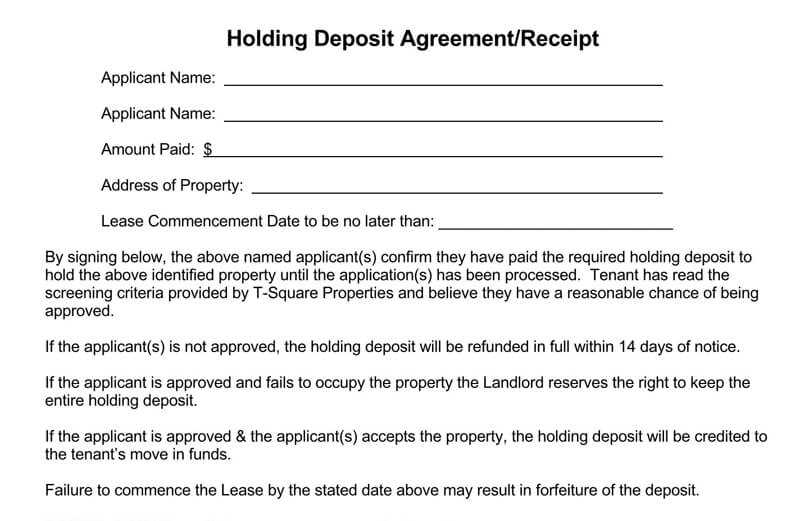

Creating an itemized expense breakdown is crucial for both tenants and landlords during the end-of-lease process. This helps to ensure transparency regarding any deductions from the security deposit and prevents misunderstandings. Having a clear and detailed record can protect both parties from potential disputes.

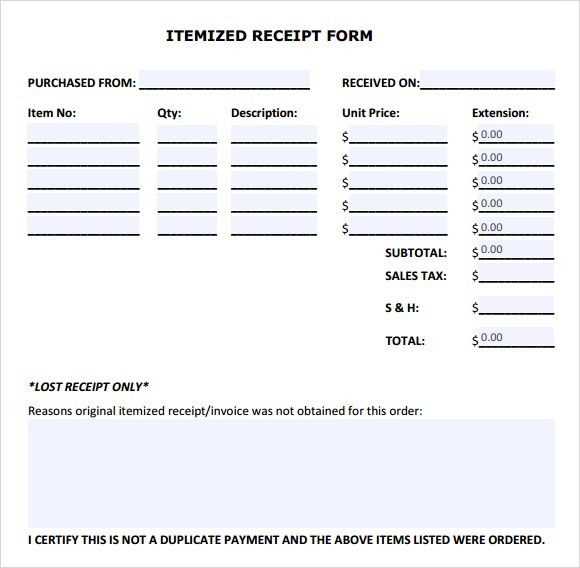

Include the date of the lease termination, the tenant’s contact information, and a list of specific deductions. Each expense should be broken down, with clear descriptions of damages or cleaning charges. This format ensures that tenants can easily track any costs deducted from their deposit and verify if they align with the lease agreement.

Be sure to include a final total and the remaining deposit amount. A well-organized end-of-lease deposit receipt will provide both parties with a comprehensive and easy-to-understand overview of all expenses related to the lease termination.

Here is the corrected version:

To ensure clarity, provide a breakdown of all expenses related to the lease, specifying each charge and its amount. Include the following sections:

1. Itemized List of Deductions

Clearly list any deductions from the deposit, such as repair costs or cleaning fees. Specify the exact reason for each charge, along with the corresponding cost, to avoid confusion.

2. Proof of Payment or Invoice

Attach any receipts or invoices supporting the charges you are deducting. This helps the tenant verify the legitimacy of the deductions and makes the process transparent.

For a seamless transaction, include a section that confirms the total amount returned to the tenant. Be precise with the date and payment method used for the refund.

Ensure the receipt template is clean, organized, and easy to read. This minimizes the chances of disputes and fosters trust between the landlord and tenant.

- Itemized Expenses and End of Lease Deposit Receipt Template

Provide a clear and concise breakdown of any expenses deducted from the deposit to ensure transparency for both parties. Create a detailed template for the end-of-lease deposit receipt to avoid disputes and keep everything on record. This template should include:

- Tenant Information: Include the tenant’s full name, address of the rented property, and lease dates.

- Landlord Information: Include the landlord’s name, contact details, and property management company (if applicable).

- Deposit Amount: Specify the original deposit amount received at the start of the lease.

- Itemized Expenses: List all deductions from the deposit, such as cleaning fees, repairs, unpaid rent, or damage to property. Be specific with costs and dates of work or damages.

- Balance to be Returned: Clearly show the remaining amount to be returned to the tenant, after any deductions.

- Date of Issuance: Include the date when the deposit receipt is issued.

Each expense should be justified with receipts or documentation where necessary. Provide this itemized receipt in both hard and electronic copies for ease of reference and future records. This will ensure accountability and reduce confusion at the conclusion of the lease.

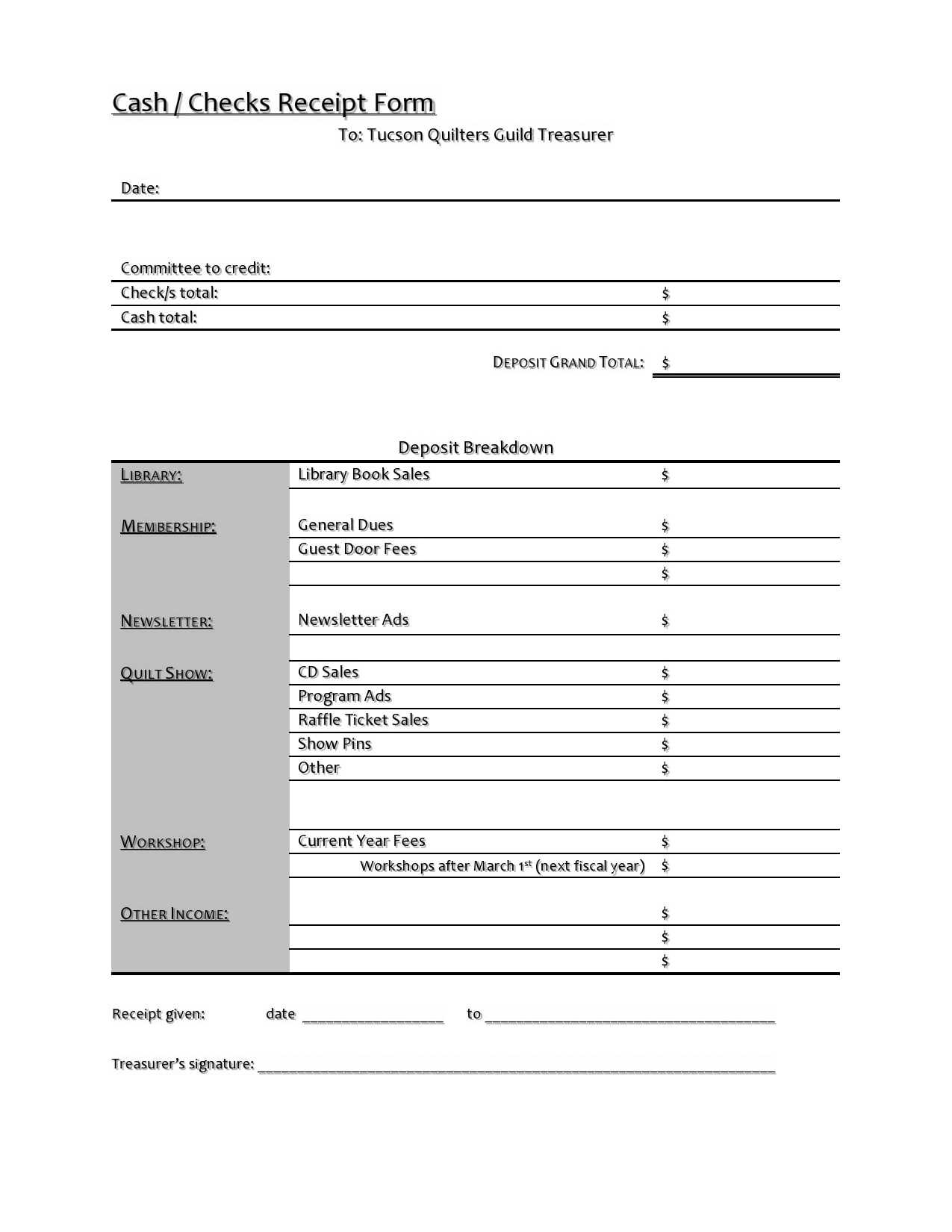

To clearly outline expenses related to a lease deposit, start by listing all charges associated with the property. This breakdown provides transparency and helps avoid disputes later. Follow these steps to create an itemized report:

- Security Deposit – Specify the total amount collected as a security deposit and mention any deductions that may occur.

- Cleaning Fees – Detail the cleaning costs if any were necessary for restoring the property to its original condition. Include labor, materials, or service fees.

- Repairs – List the specific repairs required after the tenant’s departure, such as damage to walls, flooring, or appliances.

- Unpaid Rent – If applicable, subtract any unpaid rent from the deposit amount. Ensure the rent arrears are clearly stated.

- Utilities – Include outstanding utility bills (water, electricity, gas) that the tenant has not paid, if these were part of the lease agreement.

- Administrative Fees – If the landlord incurs costs for processing the lease termination, account for these as well.

- Final Inspection Fees – If a third-party inspection was conducted to assess the property’s condition, list the inspection fee here.

Each category should have its own line item, with the amount being clearly outlined. A simple formula of “Initial Deposit – Deductions = Final Refund” will show the remaining balance that should be returned to the tenant. This helps both parties easily track all relevant charges and avoid any confusion over the amount due at the end of the lease. Always keep records of the expenses for future reference.

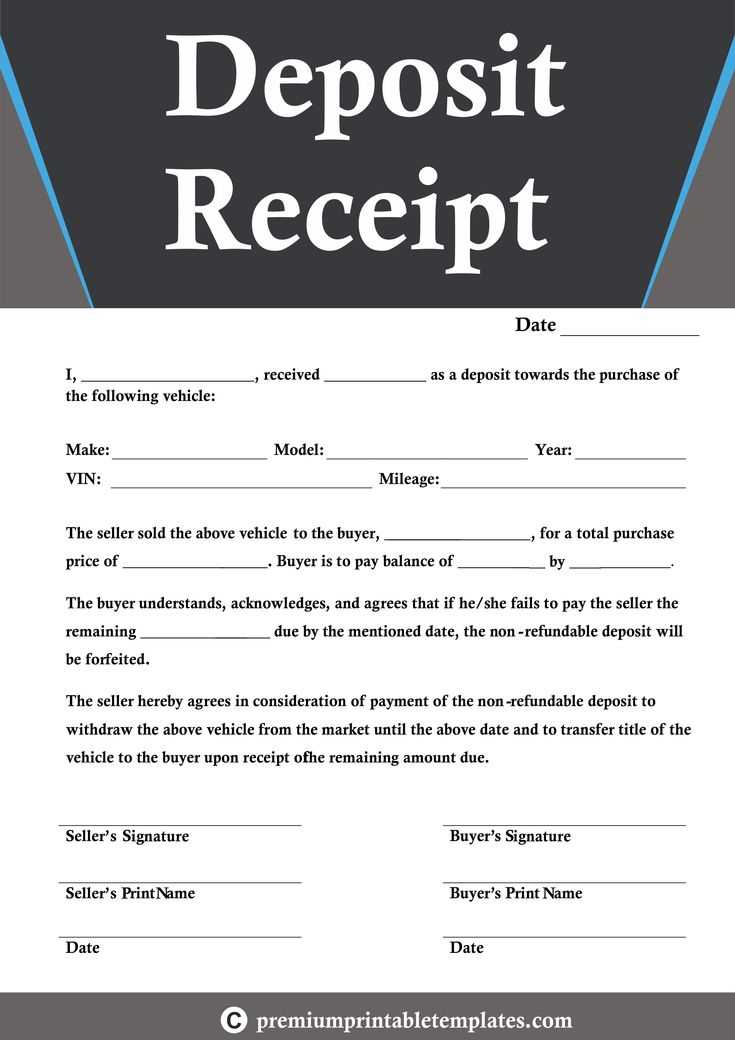

Include the names of both the landlord and tenant to clearly identify the parties involved in the transaction.

List the deposit amount. This should match what the tenant has paid, avoiding any confusion later.

Specify the payment method, such as cash, check, or bank transfer. This gives a clear record of how the payment was made.

State the date the deposit was received. This helps track the timeline for both parties.

Identify any non-refundable fees, such as cleaning charges, so the tenant knows what will not be returned.

Include conditions for withholding or returning the deposit. This covers cases like property damage or unpaid rent and should reference specific lease clauses.

Provide space for both parties to sign. This confirms their agreement on the details and terms of the deposit.

Ensure the lease deposit receipt template accurately reflects the terms agreed upon by both parties. Clearly state the amount of the deposit, the purpose of the deposit, and the conditions under which it can be withheld. Specify the timeline for returning the deposit and the deductions that may be made for damages or unpaid rent.

Double-check that all relevant state or local laws are included in the template. Different regions have varying rules regarding deposit limits, interest on deposits, and the return period. Failing to comply with these regulations could result in legal penalties.

Include contact details for both the landlord and tenant. The receipt should also indicate the property address, which helps avoid any confusion if multiple properties are involved. This helps verify the deposit’s relevance to the correct rental agreement.

Ensure that the template contains both parties’ signatures, or at least a digital record of agreement. This confirms that both the landlord and tenant acknowledge the terms and the deposit amount. Without this step, disputes over the receipt’s authenticity may arise.

Review the document for clarity and completeness. A vague or incomplete receipt can lead to misunderstandings, especially when there is a dispute over the return of the deposit. Both parties should easily understand what the deposit is for and how it will be handled.

Itemized Expenses End of Lease Deposit Receipt Template

When preparing an itemized list for the end-of-lease deposit receipt, ensure it includes all relevant deductions and charges to avoid disputes. This document serves as a record of financial transactions, detailing any amounts deducted from the deposit for repairs, cleaning, or other expenses. The format should be clear and easy to understand for both parties.

Here’s a breakdown of what should be included:

| Description | Amount Charged | Reason for Deduction |

|---|---|---|

| Cleaning Fee | $150 | General cleaning and carpet shampooing |

| Damaged Items | $200 | Replaced broken window and damaged door frame |

| Late Rent Fees | $50 | Payment was made after the due date |

| Utility Bills | $100 | Unpaid utilities for the last month |

Each itemized entry should include a brief description of the expense, the amount charged, and the reason for the deduction. It’s also helpful to reference the lease agreement or prior communications about the charge. This way, both the tenant and landlord can easily agree on the final amount to be returned or deducted from the security deposit.

Lastly, make sure the total amount of deductions is clearly stated at the bottom of the receipt. If the deposit amount covers these charges, indicate how much will be refunded to the tenant. Provide a clear breakdown of the remaining deposit amount to avoid confusion.