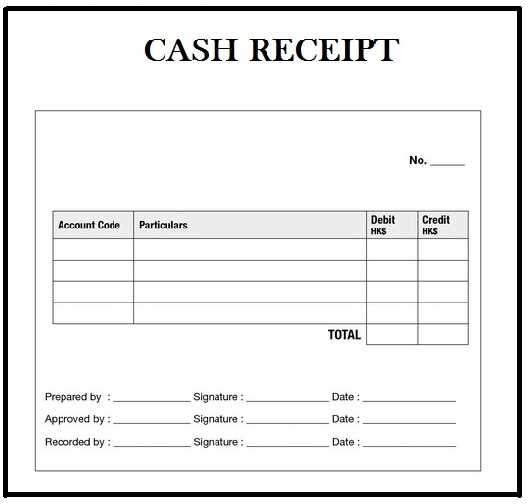

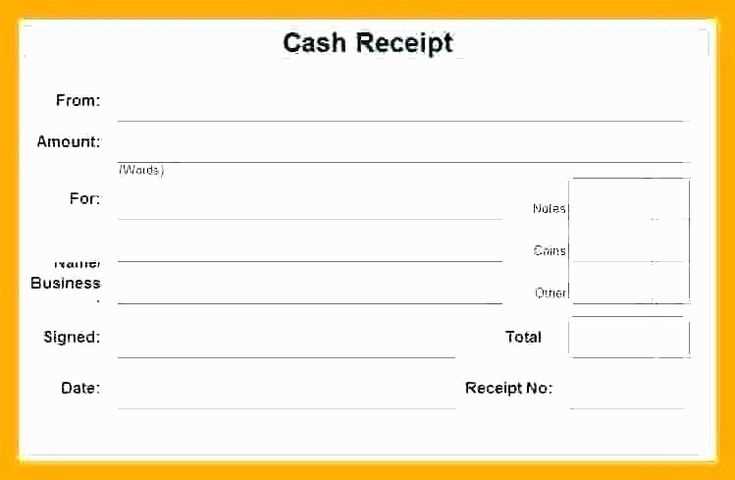

When designing a detailed cash register receipt, ensure clarity by listing each item separately along with its price, quantity, and applicable taxes. This structured format helps customers easily review their purchase history, while also providing businesses with organized transaction records.

Use clear headings for each section, such as Item, Price, Quantity, and Total. These headings guide the customer’s eye, making it easy to track each item purchased. Ensure all prices are rounded to two decimal places for consistency.

Incorporate a subtotal row before taxes to summarize the total cost of items before applying any additional charges. This allows the customer to verify the cost breakdown. Don’t forget to display tax information clearly, listing the tax rate applied, followed by the tax amount calculated.

Itemized Cash Register Receipt Template

For clarity and transparency, always include a detailed itemized list on receipts. A good template should display each item, its quantity, price, and applicable taxes. This allows customers to easily verify their purchase and ensures that the business complies with regulations. Be sure to include the total amount, breaking down the tax rates and itemized discounts if applicable.

Start with the store’s name and address at the top of the receipt, followed by the transaction date and time. This helps the customer identify the purchase easily. Below that, list each item purchased in separate rows, specifying quantity, description, unit price, and total price for each item. Include a subtotal that adds up all item prices before taxes.

Next, show the applied tax rates, indicating the percentage for each tax, followed by the total tax amount. If there are any discounts, subtract them from the subtotal before calculating taxes. Lastly, display the total amount due, which combines the subtotal, taxes, and discounts, ensuring the final total is clear and accurate.

Conclude with the payment method, and provide a section for returns or exchanges, if relevant. If using an electronic register, ensure that the template is easy to adjust for different transaction types, including cash, credit, and debit payments. This level of detail not only improves customer experience but also keeps business records accurate for accounting and audit purposes.

How to Design a Clear Itemized Receipt Layout

Keep the receipt clean by aligning the text properly. Use columns for different information like item names, quantities, prices, and totals. Ensure that each column is wide enough to prevent text from overlapping. Adjust the font size to fit the space without crowding the details.

Separate sections clearly by leaving space between item details and totals. A simple line or extra spacing helps differentiate between purchases and the final amount. This visual break enhances readability and allows the customer to easily spot the total cost.

Prioritize readability by using a legible font and consistent size. Avoid overly stylized fonts. Make the prices bold and slightly larger than the other text to draw attention to the most important numbers. Use a simple, sans-serif font for clarity.

Organize by categories if the items belong to different groups. Grouping similar items under headings, like “Groceries” or “Accessories”, helps the customer track their purchases. This reduces confusion, especially for long receipts.

Include tax and discounts clearly on the receipt. Show the tax amount separately below the total to avoid confusion. Discounts should be listed with the item they apply to, making it clear how the price was reduced.

Use appropriate spacing between rows and columns. This allows the information to breathe and ensures that the customer can easily read each item’s details without straining. Keep margins consistent and use a narrow column for the item descriptions to leave more space for the pricing section.

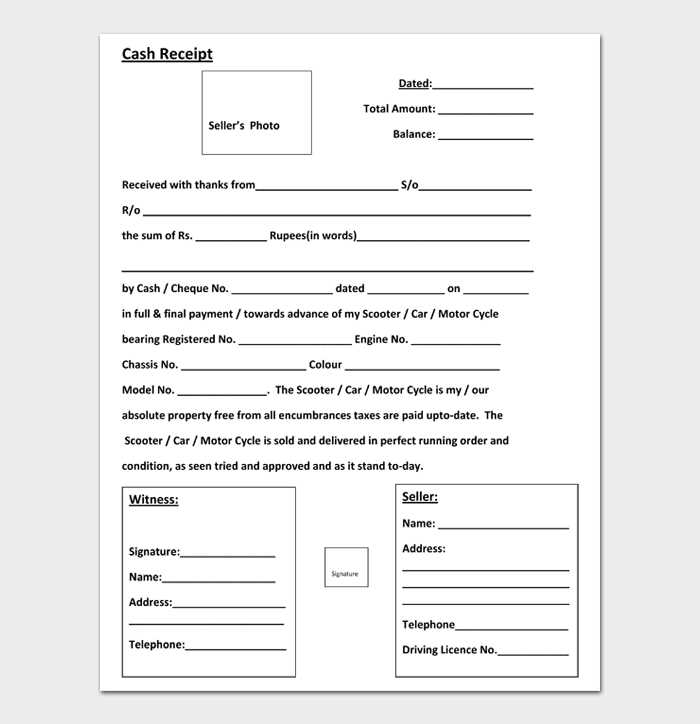

Customizing a Receipt Template for Different Businesses

Adjust your receipt template based on your business type to ensure it captures all necessary details and reflects your brand. For retail stores, include item names, prices, quantities, and a subtotal. In contrast, service-based businesses might prioritize labor hours, rates, and service descriptions, offering a breakdown for transparency. Add tax information for accurate records, with some businesses opting to list it separately and others incorporating it into the total price.

Retail Businesses

For retail businesses, the receipt should display product names, quantities, prices, and any discounts or promotions applied. If the business is subject to varying tax rates, clearly indicate these on the receipt. A simple format is ideal to help customers quickly understand their purchase details, including a breakdown of any loyalty points or rewards, if applicable. You may also want to include your store’s return policy to make the transaction clearer for customers.

Service-Based Businesses

Service-based businesses should tailor their receipts to show the details of services provided. Include the date, service description, time spent, and hourly rates. A summary of the total amount due should be presented at the bottom, breaking down any discounts or additional fees. For businesses in sectors like consultancy or repair services, a detailed breakdown can help manage client expectations and minimize confusion.

Customizing your receipt template ensures that it supports the unique needs of your business and improves the customer experience. Keep the design simple, functional, and tailored to what is most important for your specific sector.

Best Practices for Printing and Distributing Receipts

Ensure your receipt is clear and legible. Use a simple font size and avoid overly decorative styles. This improves readability and prevents customer frustration. Keep the receipt free of unnecessary graphics or text that could clutter the page.

Print receipts in a consistent format. This includes aligning important information such as the business name, address, transaction details, and payment method. Consistency helps customers quickly find the information they need.

- Include the transaction date and time to avoid confusion later.

- Make sure to clearly state the total amount paid, including any applicable taxes or discounts.

- If the receipt is for a return or exchange, include relevant details like the return policy and item codes.

Distribute receipts electronically for customers who prefer it. This reduces paper waste and provides a convenient way for customers to keep track of their purchases. Ensure the email receipt is easily readable on various devices.

If you’re printing receipts, consider eco-friendly paper options. It’s a small change that can make a big difference in your business’s environmental impact.

- Offer paperless receipts as a default option when possible.

- If customers request a physical copy, print it on recycled paper.

For businesses with high transaction volumes, invest in a reliable, fast printer to avoid delays. Make sure the receipt printer is regularly maintained to ensure quality prints.

Ensure customer privacy by protecting sensitive data. Avoid printing unnecessary personal information, such as credit card numbers or account details, on receipts.