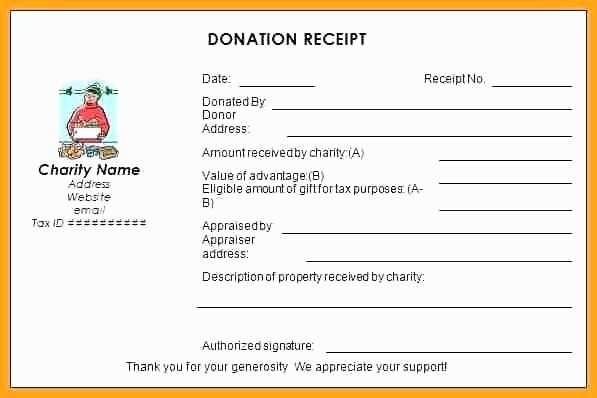

Use a clear and concise donation receipt template in Word format to streamline your documentation process. This template helps you maintain accurate records for both the donor and the organization, ensuring transparency in every transaction.

Customize the template with the donor’s name, donation amount, and date to create a professional and trustworthy receipt. Adding a brief description of the donation purpose can further clarify the transaction for the donor.

Make sure the receipt includes a statement confirming that the donor received no goods or services in exchange for the donation, which is important for tax purposes. This helps donors track their charitable contributions efficiently and accurately.

By using a Word template, you can easily modify it as needed, allowing for quick updates for different donation types and amounts. This method ensures consistency across all receipts issued by your organization.

Sure! Here’s the improved version with reduced word repetition:

For a clear and concise donation receipt template, focus on including the key details that ensure transparency and accuracy. Start by stating the donor’s name, the donation amount, and the date of the contribution. Include the nonprofit’s name and its tax-exempt status number to confirm the legitimacy of the organization.

Key Elements for the Template:

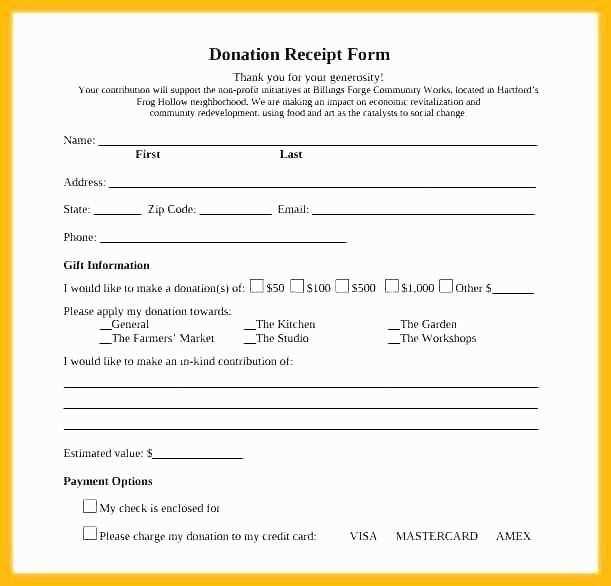

- Donor’s Name and Address

- Donation Amount and Type (monetary or in-kind)

- Date of Donation

- Tax-exempt Status of the Organization

- Purpose or Use of Donation (if applicable)

By organizing this information clearly, the receipt becomes both functional and easy to read. Double-check that the total donation value is clearly displayed, especially for in-kind donations where valuation details might be required.

Formatting Tips:

- Use a simple and easy-to-read font, ensuring all details are legible.

- Include space for signatures from both the donor and an authorized representative of the nonprofit.

Providing this receipt helps donors with tax deductions and strengthens the trust between the organization and its supporters.

- Donation Receipt Template: A Practical Guide

Ensure your donation receipt includes the following key details to comply with legal and organizational requirements:

Required Elements

| Element | Description |

|---|---|

| Donor Information | Name, address, and contact information of the donor. |

| Donation Details | Amount or description of goods donated with estimated value. |

| Date of Donation | Exact date on which the donation was received. |

| Organization Details | Name, address, and contact info of the receiving organization. |

| Tax Information | If applicable, the tax-exempt status or registration number. |

| Signature | Signature of an authorized representative of the organization. |

Additional Tips

- Use a simple, clean design to make the receipt easy to read.

- Ensure that all fields are clearly defined and easy to fill out.

- Include a thank you note for the donation, adding a personal touch.

With these guidelines in place, your donation receipt template will provide clear documentation for both the donor and the organization.

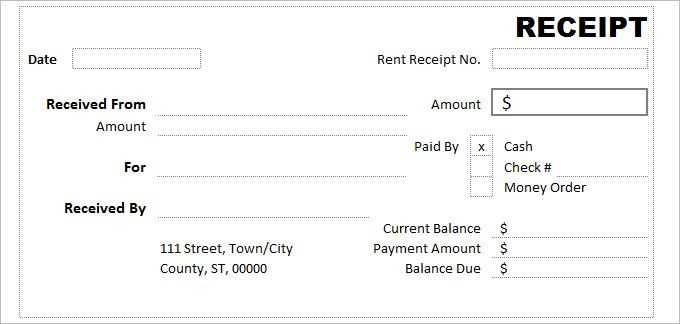

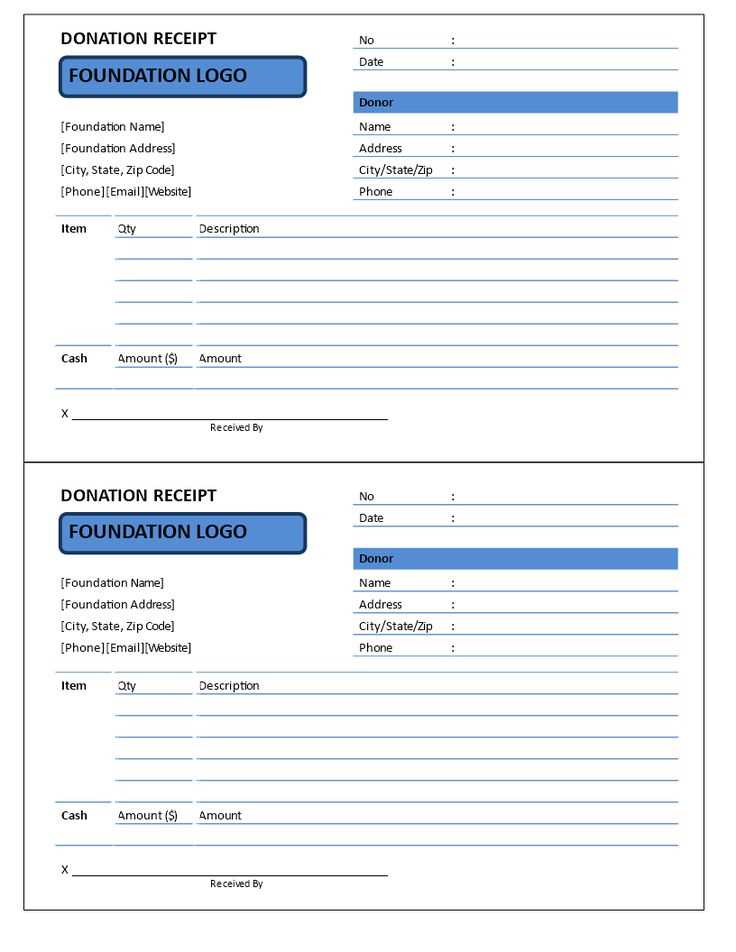

Begin by incorporating your organization’s logo at the top of the receipt to create a recognizable identity. Place it in a clear spot where donors can easily see it. Below the logo, add the organization’s name, address, and contact details. This ensures your receipt includes all the necessary information for tax or accounting purposes.

Customize the receipt’s layout by adjusting the font and size to ensure readability. Make sure to use a clean, professional font and maintain consistent sizing across headings and content. You can also choose colors that align with your organization’s branding.

Add sections for donation details such as the donor’s name, donation amount, and donation date. Ensure these fields are clearly labeled to prevent confusion. It’s also helpful to include a brief description of the donation purpose, such as a specific project or cause, if applicable.

If you offer recurring donation options, include a space to show whether the contribution is a one-time or recurring donation. If it’s recurring, specify the schedule (e.g., monthly, quarterly) and the next payment date.

Consider adding a thank-you message at the bottom of the receipt. A short, personalized note expressing gratitude can enhance the donor’s experience and encourage continued support. You may also include a section for additional instructions, such as a tax receipt disclaimer or instructions for donating again in the future.

Before finalizing the template, test it by inputting different donation amounts and donor information to make sure all fields display correctly and that there are no errors in formatting. Once you’re satisfied with the layout and content, save the template for future use and easy updates.

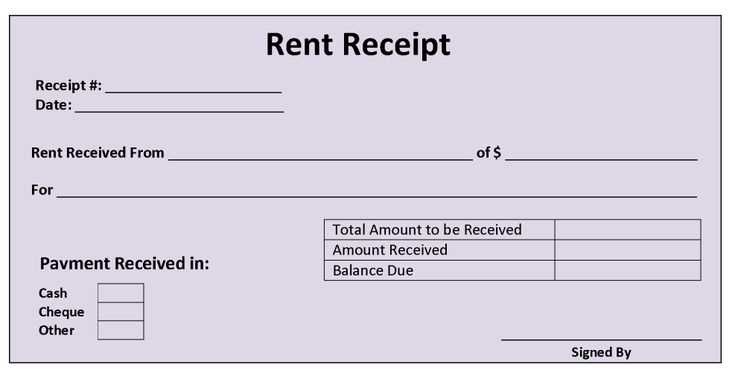

Ensure the following details are included in a donation receipt template for clarity and accuracy:

1. Donor Information

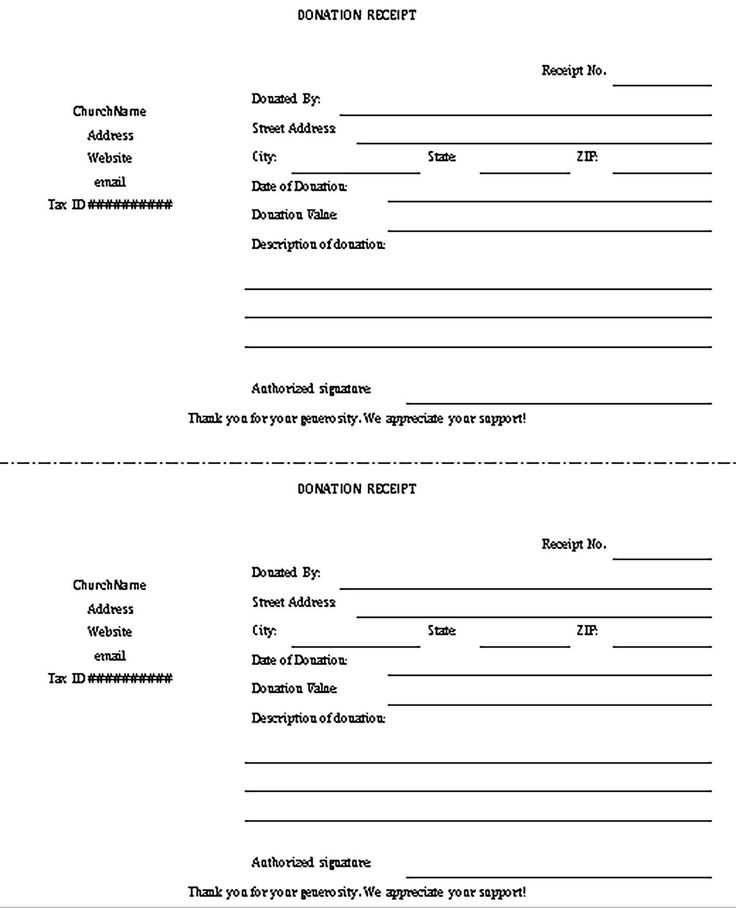

Provide the donor’s full name, address, and contact information. This helps in verifying the donor’s identity and ensures they can be reached for any follow-up or tax purposes.

2. Date and Amount of the Donation

Clearly state the date the donation was made and the total amount donated. This serves as an important record for both the donor and the receiving organization.

3. Description of the Donation

If applicable, include a description of the donated item or service, including its condition or estimated value. This is particularly important for non-monetary donations, as it helps in accurately reflecting the value for tax deductions.

4. Tax-Exempt Status

If the organization is a registered charity, mention its tax-exempt status and include its EIN (Employer Identification Number) to confirm eligibility for tax deductions.

5. Acknowledgment of No Goods or Services Provided

If the donation was made without receiving anything in return, explicitly state this. For partial donations, indicate what portion of the donation is tax-deductible.

6. Signature and Official Stamp

Include a space for the organization’s authorized signatory or a digital signature and an official stamp if necessary, ensuring the authenticity of the receipt.

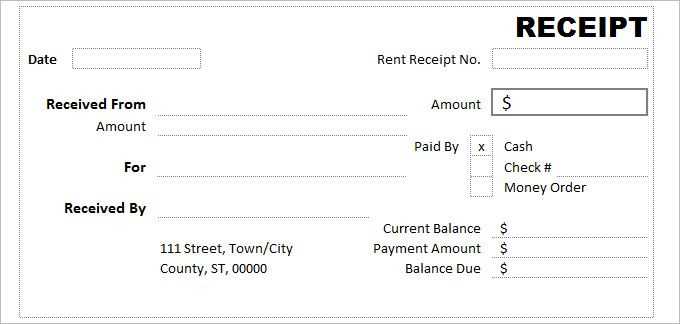

Ensure the receipt fits within a standard page size by setting margins to 1 inch on all sides. This helps avoid text or logos being cut off during printing.

Use Tables for Alignment

Tables are useful for aligning text, especially when displaying donation amounts or itemized lists. Keep the table borders hidden by setting them to “none” to maintain a clean layout. This ensures that all text lines up neatly without visible gridlines.

Choose Readable Fonts

Pick fonts that are easy to read, such as Arial, Calibri, or Times New Roman. Keep font sizes consistent for body text (10-12pt) and slightly larger for headings (14-16pt). Avoid overly decorative fonts that can detract from clarity.

When adding a logo or images, make sure they are appropriately sized and placed. The logo should not overpower the text. Use the “wrap text” option to ensure it flows well with the receipt’s content.

Use bold or italics sparingly to highlight key details, such as the donation amount or date, without overwhelming the layout.

For printing, test the receipt layout by printing a sample to ensure it appears correctly on both letter-size and A4 paper. Adjust the layout as needed before finalizing your document.

Include these key components in your donation receipt template for accuracy and transparency:

1. Donation Amount

Clearly state the exact amount of the donation, whether it’s a monetary sum or the estimated value of goods. Ensure there is no ambiguity.

2. Donor Information

Provide the donor’s full name and contact details. This helps to identify them for both the charity’s records and tax purposes.

3. Tax Information

State the charity’s tax-exempt status and include the EIN (Employer Identification Number). This is critical for the donor’s tax filing purposes.

4. Date of Donation

Include the exact date the donation was received. This serves as a reference point for both record-keeping and any applicable tax deductions.

5. Acknowledgment of No Goods or Services

If no goods or services were provided in exchange for the donation, explicitly state this. For partial donations, clearly mention what portion is tax-deductible.

6. Signature

Include a space for an authorized signature or an official stamp from the organization. This ensures the receipt’s legitimacy.