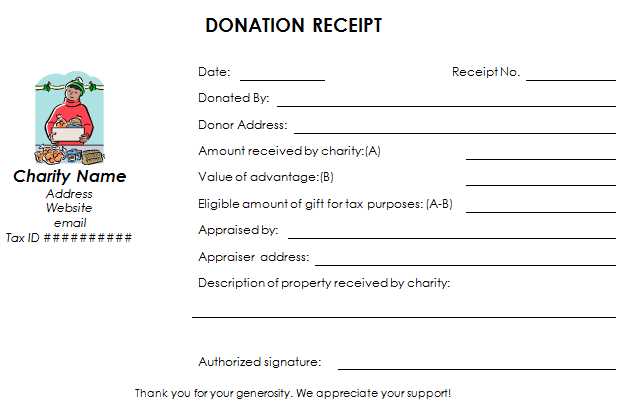

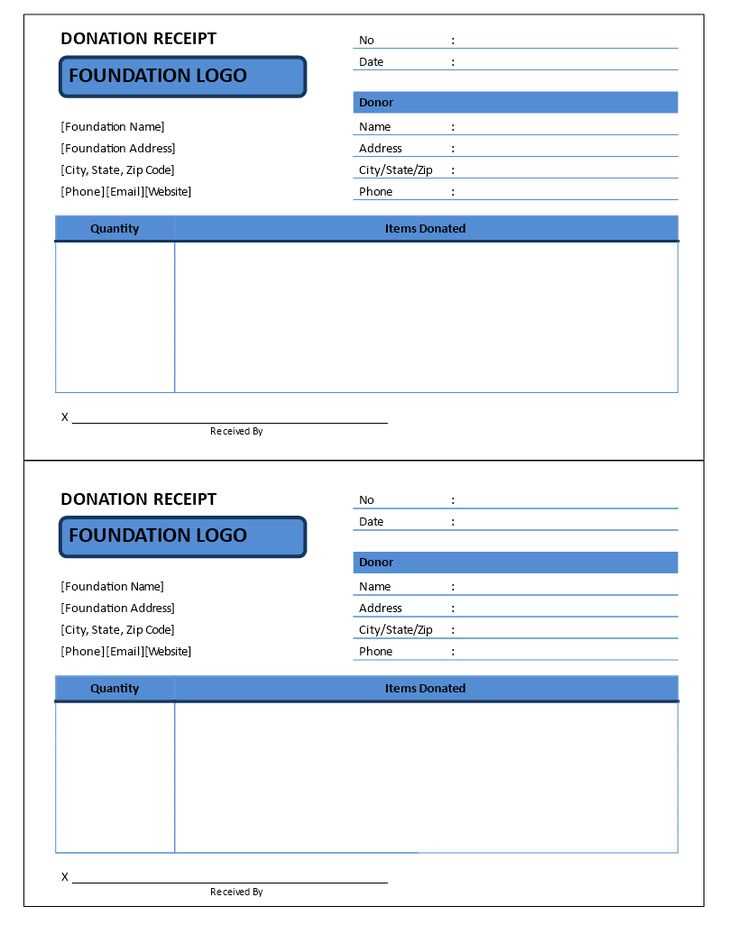

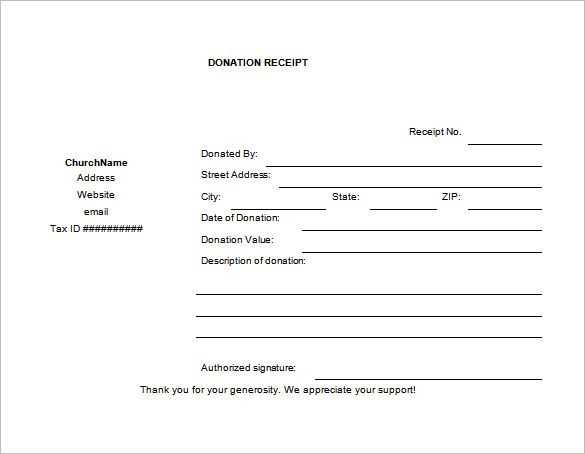

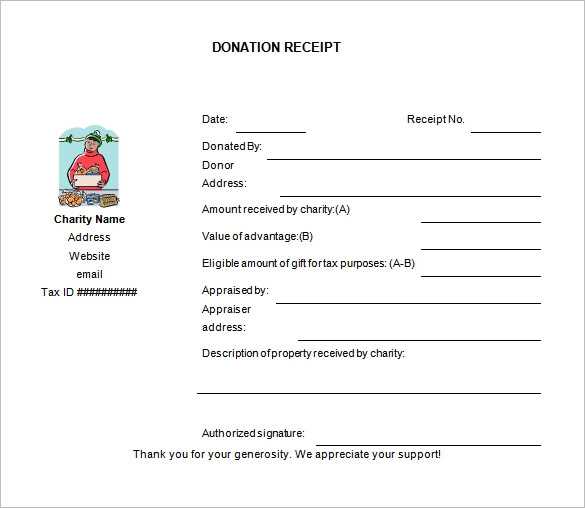

To make sure your Shul donation receipts are clear and organized, use a straightforward template that includes the key details needed for both record-keeping and tax purposes. Here’s what should be included in the template:

Key Elements of the Template

- Donor’s Name: The full name of the person making the donation.

- Shul’s Name and Contact Information: Include the Shul’s full name, address, phone number, and email for easy communication.

- Donation Amount: Clearly state the total value of the donation, whether it’s a monetary amount or the value of goods donated.

- Date of Donation: The exact date when the donation was received.

- Tax-Exempt Status: A statement confirming the Shul’s tax-exempt status, which is required for the donor’s tax records.

- Purpose of Donation (if applicable): If the donation is for a specific purpose, like a campaign or fund, mention it clearly.

- Receipt Number: Assign a unique number for each donation receipt for tracking purposes.

Sample Template Layout

Here’s a simple format you can use:

Shul Name: [Shul Name] Address: [Shul Address] Phone: [Shul Phone Number] Email: [Shul Email Address] Website: [Shul Website] Receipt Number: [Unique Receipt Number] Date of Donation: [Date] Donor’s Name: [Donor’s Full Name] Donation Amount: $[Amount] / [Item Description] Purpose (if any): [Specific Fund or Campaign] Thank you for your generous support of our community! This donation is tax-deductible under IRS Code Section 501(c)(3).

Tips for Customization

- Make sure the receipt is printed on Shul letterhead for a professional touch.

- If the donation is in-kind, provide a description of the items and their estimated value.

- Use a digital version of the template to send receipts via email for quicker delivery.

This format will help you stay organized and ensure that donors receive all necessary information for tax purposes. It also builds trust by maintaining clarity and transparency in your record-keeping system.

Shul Donation Receipt Template Guide

Begin the donation receipt with clear identification details, such as the name of the shul, its address, and contact information. This provides a professional touch and helps the donor recognize where the donation came from.

Include the date of the donation, the donor’s name, and the amount donated. If the donation is in kind (such as goods or services), describe the items or services donated in detail. Mention whether the donation is tax-deductible and provide a statement confirming no goods or services were provided in exchange for the donation, if applicable.

Customize the template to suit different types of donations. For monetary donations, specify the amount and payment method (cash, check, or online payment). For non-cash donations, include descriptions of the items or services along with their fair market value, if available. Adjust the format to be clear and easy to understand for each type of donation.

Be aware of legal requirements in your jurisdiction. In some areas, receipts for donations over a certain amount must include specific wording or be issued in a particular format. Always consult local regulations to ensure compliance. Include the shul’s tax-exempt status, as this helps the donor with their tax filings.