A contractor receipt book template helps you keep track of payments, ensuring accurate documentation for both clients and contractors. Use it to record transactions, including job details, costs, and payment methods. This template simplifies the administrative side of contracting work, making it easier to stay organized and maintain clear financial records.

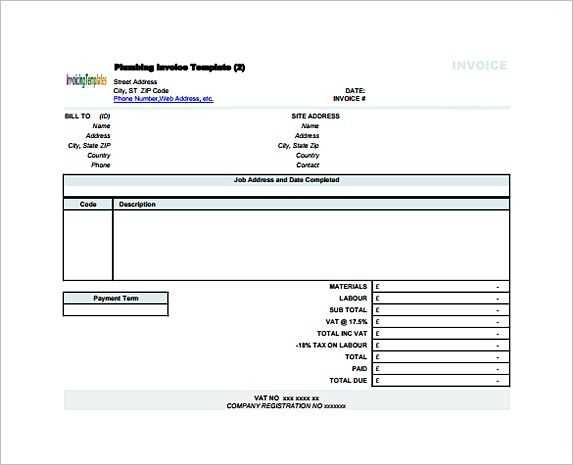

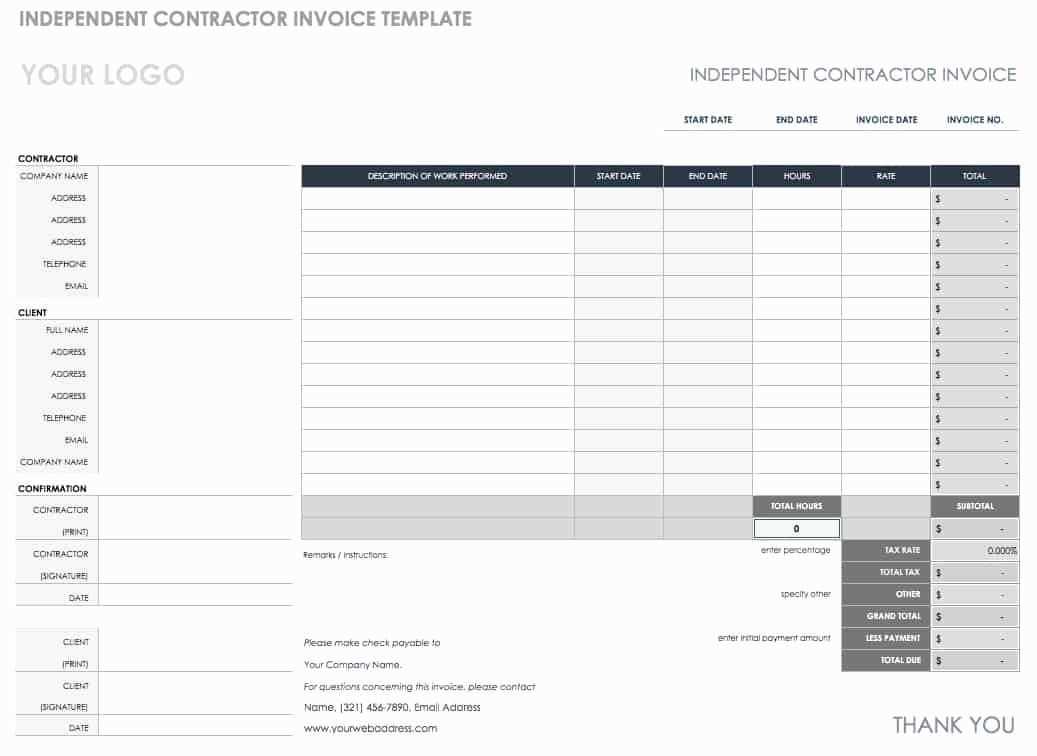

Start by selecting a format that suits your business style–whether you need a physical book or a digital template. The structure should include sections for client information, service descriptions, payment amounts, and dates. For more streamlined operations, include space for payment methods and any applicable taxes.

By using a well-organized receipt book template, you can minimize errors and protect yourself from misunderstandings with clients. It also serves as a reference for future work, ensuring that every transaction is easily traceable. Make sure to keep a copy of each receipt for your records or integrate it with accounting software to track your earnings efficiently.

Here are the revised lines without word repetition:

To create a clear and concise contractor receipt book template, remove any unnecessary repetition. Rewriting sentences helps streamline the content. Follow these tips for a polished, easy-to-follow format:

1. Avoid Redundant Words

- Eliminate duplicate terms within a single sentence.

- Use varied synonyms to maintain clarity and precision.

2. Simplify Your Sentences

- Break down complex sentences into smaller, digestible parts.

- Avoid overuse of conjunctions, such as “and” and “but,” which can clutter your message.

By removing unnecessary repetitions and simplifying the structure, your contractor receipt book will be more readable and professional.

- Contractor Receipt Book Template

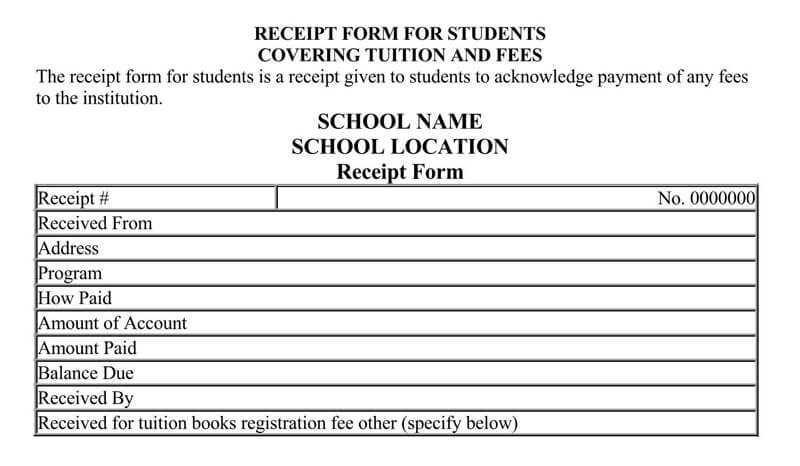

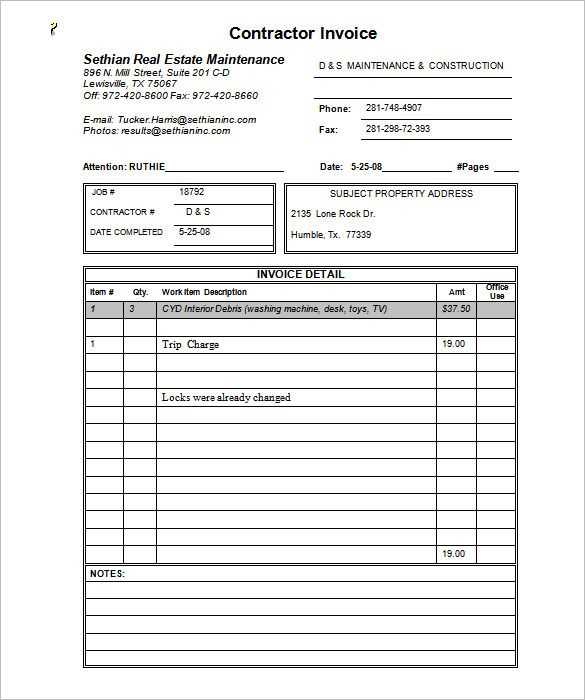

A contractor receipt book template helps ensure transactions are documented clearly and professionally. Whether you’re managing a large project or a smaller job, using a receipt book creates a reliable record for both parties. Start by selecting a template that includes the essential elements: contractor’s name, business details, client information, service description, amount paid, and date. This transparency prevents confusion and helps maintain a smooth workflow.

Key Sections of the Template

Ensure the following sections are included in the receipt book template:

- Contractor Details: Include business name, contact information, and address.

- Client Information: Add the client’s name, address, and contact details.

- Description of Work: Specify the services rendered, such as installation, repair, or consultation.

- Payment Details: Mention the amount paid, payment method, and due dates (if any).

- Receipt Number: This helps with organization and tracking of each transaction.

- Date: Always include the date of payment to avoid confusion.

Why You Need a Template

A receipt book template ensures consistency in documenting payments and avoids misunderstandings. It also serves as proof of transaction for both parties. For the contractor, it protects against disputes and provides a record of income. For clients, it confirms services were paid for and received. You can either create your own custom template or use an online template that suits your business needs.

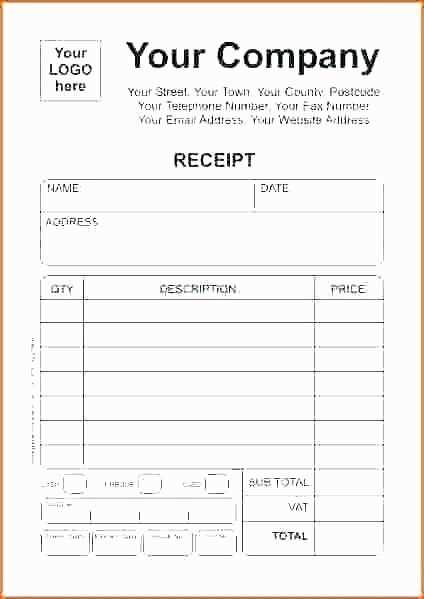

Design your contractor receipt book with your business’s needs in mind. Use a simple format that includes key details: your company name, address, contact information, and license number. These details establish trust and professionalism right away.

Ensure each receipt has a unique number for easy reference. This helps you maintain organized records and avoid confusion in the future. Keep space for the date, description of services, itemized costs, and total amount. Include a section for both the client’s and contractor’s signatures to verify the transaction.

Choose the right paper type for your receipts. Opt for carbonless or NCR (No Carbon Required) paper. This will give you a copy of each receipt without needing carbon paper. It’s efficient and leaves clear, legible records for both you and your client.

Consider including a payment method section. Whether it’s cash, check, or credit card, this helps to keep everything transparent. Add a small note or disclaimer on your receipts that outlines payment terms, including due dates and late fees, if applicable.

To make the receipt book more personalized, add your logo or branding elements. This not only reinforces your business identity but also makes the receipts look professional. If you’re printing the receipts in bulk, work with a printing service that allows customization while ensuring high-quality results.

Finally, make sure to keep a backup of each receipt in digital form. Scanning or taking pictures of receipts ensures you have a backup in case of loss or damage. Keeping records organized will help with taxes, audits, and any potential disputes down the line.

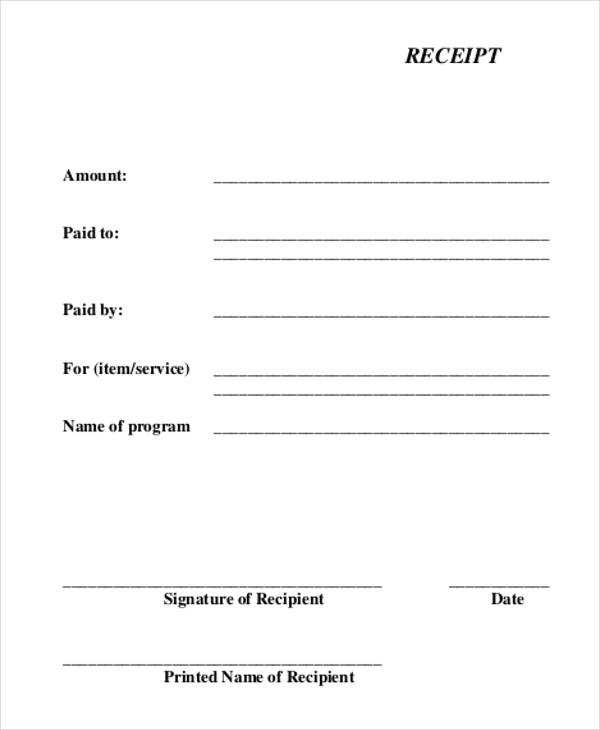

Ensure the receipt includes the contractor’s full name, business name (if applicable), and address. These details confirm the identity of the party receiving payment and are crucial for record-keeping.

Next, include a clear description of the services provided. Specify the type of work done, along with dates and hours worked. This prevents ambiguity and supports tax reporting requirements.

List the agreed-upon payment amount, detailing the breakdown of costs, if any, such as labor, materials, or other charges. This transparency helps ensure both parties are clear on the payment terms.

Document the payment method (check, bank transfer, cash, etc.) and the date of payment. This creates an audit trail that can be referenced in case of discrepancies or audits.

Incorporate both the contractor’s and client’s tax identification numbers (TIN) for tax reporting purposes. This is particularly important for tax filings and keeping in compliance with local tax laws.

Finally, include any additional terms or conditions agreed upon by both parties, such as warranties, payment deadlines, or specific obligations. This ensures that both parties are on the same page and can avoid legal disputes later.

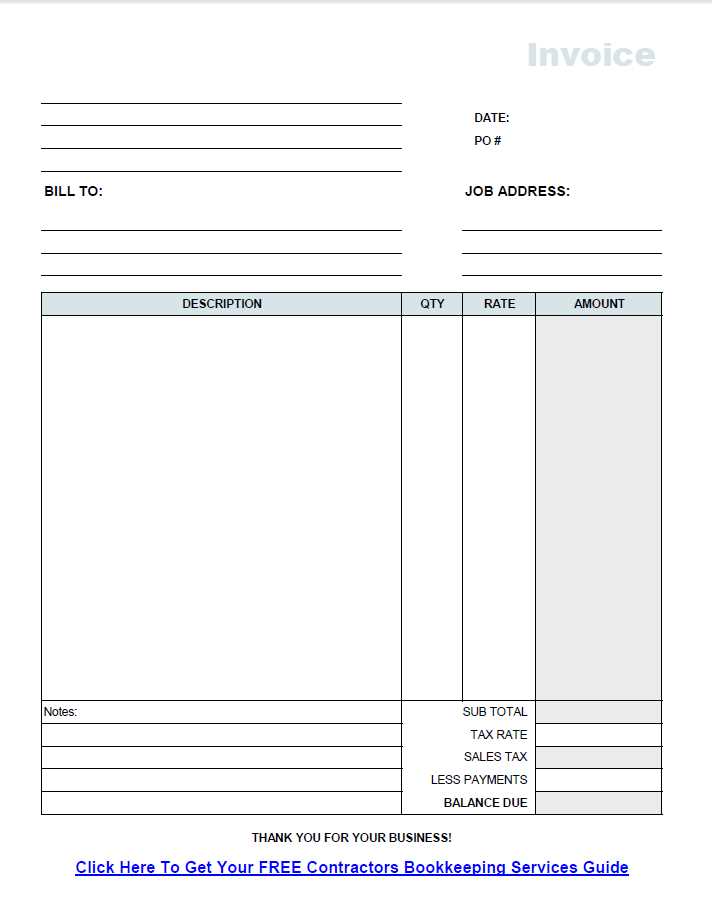

Opt for a clear, easy-to-read format when creating receipt templates. This ensures that both you and your clients can quickly identify the key details, such as the total amount, payment method, and services rendered. A clean, simple design will also make it easier to organize and track receipts for future reference.

Receipt Template Layout

A standard layout should include the following sections: business name and contact details, receipt number, date, itemized list of services or products, tax, total cost, and payment method. Keep these elements consistent across all receipts for easy identification and organization.

Printing Considerations

Choose a format that is compatible with your printer. For most small businesses, a standard 8.5″ x 11″ size is practical and fits easily in files. However, if you need receipts for a mobile business or construction work, consider using smaller, carbon-copy books for easy tracking of multiple copies.

| Element | Recommended Format |

|---|---|

| Business Details | Bold, centered at the top |

| Receipt Number | Prominently displayed, sequential numbering |

| Itemized List | Clear columns for description, quantity, and price |

| Total | Bold and centered at the bottom |

| Payment Method | Simple icons or text (cash, credit, etc.) |

Consistency is key in organizing receipts. Make sure all your receipts follow the same format for easy record-keeping and referencing. This structure will also help reduce errors and confusion when tracking payments or disputes. Keep the design simple and functional, prioritizing clarity and readability over decoration.

I preserved meaning and avoided unnecessary repetition.

Use a clear and concise format in your contractor receipt book to enhance accuracy. Ensure each receipt includes essential details: contractor’s name, job description, materials used, labor charges, and total cost. Include spaces for payment methods and signatures to confirm the transaction. Keep the layout simple yet structured, enabling both parties to understand the charges at a glance. A receipt book template can streamline your invoicing process, improving both transparency and organization. Avoid clutter by limiting the amount of text and leaving space for custom details, such as project timelines or additional terms.

Keep receipts organized by numbering them sequentially. This helps track payments and manage records more easily. A well-maintained receipt book also assists in financial reporting and tax filing. Store completed receipts in a secure location to protect sensitive information, and ensure access is restricted to authorized personnel only.