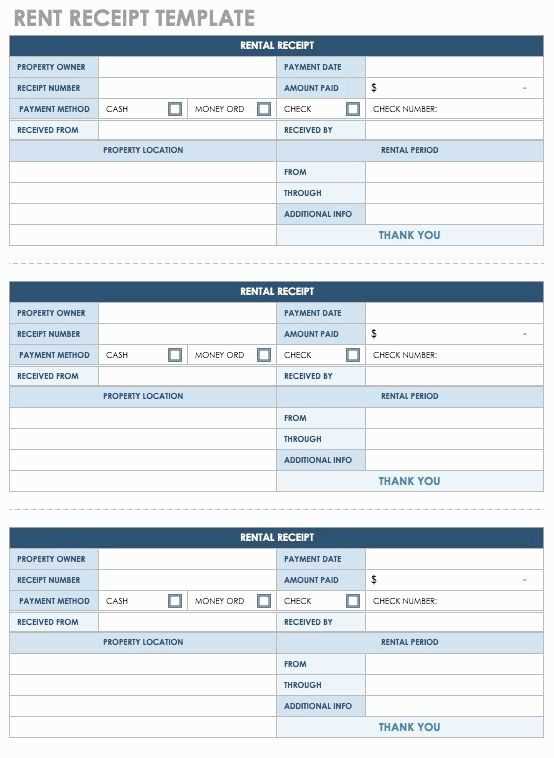

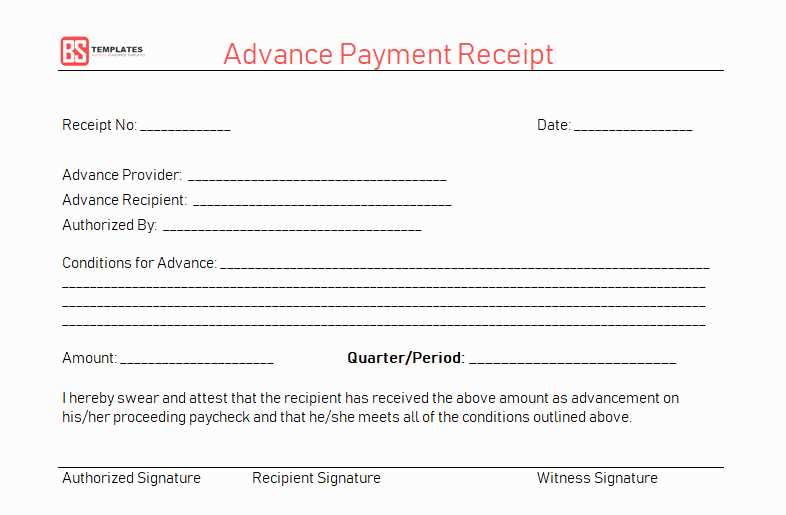

Creating a payment receipt template helps streamline the transaction process and provides clear documentation for both parties involved. The template should include key details like the transaction date, payment amount, and the method used. These elements ensure transparency and prevent confusion down the road.

Incorporating a unique identifier or receipt number into your template adds an extra layer of organization. This allows both you and your clients to track the payment with ease, reducing the chances of any discrepancies. Additionally, it’s helpful to include a brief description of the services or products purchased, so that both parties know exactly what the payment was for.

Don’t forget to leave space for your contact information and business logo. This personalization helps establish a professional image while also making it easy for clients to reach out if they need assistance. Keeping the template clean, concise, and user-friendly will enhance its utility and ensure it serves its purpose effectively.

Here are the corrected lines considering reduced repetitions:

The first adjustment focuses on keeping the sentence structure concise. For instance, instead of repeatedly stating “Thank you for your payment”, streamline it into a single expression. This keeps the tone clear and professional, without redundancy.

Next, instead of listing multiple methods of payment separately, use a combined phrase like “via credit card, bank transfer, or PayPal” for clarity and simplicity. This eliminates the need for repeating “payment method” in each line.

When referring to the invoice number, avoid repeating “invoice number” before every reference. Use shorthand like “Invoice #12345” where the context is already established.

To end, you can replace phrases such as “we kindly ask you to confirm receipt of payment” with “please confirm receipt” to make the request more direct and less repetitive.

- Thank You for Your Payment Receipt Template

A well-structured payment receipt template is key to maintaining clear communication with your clients. It should include all the necessary details to ensure your customer understands their payment transaction and has a record for future reference. Here’s a simple, efficient template you can use to express gratitude and confirm payments quickly.

| Field | Description |

|---|---|

| Receipt Number | Unique identifier for the receipt to easily track payments. |

| Date | Specific date when the payment was made. |

| Amount Paid | The exact amount paid by the customer. |

| Payment Method | Details about the payment method (e.g., credit card, PayPal, bank transfer). |

| Payee Name | Full name of the individual or business receiving the payment. |

| Sender Name | Full name of the individual or business making the payment. |

| Payment Description | A brief explanation of what the payment is for (e.g., service, product, deposit). |

Make sure to customize the template with your branding and contact information for a personalized touch. Having a consistent layout helps in building trust and professionalism in your transactions.

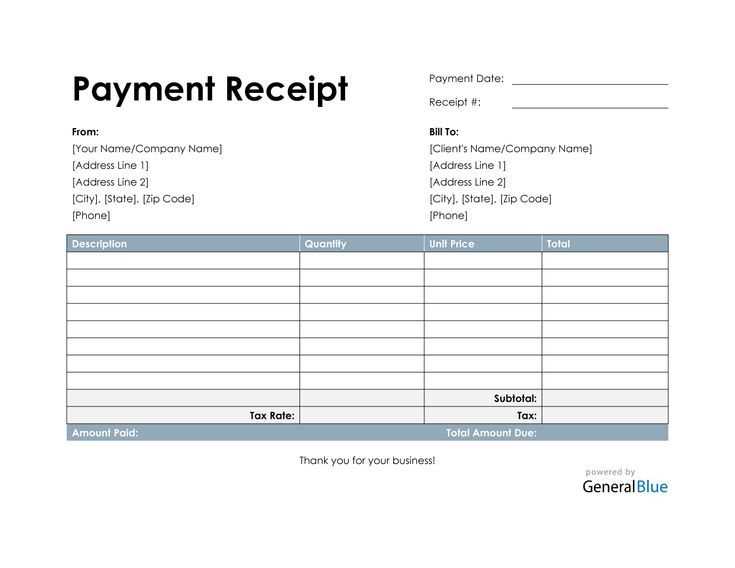

Customizing a payment receipt gives your business a professional appearance and ensures clarity for your customers. Follow these steps to tailor your receipt template effectively:

1. Add Your Company Details

- Include your business name, address, phone number, and email. This helps customers easily reach you if they have any questions or issues with their payment.

- Consider adding your business logo to reinforce brand identity and professionalism.

2. Specify the Payment Information

- Clearly state the payment method, whether it’s cash, credit card, or online transfer. Including this detail makes tracking payments easier for both parties.

- Include the transaction date and payment reference number. This provides an easy way to look up and verify payments in case of disputes.

3. List Purchased Items or Services

- Break down each item or service the customer paid for, along with the quantity and price. This transparency helps customers understand exactly what they’re paying for.

- Ensure that the total amount is clearly marked at the bottom to avoid confusion.

4. Add Tax Information

- Show the tax rate and amount separately to comply with local tax laws. This is especially important for businesses dealing with significant tax amounts.

- If applicable, include any discounts or promotional codes applied during the transaction.

5. Include Payment Terms or Notes

- If you offer a refund policy or specific terms related to the transaction, include them on the receipt. This can help prevent misunderstandings later.

- Consider adding a “thank you” message or reminder of future offers to enhance customer experience.

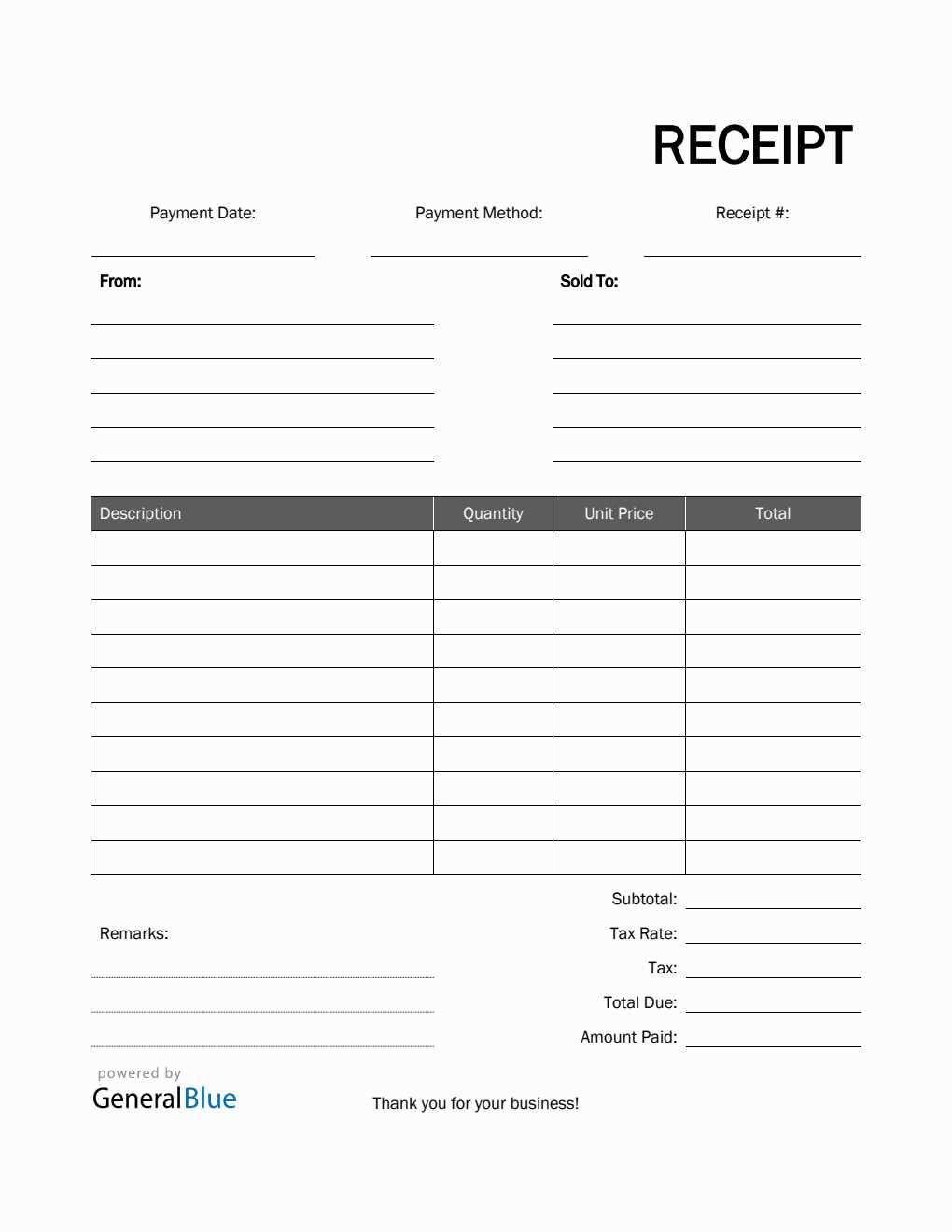

Include the payment date prominently. This establishes the exact time the transaction took place and prevents any confusion about its timing.

Clearly display the amount paid, specifying the currency. This ensures there’s no ambiguity about the payment value and allows for easy reference.

Provide the payment method used, whether it’s credit card, bank transfer, or another option. This adds transparency and helps both parties track the transaction method.

Include the payer’s and recipient’s details, such as names and contact information. This makes it easy to identify both parties involved, especially if questions arise later.

List any invoice or transaction number. This unique identifier makes it easy to locate the receipt in case of future inquiries or issues.

Offer a brief description of the goods or services paid for. This helps the payer remember what was purchased and adds clarity to the transaction.

Ensure the total amount is clearly separated from any taxes or discounts. This provides a detailed breakdown, showing how the total was calculated.

Don’t forget a clear statement of the receipt’s purpose–whether it’s a payment for a product, service, or other transaction. This keeps everything straightforward and organized.

Make sure receipts are clear and concise. Include only necessary details like transaction date, amount, and payment method. Avoid cluttering the receipt with irrelevant information that could confuse the customer.

Always send receipts immediately after the transaction is completed. Whether through email or a printout, timely delivery helps maintain trust and ensures the customer has proof of their purchase.

Use a professional, consistent format for all receipts. This not only enhances the customer experience but also makes it easier to track and reference past transactions.

Provide contact information for customer support. A simple email address or phone number adds credibility and reassures customers that they can reach out if they encounter any issues.

When sending electronic receipts, ensure they are in a universally accessible format, such as PDF. This allows customers to easily store and retrieve them when needed.

Include a personalized thank-you message. A brief note expressing gratitude can leave a positive impression, enhancing customer satisfaction and loyalty.

Verify all details before sending receipts. Double-check for accuracy in amounts, taxes, and payment methods to prevent errors that could lead to disputes or dissatisfaction.

For recurring payments, set up automatic receipts. This saves time for both you and the customer and ensures consistency in communication.

Removed Repetitive “Payment” from Each Line Without Losing Meaning

To streamline your receipt template and avoid redundancy, removing the word “Payment” in every line can improve readability while keeping the core message intact. For example, instead of writing “Payment amount,” simply use “Amount.” This simplifies the text without altering its purpose.

Effective Substitutions

When the term “Payment” appears multiple times, consider alternatives like “Transaction,” “Charge,” or “Fee” based on the context. For instance, “Payment date” can be shortened to “Date,” and “Payment method” can be “Method” if the surrounding context clearly defines the subject.

Maintain Clarity

Ensure that removing “Payment” doesn’t confuse the recipient. Make sure each line is still clear and easily understood. For example, replacing “Payment status” with just “Status” works as long as it’s understood the status relates to the transaction.