Ensure your community donation receipts are clear and professional by using a well-structured template. A properly formatted receipt not only serves as proof of contribution but also reinforces trust between donors and the organization. A good template should include all necessary details for transparency and accounting purposes.

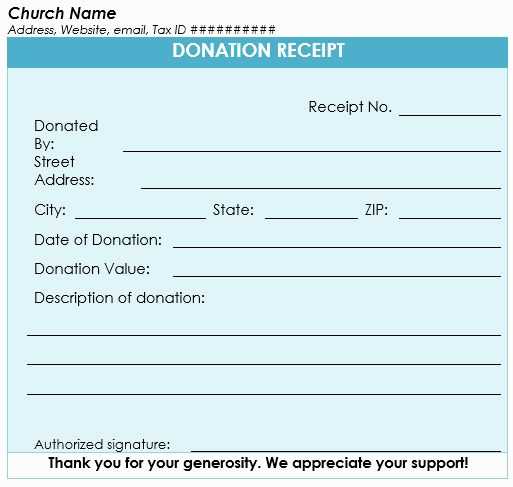

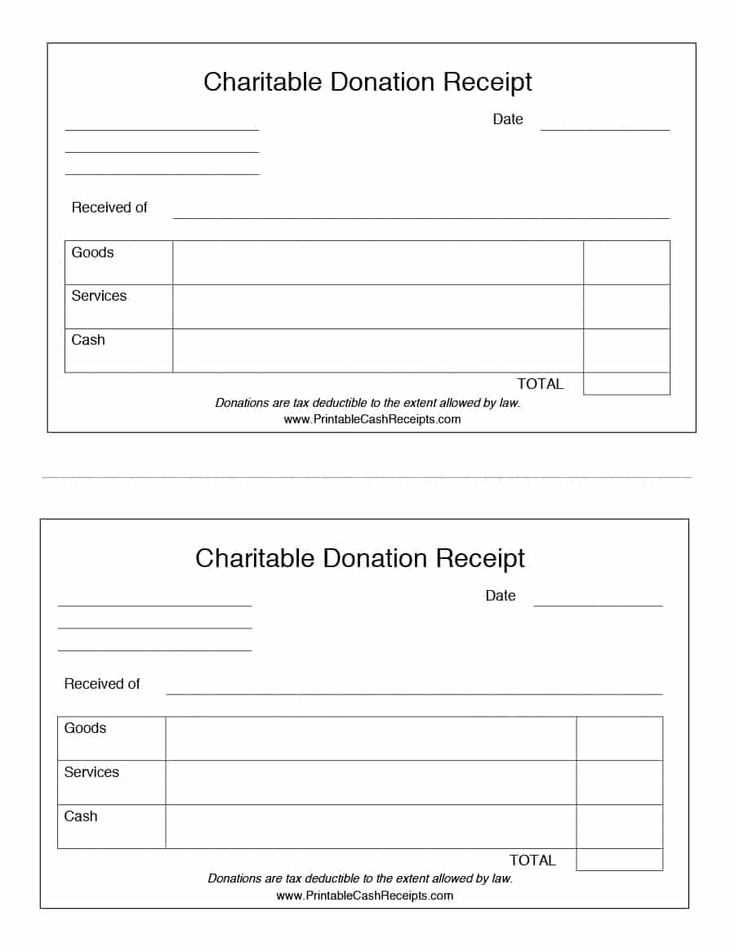

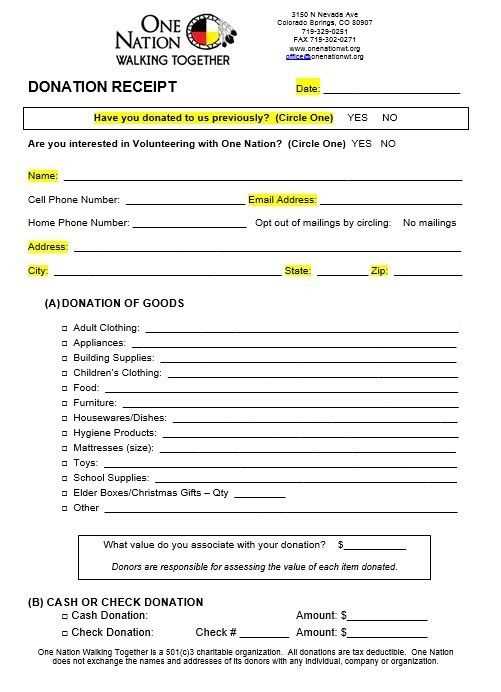

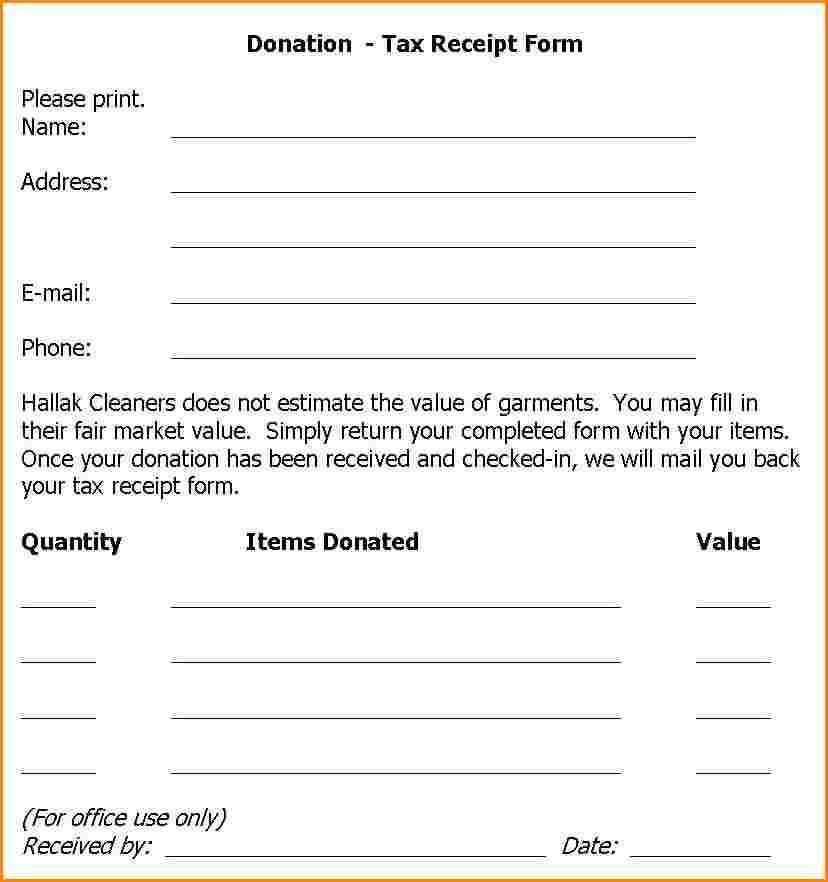

Start by listing the donor’s name and contact information, followed by the date and amount donated. Specify the nature of the donation, whether it’s monetary or in-kind. A clear description of the donation helps both parties maintain accurate records. Include the community association’s official details such as its name, address, and tax ID number to ensure the donation is properly recorded for tax purposes.

End the receipt with a thank you message and a reminder about the tax-deductible nature of the donation if applicable. This not only shows appreciation but also encourages future support from donors. Make sure your template is adaptable for various donation amounts and types, keeping it simple yet professional for ease of use.

Here is the revised version:

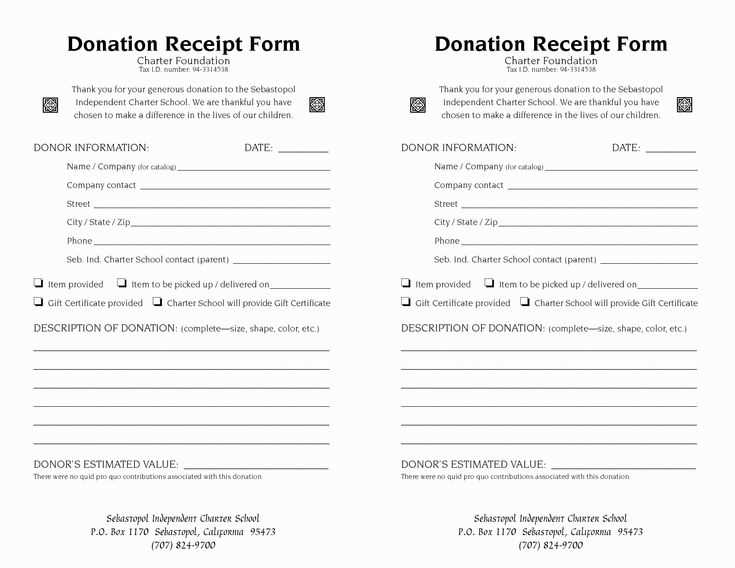

Ensure the donation receipt includes the name and contact details of the community association. Clearly state the date of the donation and its value, whether monetary or in-kind. Specify if the donation is tax-deductible. If it’s a cash donation, mention the amount received; for items, list their descriptions and estimated values. Include the donor’s name and any other necessary details for tax purposes, such as the donor’s address or ID number, depending on local requirements. A signature from an authorized person within the association adds credibility and authenticity to the document.

Make sure the wording is straightforward and unambiguous. Avoid overly complicated language to prevent misunderstandings. If the donation is made anonymously, mention this detail to comply with regulations. Additionally, include any relevant notes about the purpose of the donation if it is earmarked for a specific project or initiative.

- Receipt for Contribution to Community Association Template

To ensure transparency and proper record-keeping, it’s crucial to include the following details in a receipt for any contribution made to a community association:

- Receipt Number: A unique number for tracking purposes.

- Date of Contribution: Clearly mention the date when the donation was received.

- Donor Information: Name, address, and contact details of the donor.

- Contribution Amount: The exact amount donated, including any notes if partial or in-kind donations are made.

- Purpose of Donation: A brief description of how the funds or items will be used within the community association.

- Tax Information: If applicable, include a statement on the tax deductibility of the contribution.

- Signature: The signature of an authorized person within the association to confirm receipt.

Ensure that each receipt is issued in a timely manner and that the information is clear and accurate. This helps maintain trust and accountability within the community and assures donors that their contributions are being managed properly.

Ensure you accurately list the donor’s full name, the amount donated, and the donation date. This should be placed near the top of the acknowledgment letter or receipt, making it easy for the donor to confirm the details. For organizational clarity, include a unique donation ID or reference number.

If applicable, specify the donation method (e.g., cash, check, credit card, etc.), as this enhances transparency. Additionally, consider noting the donor’s contact details, such as address and email, for future communication. This can help maintain a relationship for follow-up or acknowledgment in future campaigns.

When possible, personalize the acknowledgment by thanking the donor for their specific contribution. A brief mention of how the donation will be used can also help the donor see the impact of their support, further strengthening their connection to your cause.

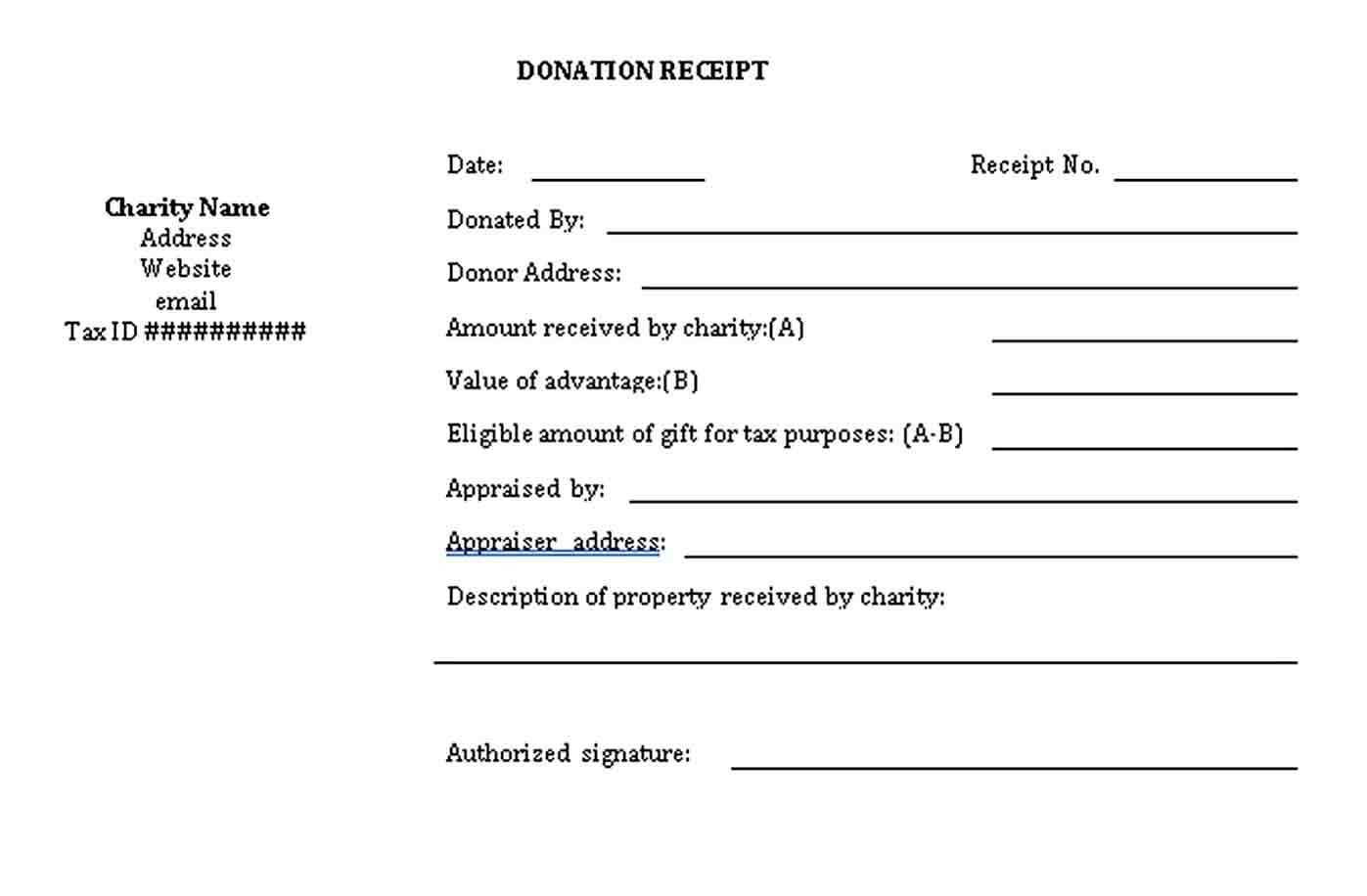

Nonprofit organizations must include specific details on contribution receipts to comply with tax laws. These elements ensure donors receive proper acknowledgment, and organizations avoid potential legal pitfalls. Here’s a breakdown of the critical components every nonprofit receipt should contain.

Donor Information

The receipt must include the donor’s full name and address. This allows the donor to verify their contribution for tax purposes and ensures that the nonprofit can properly track donations for reporting. Accuracy here is non-negotiable.

Donation Details

Clearly list the amount donated, along with the date of the donation. If the contribution is non-monetary, a description of the items or services donated should be provided. For monetary donations, the receipt should specify whether it was a cash donation, check, or other forms of payment.

Tax-Exempt Status

State the nonprofit’s tax-exempt status clearly on the receipt. Include the organization’s IRS identification number (EIN) to confirm that the organization is a qualified tax-exempt entity under Section 501(c)(3) of the IRS code. This helps the donor to substantiate their deduction on their tax return.

Statement of No Goods or Services Provided

If the donation was fully tax-deductible, the receipt must include a statement that no goods or services were provided in exchange for the donation. If goods or services were provided, the receipt should note their value and clarify how it affects the tax deduction. This prevents misunderstandings about the amount eligible for a tax deduction.

To create a meaningful acknowledgment for your community association, tailor the content to reflect the specific contribution and involvement of the donor. Begin with addressing the donor by name to make the acknowledgment more personal and relevant. Instead of generic language, mention the exact donation, whether it’s monetary, goods, or volunteer time, and highlight how it directly supports the association’s goals.

Show Gratitude and Impact

Include a statement that connects the donation to a tangible outcome. For example, if the donation funds a community project, detail how the contribution will be used, such as funding a local event or helping in the improvement of communal spaces. Acknowledging the donor’s impact makes them feel their efforts matter in the real world.

Offer Continued Engagement Opportunities

Invite the donor to stay connected with the community association through future events, newsletters, or volunteer opportunities. This not only reinforces the connection but also helps build long-term relationships, ensuring they feel continuously valued.

Ensure that your donation receipt includes all relevant details for both the donor and the association. Start with the donor’s name and contact information, followed by the donation amount, date, and purpose. Make sure to specify the tax-exempt status of the organization and any other applicable notes for tax purposes. A clear structure helps ensure proper documentation and compliance with legal requirements.

| Field | Details |

|---|---|

| Donor’s Name | Full legal name of the individual or organization making the donation. |

| Donation Amount | Exact monetary value of the contribution made. |

| Date of Donation | Date when the donation was made. |

| Donation Purpose | Specific cause or project the donation supports (if applicable). |

| Tax-Exempt Status | Confirmation that the organization is registered as a tax-exempt entity. |

| Receipt Number | Unique identifier for the donation receipt for reference and record-keeping. |

Include a thank you note to acknowledge the donor’s generosity. This adds a personal touch and reinforces the connection between the community association and its supporters.