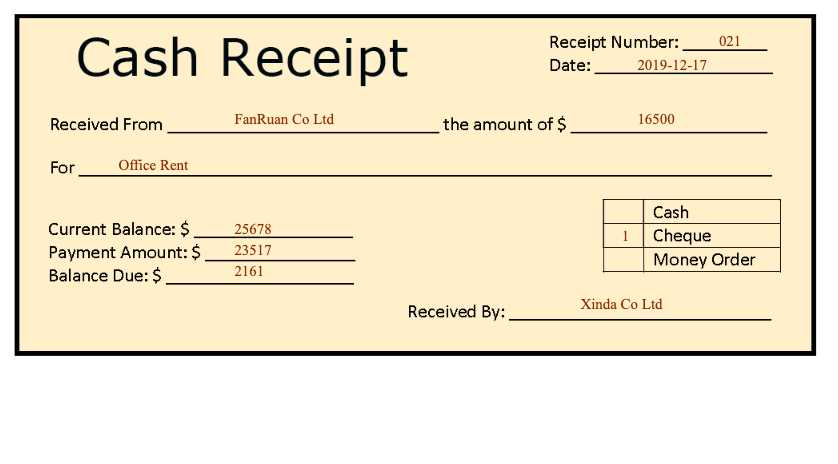

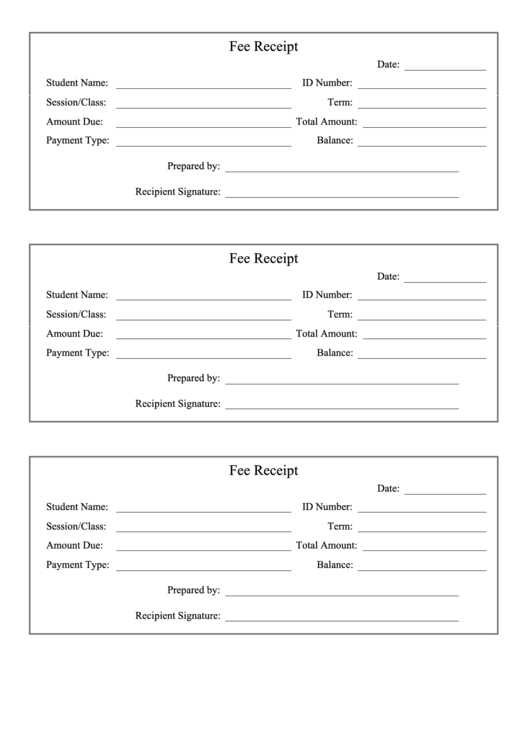

A receipt journal template is a straightforward tool designed to help track purchases and payments. This template enables you to organize transaction details, including dates, amounts, and payment methods. By using a template, you can ensure consistency and accuracy in recording receipts, making it easier to manage finances.

To get started, look for a template that includes columns for the date, vendor, amount, and payment method. These key details will allow you to track expenses clearly and quickly. You can adjust the template based on your needs by adding categories like tax or description of the goods or services purchased.

Once you have your template set up, update it regularly. Record every purchase as soon as possible to avoid forgetting important transactions. This habit will help you maintain a clear overview of your financial activities and prevent errors.

Here are the corrected lines:

Ensure that each entry in your receipt journal is accurately labeled with the date and transaction details. This helps to track expenses and income clearly.

Reviewing Transaction Details

Double-check the amounts for accuracy before entering them into your journal. Even small discrepancies can lead to larger issues when reconciling later.

Clarifying Payment Methods

Specify the method of payment for each transaction–whether it’s cash, credit, or another form. This will simplify reconciliation and offer transparency when reviewing financial records.

- Receipt Journal Template

Use a straightforward template to track every transaction clearly. A well-organized receipt journal allows for accurate financial recording, making it easier to review and reconcile accounts. The key components should include the date of the transaction, description, amount, and the payment method. Keep the entries consistent and ensure that all receipts are logged promptly for accuracy.

Structuring Your Receipt Journal

Include columns for the transaction date, the vendor or client name, the nature of the transaction, and the total amount spent or received. Adding a payment method field (cash, credit, bank transfer) helps categorize transactions. This will streamline financial audits and create transparency for both personal and business tracking.

Regular Updates and Review

Update the journal immediately after every transaction to avoid losing important details. Review the journal monthly to ensure all entries are accurate and to identify any discrepancies early on. This habit simplifies the process of managing finances and keeps records aligned with your actual spending or income.

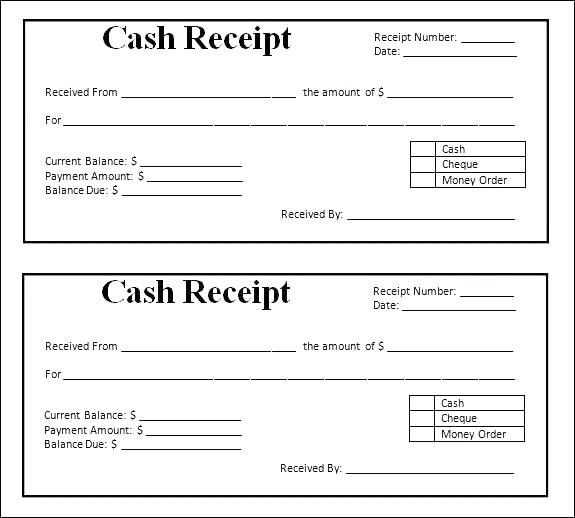

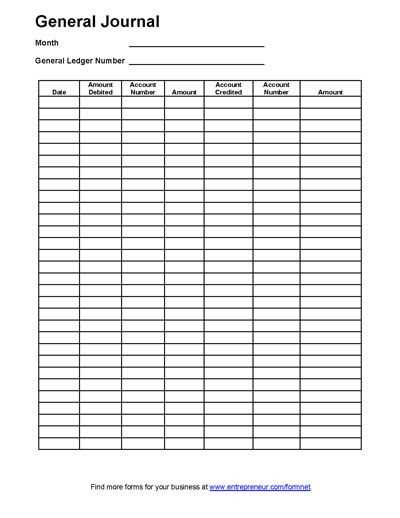

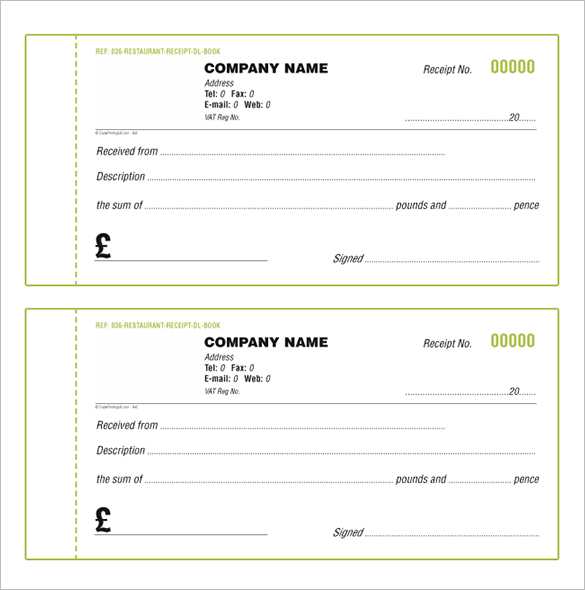

To build a receipt journal template, begin by defining key columns for tracking each transaction: Date, Receipt Number, Payee Name, Description of Service or Product, Amount Paid, Payment Method, and Category. These fields ensure clarity and offer enough detail for auditing purposes.

Design the Layout

Organize your template with a simple table structure. Place columns for each data point in a logical order, with Date and Receipt Number at the forefront. Ensure the spacing is sufficient to allow for easy entry of values. Use grid lines or borders to separate each section clearly.

Choose a Format

Decide on the software or platform for your template. Microsoft Excel or Google Sheets are ideal for small businesses due to their accessibility and ease of use. Excel allows customization with formulas to automatically calculate totals, while Google Sheets facilitates real-time collaboration if you need multiple team members to access the data.

For improved organization, include a “Notes” column for additional details such as project names, client references, or reasons for payment adjustments. This flexibility can help your small business track specific expenses or refunds.

Key tips: Keep your template simple, but flexible enough to accommodate unexpected variations in transactions. Regularly update the format as needed based on feedback or changing business needs.

Arrange your transactions into clear, defined categories to maintain clarity and structure. Grouping similar transactions together allows for quicker identification and simplifies record-keeping.

- Income and Expenses: Create separate categories for income and expenses. This distinction helps track your cash flow accurately.

- Payment Method: Include a category for payment methods, such as credit cards, cash, or bank transfers. This will help you monitor how transactions are processed.

- Date of Transaction: Use a specific column for the date to ensure chronological organization. Sorting by date lets you quickly find past transactions.

Incorporate subcategories where necessary. For example, under “Expenses,” create subcategories for “Office Supplies,” “Utilities,” and “Travel” to make your template more detailed. Assign each transaction to the appropriate subcategory to maintain accuracy.

- Transaction Type: Label transactions as either “purchase,” “refund,” “sale,” or other relevant types. This will simplify searching through transactions based on their nature.

- Amount: Always include a column for the transaction amount. This keeps the financial aspect of the template straightforward.

Finally, consider adding a column for notes, allowing extra details for each transaction. This ensures that important context is captured, whether it’s for tax purposes or business analysis.

Adjust your template based on the receipt type you’re creating. If it’s for a retail purchase, focus on product details like descriptions, quantities, and prices. A section for tax and total amounts should be easy to find. Include a customer section if it’s a return or exchange receipt, as it helps with tracking returns.

For Service-Based Receipts

For service-related receipts, highlight service descriptions, labor costs, and service dates. Add a field for service duration if applicable. This ensures customers understand the breakdown of the service provided. A clear note of payment methods, including tips, if any, is also helpful.

Incorporating Discounts and Promotions

Make room for discount codes, promotional offers, or loyalty rewards. This helps customers see how much they saved, improving their experience and encouraging repeat business. Ensure that these fields are clearly marked and easy to spot.

Customizing your receipt template for different scenarios adds clarity and enhances customer satisfaction. Adapt each section according to the receipt’s purpose for better communication and record-keeping.

Ensure the proper structure of your receipt journal by consistently using numbered lists for clarity. Each entry should start with a unique reference number to easily track each transaction.

Organize Entries Sequentially

Use the date as the first column. This ensures chronological order. Follow with the vendor name or business name. Always record the amount spent, and keep a brief note on the purpose of the expense.

Maintain Consistency in Formatting

Always use the same font style and size to ensure uniformity. Align the entries clearly with adequate spacing. Keep any supporting documentation, such as receipts or invoices, properly organized and referenced next to each entry for easy access.