Providing employees with a clear and structured cash receipt template ensures transparency in financial transactions and smooth record-keeping. A well-designed template helps avoid confusion, streamlines the process, and reduces the chances of errors or misunderstandings. This template should include essential details such as the employee’s name, the date of the transaction, the amount received, and the purpose of the payment. Make sure the layout is simple yet informative, allowing both parties to easily verify the information.

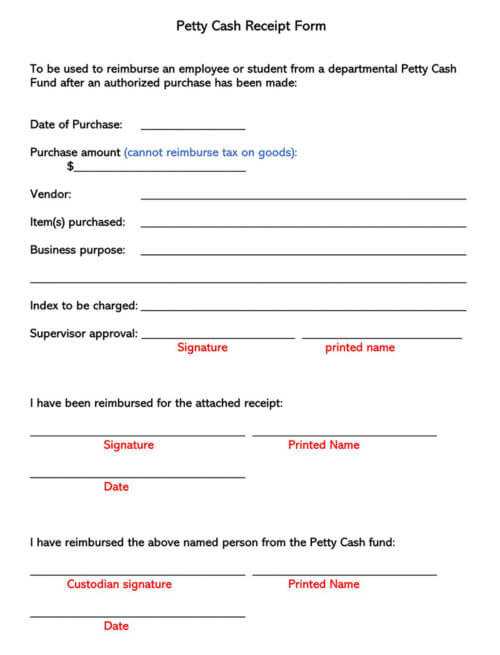

When drafting the template, consider adding space for both signatures, confirming the receipt of cash by the employee and the approving authority. Include a section for any additional notes or special conditions regarding the transaction, ensuring that any unique circumstances are documented properly. By incorporating these elements, you can create a clear and trustworthy document that serves both as a receipt and as a financial record for future reference.

It’s important to review the template periodically to ensure it meets the evolving needs of your business while maintaining clarity and accuracy in all financial documentation. A consistent format will save time for both employers and employees while providing a reliable paper trail for any audits or disputes. This simple yet effective tool will enhance your financial processes and keep both parties on the same page.

Employee Cash Receipt Template

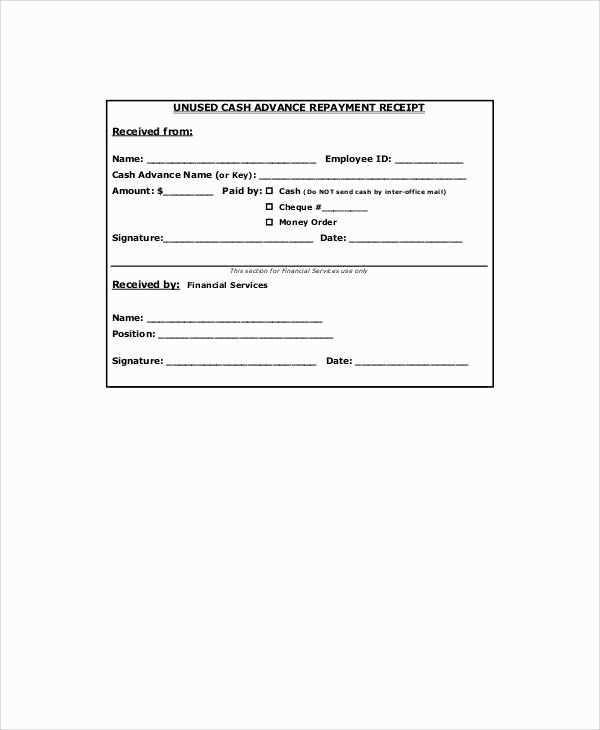

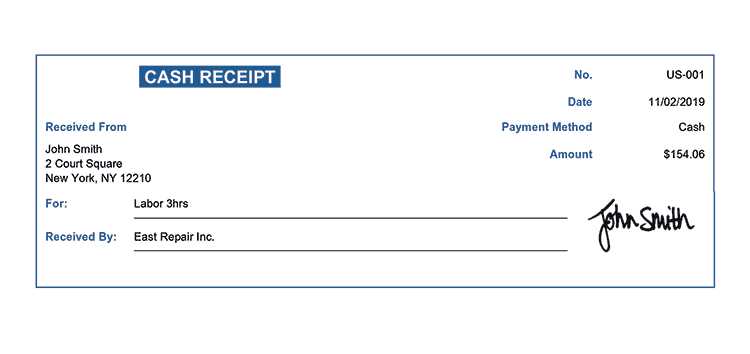

Create a clear and concise cash receipt for employees by including key details such as the amount received, the purpose of the payment, and the date of transaction. Use a straightforward format with fields for the employee’s name, the business name, and the payment method. Always include a section for both the signature of the employee and the issuer, confirming the completion of the transaction.

Ensure the template includes a unique receipt number for tracking purposes. This helps maintain accurate records for both employees and the company. Specify whether the payment is a loan repayment, wage advance, or other type of disbursement to avoid any confusion in future transactions.

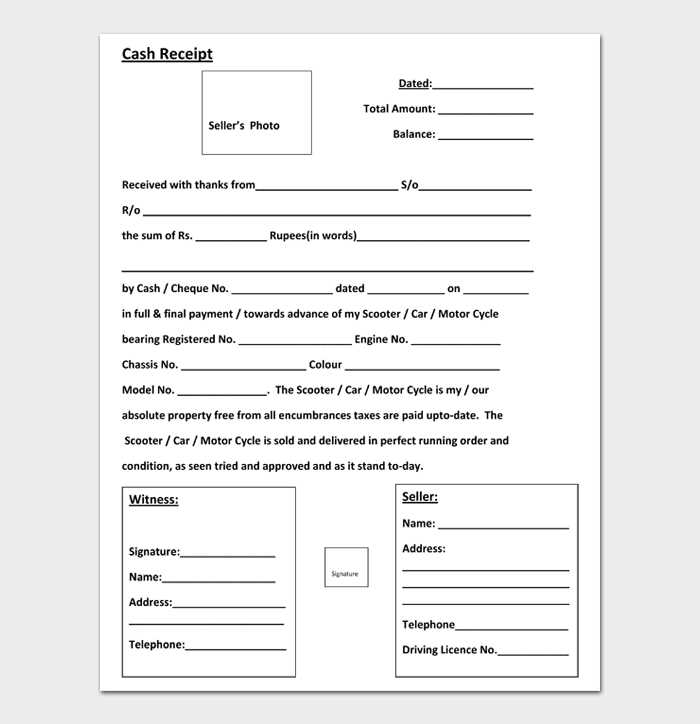

Consider adding a breakdown of deductions or additional notes related to the payment, especially if the transaction involves any adjustments, taxes, or fees. This makes the receipt more transparent and easier to understand. Keep the layout simple and professional, ensuring it can be easily printed or stored electronically.

Customizing Fields for Accurate Payment Recording

Adjust the fields on your cash receipt template to capture all relevant payment details. Include fields for payment method, date, transaction ID, and payer information. Tailor these sections based on your specific requirements, such as adding a “discount applied” field if necessary. This ensures you record every aspect of the transaction accurately.

Consider adding a “payment reference” section, which is helpful for cross-referencing with internal accounting systems. The more precise your template is, the less room there is for error or confusion down the line. Regularly review these fields to ensure they remain aligned with your payment processing methods.

Customize the layout to prioritize the most critical details, like the amount paid and outstanding balance. This way, anyone reviewing the document can quickly verify payment status. Also, include any tax breakdowns or additional charges in separate fields to avoid cluttering the main payment details.

Managing Receipt Validity and Security

Ensure that each receipt issued for employee transactions contains unique identifiers, such as a serial number or barcode. This prevents duplication and aids in traceability, helping to verify the transaction’s legitimacy.

Implementing Secure Receipt Systems

- Integrate systems that generate and record receipts automatically to eliminate manual errors and tampering risks.

- Store receipt data in encrypted formats, making it inaccessible to unauthorized personnel.

- Use multi-factor authentication for systems that allow receipt creation or modification to add an extra layer of security.

Establishing Receipt Validation Protocols

- Verify receipt authenticity by cross-referencing transaction details with internal records, such as cash flow logs and employee IDs.

- Implement real-time monitoring to flag suspicious receipt activity, such as large amounts or repeated transactions.

- Provide employees with clear instructions on handling and issuing receipts to minimize the risk of human error or fraud.

Integrating the Template with Payroll and Accounting Systems

Linking an employee cash receipt template with payroll and accounting systems streamlines financial tracking. Start by ensuring the template captures essential payment details such as employee name, amount, date, and purpose. This information can automatically sync with payroll software for easy record-keeping and processing. Many payroll systems allow for custom fields, so tailor the template to match specific payroll data points, such as pay periods or deductions.

Linking Payment Data with Accounting Software

For accounting, the template can export payment data directly to accounting software. Set up a mapping system where each category from the receipt template (e.g., wages, bonuses) is linked to its corresponding account in the accounting system. This eliminates manual entry errors and ensures accurate financial reports. With accounting software that supports import functions (like CSV files), data flow becomes automated, saving time during monthly reconciliations.

Real-Time Tracking and Reporting

Integrating the receipt template with both systems enables real-time tracking of employee payments. This connection provides payroll administrators with immediate access to the most recent cash receipts, while accounting departments benefit from up-to-date financial statements. By eliminating redundant data entry, errors are reduced, and the process becomes more transparent for auditors and other stakeholders.