To create a receipt for a 501(c) donation, include all required details that make the document valid for tax purposes. This includes the name and address of the organization, the date of the donation, and the donation amount. Ensure the receipt is signed by an authorized person from the organization.

Key Information to Include:

1. The name and address of your 501(c)(3) organization.

2. A description of the donation. If it’s a monetary gift, state the amount donated. For non-cash donations, provide a brief description of the item(s) and an estimated value.

3. A statement that no goods or services were provided in exchange for the donation (if applicable).

4. The date of the donation.

5. The IRS tax-exempt number, which is essential for the donor’s tax filing.

Make sure that the receipt complies with IRS guidelines. If goods or services were provided in exchange for the donation, the receipt should include an estimate of their value. Donors can only claim deductions for the amount that exceeds the value of any goods or services received.

Providing a well-structured receipt ensures your donors have everything they need for their tax return while keeping your organization compliant with IRS rules. Make it clear and precise to avoid any confusion.

Here are the corrected lines with minimal repetition:

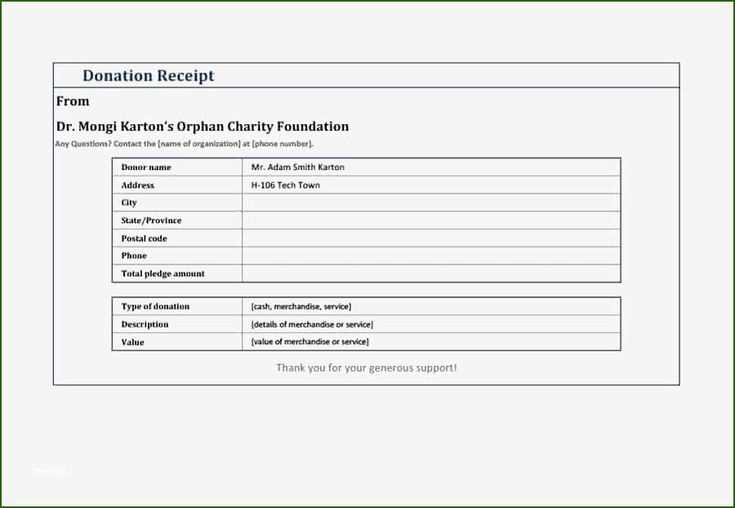

For a 501(c)(3) donation receipt template, ensure that all required information is included clearly. Start by stating the name of your organization and its tax-exempt status. List the donor’s name, donation date, and the amount donated. If the donation includes goods or services, describe them along with an estimate of their value. Make sure to mention whether any goods or services were provided in exchange for the donation, and if so, the value of those items.

Key Elements for a Valid Donation Receipt

Donor’s Name: Include the full name of the donor. For individual donations, use the first and last name. For corporate donations, include the company’s official name.

Donation Date: Specify the date on which the donation was made. This helps both the donor and the organization keep accurate records.

Amount Donated: State the exact amount of money donated. If applicable, include any non-cash contributions and a description of their value.

Additional Information

If the donor received anything in return for their donation, such as goods or services, include the fair market value of those items. This helps both the donor and your organization comply with IRS guidelines.

End the receipt by acknowledging that no goods or services were exchanged, if applicable, and ensure the signature of an authorized representative from the organization is included.

Receipt Template for 501(c) Donation

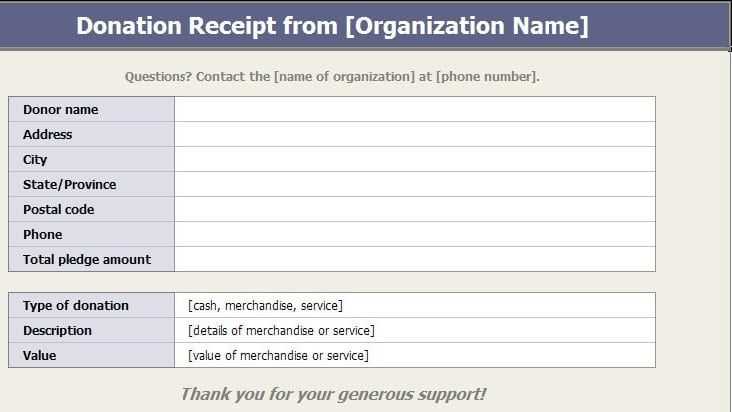

Include the following key elements in your 501(c) donation receipt template to comply with IRS guidelines:

- Organization’s Name and Address: Clearly list the name of your organization, along with its physical address. This ensures the donor can verify the recipient of the donation.

- Date of the Donation: Record the exact date when the donation was received. This is important for tax purposes and documentation.

- Donation Amount: Specify the amount donated in both numerical and written form. For non-cash donations, provide a description of the items received, including their estimated value.

- Statement of No Goods or Services Provided: Include a statement affirming that no goods or services were exchanged for the donation, if applicable. If something was provided in return, describe it and state the fair market value.

- Tax-Exempt Status Confirmation: A note confirming the organization’s tax-exempt status under section 501(c)(3) of the IRS Code.

- Donor Information: Include the donor’s name and, if available, their address. This ensures proper record-keeping for tax reporting.

- Signature: Add a signature field for an authorized representative of the organization to sign the receipt.

Make sure all sections are complete and accurate for the donor’s records. This helps them claim the deduction correctly during tax season.

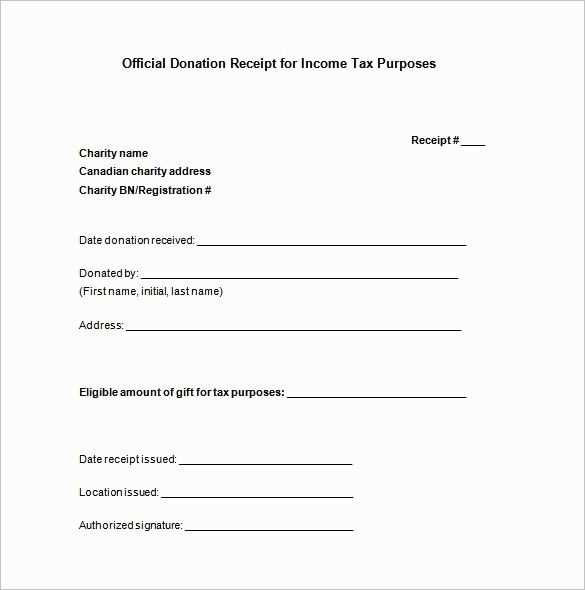

To ensure a 501(c) donation receipt complies with IRS requirements, include the following key details:

- Organization’s Name and Address: Clearly list your nonprofit’s legal name and address. This is crucial for identification.

- Date of Donation: Mention the exact date the donation was made. This is used to verify the timing of the contribution.

- Amount of Cash Donations: For monetary donations, specify the exact dollar amount given. If it’s a check or credit card donation, include those details as well.

- Description of Non-Cash Donations: Provide a description of any donated property. Avoid placing a value on these items, as the donor is responsible for determining their worth.

- Statement of No Goods or Services Provided: If your nonprofit did not provide anything in exchange for the donation, include a statement saying this. If there were goods or services provided, list what they were and their estimated value.

- Tax-Exempt Status: The receipt must state that the organization is recognized as a tax-exempt entity under Section 501(c)(3).

- Donor’s Name: Include the name of the individual or entity that made the donation, matching the records you hold.

Additional Tips

- Ensure the donation receipt is provided promptly after the donation is made, ideally by the end of the calendar year for donations received in that year.

- If the donation is valued over $250, a more detailed receipt with a statement about the value of goods or services is necessary.

- Keep a copy of the receipt for your organization’s records. This ensures accurate reporting during tax filing and audit procedures.

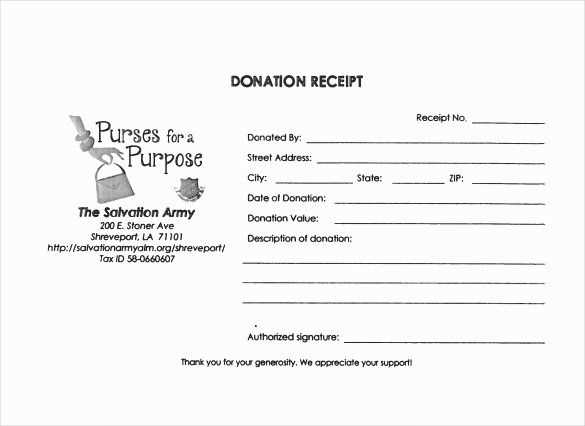

To create a clear and professional 501(c) donation receipt template, prioritize readability. Use a clean, simple layout that allows donors to easily find key details, such as the donation amount, date, and organization’s contact information. Break the information into clearly defined sections with headings that make it easy to scan.

Choose a legible font with good contrast against the background. Sans-serif fonts like Arial or Helvetica work well for digital and printed templates. Avoid overly decorative fonts that may hinder readability. Keep the font size consistent throughout the document, with larger text for key information like the donation amount and organization name.

Incorporate your organization’s logo and branding elements, but keep them minimal so they don’t distract from the content. Ensure that the logo is clear and does not overpower the main message of the receipt.

Ensure proper alignment and spacing. Leave adequate margins around the edges of the template, and use consistent spacing between sections. This allows the information to breathe and makes it easier for donors to follow. A well-structured receipt feels organized and professional.

Include a brief statement describing the nature of the donation, such as whether it is a monetary or in-kind contribution, and ensure it aligns with IRS requirements. Additionally, provide a statement confirming the tax-exempt status of your organization, so donors know they can claim the deduction.

To avoid confusion, always specify the donation amount, the value of any goods or services provided, and a statement confirming no goods or services were exchanged for the donation, if applicable. Include a thank-you note that acknowledges the donor’s contribution and highlights its impact.

To comply with IRS regulations, 501(c) organizations must issue donation receipts that meet specific requirements. The receipt must include details such as the amount of the donation, the date it was received, and a statement that no goods or services were provided in exchange for the contribution, unless they were of nominal value.

Key Requirements for 501(c) Donation Receipts

When creating donation receipts, ensure that they include the following:

- Organization Name and Address: Include the legal name of your organization and its address.

- Donor Information: List the name of the donor and their contact details, ensuring it’s clear who made the donation.

- Date of the Donation: This is crucial for the donor’s tax records and for proper bookkeeping.

- Amount of the Donation: Clearly state the amount of money donated or a description of donated property.

- Goods or Services Provided (if any): If goods or services were exchanged, state the value of what was received in return. If nothing was received, include a statement like, “No goods or services were provided in exchange for this donation.”

- Tax-Exempt Status: The receipt should affirm the organization’s 501(c) status and that contributions are tax-deductible as allowed by law.

Sample Donation Receipt Template

| Item | Description |

|---|---|

| Organization Name and Address | Example Nonprofit, 123 Charity Lane, City, State, ZIP |

| Donor Name | John Doe |

| Donation Date | February 12, 2025 |

| Donation Amount | $200.00 |

| Goods/Services Provided | No goods or services were provided in exchange for this donation. |

| Tax-Exempt Status Statement | Example Nonprofit is a 501(c)(3) tax-exempt organization. |

Don’t forget to issue a receipt for each donation, especially if the amount exceeds $250. For donations under this amount, while not legally required, it’s a good practice to issue one for clarity and to maintain proper records for both parties.

Ensure that your 501(c) donation receipt includes the donor’s name, donation amount, and the date of the contribution. Clearly state that no goods or services were provided in exchange for the donation. Include a statement about the tax-exempt status of the organization, and provide a clear description of the organization (name, address, and EIN).

If the donor made a non-cash donation, detail the type of property and its estimated value, but do not appraise the item. It’s also helpful to include a thank-you message for the donor’s generosity, while confirming that the receipt is compliant with IRS regulations.