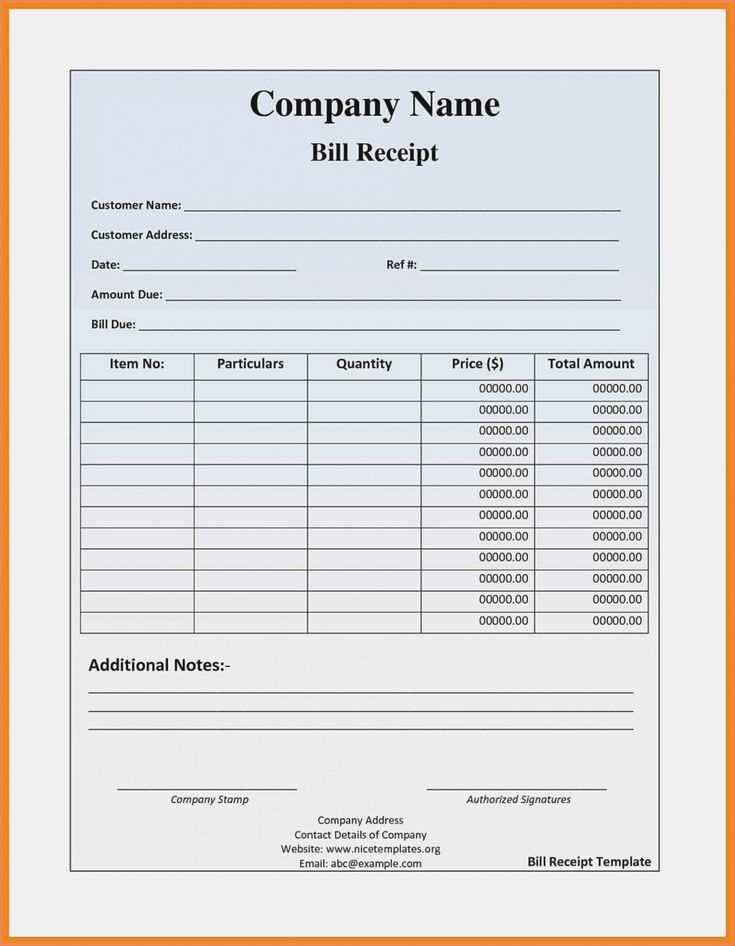

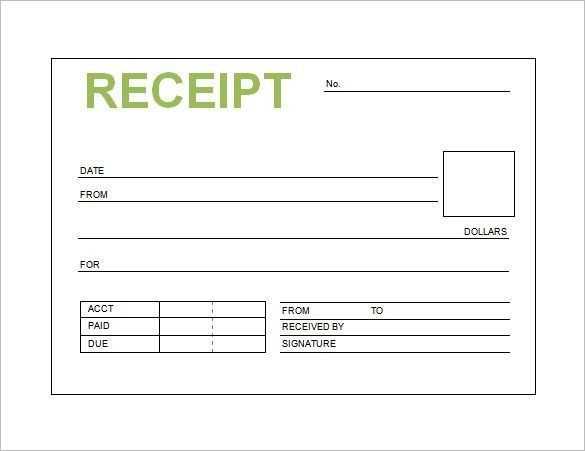

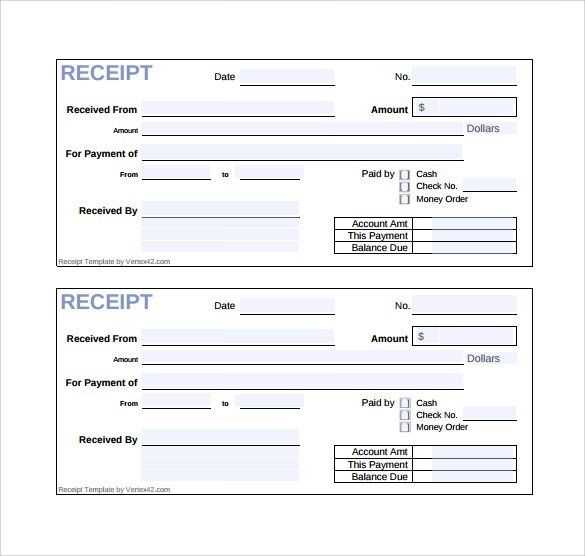

Basic Structure

When creating a receipt template for Malaysia, make sure to include all necessary details to meet local business requirements. The template should have the following fields:

- Receipt Title: Include “Receipt” clearly at the top.

- Business Name: The full name of the company or individual providing the service.

- Address: The business’s address, including postal code.

- Contact Details: Phone number and email address.

- Receipt Number: A unique identifier for each receipt issued.

- Date of Transaction: The exact date when the payment was made.

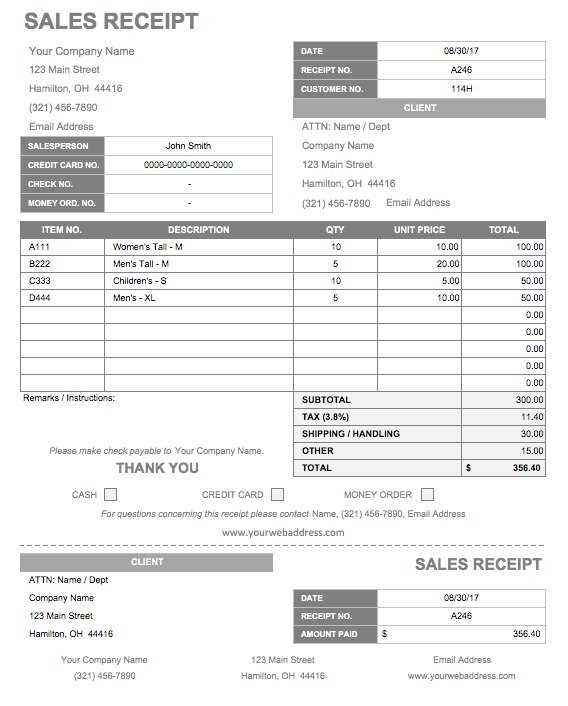

- List of Goods/Services: A detailed list of the products or services purchased, along with their respective prices.

- Total Amount: The total payment received, including any taxes or additional charges.

- Payment Method: Specify the mode of payment, such as cash, credit card, or online transfer.

Formatting Tips

Clear, Legible Fonts

Choose fonts that are easy to read. Standard options like Arial or Times New Roman in size 12 or 14 are suitable. Avoid overly decorative fonts that could make the information unclear.

Alignment and Spacing

Ensure the receipt is neatly aligned. Use left alignment for addresses and right alignment for prices to ensure clarity. Adequate spacing between sections helps separate the information clearly.

Including Tax Information

GST Details

Malaysia operates a Goods and Services Tax (GST), which should be reflected on receipts for applicable goods and services. Indicate the tax rate and the amount of GST separately from the total price. Ensure the GST registration number of the business is visible.

Tax Exemption Notes

If your business offers tax-exempt goods or services, clearly mention this on the receipt. This helps avoid confusion for the customer during the transaction.

Example Template

------------------------------------------------- RECEIPTBusiness Name: XYZ Electronics Address: 123 Jalan ABC, Kuala Lumpur, 50000 Contact: +60123456789 | [email protected] Receipt No: 001234 Date: 10-Feb-2025Items:Laptop – RM 2,000.00Mouse – RM 50.00Total: RM 2,050.00 GST (6%): RM 123.00Grand Total: RM 2,173.00Payment Method: Credit Card

Final Tips

- Keep a Copy: Retain a copy of each receipt for your business records.

- Electronic Receipts: If you provide digital receipts, ensure they are clear and include all relevant information.

- Design Consistency: Maintain a consistent design across receipts for professional presentation.

Malaysia Receipt Template: Practical Guide

How to Create a Legally Compliant Receipt in Malaysia

In Malaysia, a legally compliant receipt must include certain mandatory details. The receipt must clearly state the business name and business registration number, as well as the date of the transaction. The amount paid and the description of goods or services are also required. These elements ensure both transparency for the customer and compliance with Malaysian law.

Additionally, if applicable, the GST (Goods and Services Tax) must be stated separately. The total amount should reflect the GST-inclusive price unless the business is exempt from GST. If the transaction is not subject to GST, this must be explicitly mentioned on the receipt as well.

Key Elements to Include in Your Malaysian Receipt

- Business Information: Company name, business registration number, and physical address.

- Transaction Date: The specific date the transaction occurred.

- Items/Services Purchased: A clear list or description of the items or services, including quantities.

- Amount Paid: The total amount paid, including the breakdown of taxes if applicable.

- GST Details: If GST is applicable, the amount and percentage must be separately shown.

- Payment Method: Specify whether the payment was made by cash, card, or other methods.

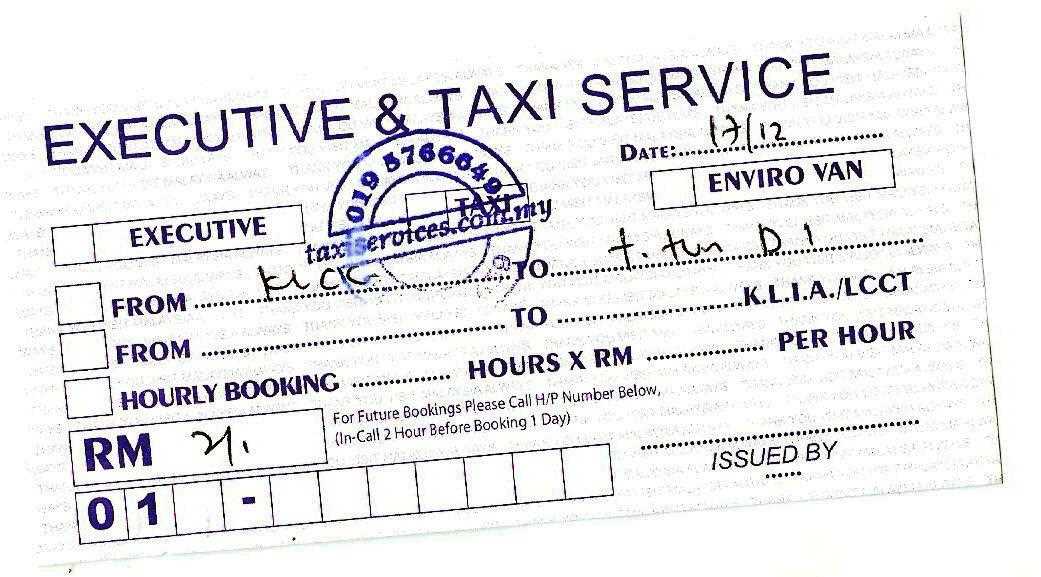

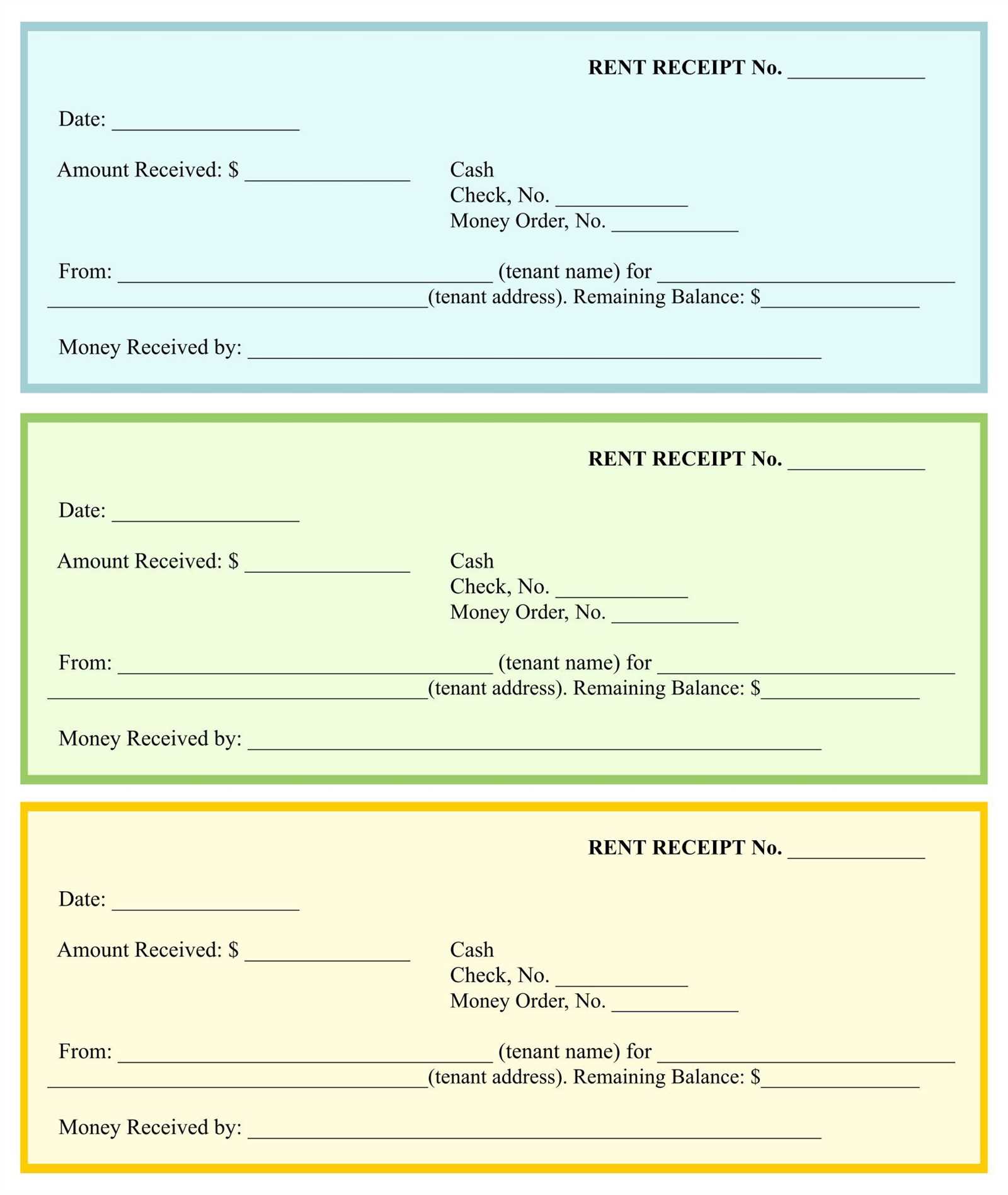

Customizing a Receipt for Different Business Types in Malaysia

Receipts should be tailored to the specific needs of different businesses. For example, a retail business should focus on listing each individual item, with clear pricing and taxes. On the other hand, a service-based business might emphasize the nature of the service provided, along with the hours or quantity billed. If you are running a freelance or consultancy business, providing detailed descriptions of services rendered is key.

When customizing, also consider the integration of electronic receipts for online transactions or mobile payments, ensuring they include the same required elements, while maintaining a user-friendly format for customers.