.

- Description of the Item: Clearly describe the donated item or service without its value.

- Donation Date: Specify the exact date the donation was made.

- Fair Market Value: If applicable, provide the fair market value of the item. Ensure that it is not inflated.

- Organization Information: Include the charity’s name, address, and tax-exempt status.

- Statement of No Goods or Services Provided: Confirm that no goods or services were exchanged for the donation, if true.

- Tax ID Number: Ensure the charity’s tax identification number is visible.

- Signature: Include an authorized representative’s signature to validate the receipt.

Ensure all details are clear and correct to comply with tax regulations and allow your donors to benefit from tax deductions.