Creating a donation receipt template is a straightforward task when you have the right structure in place. Start with a clear acknowledgment of the donation and include essential details like the donor’s name, donation date, and the amount. Be sure to specify whether the donation was monetary or in-kind.

Include the organization’s details, such as its name, address, and tax-exempt status. This not only helps in transparency but also provides the necessary information for tax purposes. Ensure you mention that no goods or services were exchanged in return for the donation to comply with IRS guidelines.

Keep the tone professional and respectful, as the letter serves both as a thank-you note and a formal record. This receipt could be the donor’s tax deduction proof, so accuracy is key. Providing clear and concise details will make the process seamless for both parties.

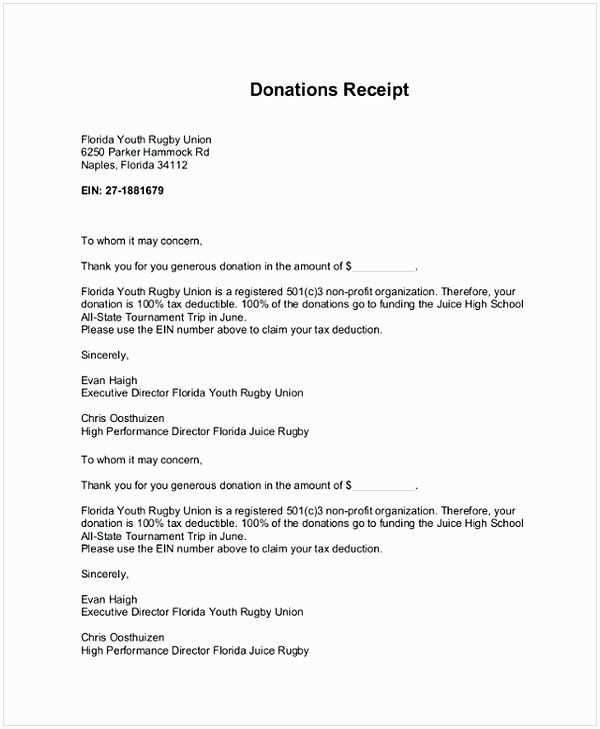

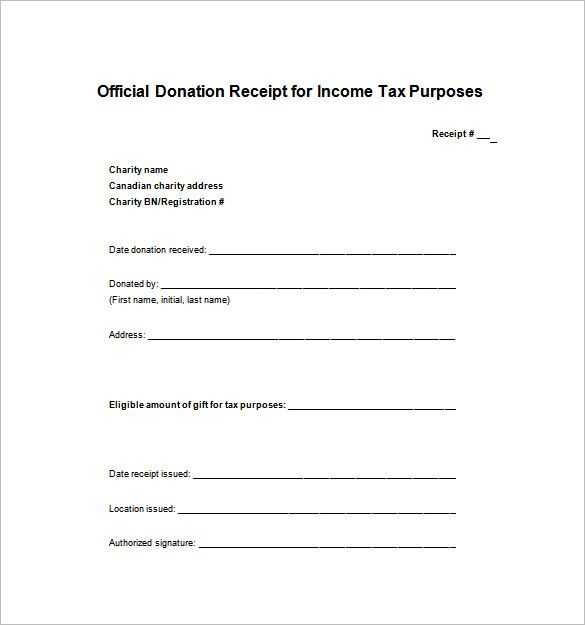

Letter of Donation Receipt Template

Include the donor’s full name and address at the beginning of the letter. Clearly state the date of the donation and the amount or item donated. If the donation is cash, specify the exact sum; if it’s in-kind, describe the items in detail. Mention whether the donation was tax-deductible. For example, “No goods or services were provided in exchange for this donation.”

Make sure to thank the donor for their generosity. Express appreciation for their support and how the donation will be used. Ensure that the tone remains professional and warm. Provide contact details in case the donor has further questions or needs additional information.

End the letter with the signature of an authorized person, such as a representative from the organization. Include the title of the person signing and the organization’s name for clarity.

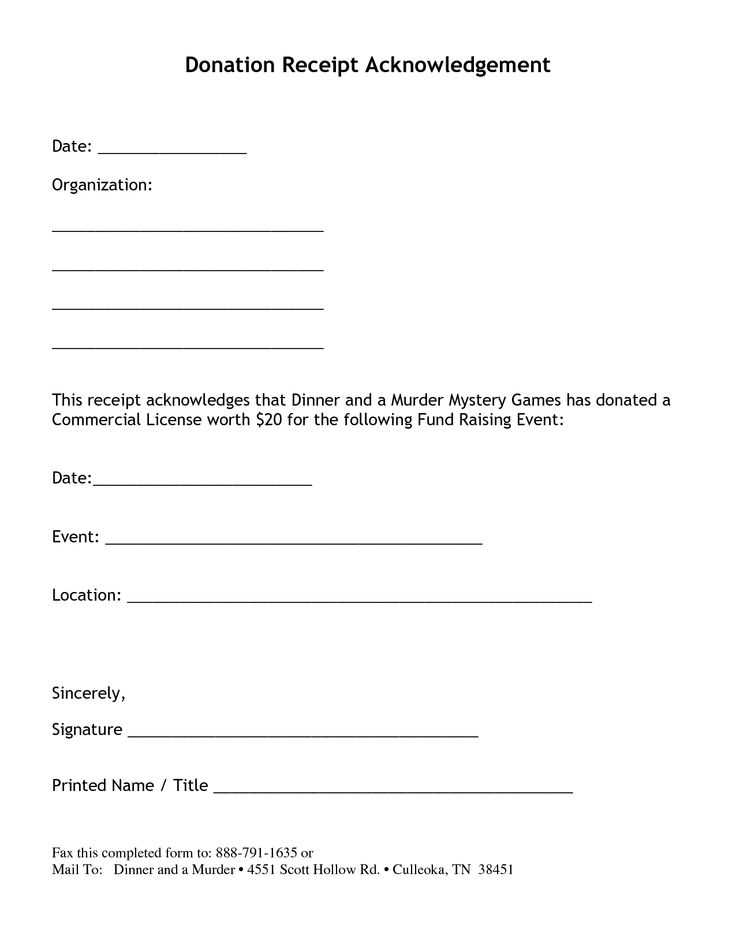

How to Structure a Donation Receipt Letter

Begin the letter by clearly stating the donor’s name and the amount or description of the donation. If the gift is in kind, provide specific details, such as the item donated and its condition. Acknowledge the contribution with a sentence of thanks to express genuine appreciation for the donor’s generosity.

Include Required Tax Information

Ensure the letter includes the necessary tax-related information. Clearly mention that no goods or services were provided in exchange for the donation, if applicable. This detail is crucial for the donor’s tax records and must be presented in an easily understandable way.

Provide the Organization’s Information

Next, include the name of your organization, its address, and relevant contact details. This adds credibility and allows the donor to easily follow up if needed. Make sure your nonprofit’s tax-exempt status is stated clearly for tax purposes.

Conclude the letter by reiterating your appreciation and expressing the impact their donation will have. Keep the tone respectful and warm, ensuring the donor feels valued for their contribution.

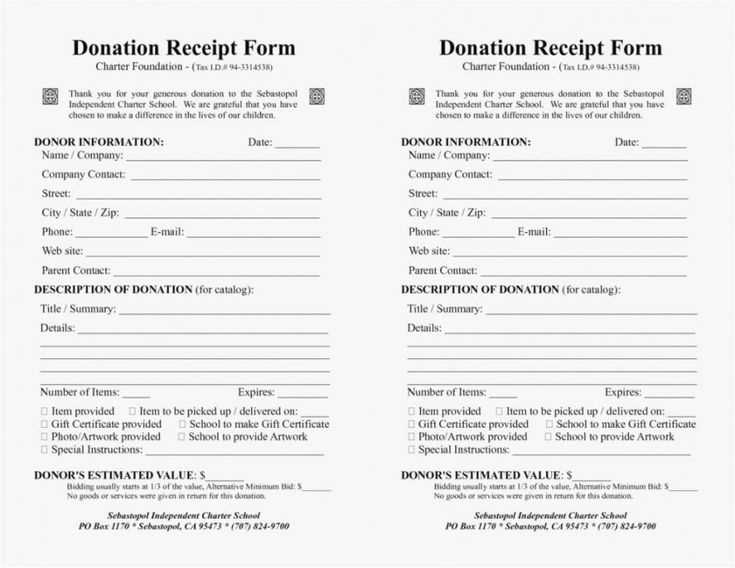

What Information Should Be Included in the Letter?

The letter must clearly detail the donation specifics. Include the following key elements:

- Donor’s Full Name: Ensure the donor’s full legal name is clearly stated for proper documentation.

- Date of Donation: Clearly mention the exact date when the donation was made.

- Description of Donated Item(s): Provide a clear and detailed description of the items or funds donated. If it’s a monetary donation, include the amount donated.

- Value of Donation: For non-monetary gifts, specify the estimated value of the donated items.

- Tax Deductibility Notice: Include a statement regarding the donor’s eligibility to claim tax deductions for the donation, if applicable.

- Organization Details: State the name of the organization receiving the donation, including its official address and contact information.

- Thank You Statement: Acknowledge the donor’s generosity with a personalized expression of gratitude.

Ensure all information is accurate and precise to maintain transparency and comply with relevant tax and legal requirements.

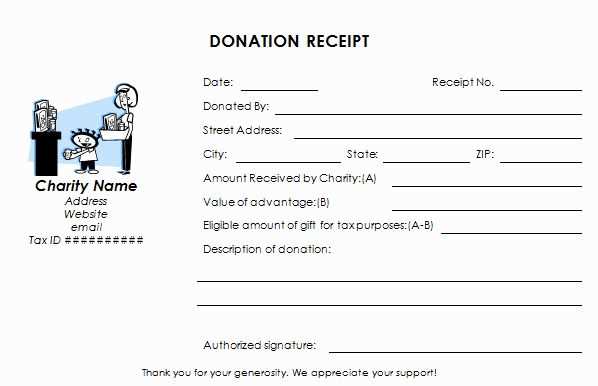

Common Mistakes to Avoid in Donation Receipts

Ensure that donation receipts contain the correct donor information. Misprints or incomplete data, such as missing names or addresses, can create confusion and complicate tax filings for donors. Double-check all details before issuing receipts.

Failure to Specify the Donation Amount

Always specify the exact amount of the donation. Vague references like “a generous gift” or “donation of an unspecified amount” can cause issues during tax deductions and audits. This is critical for both cash and non-cash donations.

Not Including a Nonprofit’s Tax Status Information

Clearly state the nonprofit’s tax-exempt status. A donation receipt should include the organization’s tax ID number and a statement confirming that the nonprofit is qualified to receive tax-deductible donations. This is important for the donor’s ability to claim deductions.