Creating an acknowledgement of cash receipt template is an easy and effective way to keep track of cash transactions. This document serves as proof that a payment has been made and received, offering clarity for both parties involved. By including clear details in the template, you can avoid misunderstandings and ensure a transparent record of each transaction.

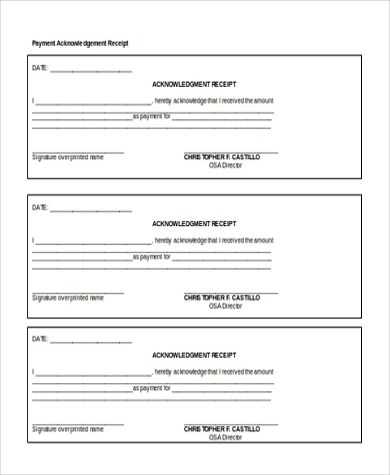

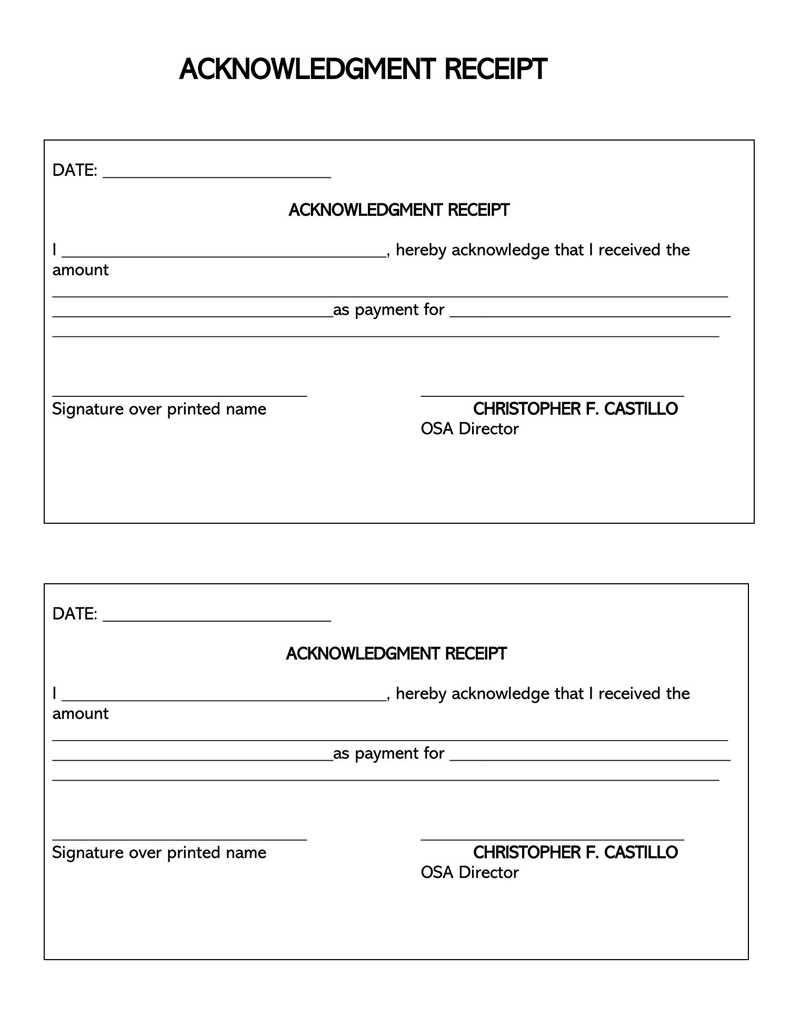

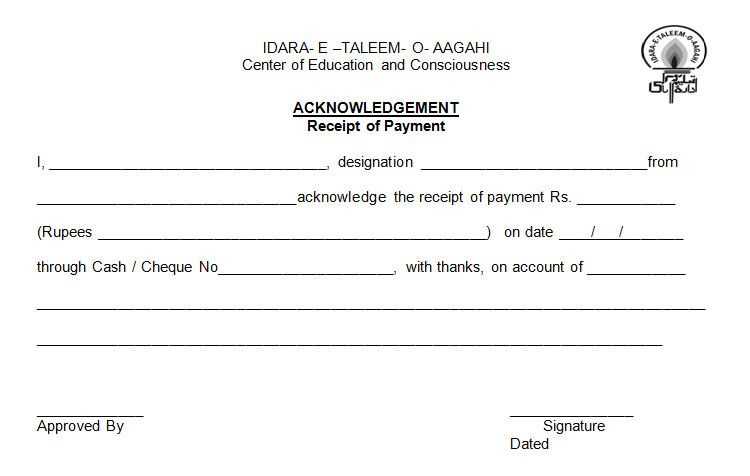

The template should include specific information such as the date of receipt, the amount of cash received, the name of the payer, and the reason for the payment. It’s also important to include the signature of the person acknowledging the receipt, confirming that the payment was handled accurately and securely.

Once you have the right details in place, customizing your template to fit your needs becomes simple. Whether for personal or business use, a well-structured receipt helps streamline transactions and provides peace of mind for both the payer and the recipient.

Here’s the corrected version:

Ensure the acknowledgment of cash receipt is clear and specific. Avoid vague statements that may cause confusion. Include the following details:

- Date of receipt: The exact date when the payment was made.

- Amount received: Clearly state the amount received in both figures and words.

- Payment method: Specify how the payment was made (e.g., cash, check, bank transfer).

- Sender details: Include the name and contact information of the person making the payment.

- Receiver details: Include the name and contact information of the person receiving the payment.

- Purpose of payment: Describe the reason for the payment (e.g., purchase, service, loan repayment).

- Signature: Ensure the document is signed by both parties, if applicable.

Provide space for any additional notes or references, such as invoice numbers or contract details. This allows both parties to have a record that aligns with the transaction’s specifics.

Keep the format simple and organized for easy reading and future reference. Avoid unnecessary sections or overly complex language. The goal is clarity and transparency in the transaction.

- Acknowledgement of Cash Receipt Template

Use this template for documenting cash receipts, ensuring clarity and proper record-keeping for both the payer and the recipient.

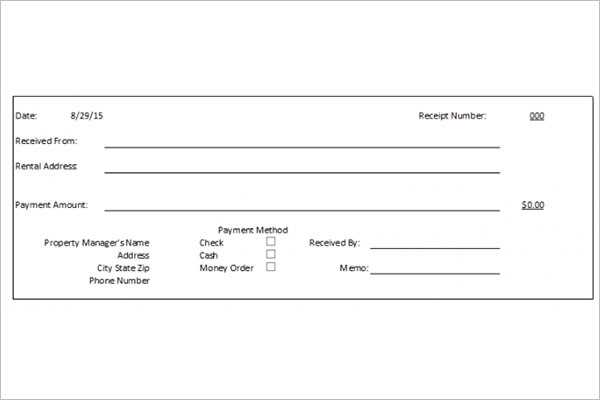

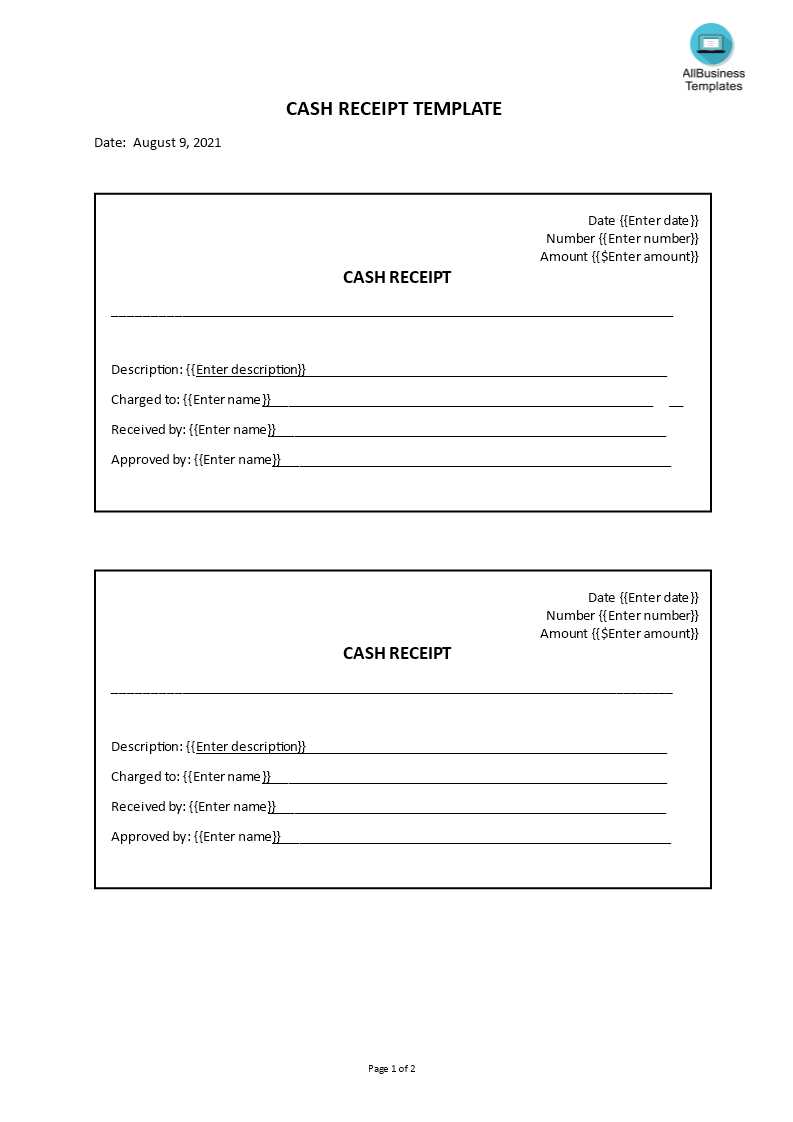

1. Receipt Number and Date: Include a unique receipt number and the exact date the payment was received. This is vital for tracking and organizing transactions.

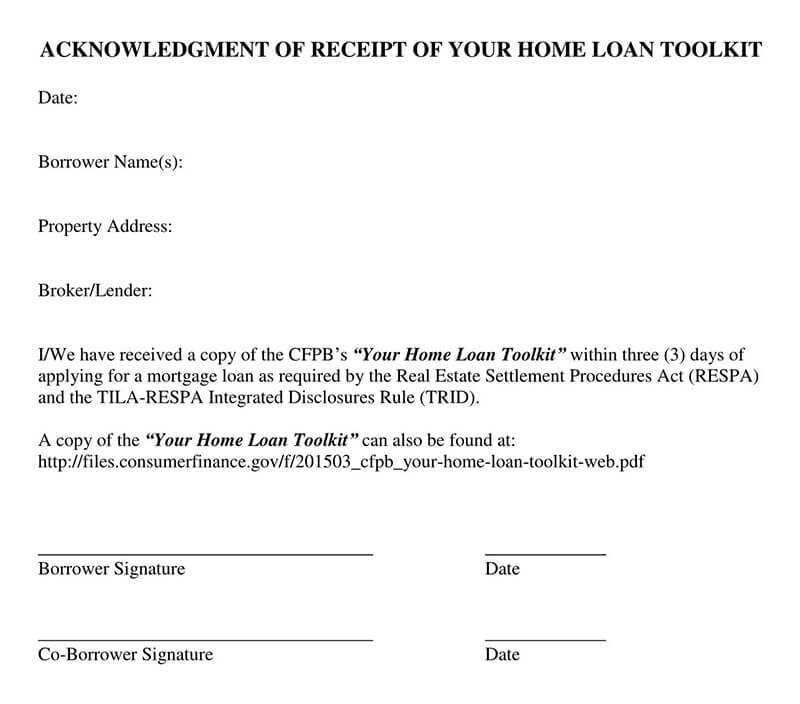

2. Payer Information: Record the payer’s full name and contact information. This ensures you can easily reach out to them if there are any issues with the payment.

3. Amount Received and Payment Method: Clearly state the amount of cash received, along with the payment method used (e.g., cash, check). This section helps verify the amount and the form of payment.

4. Purpose of Payment: Specify the reason for the payment, such as for goods, services, or a deposit. This section provides context to the transaction.

5. Recipient Information: Include the name, address, and contact information of the party receiving the payment. This verifies the transaction for both parties.

6. Signatures: Provide space for the payer and recipient to sign the document, confirming that both parties agree to the details of the transaction.

7. Additional Notes or Terms: If necessary, include any further details, such as payment conditions, installment plans, or references to invoices or contracts. These notes help clarify the agreement and prevent confusion.

By following this structure, you ensure both parties are on the same page and have a formal acknowledgment of the cash receipt for future reference.

Ensure clarity in your acknowledgment template by breaking down the transaction details into easily identifiable sections. This helps the recipient quickly verify the information. Include the date of receipt, the payer’s name, and the exact amount received. Avoid ambiguity in these key fields.

The format should allow for both manual and digital entries. Use simple tables to categorize the details: one column for the description of the transaction, another for amounts, and a final one for any comments or references. This method keeps the acknowledgment organized and easy to follow.

| Description | Amount | Reference/Comments |

|---|---|---|

| Payment for invoice #1234 | $500 | Received via bank transfer |

| Cash deposit | $200 | Deposit at the front desk |

Include a section for the signature of the person acknowledging the receipt, along with the date. This confirms the transaction details are accurate and can be used for future reference if needed.

Always double-check the format for consistency across all acknowledgment receipts. Make sure the structure is uniform, with clear headers and enough space to input specific details without cluttering the document.

A cash receipt should contain specific details that provide clarity and ensure accuracy. Include the following key elements:

- Receipt Number: A unique identifier for each transaction helps in tracking and organizing receipts.

- Date of Transaction: Clearly state the date when the payment was made to avoid confusion later.

- Amount Received: Specify the exact amount of cash received, written in both numbers and words for added clarity.

- Payer’s Name: Record the name of the person or business providing the payment. This helps confirm who made the payment.

- Payment Purpose: Mention the reason for the payment, such as a service fee, product purchase, or loan repayment.

- Method of Payment: Specify that the payment was made in cash to differentiate it from other methods like check or credit card.

- Receiver’s Details: Include the name and signature of the person or business receiving the payment for verification.

Optional Details

- Address or Contact Information: In some cases, it’s helpful to include the address or contact information of both parties for reference.

- Additional Notes: If there are any special conditions or remarks related to the payment, include them here.

By including these key details, you ensure that your cash receipts are clear, traceable, and legally sound.

Customizing a cash receipt template for various types of transactions ensures accuracy and meets specific requirements. Tailor each section of the template according to the transaction’s purpose, whether it’s a simple purchase, a loan repayment, or a service rendered. Below are specific adjustments you can make to suit each case.

For Sales Transactions

Start by including the buyer’s details, such as name, address, and contact information. Add a brief description of the goods or services purchased, followed by their unit price and quantity. Ensure the total amount reflects any taxes or discounts applied. Specify the payment method clearly–whether it’s cash, credit, or a bank transfer. For simplicity, include a unique receipt number for future reference.

For Loan Repayments

When customizing for loan repayments, focus on the borrower’s name and loan details. Specify the amount paid, the remaining balance, and the date of the payment. Make it clear if the payment is a partial repayment or the full amount. Including the loan agreement reference number can prevent confusion. Always include the lender’s contact details for transparency.

For more personalized transactions, you can add additional fields like transaction type (deposit, withdrawal, refund) or purpose notes. These customizations make the template flexible and functional for any specific scenario, ensuring clear and organized records. Adjusting the layout and adding relevant sections as needed will make the receipt more suitable for each unique transaction.

Incorporating the right details in a cash receipt acknowledgment helps clarify the transaction and prevent future disputes. A simple yet clear format provides the recipient with proof of the cash received. It’s crucial to list the date of the transaction, the amount received, the name of the person or entity making the payment, and the reason for the payment. This ensures transparency and keeps all parties informed.

Key Components to Include

The acknowledgment should contain the following basic elements:

- Date of receipt

- Amount received in words and numbers

- Name of the payer

- Description of the payment purpose

- Signature of the recipient

Formatting Tips

Using bullet points or numbered lists makes the receipt easier to read and ensures important information isn’t overlooked. Keep it brief and organized. Double-check for accuracy, especially when transcribing numbers or names. A well-organized acknowledgment can make record-keeping smooth and hassle-free.