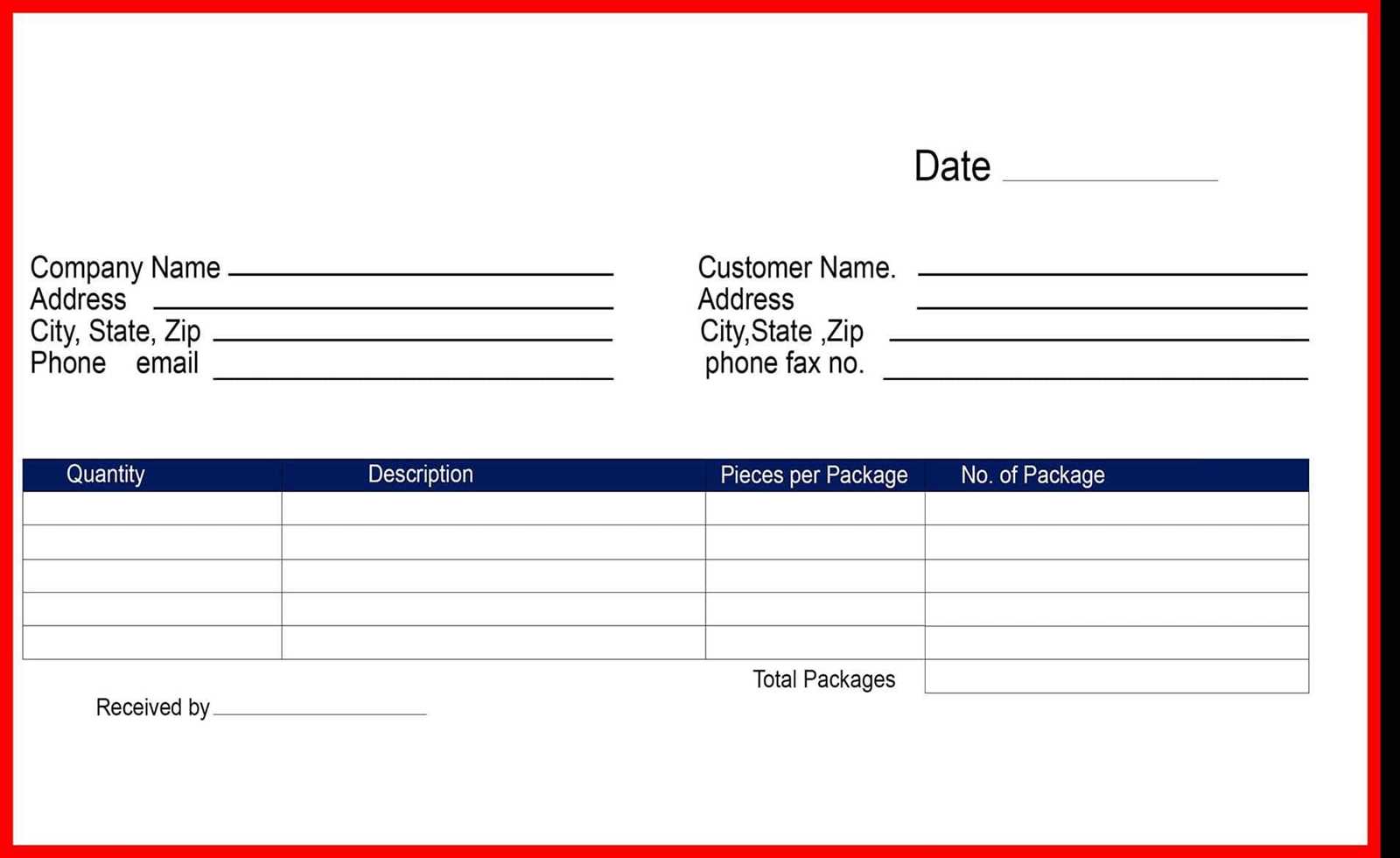

To ensure smooth processing of receipts, it’s important to accurately match them to the corresponding transactions. Begin by gathering all the relevant documents, including the receipt and any associated purchase or sales information. This will help verify the transaction and ensure that the receipt aligns with the details of the sale or purchase.

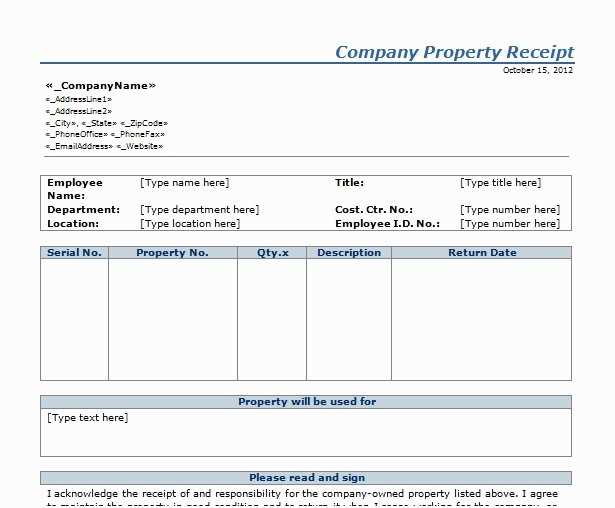

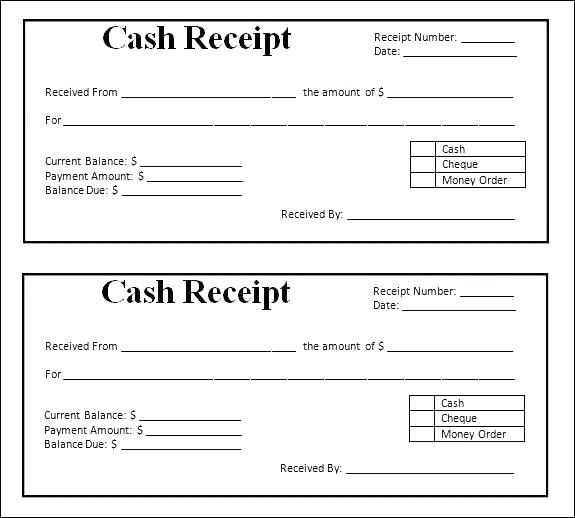

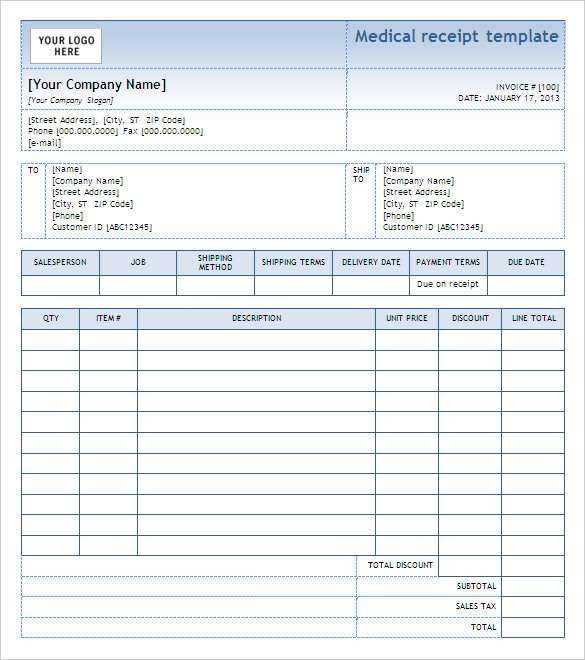

When creating the receipt template, include fields for essential details such as the date, transaction number, item descriptions, prices, and total amount. Organizing these details clearly allows for faster verification and processing. Make sure the template is designed to accommodate different payment methods, including cash, credit, and electronic transfers.

Once the receipt is matched, cross-check the totals. If discrepancies arise, investigate further to ensure the amounts match what was actually processed. Addressing these inconsistencies early prevents errors in financial reporting and improves overall accuracy in record-keeping. Follow these steps to create a streamlined system that ensures each receipt is properly processed and recorded without delay.

Fnsacc302a Prepare Match and Process Receipt Template

To prepare and match receipts efficiently, start by reviewing the relevant transaction details. Ensure the receipt aligns with the invoice or payment records. Enter the date, amount, and description accurately. Double-check for discrepancies before proceeding with any action.

Matching Process

Matching the receipt to the correct transaction requires attention to detail. Compare the amounts, vendor details, and payment methods. If the receipt does not match the expected transaction, investigate further to identify any missing or incorrect information.

Processing the Receipt

Once matched, process the receipt by updating the accounting system or financial records. Record all necessary information such as transaction codes, payment references, and any relevant notes. Ensure that the processed receipt is stored securely for future reference and audits.

How to Match Invoices with Receipts for Accurate Record Keeping

Begin by verifying the invoice details, including the date, total amount, and itemized list of products or services. Cross-check these with the receipt to confirm that all items listed match the amounts paid. If there are discrepancies, investigate whether the receipt includes taxes, discounts, or other adjustments not shown on the invoice.

Step 1: Verify Invoice and Receipt Dates

Ensure that the dates on both the invoice and receipt align. A mismatch in dates may indicate an error in recording the transaction or a delay in payment. The receipt date should reflect when the payment was made, not when the invoice was issued.

Step 2: Confirm Payment Method and Amount

Check that the payment method on the receipt matches the payment method indicated on the invoice, whether it’s via credit card, cash, or bank transfer. Confirm the payment amount is equal to the total listed on the invoice, ensuring there are no underpayments or overpayments.

If there are multiple receipts for a single invoice, ensure that each partial payment is recorded and corresponds to the appropriate portion of the invoice. Keep a detailed log of all transactions for future reference.

Step-by-Step Guide to Processing Receipts Using Fnsacc302a Template

Start by gathering all receipts that need to be processed. Ensure each receipt is clear and legible for accurate data entry.

- Step 1: Open the Fnsacc302a template. This template will serve as a structure to input necessary details for each receipt.

- Step 2: For each receipt, enter the date of the transaction. This date is crucial for accurate record-keeping.

- Step 3: Enter the vendor details, including the vendor name, address, and contact information. Ensure this data is accurate to avoid confusion in the future.

- Step 4: Fill in the receipt amount. Double-check the figures to ensure no errors are made during entry.

- Step 5: Categorize the transaction. The template should have predefined categories, such as “supplies,” “services,” or “miscellaneous.” Choose the correct category based on the receipt’s purpose.

- Step 6: Include any relevant tax information. Some receipts may have tax details that need to be separated for reporting purposes.

- Step 7: Attach a copy of the receipt, if possible. If the template allows, you may scan and upload the document for record-keeping.

- Step 8: Review the information entered for accuracy. Check all amounts, dates, and categories before finalizing.

- Step 9: Save and submit the completed receipt form according to your company’s guidelines. Ensure the document is stored in the correct location for future reference.

By following these steps, you will ensure that all receipts are processed correctly and consistently using the Fnsacc302a template.

Common Mistakes in Receipt Matching and How to Avoid Them

Start by verifying that all the relevant details match between the receipt and the corresponding transaction. A simple oversight in data entry or missing information can cause significant errors in the matching process. Double-check dates, amounts, and payment methods to ensure accuracy.

1. Ignoring Small Errors in Amounts

Even small discrepancies in amounts can cause problems down the line. Compare each line item on the receipt to the transaction record to identify any mismatch. Ensure that taxes, discounts, and tips are correctly reflected and accounted for.

2. Failing to Match Payment Methods

Make sure the payment method on the receipt corresponds to the one recorded in the system. For instance, if the payment was made with a credit card, it should be listed as such. Inaccuracies here may lead to confusion in financial reports or audits.

| Receipt Detail | Transaction Record | Possible Issue |

|---|---|---|

| Amount: $100 | Amount: $99.99 | Mismatch due to rounding or tax discrepancy |

| Payment method: Credit Card | Payment method: Cash | Payment method error |

Addressing these issues ensures accurate receipt matching and prevents mistakes that can complicate accounting or reconciliation tasks. Regular checks and updates in your system can save time and reduce the risk of errors in the future.