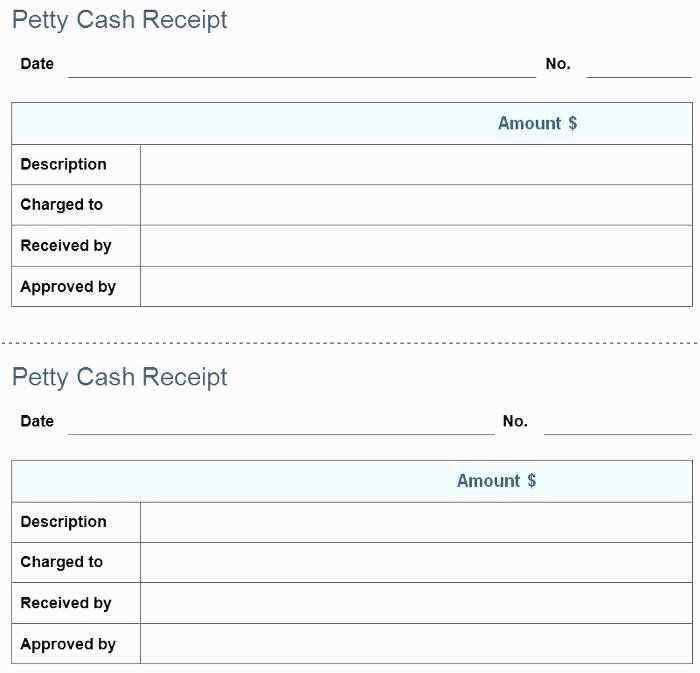

A simple petty cash receipt template is a straightforward tool for tracking small business expenses. It allows for clear documentation of cash transactions, ensuring transparency and proper accounting. By using this template, you can maintain a neat and organized record of petty cash withdrawals, helping you stay on top of your finances without unnecessary complexity.

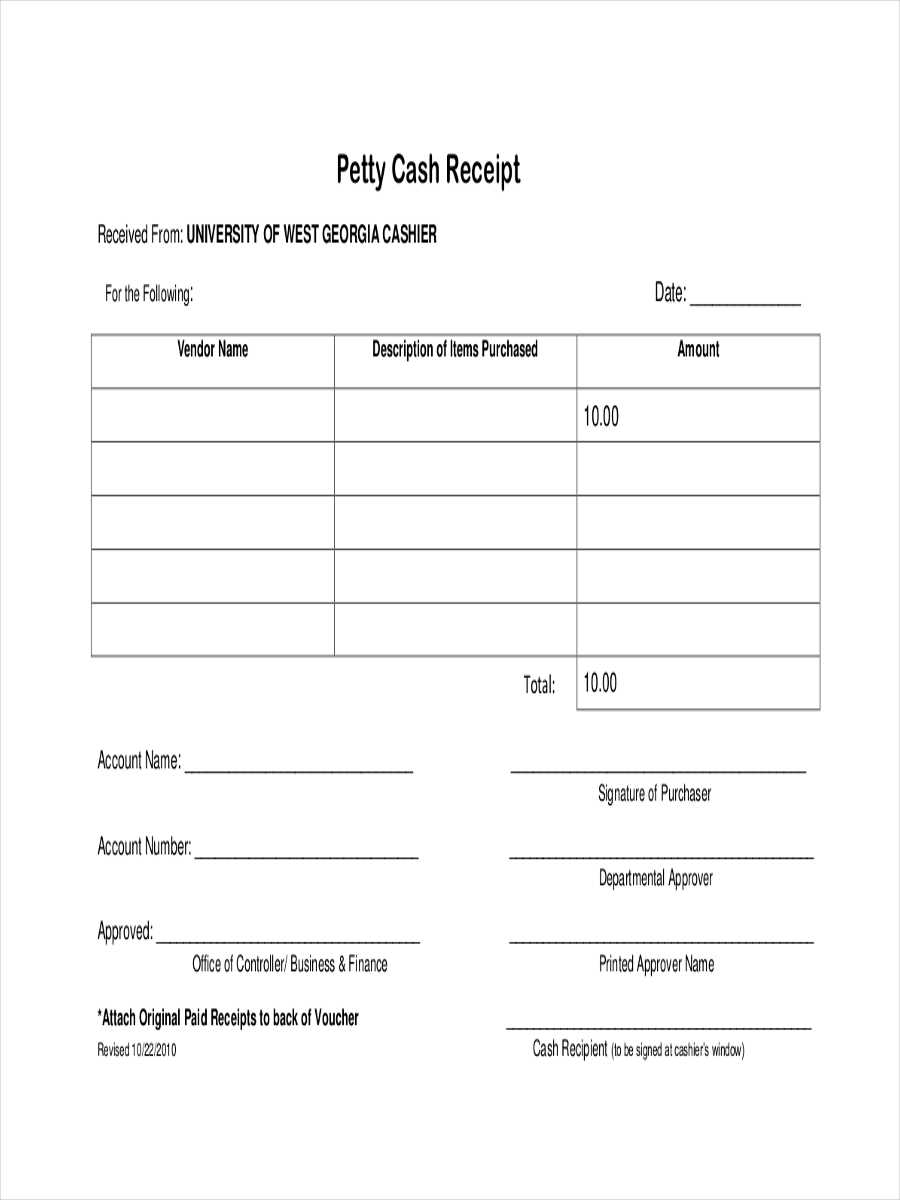

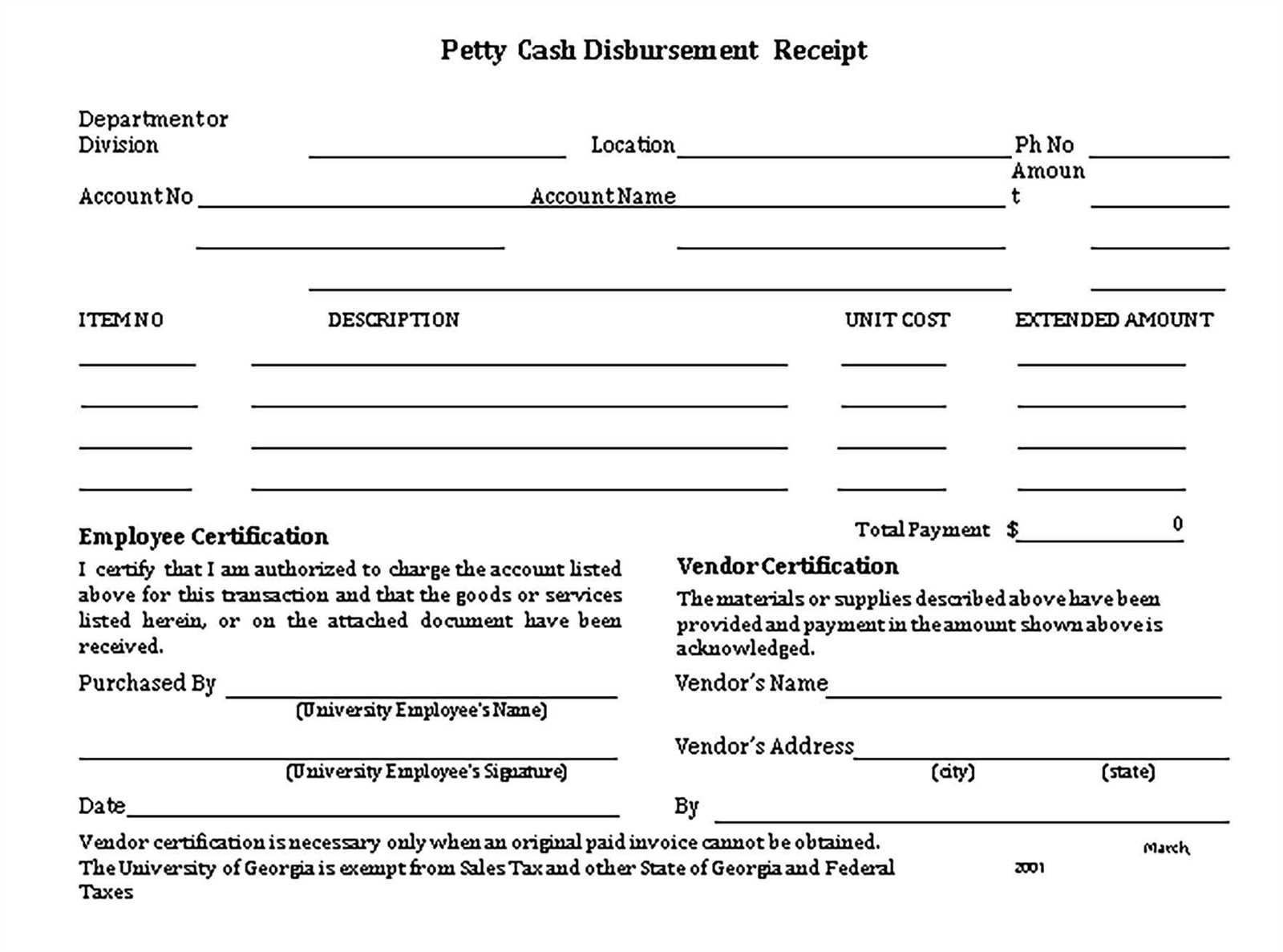

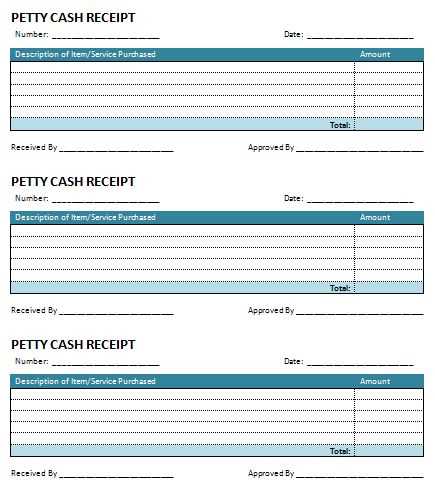

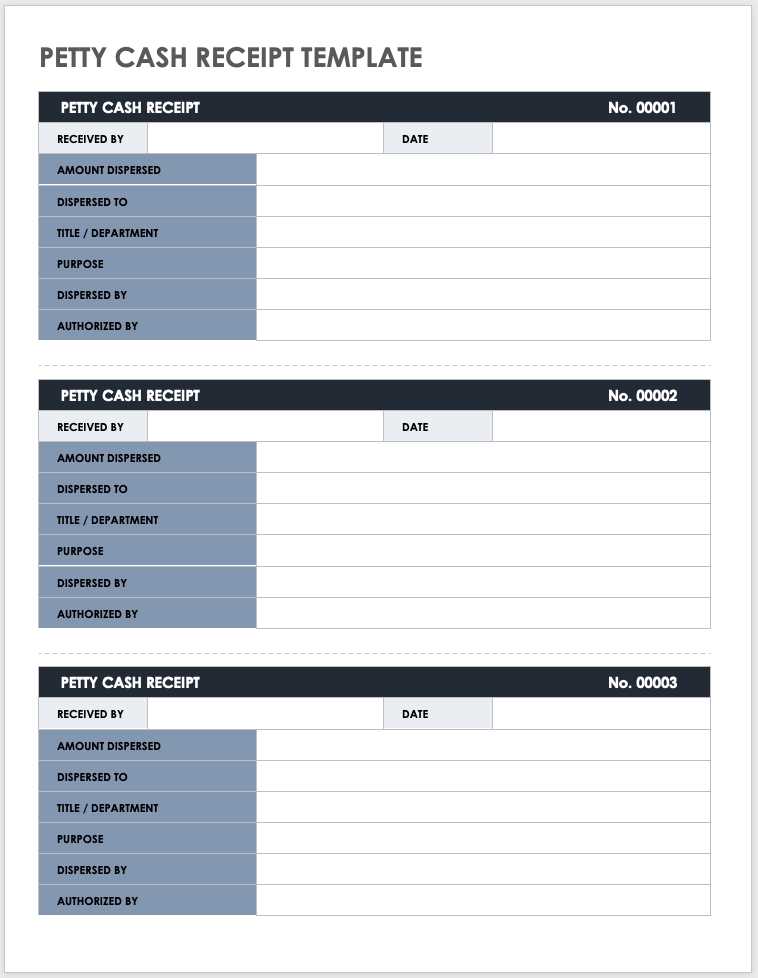

The template should include fields for the date, amount, purpose of the transaction, and the name of the person receiving the funds. Including a signature line or space for authorization helps add a layer of accountability, confirming the transaction was properly approved. This setup minimizes errors and reduces confusion during audits.

Using a simple, well-structured receipt template can also save time when reconciling petty cash at the end of each month. It provides a reliable reference for both employees and managers, ensuring that every expense is accounted for and categorized appropriately. This simple tool prevents small cash expenditures from slipping through the cracks and aids in budgeting efforts.

Here are the corrected lines:

When creating a petty cash receipt, ensure all relevant fields are clearly filled out to avoid confusion. The first step is to include the date of the transaction, making sure it’s formatted correctly (e.g., YYYY-MM-DD). This helps with chronological record-keeping.

Amount and Currency

Next, accurately record the amount spent and the currency. If applicable, indicate the exchange rate used for foreign transactions. This allows for proper conversion and auditing of funds.

Purpose of the Expense

Always specify the purpose of the cash disbursement. Instead of vague terms, use detailed descriptions such as “office supplies” or “travel expenses.” This will help track the nature of the expenses over time.

Finally, ensure that the recipient’s signature is included to confirm receipt of funds. It’s also helpful to add a space for the signature of the person authorizing the expense for accountability purposes.

- Simple Petty Cash Receipt Template

A simple petty cash receipt template helps streamline financial documentation, making it easier to track small cash transactions. The template should be concise, clear, and include all key details of the transaction. Here’s how to structure a basic template:

| Receipt Number | [Enter Receipt Number] |

|---|---|

| Date | [Enter Date of Transaction] |

| Payer Name | [Enter Name of Person Receiving Cash] |

| Amount | [Enter Amount Given] |

| Description of Expense | [Provide Brief Description of the Expense] |

| Authorized By | [Enter Name of Person Authorizing Payment] |

| Signature | [Enter Signature] |

Make sure the information is filled out correctly each time a petty cash transaction is made. This ensures accuracy in your financial records and provides a solid audit trail. Using a consistent template like this one will save time and improve accuracy in your financial management.

Create a straightforward petty cash receipt template by following these steps:

- Choose the Right Layout: Begin with a clean, structured layout. Make sure there’s space for all necessary details like the date, amount, purpose, and recipient.

- Include Key Information: A basic receipt should include:

- Date: The exact date of the transaction.

- Amount: The total amount of money given.

- Purpose: A brief description of what the petty cash is being used for.

- Recipient’s Name: The individual receiving the cash.

- Signature: The person handing out the cash should sign for confirmation.

- Design for Clarity: Use a simple, readable font like Arial or Times New Roman. Avoid overcrowding the template with unnecessary graphics or details.

- Include Space for Additional Notes: Leave a section for any additional remarks or reference numbers that might be needed for future follow-up.

- Use a Consistent Format: Ensure all receipts follow the same template. This will make tracking and organizing them easier.

Once you’ve laid out the template, you can either print it or save it digitally. This simple format will help maintain transparency and accountability in petty cash transactions.

Ensure your petty cash receipt has the following key components to guarantee clarity and proper tracking.

1. Date of the Transaction

Always include the exact date when the transaction took place. This will help you track expenses and ensure that records are up-to-date for accounting purposes.

2. Receipt Number

A unique receipt number will simplify tracking, prevent confusion, and make audits easier. This number acts as a reference point for future documentation or inquiries.

3. Description of the Expense

Clearly state what the payment was for, including any relevant details like the items purchased, services rendered, or the purpose of the transaction. This provides context for the expenditure.

4. Amount Paid

Record the exact amount paid, making sure it aligns with the transaction. Specify the currency if necessary, especially for international transactions.

5. Payment Method

Indicate whether the payment was made in cash, by check, or through another method. This helps clarify how the funds were distributed.

6. Signature

Both the payer and the recipient should sign the receipt. This step adds a level of verification and ensures that both parties agree on the details.

7. Name of the Payee

Include the name of the person or organization receiving the funds. This adds a layer of accountability and helps avoid errors.

Adjust the petty cash template to reflect your business’s unique needs. Begin by modifying the header with your company’s name, address, and contact details. This ensures every receipt is properly branded and identifiable. If you have specific internal codes or categories for expenses, add customizable fields to categorize the cash outflows accordingly.

For more accuracy, adjust the template to include transaction details that matter most to your business, such as department, project name, or employee names. These can be added as optional fields depending on the scale of your operation.

Consider including a section for approval signatures. If your business requires managerial oversight, adding a field for the authorized person to sign off on the transaction helps maintain accountability.

Ensure that the format matches your accounting or bookkeeping requirements. If you use specific software for managing your finances, ensure the template is compatible or can be easily imported into that system. This minimizes the risk of errors and streamlines your financial processes.

Finally, evaluate whether you need to set up recurring petty cash transactions. If so, incorporate a recurring expense option to save time. This can be useful for regular expenses like office supplies or transportation.

Simple petty cash receipt template

You can simplify your petty cash tracking by using a clean, easy-to-follow template. Start by ensuring the key details are captured: date, description of the expense, amount, and the purpose of the transaction. This keeps records straightforward and avoids confusion later.

Key Elements of a Petty Cash Receipt

Include these core components:

1. A clear title, “Petty Cash Receipt,” at the top.

2. A section for the date, which helps in tracking expenditures.

3. A field for the description of the item or service purchased.

4. An area to note the amount spent.

5. A space for the signature or initials of the person authorizing the transaction. This adds an extra layer of accountability.

Why This Template Works

By keeping the format simple and organized, it minimizes mistakes and ensures consistency. Each time you fill out the receipt, you know exactly what information is needed, making reporting and audits easier. Save your template for quick access and avoid the hassle of creating new forms each time a small purchase is made.