To create accurate and clear receipts and payment templates, ensure that each document includes essential details such as transaction date, payment method, amount, and the parties involved. This basic structure helps avoid confusion and keeps records organized for both personal and business use.

Be specific when describing the purpose of the payment or receipt. Clearly outline the reason for the transaction–whether it’s for services rendered, a product purchase, or a loan repayment. This eliminates any ambiguity and streamlines record-keeping.

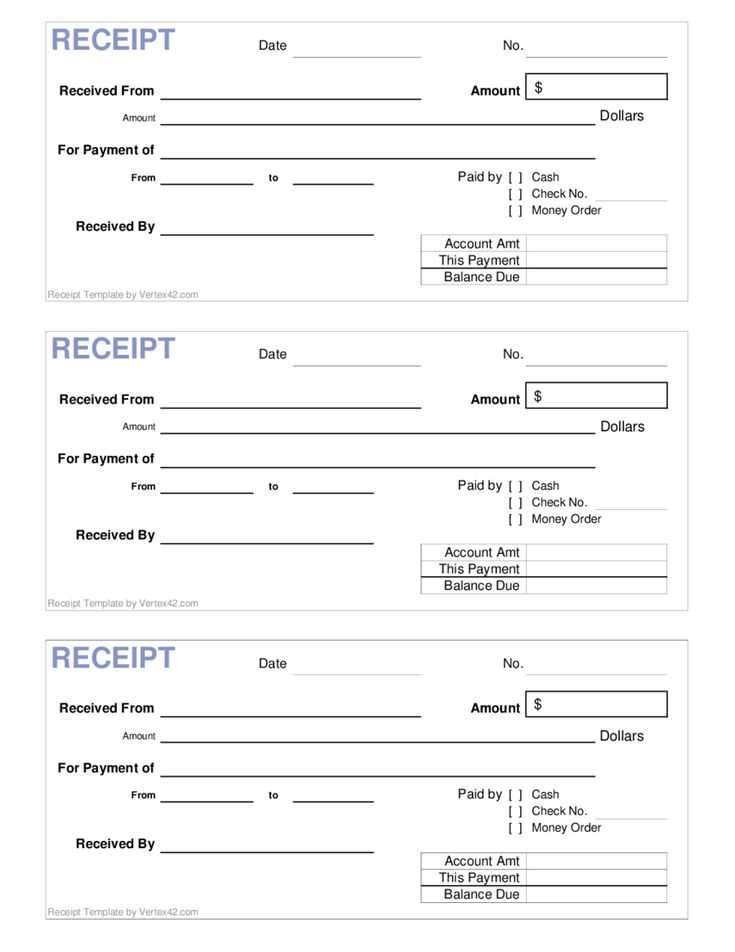

Maintain consistency in the format of your templates. Use a fixed layout for ease of use, and ensure that all necessary fields are included. The template should provide a smooth workflow for generating receipts or payment records quickly without leaving out crucial details.

Don’t forget to include relevant terms such as payment due date, late fees, or any discounts applied. These small details can make a big difference in managing finances and preventing misunderstandings.

Template Receipts and Payments

Ensure all receipts and payments are clearly documented using standardized templates. A well-structured template helps avoid confusion and ensures consistency in financial records. Each template should include fields such as the date, amount, payer/receiver details, and purpose of the transaction.

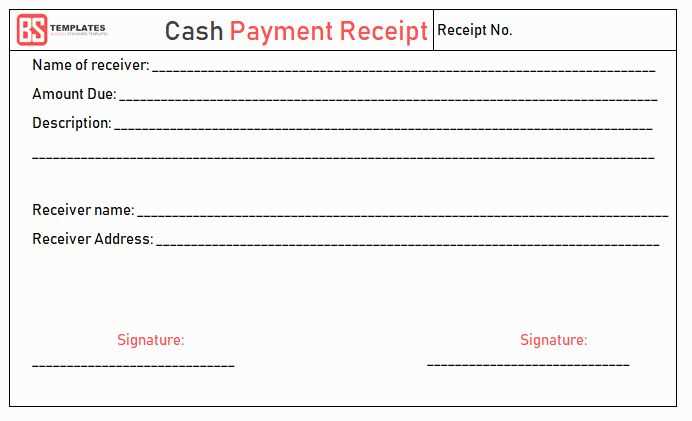

Receipts should clearly state the amount received, the payer’s details, and the method of payment. Include a reference number for tracking purposes. This allows easy verification and accountability. For example, a receipt for a product purchase should mention the product details, purchase price, and any applicable taxes.

Payments should be recorded with equal attention to detail. Include the amount paid, recipient details, payment method, and the reason for the payment. A clear payment template will help both parties track their financial commitments and avoid misunderstandings. For recurring payments, such as subscriptions or installment plans, note the frequency and due dates as part of the template.

Templates should be adaptable to different transaction types but maintain consistency. Use predefined categories for various transactions, such as “service payment,” “product sale,” or “loan repayment.” This makes future reference and reporting easier.

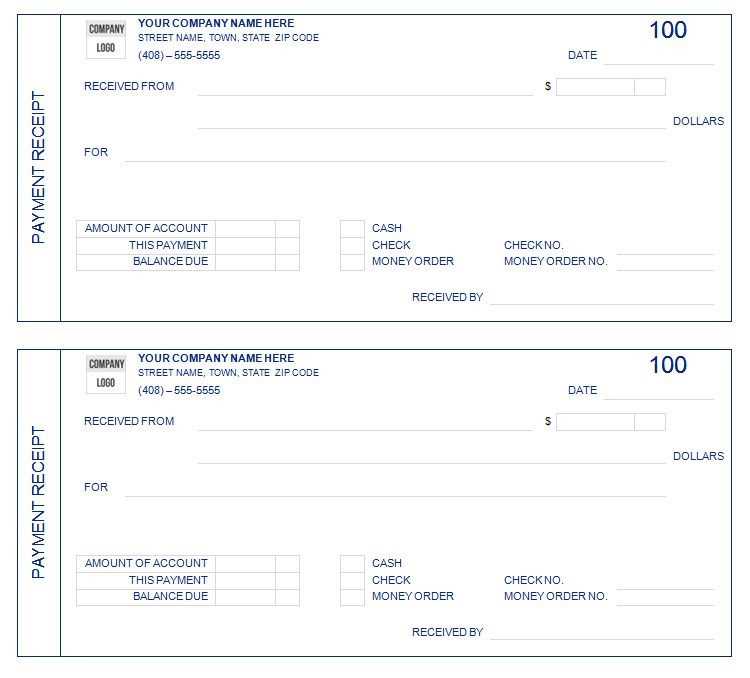

Designing a Receipt Template for Business Transactions

Focus on clarity and simplicity when designing a receipt template. Make sure all the key transaction details are easy to identify and understand at a glance.

- Business Information: Include the business name, address, contact details, and tax information at the top of the receipt.

- Receipt Number: Assign a unique receipt number for easy tracking and reference. Ensure it’s clearly visible.

- Date and Time: Include the date and time of the transaction. This helps with both record-keeping and customer reference.

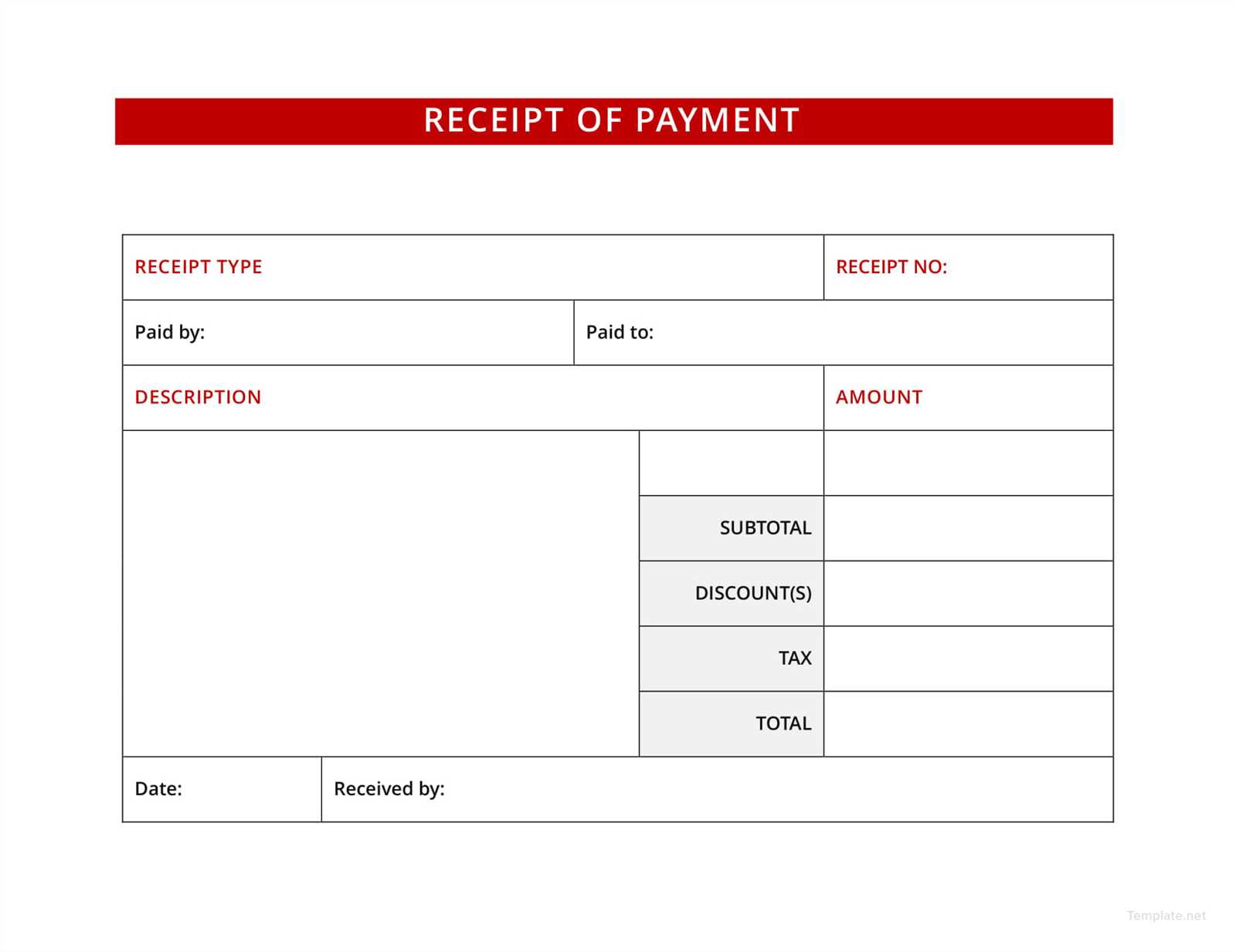

- Transaction Details: List the items or services purchased, their quantities, and the individual prices. This should be clear and well-organized.

- Total Amount: Display the total amount paid, including taxes or discounts, in a bold or highlighted font.

Use a consistent font style and size to enhance readability. Avoid clutter by limiting unnecessary details and maintaining a clean layout. Ensure that the receipt reflects your brand’s identity with professional yet simple design elements.

Include a payment method section to specify whether the transaction was made via cash, card, or other methods. This adds transparency and aids in record tracking.

- Return Policy: If applicable, mention the return or exchange policy at the bottom of the receipt.

- Signature: If needed, include space for a signature or approval mark for verification purposes.

Keep the design versatile, so it can be adapted for both physical and electronic formats. Ensure that the template is easily customizable to suit different transaction types. The goal is a receipt that is clear, concise, and professional while meeting all necessary legal requirements.

Setting Up a Payment Template for Easy Tracking

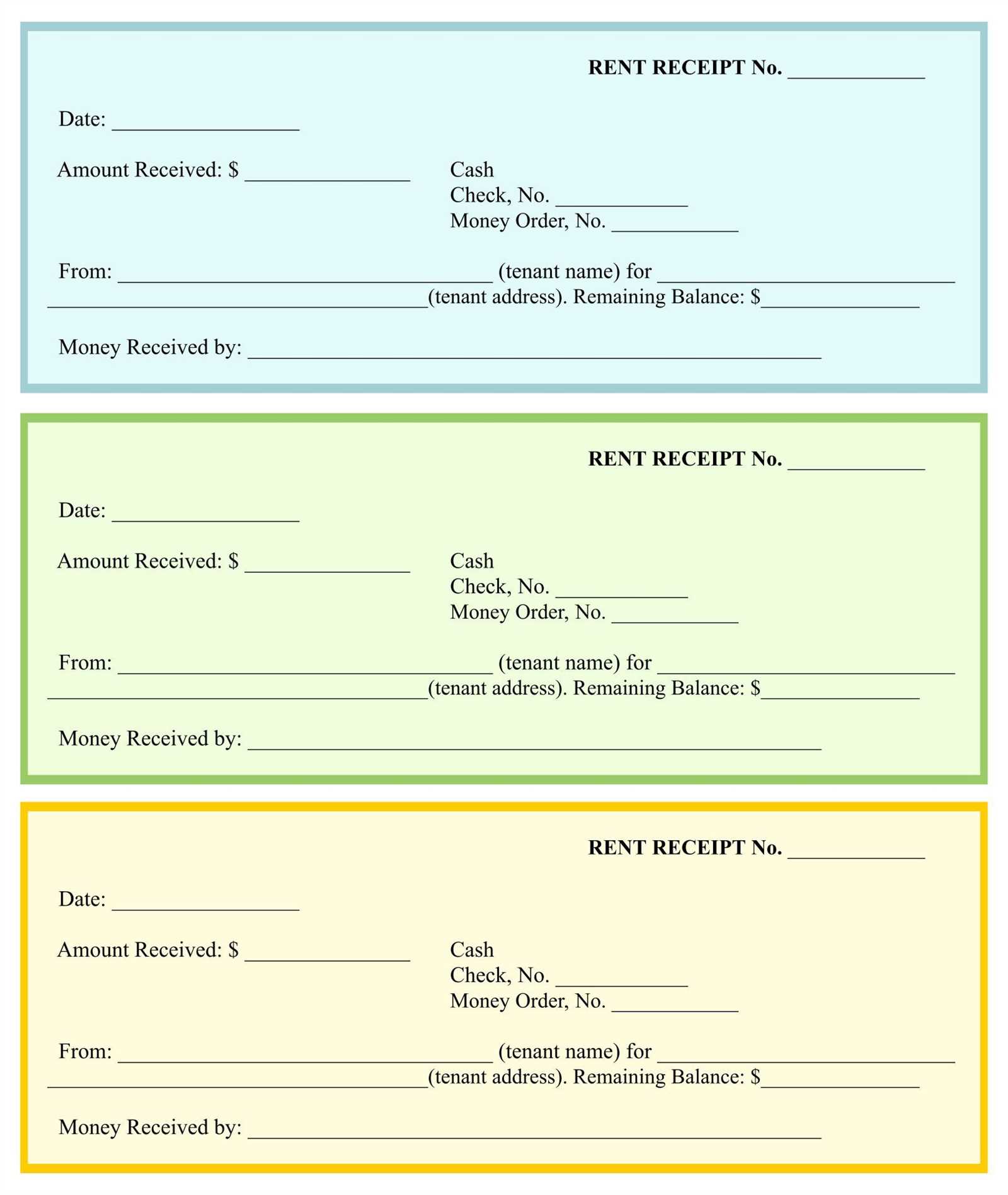

Begin by defining clear categories for your payments–such as utilities, salaries, or subscriptions. Assign each category a unique identifier or code, making it easy to search and filter when reviewing transactions. This will allow for straightforward tracking across all future payments.

Create Detailed Payment Fields

Include fields for the payment amount, due date, recipient name, and purpose. This ensures that no key information is missed and simplifies the reconciliation process. For recurring payments, set up automatic reminders for each due date to maintain consistency in tracking.

Use a Template Tool for Automation

Choose a reliable template tool that integrates with your accounting software. This tool should allow you to auto-fill payment details, such as amounts and recipients, based on previous entries. Automating this process will save time and reduce human error.

With these steps, your payment tracking will become much smoother, providing an easy way to stay on top of your finances.

Customizing Templates for Different Payment Methods

Adjust your templates for each payment method to ensure clarity and consistency. For credit card payments, include fields for card type, transaction ID, and authorization code. For bank transfers, highlight bank account details and reference numbers. Tailor sections to display relevant payment method-specific information, minimizing confusion for your customers.

Credit Card Payments

For credit card transactions, ensure the template accommodates details like the cardholder’s name, card type (Visa, MasterCard, etc.), and last four digits of the card. It’s also helpful to include the transaction approval code for easy verification.

Bank Transfers

When dealing with bank transfers, include the payer’s bank name, account number, and a unique transaction reference. A clear indication of the payment’s status helps avoid misunderstandings between parties.