When creating invoices and receipts, the right template can save time and ensure consistency. Choose a template that suits the type of transaction and business you handle. A clean, organized format allows you to quickly input all necessary details such as amounts, dates, and payment methods, making your financial records easy to follow.

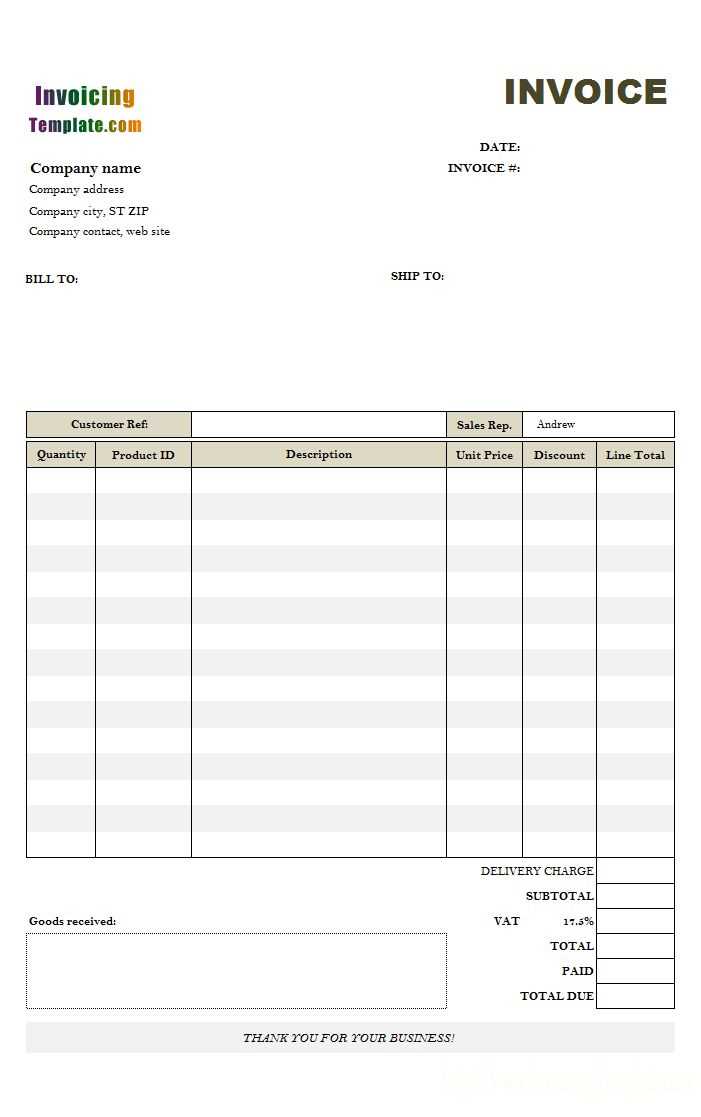

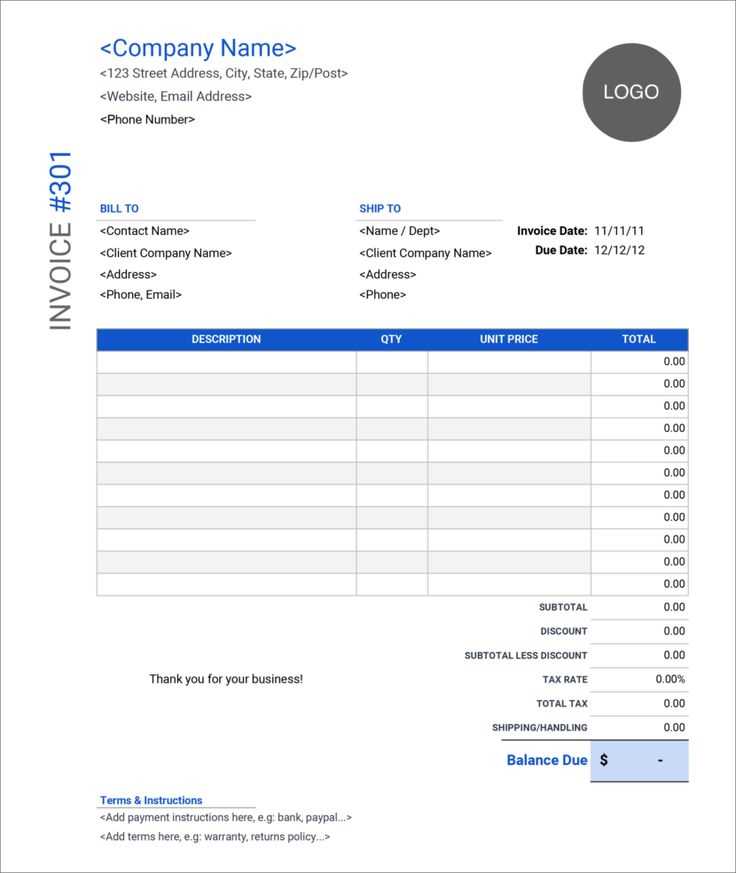

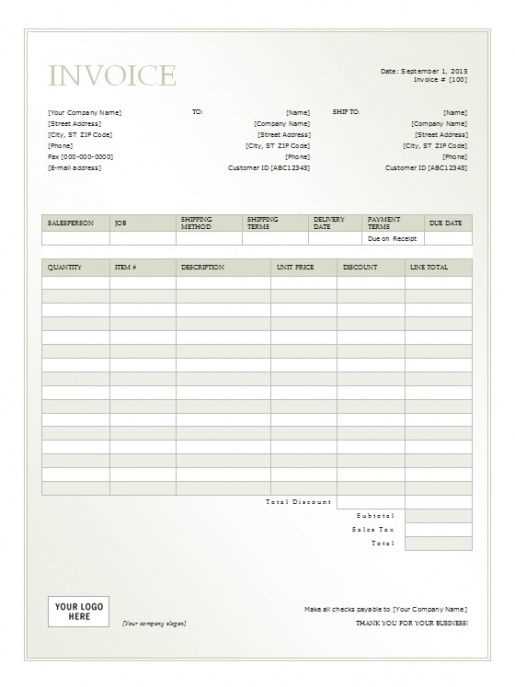

For invoices, look for templates that include fields for the business name, customer information, item descriptions, quantities, prices, and taxes. These templates often allow for customization to fit the needs of different industries. Make sure the template you use has a professional layout that makes your document look polished and well-structured.

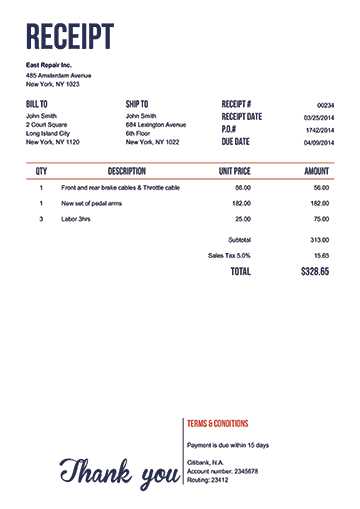

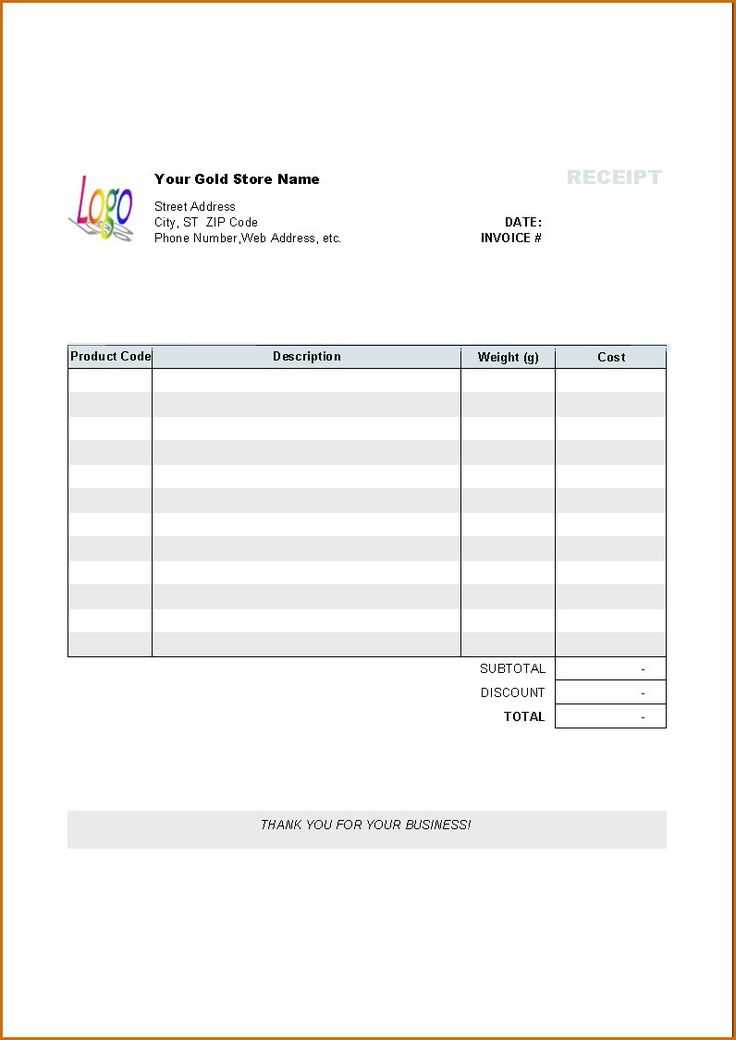

Receipts, on the other hand, need a more straightforward format. A simple template with the business name, date, and transaction details will suffice. Customize it by adding payment methods and any other relevant details to keep a record for both the customer and your accounting system.

Using pre-designed templates ensures that you won’t miss critical information while maintaining a professional appearance. Templates are a great way to save time and avoid errors in financial documents.

Templates for Invoices and Receipts

Using a template for invoices and receipts streamlines the billing process and ensures all necessary information is included. Customize these templates to suit your business needs, saving time and avoiding mistakes. Start with clear sections for the buyer and seller details, transaction date, payment terms, and a breakdown of services or products.

Invoice Template Tips: Include a unique invoice number, your company logo, and the correct tax rates. Specify the payment due date and provide clear instructions for payment methods, whether by bank transfer, card, or online service.

Receipt Template Tips: A receipt should contain the transaction date, a description of the purchased goods or services, the total amount paid, and payment method (cash, card, etc.). Keep it simple but include any relevant tax information if necessary.

Both templates should be easy to read and professionally designed. Consistency in layout helps build trust and ensures you don’t miss important details. Use a word processor, spreadsheet software, or invoicing software to create and store these templates.

How to Choose the Right Invoice Template for Your Business Needs

Pick an invoice template that reflects your business’s professionalism and keeps your transactions clear. The right template helps you maintain consistency and ensures all necessary details are present. Here’s how to select one:

First, assess your business type. Different industries have different needs when it comes to invoicing. For example, service-based businesses may not need product descriptions, while product-based businesses should have a detailed breakdown of each item. Ensure your template fits your business model.

Next, focus on simplicity. Look for templates with easy-to-read fonts and clear section divisions. Avoid overly complex designs that may confuse your clients. Your template should prioritize functionality over aesthetics.

Consider customization options. Choose a template that allows you to easily adjust key elements like your business logo, contact details, and payment terms. Personalizing these details enhances the client experience and reinforces your brand identity.

Make sure your template includes all required fields. This typically includes your business name and contact information, client details, invoice number, date, itemized list of products or services, payment terms, and total amount due. Check that these elements are clearly separated and easy to understand.

Finally, test for compatibility. Ensure the template works with your accounting software or payment system. If you use tools like QuickBooks, make sure the template can be imported or integrated smoothly, saving time and reducing errors.

| Key Considerations | What to Look For |

|---|---|

| Business Type | Industry-specific fields and item breakdown |

| Design | Simple, professional layout with easy-to-read sections |

| Customization | Ability to add your logo, contact details, and payment terms |

| Required Fields | Business name, client info, invoice number, itemized list, total |

| Compatibility | Integration with accounting software and payment systems |

By considering these aspects, you can choose an invoice template that not only saves time but also enhances the professionalism of your transactions.

Customizing Receipt Templates for Different Payment Methods

Adjust your receipt templates based on the payment method used to provide clear and relevant information. For card payments, include the last four digits of the card number and the transaction approval code. For cash payments, indicate the exact amount received and any change given. When using mobile payment systems like Apple Pay or Google Pay, highlight the payment method used along with any unique transaction identifiers.

For bank transfers, add the bank account details and reference number for easier tracking. If multiple methods are used (e.g., partial payment by card, partial by cash), list each separately for clarity. Keep the format simple yet detailed enough to confirm the transaction method and status without overwhelming the recipient.

Be sure to adjust the layout to accommodate additional fields depending on the payment method. This makes your receipts more functional, offering a streamlined experience for both your business and customers.

Common Mistakes to Avoid When Using Invoice and Receipt Templates

Make sure to double-check the accuracy of all details before sending invoices or receipts. This includes client names, addresses, and payment terms.

- Forgetting to Include the Invoice Number: Each invoice should have a unique identifier. This helps both parties track payments and prevent confusion.

- Incorrect Date Format: Ensure that you use a consistent and clear date format. An ambiguous date may delay payment processing.

- Omitting Tax Information: If taxes apply, include them clearly. Many templates allow for automatic tax calculations, so take advantage of this feature.

- Leaving Out Payment Terms: Specify payment deadlines and accepted methods. Not doing so can lead to misunderstandings and late payments.

- Using Inconsistent Currency Symbols: Always ensure you are using the correct currency for the transaction. Inconsistent symbols or formatting can confuse your client.

- Not Including Contact Information: Include your business’s contact details, including phone number and email, in case your client needs to get in touch about the invoice or receipt.

- Cluttering the Template: Avoid overloading the invoice with unnecessary details or graphics. Keep it clean and professional.

- Failing to Proofread: Always review your template for typos, missing information, or formatting errors before sending it out.

By avoiding these mistakes, you ensure clarity in communication and maintain professionalism with clients.