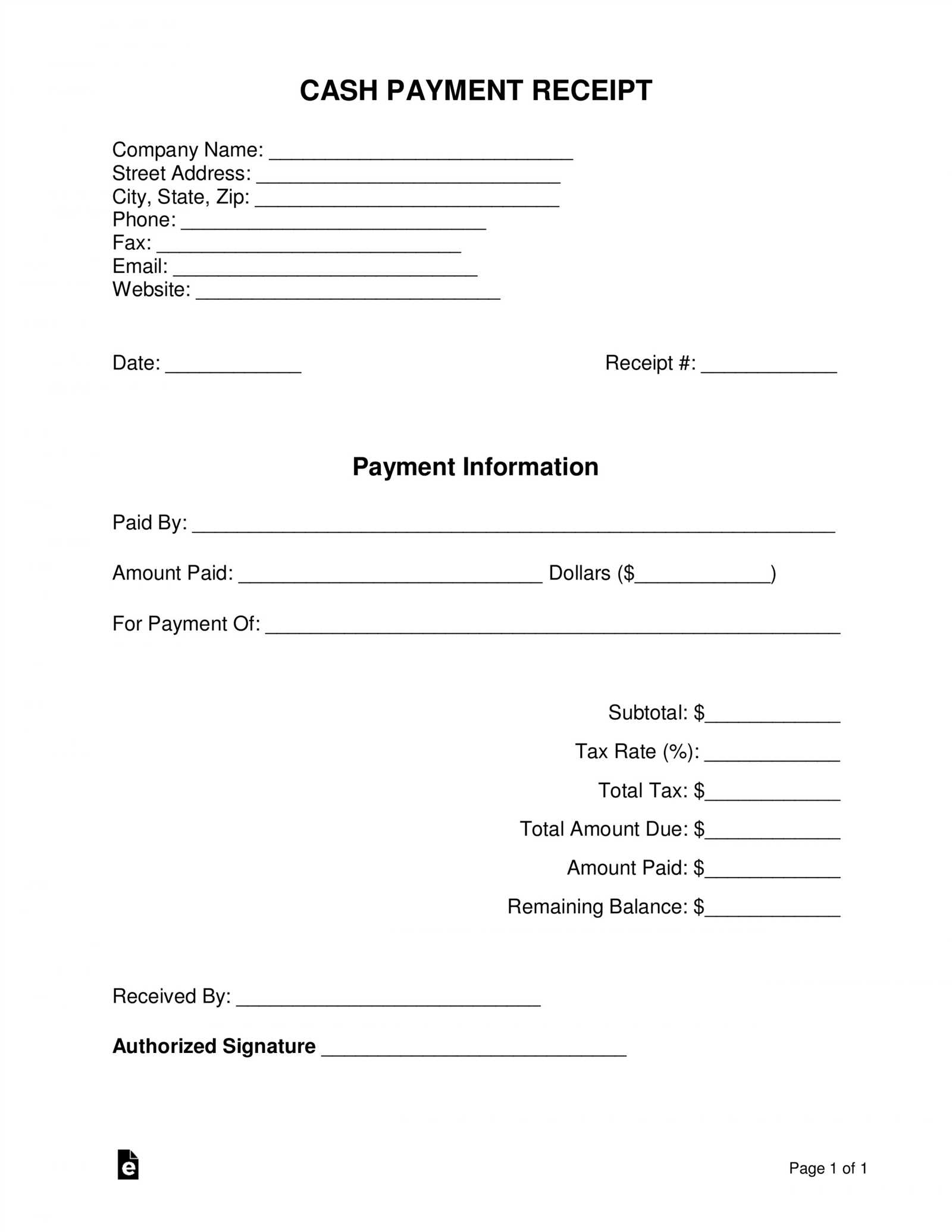

A loan repayment receipt is a clear acknowledgment that a payment has been made on a loan. It helps both the lender and the borrower keep accurate records of financial transactions. Using a proper template ensures that the receipt contains all the necessary details to avoid confusion later. The receipt should list the amount paid, the loan balance, the payment date, and any other relevant information, such as the method of payment.

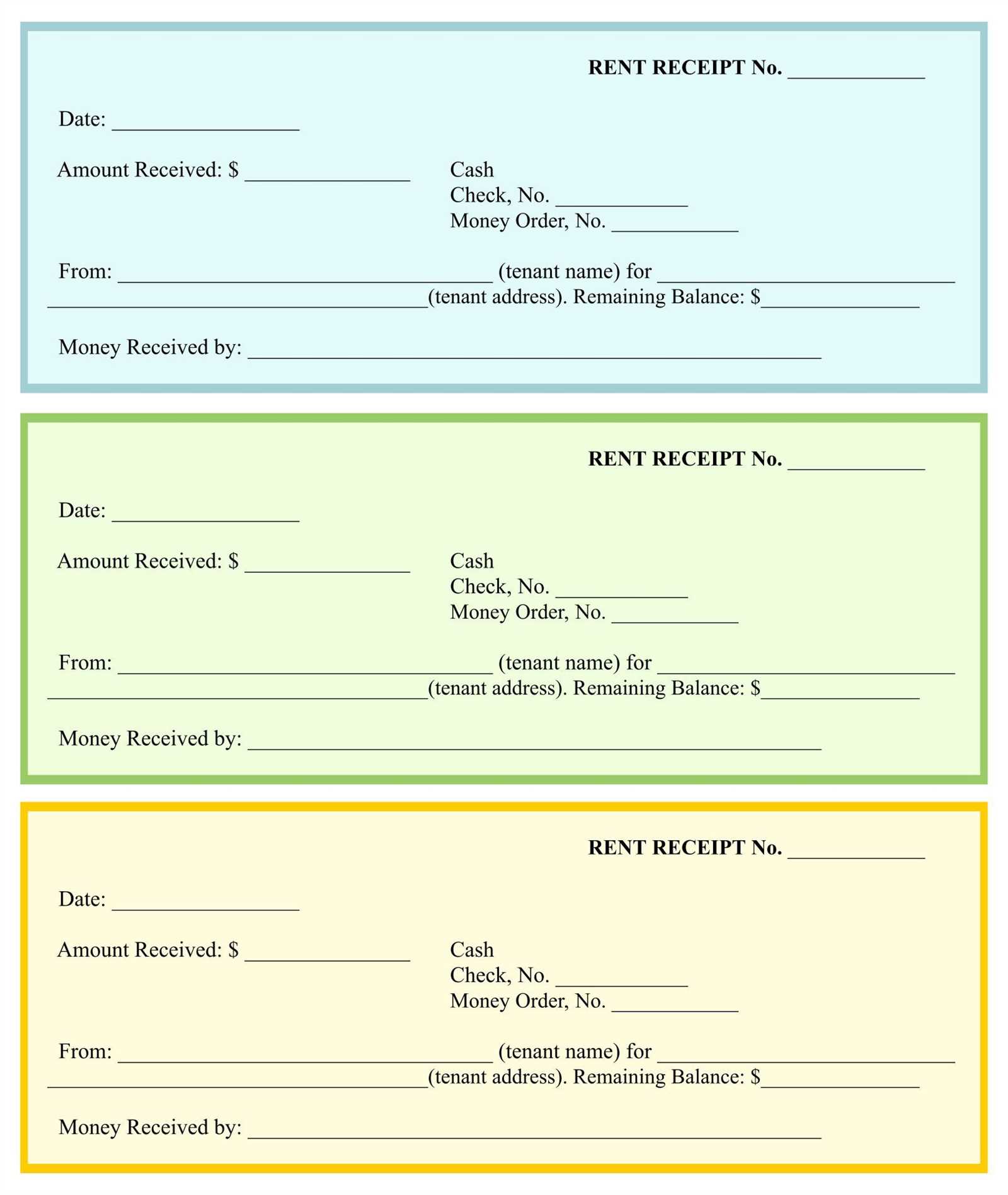

To create a loan repayment receipt, start by including the borrower’s name and the lender’s name clearly at the top. Specify the loan’s remaining balance and the amount paid in the transaction. It’s also essential to include the payment date and any reference number or check number associated with the payment. This ensures transparency in the transaction and helps both parties track the loan status effectively.

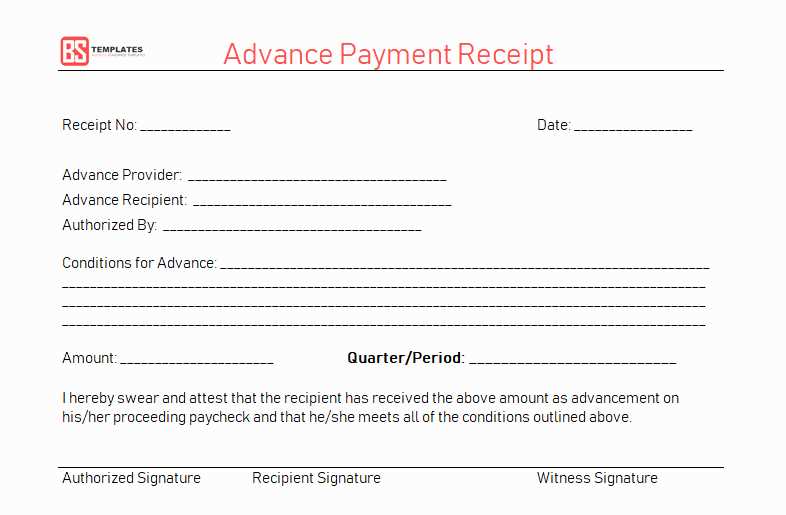

Make sure to indicate the payment method used, whether it’s cash, bank transfer, or another method. If the payment was made through an online platform, it can be helpful to include the transaction ID for easier tracking. Conclude the receipt with a clear statement that the payment has been received, and include space for both parties to sign, confirming that the transaction is complete.

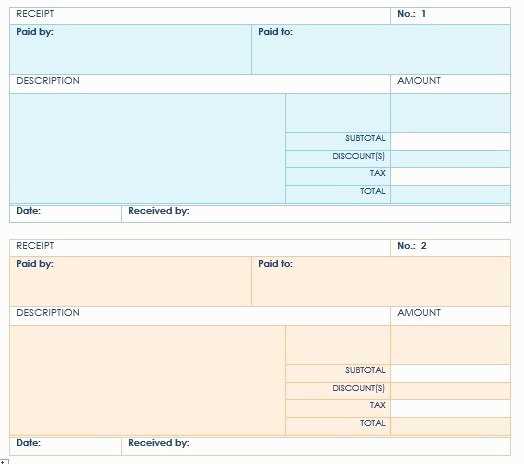

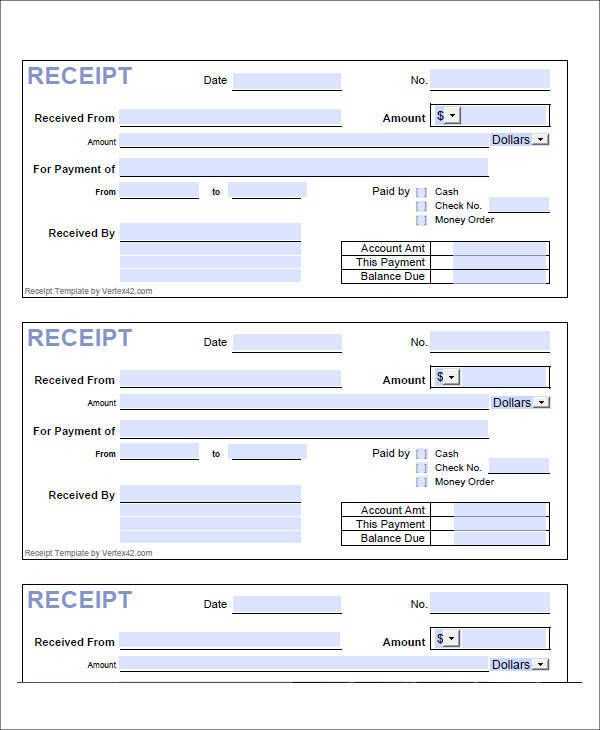

Loan Repayment Receipt Template

To create a simple yet professional loan repayment receipt, include the following key details:

- Date of Payment: Always specify the exact date when the payment is made.

- Receipt Number: Use a unique receipt number for tracking purposes.

- Loan Amount Paid: Clearly state the amount paid, including currency.

- Remaining Balance: Indicate the current loan balance after the payment.

- Payee and Payer Information: Include the names of both the lender and borrower.

- Payment Method: Specify whether the payment was made by cash, cheque, bank transfer, etc.

- Signature: Have a place for the lender’s signature as confirmation of receipt.

Template Structure Example

Here’s a simple layout for your loan repayment receipt:

- Receipt Number: 00123

- Date: 15th February 2025

- Paid Amount: $500

- Remaining Balance: $1500

- Payer: John Doe

- Payee: Jane Smith

- Payment Method: Bank Transfer

- Signature: _______________________

Additional Tips

- Ensure the receipt is legible and accurate to avoid confusion.

- Store the receipts securely for future reference and accountability.

- Use a digital version for easy tracking and sharing, especially for online transactions.

Creating a Basic Loan Repayment Receipt

To create a simple loan repayment receipt, include the following key details:

1. Loan Information

Start by documenting the loan’s basic details such as the loan amount, interest rate (if applicable), and the total outstanding balance before the repayment was made. This ensures clarity and provides a reference point for both parties.

2. Payment Information

Record the date the repayment was made, the amount paid, and the method of payment (e.g., cash, cheque, bank transfer). This will provide a clear audit trail for both the lender and borrower.

Include a unique receipt number for tracking purposes. This number helps differentiate between multiple repayments and serves as an official reference in case of disputes.

Always provide space for signatures from both the lender and borrower. This adds a layer of accountability and ensures both parties confirm the transaction.

Incorporating Payment Terms and Conditions

Specify clear due dates for each payment, whether monthly or based on another schedule. Detail the exact amount required for each payment, ensuring transparency for both parties involved.

Include information on late fees or penalties for overdue payments. This will establish clear expectations regarding consequences and help avoid misunderstandings.

Outline acceptable payment methods, such as bank transfers, credit card payments, or checks, and provide relevant details like account numbers or payment links.

Define the currency in which payments should be made to prevent any confusion, especially in cross-border agreements.

Clarify whether the loan balance can be paid off early and if any early repayment fees apply. This allows the borrower to plan ahead and avoid surprises.

State the consequences of missed payments, such as potential legal action or adjustments to the loan terms, to provide both parties with a clear understanding of their obligations.

Formatting and Customization Tips for Loan Repayment Receipts

Prioritize Clarity in your formatting. Ensure that the payment amount, due date, and transaction number are immediately visible. Use bold for the key financial details and ensure adequate spacing around each section to prevent clutter.

Use Structured Layouts for easier comprehension. Place the borrower’s name and loan details at the top of the receipt, followed by payment information. A well-organized structure allows the reader to quickly locate any necessary information.

Incorporate Payment History for transparency. If applicable, include a section that lists previous payments, their dates, and amounts. This helps both parties track the status of the loan repayment process.

Customize for Branding by adding your company’s logo or any other branding elements. This ensures that the receipt reflects your business identity while maintaining a professional tone.

Utilize Clear Date Formatting to avoid confusion. Use the full month name, day, and year to ensure there is no ambiguity in payment timelines. For example, write “February 12, 2025” rather than “02/12/25.”

Highlight Payment Method for clarity. If payment was made by bank transfer, cash, or other methods, note it clearly. This can help avoid disputes regarding how payments were made.

Include Legal Disclaimers when needed. If there are any terms related to the loan repayment or conditions tied to the receipt, make sure these are written in simple language at the bottom of the document.