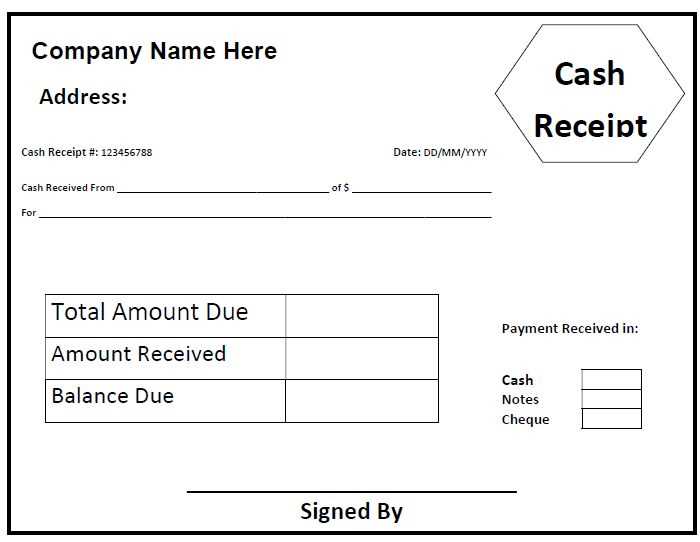

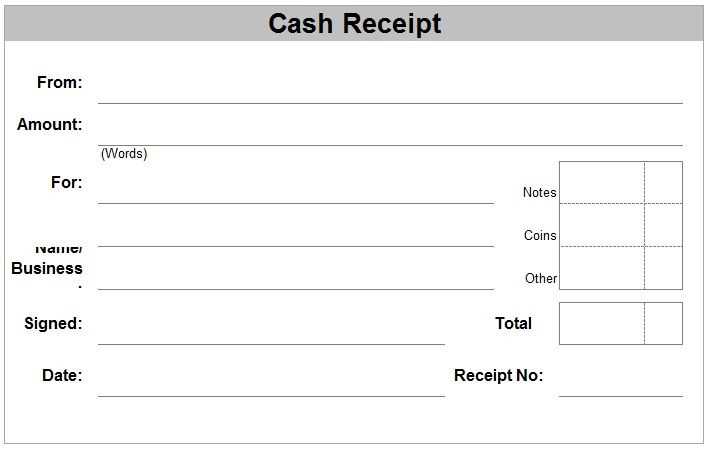

Key Elements of a Cash Advance Receipt

Ensure that your cash advance receipt includes all relevant details for clarity and transparency. These details help both the recipient and the issuer maintain accurate records.

- Date – Record the exact date of the transaction.

- Receipt Number – Assign a unique identifier to track the receipt.

- Cash Advance Amount – Clearly state the total amount of cash advanced.

- Payer’s Name – Include the name of the person or organization providing the funds.

- Payee’s Name – Add the name of the person or entity receiving the advance.

- Purpose – Specify the reason for the cash advance.

- Signature of Payer – Both parties should sign the document for verification.

- Signature of Payee – The recipient’s signature confirms receipt of funds.

Template Example

Here’s a simple cash advance receipt template for quick use:

Date: [Insert Date] Receipt Number: [Insert Receipt Number] Cash Advance Amount: $[Amount] Payer Name: [Payer's Full Name] Payee Name: [Payee's Full Name] Purpose: [Reason for Advance] I, [Payee's Name], confirm receipt of the cash advance of $[Amount] from [Payer's Name] on the date mentioned above. I understand that this advance will be deducted from my salary/compensation or repaid by [Specify Terms]. Payer’s Signature: __________________________ Payee’s Signature: __________________________

Why Use a Template?

A template ensures that you don’t miss any critical information when issuing or receiving a cash advance. It keeps everything organized and legally sound, reducing the chance for errors or misunderstandings. Adopting a consistent format also streamlines accounting and financial record-keeping, making audits and reviews more straightforward.

Tips for Creating Your Own Receipt

- Customize the template to suit your specific business or personal needs.

- Keep multiple copies for both the payer and the payee.

- Consider using accounting software or apps to automate the process and store receipts securely.

Cash Advance Receipt Template: A Practical Guide

How to Design a Basic Receipt Template for Cash Advances

Key Elements to Include in a Cash Advance Receipt

Best Practices for Formatting Your Receipt Template

How to Customize a Cash Advance Receipt for Your Business

Ensuring Compliance with Legal Requirements in Receipts

Common Mistakes to Avoid When Using a Cash Receipt Template

Start by including clear headings to identify key sections. This structure makes it easier for both the issuer and recipient to track the transaction details. The main parts should include the date of the advance, the amount given, the recipient’s name, and the reason for the advance.

Key Elements to Include: Include the date of the transaction, the name of the recipient, and the exact amount of cash advanced. A description of the purpose for the advance, including relevant project or task identifiers, helps keep records organized. A space for signatures from both the issuer and the recipient will verify the transaction and ensure accountability.

Best Practices for Formatting: Keep the design clean and professional. Use consistent fonts and sizes, and ensure there’s adequate space between sections. A simple table or grid layout can help structure the receipt, making it easy to read. Avoid clutter and use bold text for key data points like amounts and dates.

Customization for Your Business: Tailor the receipt template by adding your business logo, name, and contact information at the top. You can also include a specific reference number or employee ID for internal tracking. Adjust the layout to suit the style of your business while maintaining clarity and professionalism.

Ensuring Compliance: Confirm that your receipt template adheres to local financial regulations. Depending on your location, this may involve including tax information, payment terms, or other legally required details. Check with a legal expert to ensure compliance with relevant laws, such as those governing employee advances.

Common Mistakes to Avoid: Don’t omit any details, such as the reason for the advance or the exact amount. Skipping these can cause confusion later. Avoid vague descriptions and always verify that the date and signatures are clearly recorded. Double-check that the formatting is clean and easy to follow–crowded or inconsistent documents can lead to misunderstandings or errors.