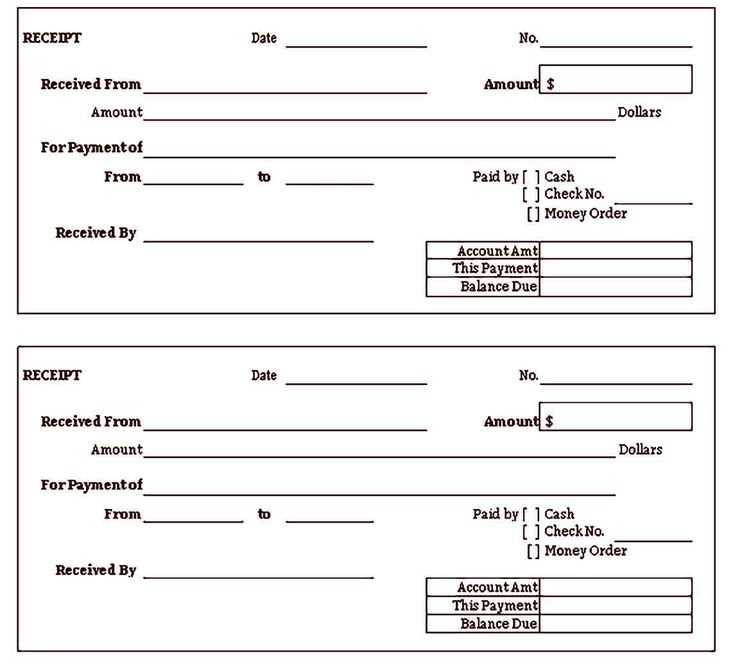

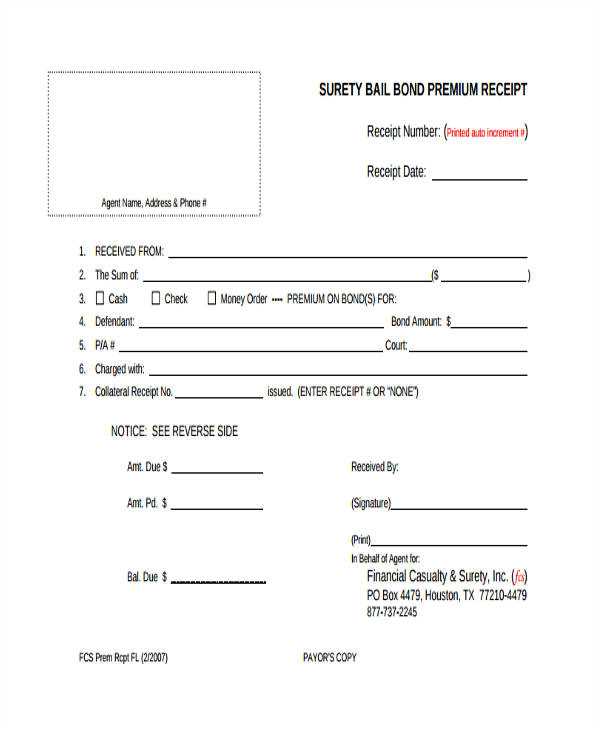

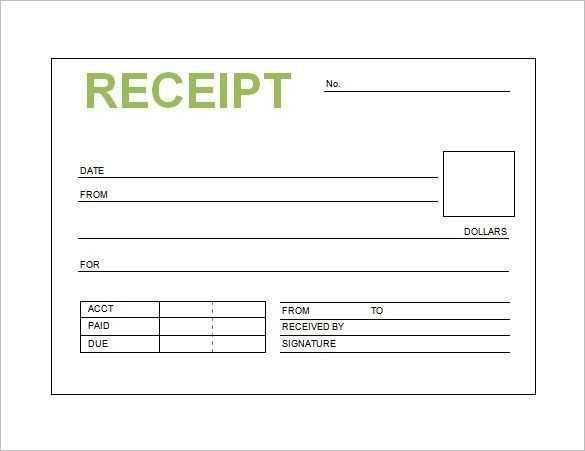

Use a clear, concise receipt template to streamline transactions and avoid confusion. The template should include key details such as the transaction date, itemized list of goods or services, total amount, and payment method. Be sure to provide a unique identifier for each receipt to help with record-keeping.

Ensure the template includes space for both the seller’s and buyer’s information, like names and contact details. A well-organized receipt can prevent future disputes and simplify accounting, especially for tax purposes.

Use editable formats such as Word or PDF to make modifications easy, and tailor the design to suit the type of transaction, whether it’s for a retail purchase or a service. An effective receipt will be clear, professional, and easy to understand at a glance.

Here’s the revised version:

Make sure your receipt template includes key elements: the seller’s details, buyer’s information, a clear description of the product or service, the date of transaction, and the total amount. These components ensure the receipt is both useful and legally compliant.

Key Elements

Start with the seller’s name, address, and contact information. This ensures both parties can verify their identities if necessary. Follow with the buyer’s name and contact details to ensure proper record-keeping. Include a breakdown of the purchased items or services, including quantities, prices, and any applicable taxes.

Formatting Tips

Keep the layout clean and legible. Use consistent fonts and size for clarity. Consider adding a unique reference number for easier tracking. The total amount should be prominently displayed, with any taxes listed separately to avoid confusion.

Receipt Template AU: A Practical Guide

How to Create a Basic Receipt Template for Australian Use

Key Elements to Include in an Australian Receipt

Customizing Your Template for Different Business Types in Australia

Common Mistakes to Avoid When Using a Receipt in Australia

How to Use Digital Tools to Generate a Receipt in Australia

Legal Requirements for Receipts: What You Need to Know in Australia

To create a receipt template for Australian use, start with including basic information such as the business name, contact details, and ABN (Australian Business Number). Ensure the format is clear and easy to understand, with a space for the item or service description, quantity, price, and total amount. Include the date of transaction and any applicable GST (Goods and Services Tax) details. These elements are necessary for the receipt to be considered legitimate.

Key Elements to Include in an Australian Receipt

For a receipt to comply with Australian regulations, ensure it includes the following elements:

- Business name and contact information

- ABN (Australian Business Number)

- Description of goods or services

- Price, quantity, and total amount

- Date of transaction

- GST details (if applicable)

These components are required for legal and tax purposes, and will help ensure the receipt is both valid and useful for record-keeping.

Customizing Your Template for Different Business Types in Australia

Customizing your receipt template depends on the nature of your business. Retail stores may focus more on itemized lists, while service-based businesses should highlight the services rendered. If you’re dealing with taxable items, clearly display the GST amount for transparency. Keep your template adaptable to include any industry-specific information or regulations required in your sector.

Digital tools like Microsoft Excel, Google Docs, or online receipt generators can streamline the process of creating receipts. These tools often come with pre-made templates that include the key elements mentioned, allowing you to easily customize your details and create professional-looking receipts. For larger businesses, consider using accounting software such as Xero or QuickBooks that can automatically generate receipts and track transactions.

Common Mistakes to Avoid When Using a Receipt in Australia

Avoid common mistakes such as failing to include the ABN, missing GST details for taxable transactions, or omitting itemized descriptions. Always check the accuracy of transaction amounts and ensure the correct tax rate is applied. Incorrect or incomplete receipts can lead to legal issues or confusion during audits.

Lastly, understand the legal requirements for receipts in Australia. Australian law requires receipts for certain transactions, especially when GST is involved. Failure to issue valid receipts can result in penalties, especially for businesses that are GST-registered. Be sure to stay informed about the latest regulations to ensure your receipts remain compliant.