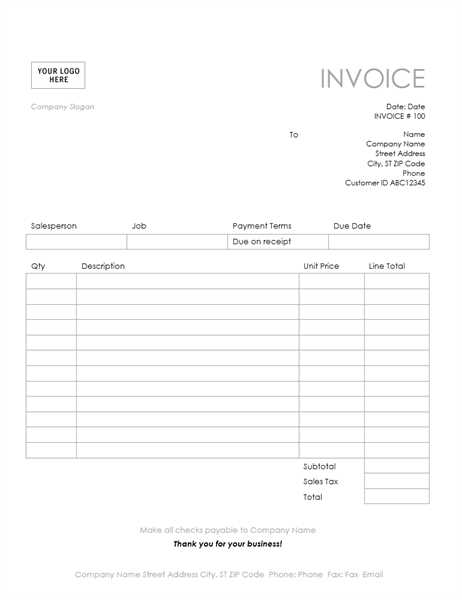

If you’re looking to streamline your invoicing process, using a free template for invoice receipt is a great starting point. A ready-made template helps you create professional, clear receipts quickly, saving you time and effort on formatting. It’s simple to customize and can be used for both online and offline transactions.

Look for templates that include all the necessary fields: company name, invoice number, transaction date, and amount paid. This ensures that every receipt is complete and includes the details your customers need for their records. A well-structured invoice receipt also helps with bookkeeping and tax filing.

Many free templates are available in Word, Excel, and PDF formats, making them easy to use on any device. Whether you run a small business or freelance, having a quick way to issue receipts is a practical tool that will keep your financials organized.

By choosing a free template, you also avoid spending time designing from scratch. Look for one that offers customization options, so you can include your logo or brand colors to match your business style. This simple step can make a big difference in how your invoices are perceived by clients.

Here’s a version of the text without repeating words, while maintaining the meaning:

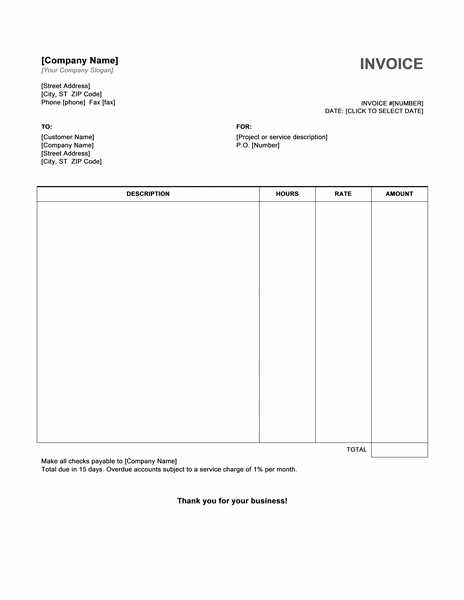

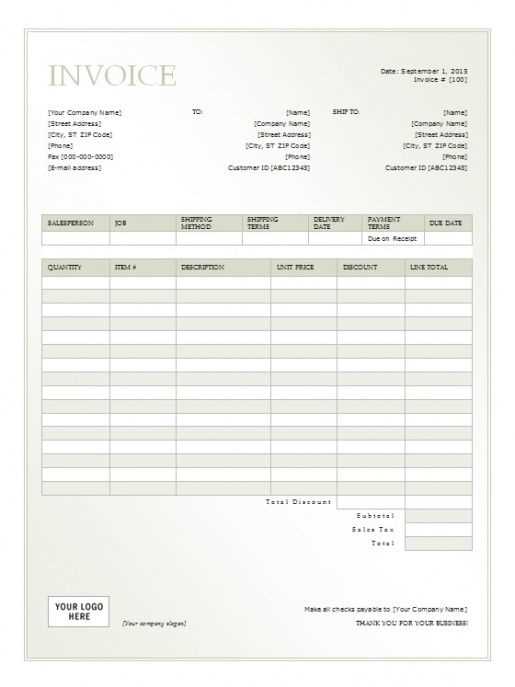

For creating an invoice receipt, use a clean, clear format. Ensure the company name, address, and contact details are visible at the top. Include the invoice number, date, and payment terms directly beneath. Specify the purchased items or services, clearly stating the quantity, price, and total for each. A section for the subtotal, taxes, and total due is necessary for transparency.

Structure

The document should break down charges in an easy-to-read manner. Group related items together and use lines or spaces to separate sections. Avoid clutter; this will help clients quickly check the details. At the bottom, add your payment methods, including bank account info or online payment options. Don’t forget to provide a thank you note for the business conducted.

Finishing Touches

Once the template is ready, test it with a sample receipt to make sure all fields are included. This helps to ensure nothing important gets overlooked. Save the final version in a format that can be easily edited or printed. Use professional fonts and sizes to make the document look clean.

- Free Template for Invoice Receipt

If you’re looking to quickly generate an invoice receipt, using a free template can save you time and ensure you include all the necessary details. A well-structured invoice receipt should have a clear layout and contain all the information your client needs to understand the transaction. Here’s a basic structure for a free invoice receipt template:

Key Sections of an Invoice Receipt

- Invoice Number: A unique identifier for the transaction. This helps in record-keeping and easy reference.

- Date of Issue: The date when the invoice is created or received.

- Seller and Buyer Information: Include the names, addresses, and contact details of both parties.

- Description of Goods/Services: A clear, concise description of the product or service provided.

- Amount Paid: The total amount paid, including taxes or discounts if applicable.

- Payment Method: How the payment was made (e.g., credit card, bank transfer, cash).

- Signature: A space for the authorized person’s signature, confirming the receipt of payment.

Customizing the Template

Many free invoice receipt templates are available in formats like Word or Excel, allowing you to edit them with your specific details. If you need to adjust the layout or add extra fields, these formats offer flexibility. To ensure the template works for your business:

- Double-check the fields are relevant to your transactions.

- Include your business logo and branding for a professional touch.

- Ensure the payment terms, like due date or late fees, are clearly stated.

These simple adjustments can make the template fit your business needs and help maintain clear communication with your clients.

To download a free invoice receipt format, visit reliable websites that offer downloadable templates. Many platforms provide customizable formats that suit various business types. Look for a format that fits your needs, whether it’s for product sales, services, or rent. Free templates often come in formats like .docx, .xlsx, or .pdf, so make sure the file type is compatible with your software.

Steps to Download the Template

1. Choose a website: Search for “free invoice receipt template” on trusted sites such as Template.net, Microsoft Office templates, or other specialized business resource pages.

2. Select the right template: Browse through the available templates, filtering by the type of receipt you need (e.g., sales, service). Look for a clean, easy-to-edit design.

3. Download: Once you’ve found your preferred format, click the download button. The template will be saved to your device in seconds.

Customize Your Template

After downloading, open the template in your preferred software, and customize it with your business information, including your logo, contact details, and payment terms. Add or remove fields as needed to reflect the transaction specifics.

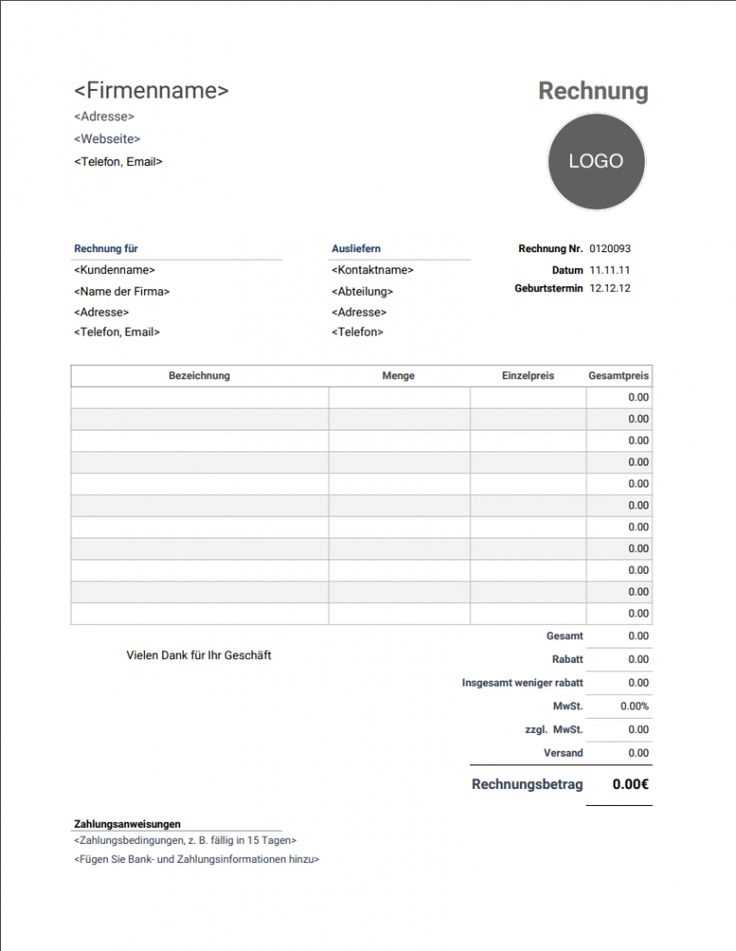

Adjusting your free invoice template to fit your business style is straightforward and practical. Begin by incorporating your company’s logo and adjusting the color scheme to match your brand identity. Most templates allow you to replace default placeholders with your logo image or company name, helping you create a professional appearance right away.

Modify the Fields for Better Accuracy

The next step is to fine-tune the fields based on your business type. For example, service-based businesses might need to include fields for hours worked, while product-based businesses should prioritize item descriptions and quantities. Ensure the template includes space for the customer’s name, contact details, and purchase information. Add or remove any fields that don’t apply to your specific transactions.

Customize Payment Terms and Conditions

Adjust payment terms to reflect your company’s policies. You may want to set your standard payment terms, such as “due upon receipt” or “net 30 days.” You can also include late fee information, if applicable. Additionally, remember to update any tax rate fields based on your location or specific industry needs.

| Template Customization Area | Recommended Change |

|---|---|

| Logo | Replace with your business logo |

| Item Descriptions | Ensure it aligns with the goods or services you offer |

| Payment Terms | Update with your business’s preferred terms (e.g., “net 30” or “due on receipt”) |

| Tax Information | Adjust the rate to reflect your location or industry |

Personalizing these details allows the template to truly reflect your business practices while keeping it efficient and clear for your customers.

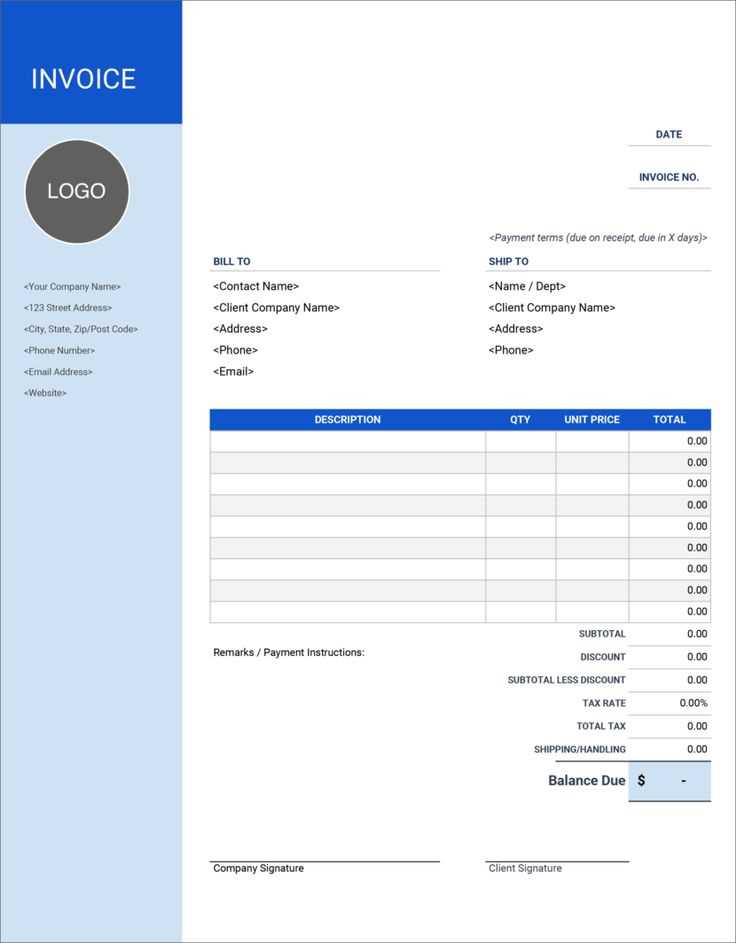

Start by filling in the date of the transaction at the top of the invoice receipt. This is critical to record when the payment was made or received.

Next, list the full name of the buyer or recipient. Make sure the name matches the official documents to avoid any confusion later.

Provide a clear description of the goods or services that were sold. Be specific–include quantities, unit prices, and item numbers if possible to avoid ambiguity.

For pricing, break down each item or service with its corresponding cost. Afterward, sum up the individual costs to show the total amount due or received.

- Include any discounts that apply, showing the original price and the reduced amount.

- If applicable, list taxes separately, specifying the tax rate and amount.

Include the payment method used for the transaction. Specify whether it was cash, check, credit card, or another method.

For both parties’ clarity, indicate the payment terms. This can be “due upon receipt,” “net 30 days,” or any other terms agreed upon during the transaction.

Finally, include a unique invoice number. This helps with tracking and referencing the document in the future.

Double-check the document for accuracy before finalizing. Ensure all fields are filled correctly, as errors can cause complications later.

To add taxes and discounts to your invoice template, start by calculating the tax rate for your location or business requirements. Most invoicing templates have fields specifically for tax. If your template doesn’t include these, simply add a row titled “Tax” below the itemized list of products or services. Then, apply the tax percentage to the subtotal. For example, if your subtotal is $100 and your tax rate is 8%, multiply $100 by 0.08 to get $8. Add this value in the tax row, and the final total will be $108.

For discounts, calculate the discount percentage you want to apply. If you offer a 10% discount on a $100 invoice, multiply $100 by 0.10 to get $10. Deduct this from the subtotal before applying tax. The discount should be clearly labeled in a separate row below the items, showing the amount subtracted.

To ensure clarity, always include a final “Total Due” line that reflects both tax and discount adjustments. This helps the client understand the breakdown of charges and makes the invoice transparent.

Wave offers an intuitive platform that lets you create professional invoice receipts quickly. It provides a variety of customizable templates that can be easily adjusted to fit your business needs. You can also manage your finances and track payments directly within the app, making it a solid choice for small business owners.

Invoice Generator simplifies the invoicing process with easy-to-use templates. This tool lets you input the necessary details like the client’s name, item descriptions, and prices, and generates a clean invoice receipt. The platform is free to use, and no sign-up is required, making it convenient for quick invoicing tasks.

Zoho Invoice offers a free tier with powerful features for creating invoice receipts. With customizable templates, it allows you to add your company logo, personalize the design, and include payment terms. The platform also provides invoicing automation and payment reminders, which saves time on follow-ups.

PayPal provides a simple way to create invoice receipts if you already use their payment system. You can select from several templates, add details, and send invoices directly to clients. It’s particularly useful for businesses that receive payments through PayPal and want a seamless way to issue receipts.

Invoicely allows you to create and manage invoices for free. The tool includes basic templates and enables you to track time and expenses. The free version covers most essential features, making it a solid option for freelancers and small businesses that need quick invoicing without extra frills.

Simple Invoices offers a minimalist approach to creating invoice receipts. With a straightforward interface, you can generate professional invoices in minutes. It is a great tool for those who need a basic, no-nonsense invoicing solution.

To save your invoice receipt as a PDF, open the file in your preferred invoice software or online platform. Look for the “Download” or “Export” button, usually located in the top-right corner. Choose PDF as the output format and click “Save” or “Download”. The file will be saved to your device in PDF format.

If you’re using a browser to generate the receipt, you can also use the built-in “Print” feature. Simply select “Print” from the menu, then choose “Save as PDF” as the printer option. This method works well for invoices viewed in a web browser or online tool.

Once you have the PDF, you can share it easily. Open your email or file-sharing platform, attach the PDF file, and send it to the intended recipient. Alternatively, if you want to send the receipt via messaging apps, simply open the app, attach the PDF, and send it directly.

For added convenience, consider storing the PDF in cloud storage (e.g., Google Drive, Dropbox) so you can access and share it from any device at any time.

To create a professional and clean invoice receipt, consider using a free template designed for this purpose. These templates often include all necessary fields, such as the business name, customer information, item descriptions, and total amount due. Customizing these templates to match your brand’s style is easy and saves time compared to designing an invoice from scratch.

Key Elements to Include

Make sure the template contains clear sections for:

- Invoice number

- Invoice date

- Due date

- Client details

- Itemized list of services or products

- Total amount with taxes, if applicable

- Payment methods accepted

Customization Tips

Choose a template that allows for easy customization. Add your company logo, change font colors to match your branding, and adjust the layout as needed. Most templates offer fields for both digital and print use, ensuring compatibility across various platforms. Don’t forget to review the template for clarity and accuracy before sending it out.