Creating a sales receipt for Craigslist transactions can save you time and protect you in case of disputes. A clear and concise receipt helps both buyer and seller keep track of the sale and provides proof of the exchange. The template should include all necessary details to ensure both parties are covered, such as item description, sale price, date, and any agreed-upon conditions.

Key elements of a Craigslist sales receipt:

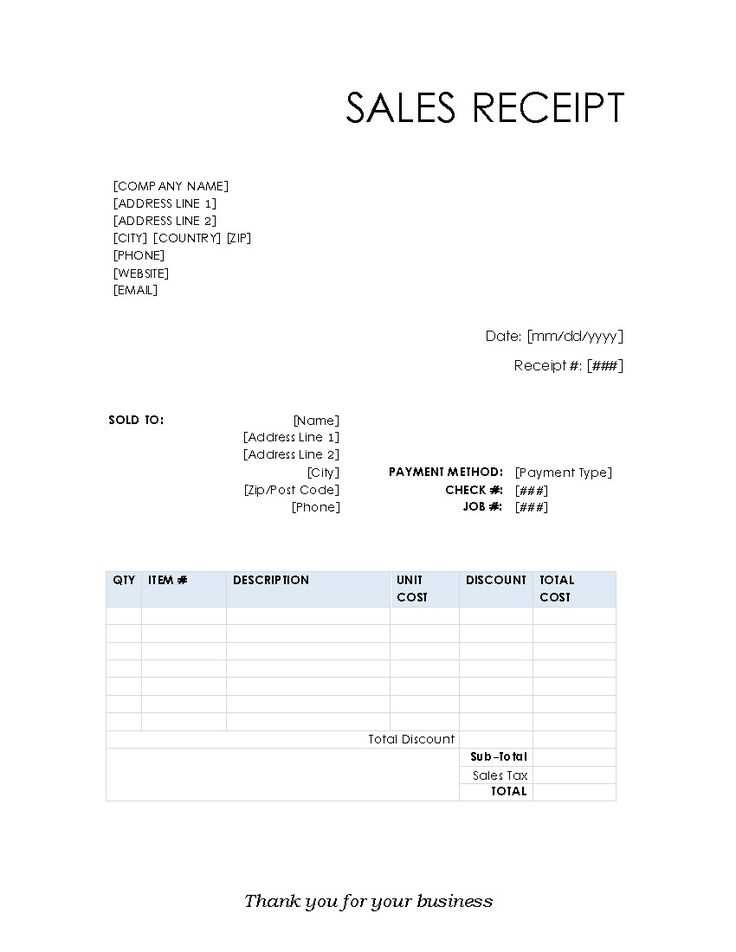

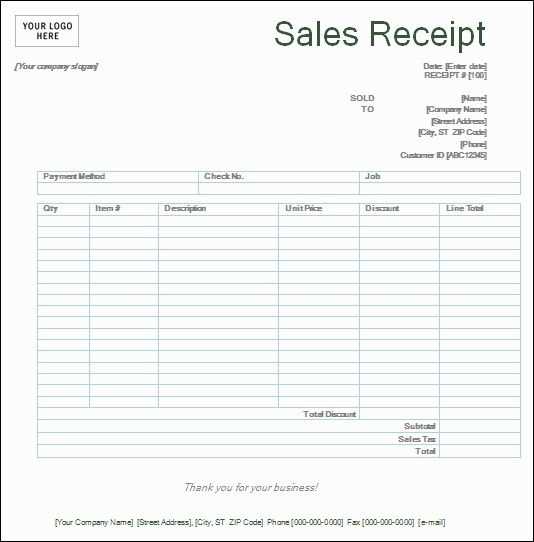

First, include the date of sale and transaction number, which are vital for record-keeping. Clearly list the item(s) sold, including a brief description and condition. The price must match the amount agreed upon, and any taxes or additional fees should be noted if applicable. Also, include the method of payment (cash, PayPal, etc.) to avoid misunderstandings later.

Including the names and contact information for both buyer and seller ensures you can reach each other if needed. A space for both parties’ signatures makes the document legally binding, offering extra protection should anything go wrong. If the sale involves any warranties or guarantees, note these clearly on the receipt as well.

This straightforward approach minimizes confusion and adds a layer of security to your Craigslist transactions. Use a template for consistency and ease–just fill in the relevant details each time you make a sale.

Here’s the corrected version:

Ensure the receipt clearly states the transaction details. Begin with the seller’s name, contact information, and the date of the sale. Specify the item sold, including its make, model, and condition. The price should be highlighted, and don’t forget to include any applicable taxes or fees. If relevant, add shipping costs or warranties provided. It’s also helpful to include both the buyer’s and seller’s signatures for added legitimacy. Lastly, mention any return policies or terms of sale in a concise manner to avoid confusion later on.

Using a clean, organized layout helps both parties reference the information with ease. Make sure the text is legible and the document can be easily saved or printed for records.

- Craigslist Sales Receipt Template: A Practical Guide

Ensure your Craigslist transaction goes smoothly with a clear, professional sales receipt. A well-structured receipt provides both buyer and seller with documentation of the exchange, which can be helpful for future reference or dispute resolution.

The following elements are necessary for creating a simple yet complete receipt:

- Transaction Date: List the exact date of the sale to keep track of when the exchange occurred.

- Buyer and Seller Information: Include the names and contact details of both parties involved. This ensures that both sides can follow up if needed.

- Item Description: Clearly describe the item(s) sold, including relevant details such as condition, model, and serial number if applicable.

- Sale Price: State the agreed-upon price for the item, ensuring no ambiguity regarding the amount paid.

- Payment Method: Specify how the buyer paid, whether it was in cash, check, or another method like PayPal.

- Signature Lines: Provide spaces for both parties to sign, confirming the sale has taken place. This adds an extra layer of security and agreement to the transaction.

By including these elements, you help ensure transparency and protect both the buyer and the seller from future misunderstandings. A simple, clearly written receipt is a key step in closing any Craigslist deal confidently.

Creating a clear and simple sales receipt for Craigslist transactions helps both parties keep a record of the sale and avoid any confusion down the road. Here’s how you can easily put one together:

- Include the Transaction Date: Write the exact date of the sale. This helps establish the timeline of the transaction and can be useful for future reference.

- Detail the Item Sold: Be specific about the item, including its make, model, and any relevant serial numbers. The more details, the better it is for both parties.

- Include Buyer and Seller Information: Write the names of both the buyer and seller. You should also include contact information (phone number or email) to make follow-up easier, if needed.

- State the Sale Price: Clearly note the agreed-upon price for the item. If any discounts or negotiations were involved, outline those as well.

- Payment Method: Specify how the payment was made, whether through cash, check, PayPal, or another method. This is important for clarity in case of disputes.

- Provide Signatures: Both parties should sign the receipt, confirming the transaction. This adds a layer of legitimacy and helps if there are any questions later on.

- Optional: Include Return Policy: If applicable, state any terms for returns or exchanges. Craigslist transactions are usually final, but it’s still a good idea to clarify the return policy upfront.

By including these details, you create a straightforward, transparent record that protects both the buyer and seller. A good receipt is a simple but effective way to document the transaction.

Clear and concise information is crucial for both the buyer and seller. Here’s what should be on your sales receipt:

- Transaction Date: Always include the exact date the sale was completed. This helps track the timeline for returns, warranties, or disputes.

- Seller’s Information: Provide your name or business name, address, and contact details. This adds legitimacy and a point of contact if there are questions later.

- Buyer’s Information: Include the buyer’s name and contact details, especially for high-value items. This can be useful for record-keeping or if you need to reach out about the sale.

- Item Description: List the items being sold with clear descriptions. Include model numbers, serial numbers, or any unique identifiers to avoid confusion. Be precise about the condition of the item–new, used, or refurbished.

- Sale Price: Clearly state the price of each item sold and the total amount paid. If discounts or taxes apply, break them down separately.

- Payment Method: Specify how the payment was made–whether by cash, check, credit card, or another method. This ensures transparency and avoids any misunderstandings later.

- Return/Refund Policy: If you offer returns or refunds, briefly outline the terms here. Be clear on the time frame, condition of the item for returns, and whether you offer full or partial refunds.

Additional Information

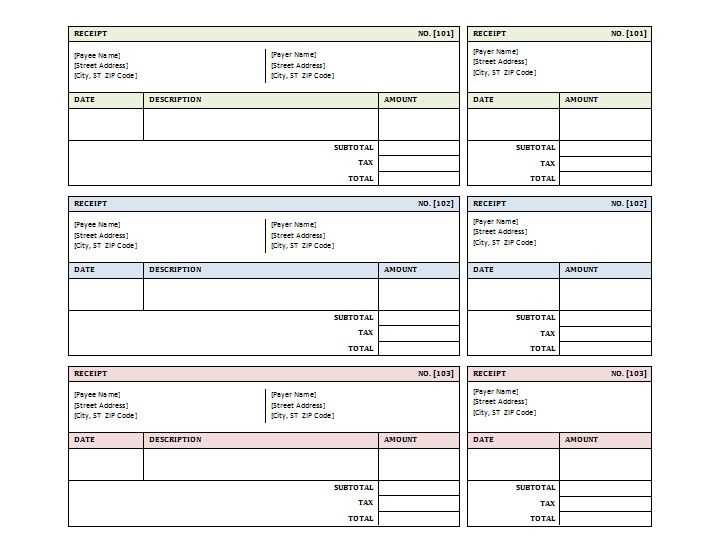

- Invoice or Receipt Number: Assign a unique number to each transaction for easy reference. This helps with record-keeping and future audits.

- Warranty or Guarantee Details: If applicable, state the warranty period and what it covers. This can give the buyer peace of mind and clarify any responsibilities.

Provide a receipt whenever a transaction involves a significant amount of money or high-value items. This ensures both parties have documentation in case of disputes or issues. A receipt can help prove the exchange was completed and prevent future misunderstandings.

Key Scenarios for Providing a Receipt

| Transaction Type | When to Provide a Receipt |

|---|---|

| High-Value Items | Always, for purchases over $100 or items such as electronics or furniture. |

| Used Vehicles | Always, as a receipt is required for title transfer and proof of sale. |

| Trades or Barters | If money or goods are exchanged, a receipt protects both parties. |

| Cash Transactions | Provide a receipt to verify the cash exchange took place. |

Details to Include on a Receipt

Always include the date, the names of both parties, the agreed price, and a description of the item or service. If applicable, include serial numbers, warranties, or terms of the agreement. This information can be crucial for any potential follow-up or claims.

1. Missing or incorrect contact information

Always include accurate contact details of both the buyer and seller. This includes names, phone numbers, and email addresses. Incorrect or missing information can lead to confusion, especially if there is a need to follow up after the transaction.

2. Not specifying the payment method

Clarify how payment was made (cash, check, credit card, etc.). Leaving this out creates ambiguity in case of disputes over payment. Make sure to mention any deposits or installment payments if applicable.

3. Not itemizing the products or services

Be detailed when listing items or services sold. Include quantities, descriptions, and unit prices. A vague list can result in confusion or disputes over what exactly was purchased.

4. Forgetting to include the date of the transaction

Always include the exact date the transaction took place. This helps both parties track the timeline of the sale and can be crucial for returns, warranties, or tax purposes.

5. Overlooking signatures

Ensure that both parties sign the receipt. This provides proof that both the buyer and seller agreed to the terms of the sale. A missing signature can make the receipt invalid in some situations.

6. Leaving out return or refund policies

If applicable, include any return, exchange, or refund policies in your receipt. This sets clear expectations for the buyer and protects the seller from future disputes.

7. Failing to include tax details

Ensure that any taxes or additional fees are clearly noted. If the sale is taxable, the receipt should include the tax rate and amount. Failing to include this information can cause issues with record-keeping or taxes later.

8. Using ambiguous language

Be clear and specific with the language you use. Avoid vague terms that could be interpreted in different ways. The more precise the language, the less likely there will be misunderstandings.

Always ensure you comply with local laws regarding the sale of goods. Each state or country has specific rules about what can and cannot be sold, so it’s important to research these before listing items. For example, selling stolen property, illegal goods, or anything that violates consumer protection laws can result in serious legal consequences.

Be clear about your item’s condition. Misrepresentation can lead to legal disputes. Make sure to describe any defects or damages accurately to avoid future issues. If the buyer feels misled, they may file a claim against you, which could result in fines or even legal action.

Keep records of all transactions. A receipt or proof of purchase is highly recommended. This documentation serves as protection in case of disputes or chargebacks. While Craigslist doesn’t provide a receipt template, creating one with details about the transaction, including dates, prices, and both parties’ contact information, can be very helpful.

Ensure your transaction is fair. Don’t engage in price gouging or unfair pricing tactics, especially in sensitive circumstances, like during emergencies. Not only can this harm your reputation, but it could also lead to legal penalties under consumer protection laws.

For large transactions, consider using a secure payment method, such as PayPal, and avoid accepting checks or wire transfers from unfamiliar sources. This helps protect both parties from fraud.

If you’re dealing with high-value items or transactions that may raise red flags, consult a legal professional to ensure compliance with all regulations. In some cases, such as car sales or real estate, additional legal documentation may be necessary to complete the transaction properly.

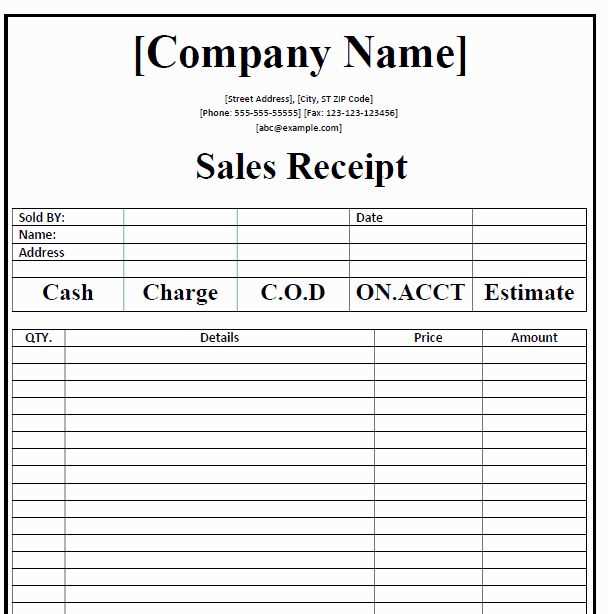

To tailor your receipt template for specific types of sales, adjust the key details based on what’s being sold and the transaction method. For physical goods, list the item descriptions, quantities, and prices. If services are involved, include the service type, duration, and hourly rates instead. Ensure the date and time reflect the exact transaction to avoid confusion.

Adjust Layout and Sections

For different sales scenarios, you may need to rearrange sections on your receipt. For example, when selling multiple items, consider adding a table for itemized entries with corresponding quantities and prices. For services, a detailed breakdown of time and rate can be more beneficial. Including a tax section will be important for both physical and service-based transactions.

Customize Payment Details

Include fields for different payment methods, whether it’s cash, credit card, or an online payment platform. If you’re using discounts or coupons, make sure there’s space for discount codes, percentages, or total amounts subtracted. This provides a clear overview of the transaction and ensures transparency.

Here, I’ve removed the repetition of the word “Craigslist” and reorganized the phrases to maintain the meaning while avoiding redundancy.

Ensure your sales receipt clearly outlines the transaction. Start with a header that includes your name, the buyer’s name, and the date. This basic information helps both parties identify the sale quickly. The next section should describe the item being sold, including its model, condition, and any relevant details that clarify the transaction. If applicable, list the agreed-upon price and note any additional fees or discounts that apply. Be clear about payment methods–whether cash, check, or digital transfer.

Don’t forget to include a statement acknowledging the item was sold “as is,” especially if the sale was made for used goods. This protects both parties and reduces any potential future disputes. End with a space for both buyer and seller to sign, confirming that they agree to the terms. Keeping a copy of the receipt for your records is always a good idea for reference in case any issues arise after the sale.