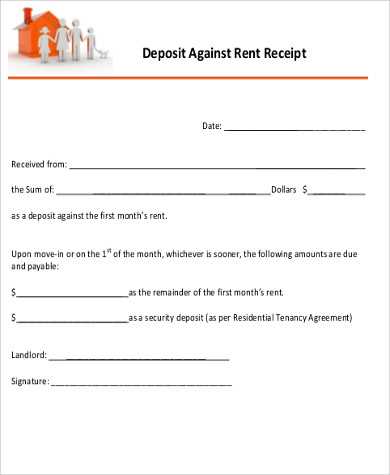

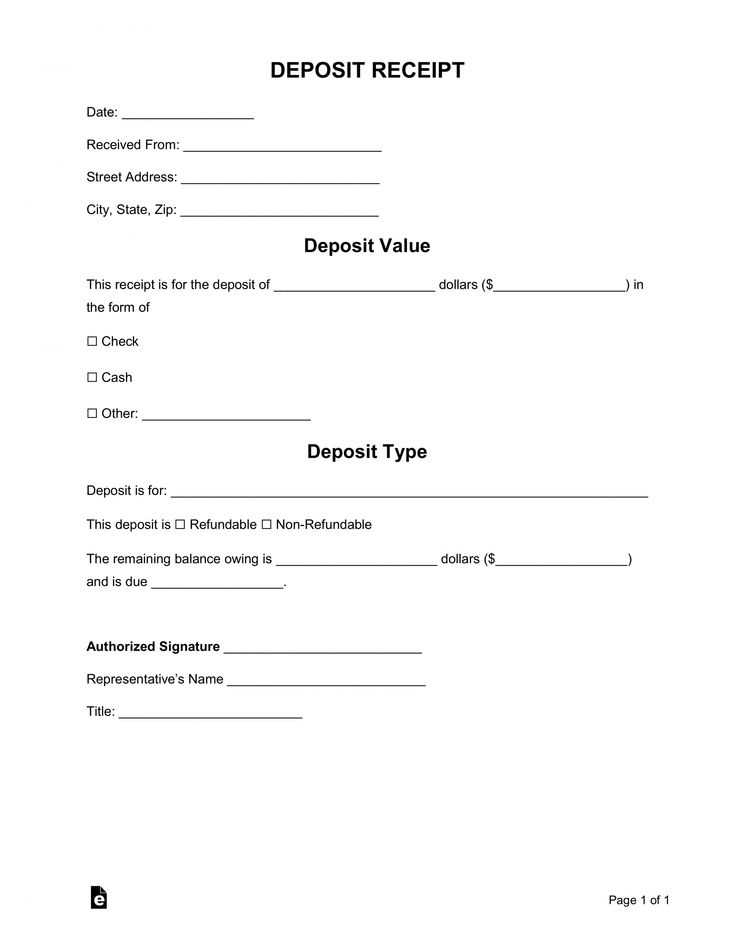

Use a deposit receipt template to clearly document payments made to secure a transaction. The template should include specific details such as the date, amount deposited, and the name of the payer. Make sure to provide space for the signature of both parties, indicating that both agree to the terms of the deposit.

A good deposit receipt will also mention the purpose of the deposit, whether it’s for renting a property, securing an event space, or as an advance on a product or service. Including this information ensures that both the payer and the recipient understand the nature of the payment and can refer back to it if needed.

Customize the template to fit your business or personal needs, but always ensure that the essential details are present. It’s a straightforward tool that helps in maintaining transparency and prevents misunderstandings between involved parties.

Here’s a revision to avoid repetitions and maintain clarity:

To ensure a deposit receipt template remains clear and professional, focus on concise language and structure. Avoid unnecessary phrases or redundant terms. Instead of repeatedly stating the deposit amount, mention it once with clear labeling. For instance, specify the “Deposit Amount” in a separate line to draw attention.

Clear Formatting for Key Information

Group relevant details together. Start with the transaction date, followed by the deposit amount, and the payer’s name. This makes it easier for recipients to quickly locate important details. A clean, straightforward design can enhance readability.

Use Simple Language

Avoid using overly technical or complex terms. For example, instead of writing “deposit confirmation,” simply use “deposit receipt.” Clear and plain language helps prevent confusion and ensures your document is user-friendly.

What is a Deposit Receipt Template and When to Use It?

A deposit receipt template is a pre-formatted document used to confirm the receipt of a deposit payment. It typically includes key details such as the amount deposited, the purpose of the deposit, the payer’s information, and the date. It serves as a proof of transaction for both the payer and the recipient.

When Should You Use a Deposit Receipt Template?

Use a deposit receipt template whenever a deposit is made to ensure clear documentation. Here are common situations when it is needed:

- Rent Payments: When tenants pay a deposit to secure a rental property.

- Business Transactions: When customers make a deposit for products or services.

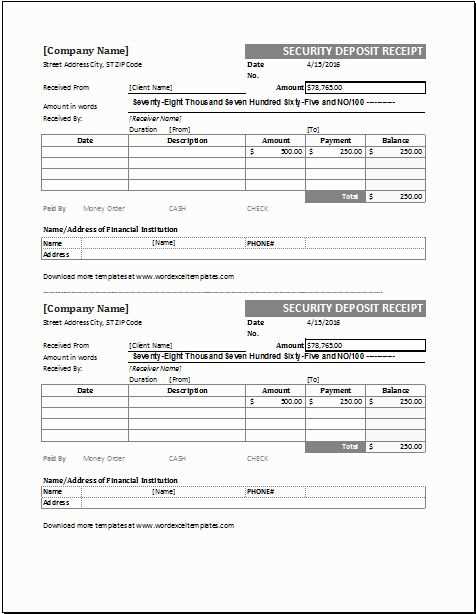

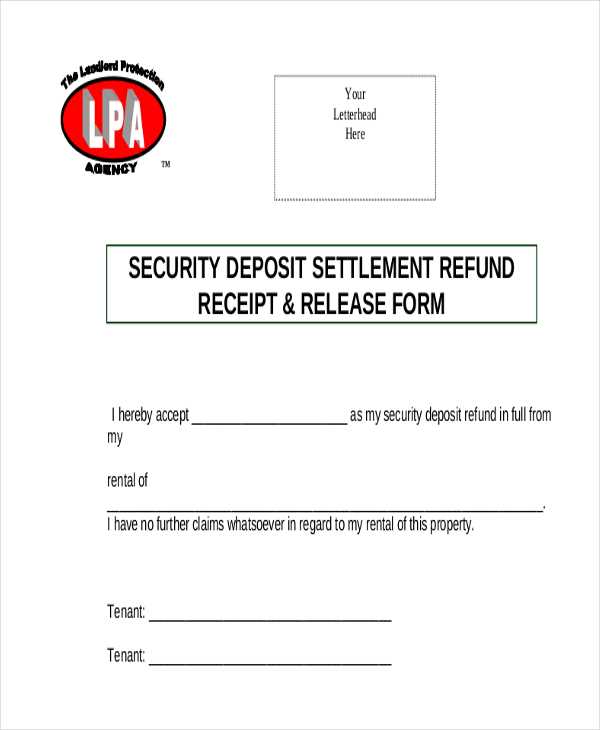

- Security Deposits: For any security deposits made during transactions, such as for event venues or equipment rentals.

- Advance Payments: To acknowledge the receipt of an advance payment for future services or goods.

Having a standardized template makes the process more efficient, reducing errors and ensuring both parties have the same documentation.

Key Elements of a Deposit Receipt Template

The deposit receipt template should include specific details to ensure clarity and prevent confusion. Start with the title “Deposit Receipt” to make it immediately recognizable. Below the title, include the date of the transaction, ensuring that it matches the actual deposit time.

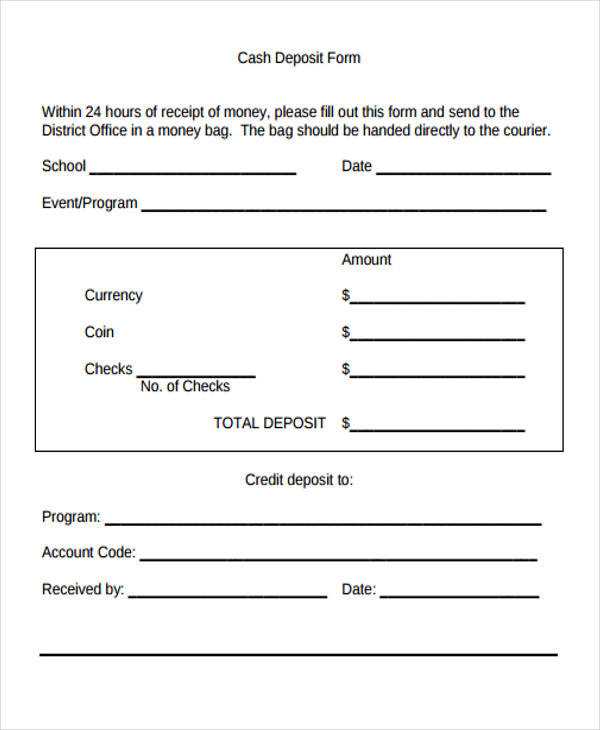

Transaction Details

Clearly specify the deposit amount and the method used for the transaction, whether it’s cash, check, or electronic transfer. Add a unique transaction number or reference code to make tracking easier. Including the purpose or reason for the deposit can also be helpful.

Parties Involved

The receipt should list the name of the individual or entity making the deposit, along with their contact details if necessary. Similarly, include the name and contact details of the receiving party. This will help identify both sides of the transaction.

For added clarity, it’s also useful to include the location or branch where the deposit occurred. This information can be especially helpful for future inquiries or disputes.

How to Tailor a Deposit Receipt Template for Various Transaction Types?

Customize your deposit receipt template based on the type of transaction by including specific fields that reflect the unique details of each case. For a cash deposit, make sure to list the exact amount in both numerical and word formats. If the deposit involves checks, note the check number, bank, and any special instructions. For wire transfers, provide transaction reference numbers and associated bank details. This clarity prevents confusion and ensures both parties have the correct record of the transaction.

Consider the Purpose of the Deposit

Adjust the template according to the deposit’s purpose. For instance, for a rental deposit, include tenant and property details, while a business deposit may need invoice numbers and details of goods or services provided. A personal deposit might only require the names of the involved parties and a brief description of the reason for the deposit.

Incorporate Legal and Regulatory Requirements

Make sure to align the receipt with any legal requirements for specific deposit types, such as adding terms for refunds or withdrawal policies for security deposits. The inclusion of any relevant contract references or compliance clauses helps ensure that both parties understand the terms.