For managing charity finances, the use of receipts and payments accounts is a practical approach to track the inflow and outflow of funds. Start by organizing all incoming donations and payments. Ensure that each transaction is clearly documented with dates, amounts, and relevant details, such as the source of donations or the purpose of expenses.

Receipts should include all forms of income, from donations to grants and fundraising events. Each entry must be classified by its type to provide clarity. Break down income into categories like individual contributions, corporate sponsorships, and any other sources. This makes it easier to generate accurate reports and ensures transparency in financial dealings.

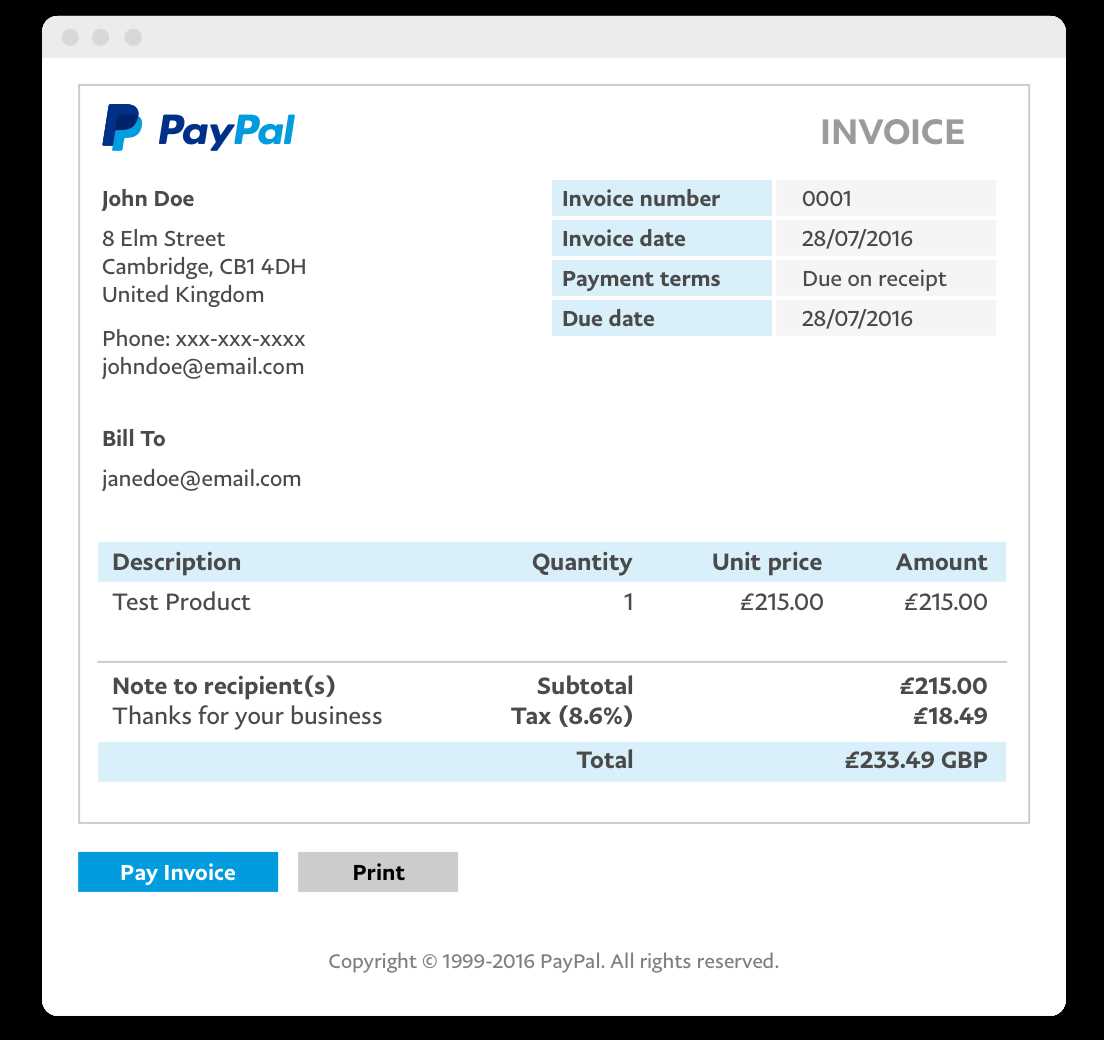

Payments need similar attention. Categorize expenses based on their purpose, such as operational costs, event-related expenses, and program funding. Every payment should be linked to a supporting invoice or receipt for validation. The goal is to maintain a clear and concise record of all outflows, which helps in financial audits and annual reporting.

Using charity accounting templates simplifies this process, reducing the likelihood of errors and offering a clear overview of your finances. These templates can help ensure consistency across different reporting periods, aiding in better decision-making and accountability for donors, trustees, and regulatory bodies.

Here are the corrected lines:

Focus on clarity and accuracy: Each line in the accounting template must clearly indicate the amount received or paid, along with the corresponding date. Ensure that each entry is supported by appropriate documentation for transparency.

Separate categories effectively: Group payments and receipts into distinct categories, such as “Donations” and “Expenditures.” This helps to track finances more efficiently and prevents confusion.

Use consistent formatting: Maintain a uniform structure for all entries. This includes the same number format, date style, and account descriptions. Consistency ensures better readability and prevents errors in data interpretation.

Check for accuracy: Cross-reference each entry with bank statements or receipts to verify the numbers. This helps avoid discrepancies and ensures that the accounts reflect the true financial position.

Regular updates: Update the accounts promptly after any payment or receipt is made. Delaying entries can lead to missing or incorrect data, affecting financial reporting.

- Charity Accounting Templates: Receipts & Payments Records

Use a clear, organized format to document all charity receipts and payments. This ensures transparency and helps in preparing accurate financial reports. Below is a simple template that you can adapt for your charity’s accounting records:

| Date | Description | Receipt Amount | Payment Amount | Balance |

|---|---|---|---|---|

| 01/02/2025 | Donation from XYZ Company | £500 | £0 | £500 |

| 05/02/2025 | Fundraising Event Expenses | £0 | £200 | £300 |

| 10/02/2025 | Grant from Local Council | £1,000 | £0 | £1,300 |

Ensure that each transaction is recorded immediately after it occurs. Regularly update the balance to avoid discrepancies. Also, make a note of the source or purpose of the receipt or payment for easy reference during audits.

Begin by separating your charity’s income and expenses into distinct categories. Use a simple cash book format, where all receipts are recorded on one side and all payments on the other. This makes tracking both inflows and outflows clear and transparent.

For receipts, create accounts for donations, grants, fundraising activities, and any other sources of income. For payments, separate categories for operating costs, fundraising expenses, and program costs will give you a clear view of how the charity’s funds are used. Each transaction should be recorded with a clear description and the amount involved.

Maintain consistency in recording entries. Use the same format and level of detail for each transaction. This makes it easier to prepare accurate reports and to identify any discrepancies quickly. Keep supporting documentation, such as receipts and invoices, for reference during audits.

Use a simple chart of accounts, avoiding complex classifications that could create confusion. Focus on the key areas relevant to charity operations–income, expenditure, and bank transactions. The clearer the structure, the easier it will be to track the charity’s financial position.

For more accurate reporting, reconcile bank statements regularly and match them against your receipts and payments accounts. This step helps ensure that all transactions are recorded properly and that no income or expenditure is overlooked.

Begin by organizing the key categories of receipts and payments. These categories will form the backbone of your template. For example, separate sections for donations, grants, fundraising, and operational expenses can make it easier to track the funds.

Step-by-Step Template Design

- Receipt Entries: Set up fields to record the date, description, donor details, and the amount received. Include a column for payment method (e.g., cash, cheque, bank transfer).

- Payment Entries: Similar to receipt entries, create fields for the date, description, payee, and the payment amount. Add a column for categorizing the type of expense (e.g., operational costs, project-related costs).

- Balance Tracking: Include a running total that updates automatically after each entry, ensuring that the template reflects the actual balance.

- Visual Clarity: Use a simple, clean layout to make data entry straightforward. Keep the design minimal to focus on the numbers and categories without distractions.

Formatting Tips

- Column Width: Adjust the column widths to fit the data being entered. Don’t overcrowd your fields, as this can make it harder to track payments or receipts.

- Cell Borders: Use borders for each entry to visually separate the data and create a more organized structure.

- Conditional Formatting: Apply color codes for different categories of income and expenses to help differentiate between types of entries.

By setting up this structure, you ensure that every receipt and payment is logged accurately and efficiently. Keep the template simple yet detailed, and update it as needed for changes in the financial structure of your charity.

One common mistake in charity receipt and payment records is failing to separate personal and organizational funds. Keep charity funds distinct to ensure transparency and compliance with legal standards. Using personal accounts for charity transactions leads to confusion and potential misreporting. Always set up dedicated charity bank accounts.

Incorrect Categorization of Transactions

Misclassifying expenses and income can distort the financial picture. Ensure each payment and receipt is categorized correctly according to its purpose, whether it’s a donation, grant, or administrative cost. Failure to properly categorize could lead to inaccurate reporting and impact tax-exempt status.

Lack of Supporting Documentation

Each transaction should be backed by appropriate documentation, such as receipts, invoices, or bank statements. Without these records, you risk losing the ability to justify your financial entries during audits. Ensure every transaction is traceable and well-documented for transparency and accuracy.

Another common error is not recording transactions in real-time. Delayed entry can cause omissions and make it harder to track financial progress. Record each receipt and payment as it occurs to maintain an accurate, up-to-date financial record.

Lastly, failing to reconcile accounts regularly can result in discrepancies that go unnoticed. Set a schedule to regularly check your bank statements against your financial records to spot and correct any differences quickly. Regular reconciliation prevents errors from accumulating over time.

When creating receipts and payments accounts for charity organizations, focus on clarity and simplicity. Ensure that each transaction is accurately categorized under income or expenditure, and provide clear descriptions for each entry. Regularly update the accounts to reflect all cash inflows and outflows, ensuring that no transaction is overlooked.

Receipts

Record all donations, grants, and fundraising proceeds as receipts. Clearly identify the donor or source of the funds, and include the date of the transaction. For transparency, ensure that large or recurring donations are separately listed, with relevant references for any special conditions tied to the funds.

Payments

For payments, list expenses clearly, grouping them by category such as operational costs, program-related expenses, and administrative overheads. It’s crucial to maintain detailed records of each payment, including the purpose and recipient. This will help avoid discrepancies and ensure accurate reporting at year-end.