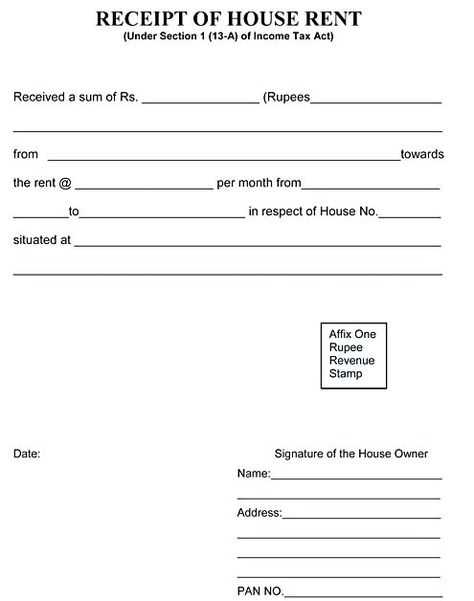

To create a clear and accurate yearly rent receipt in India, include key details such as tenant and landlord information, the rental amount, and the payment frequency. Ensure the date of the transaction is clearly mentioned, along with the rental period for which the payment is made. This helps both parties maintain transparent records for tax and legal purposes.

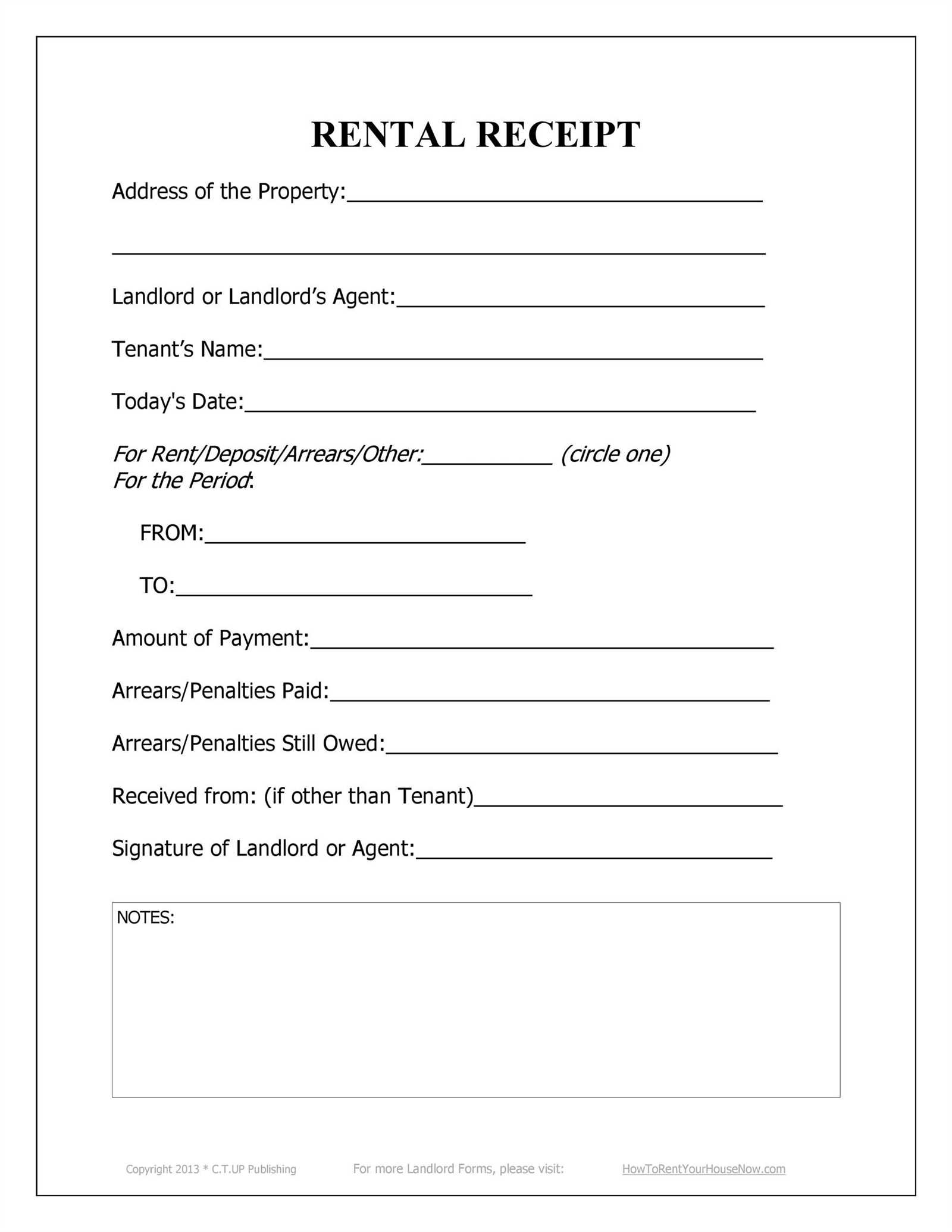

List the full address of the property being rented, as well as any additional terms such as security deposits or maintenance fees, if applicable. A well-structured receipt includes a breakdown of any advance payments or deductions, ensuring there are no misunderstandings.

For added clarity, incorporate a signature or stamp from the landlord to authenticate the receipt. The receipt can be formatted as a document, printed, or sent digitally, but should always be signed by the party receiving the rent. Using a template streamlines the process, making it easier to generate consistent, error-free records each year.

Here’s a revised version of your text:

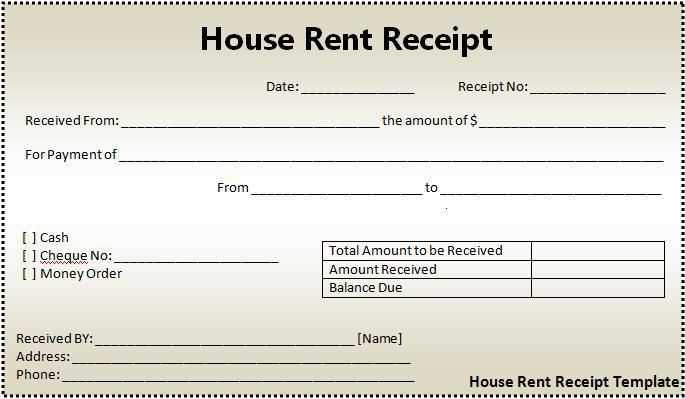

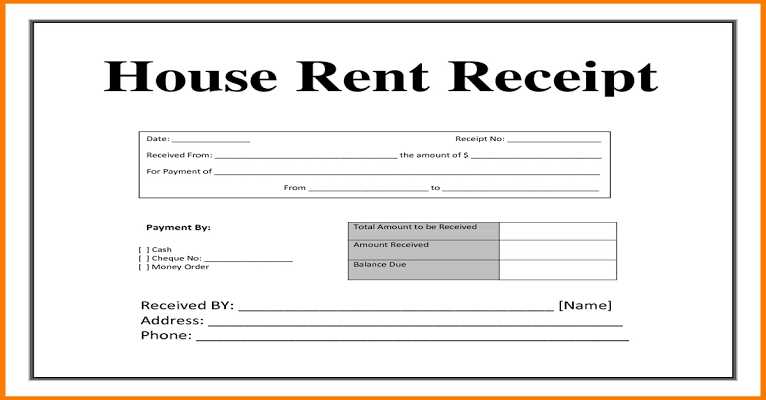

Provide the full names of both the landlord and tenant at the top of the receipt. Include the property address where the rent is being paid, along with the rental period covered by the receipt. Specify the total amount paid for the period and break it down if there are any additional charges, such as maintenance or utilities.

Make sure to mention the payment method, such as bank transfer, cash, or cheque. It’s important to state whether the payment is for a monthly, quarterly, or annual rent cycle. Include the date of payment to avoid confusion in future reference.

At the bottom of the receipt, include a space for signatures from both the landlord and the tenant, as this confirms that the payment has been received. Optionally, add a unique receipt number for tracking purposes.

Yearly Rent Receipt Template India

To create a Yearly Rent Receipt in India, include details such as the landlord’s name, tenant’s name, rental period, payment amount, and address of the rented property. Start by stating the rental amount in words and figures, followed by the payment method, such as cash or bank transfer. Mention the exact period covered by the receipt and specify any advance payments or security deposits received.

Legal details to include are the GST registration number (if applicable) and the tenant’s PAN number for transactions exceeding a certain threshold. For validity, the receipt should bear the landlord’s signature along with the date and location of issuance. This information ensures the document meets Indian taxation and legal standards.

When customizing receipts for tax filing, ensure that the rent paid aligns with the figures reported to tax authorities. Include clear references to any exemptions or deductions the tenant may qualify for under Section 80GG of the Income Tax Act, if relevant. Keep the format simple and easy to read to avoid confusion during audits.