To streamline the process of acknowledging donations, using ready-made donation receipt letter templates can save time and ensure compliance with tax regulations. A good donation receipt not only expresses gratitude but also includes necessary details like the donor’s information, donation amount, and any goods or services provided in return.

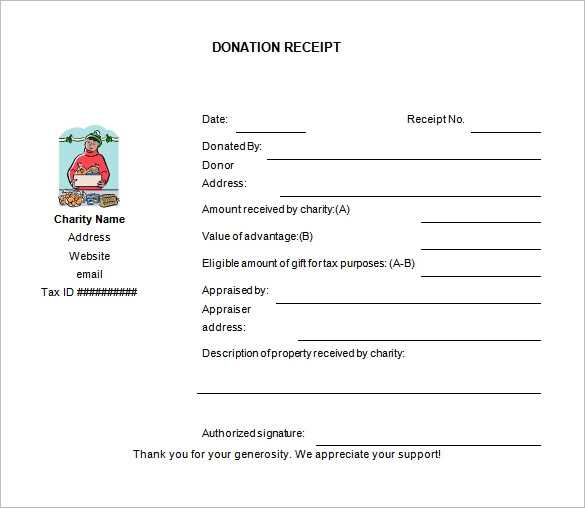

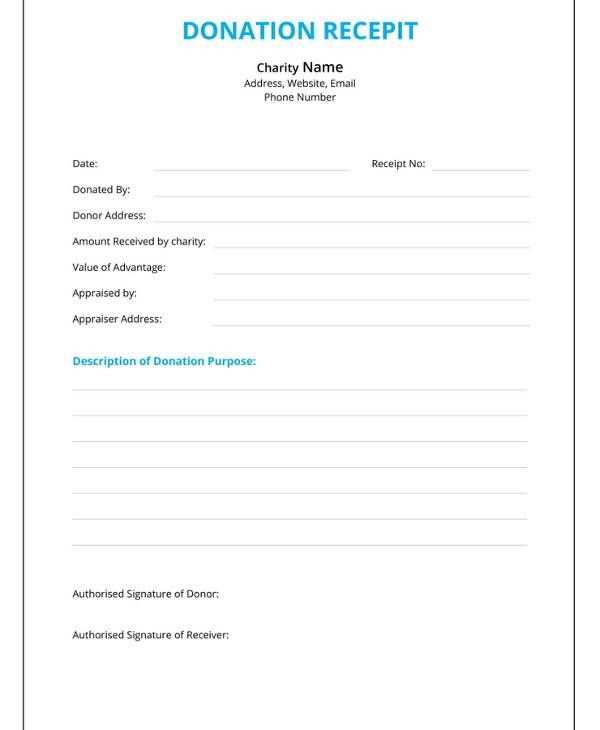

The best templates are clear and concise, containing fields for the donor’s name, address, donation date, and value of the donation. Make sure to specify whether the donation was monetary or in-kind and whether any goods or services were exchanged, as this impacts tax deductions.

Don’t forget to include your organization’s name, tax ID number, and a statement confirming the donor received no goods or services, or a description of them if they did. These details help donors maintain accurate records for their tax filings.

Here is the revised version:

Make the donation receipt clear and simple. Start with the donor’s name, the amount donated, and the date of the donation. Include your organization’s name and a brief statement about its mission or cause. This transparency helps establish trust and ensures proper documentation.

Structure of a Donation Receipt

Each receipt should list the full name of the donor, the amount donated, and the donation method. Be sure to mention if the donation is tax-deductible. The receipt should also state that no goods or services were provided in exchange for the donation if applicable. This is important for tax purposes.

Additional Elements

Consider adding a thank you note at the end of the letter. Personalizing this with a brief message about how the donation will make an impact can create a stronger connection with the donor. A simple closing line such as “We deeply appreciate your generosity” is sufficient and warm.

Donation Receipt Letter Templates

Creating a Basic Donation Receipt in Microsoft Word

To create a basic donation receipt in Microsoft Word, begin with a clean document. Start by including your organization’s name, address, and contact details at the top. Below that, specify the donor’s name, address, and the date of the donation. Clearly describe the donation, whether it’s monetary or in-kind, including the amount or a description of items donated. Include a statement confirming whether the donor received any goods or services in return for their donation. End with a thank-you note and a signature line for the person authorizing the receipt. This format is straightforward and meets IRS requirements for tax deductions.

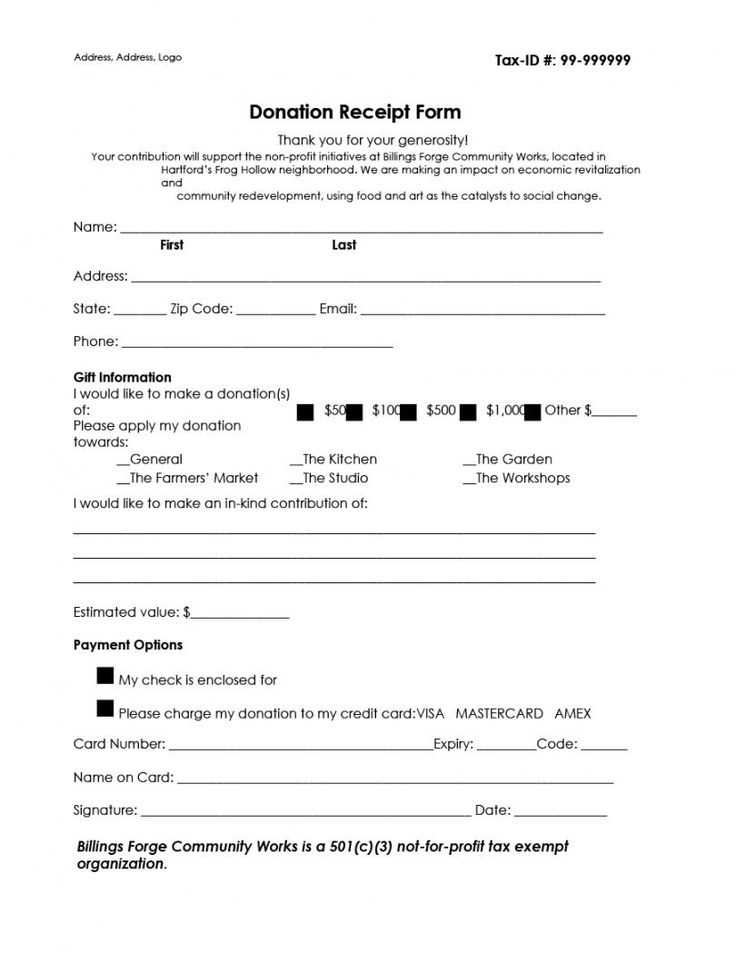

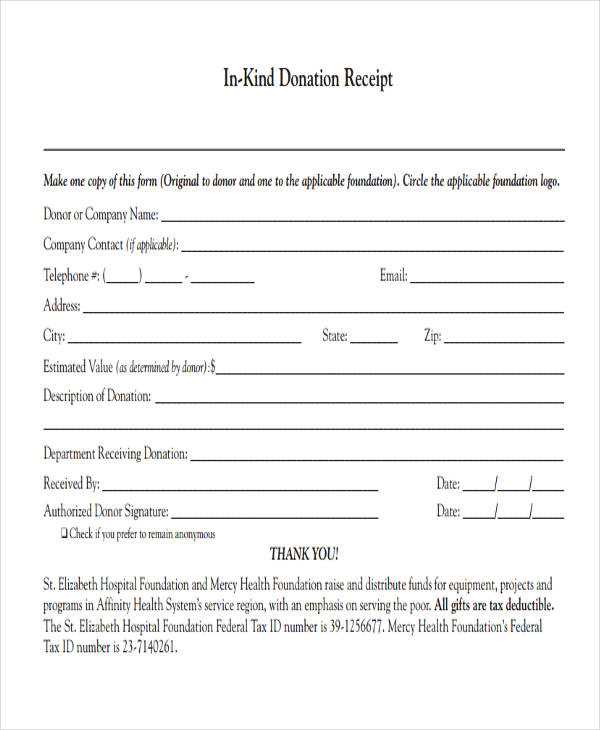

Customizing Receipt Templates for Specific Donation Types

Customizing receipt templates depends on the type of donation. For monetary donations, list the exact amount given, along with the donation date. For item donations, provide a detailed description, including quantity and condition, without assigning a monetary value (as the donor must determine the value). For donations of services, describe the service provided and its fair market value. Adjust the template based on these specifics, ensuring all necessary information is included to support tax filings and donor records.

Legal Considerations When Drafting a Donation Receipt

When drafting a donation receipt, it’s important to comply with tax laws. The IRS requires receipts for donations over $250 to include a statement about whether goods or services were provided in exchange for the donation. If any goods or services were provided, the receipt must state their fair market value. For donations of $75 or more, a separate statement is required to confirm the donor received something in return. Always ensure the donation receipt includes the organization’s tax-exempt status and a clear description of the contribution, as this will help both the donor and the nonprofit organization maintain accurate tax records.