Creating a proper security deposit receipt ensures clear documentation between tenants and landlords in Chicago. This receipt serves as proof that a tenant has paid the security deposit for a rental property and outlines the terms regarding its return. A well-structured receipt helps avoid future disputes and ensures both parties understand their rights and obligations.

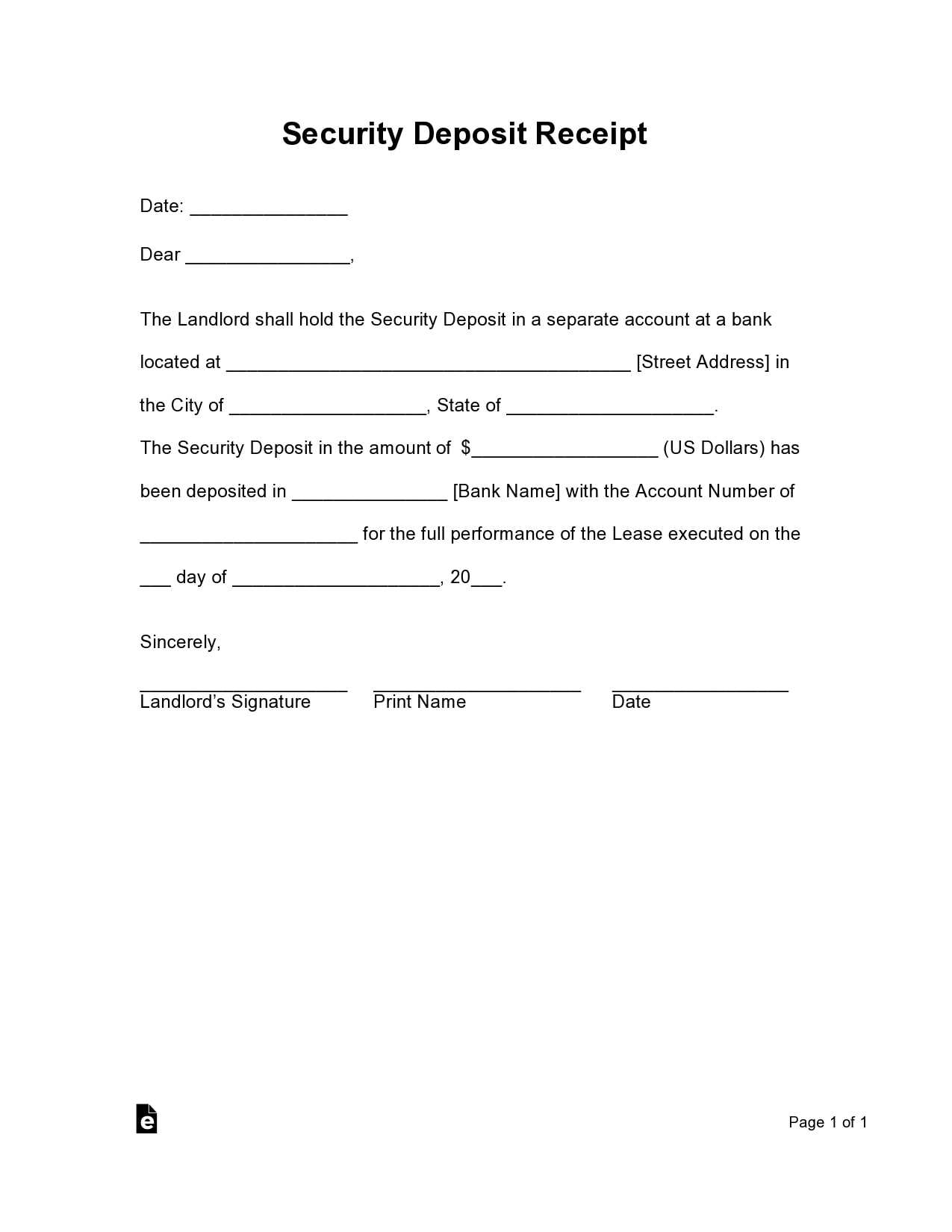

The template should include the amount of the deposit, the date it was paid, the address of the rental property, and the name of the landlord and tenant. In addition, it should specify if the deposit will be used for any repairs or damages, and the conditions under which it will be returned, as per Chicago’s rental laws.

Make sure the receipt is signed by both the tenant and the landlord, providing a copy to each party. This simple step provides transparency and protects everyone involved, ensuring that the rental transaction is smooth and free from misunderstandings.

Here’s the revised version:

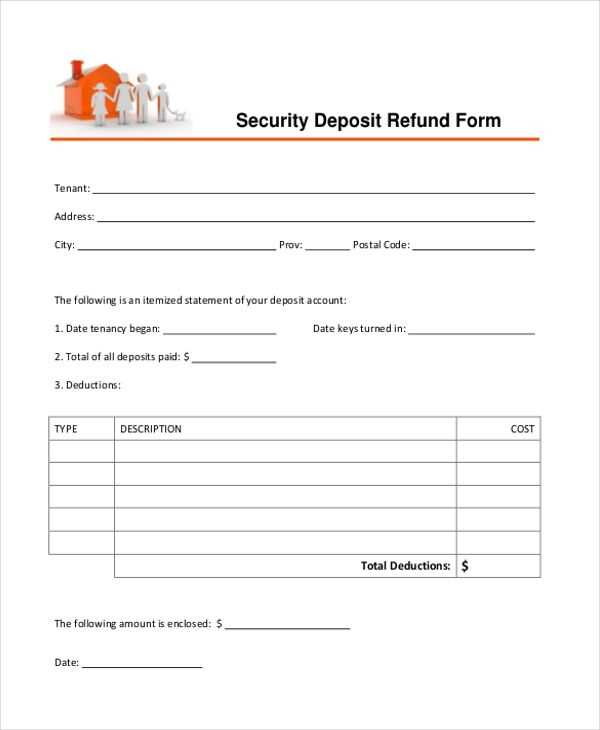

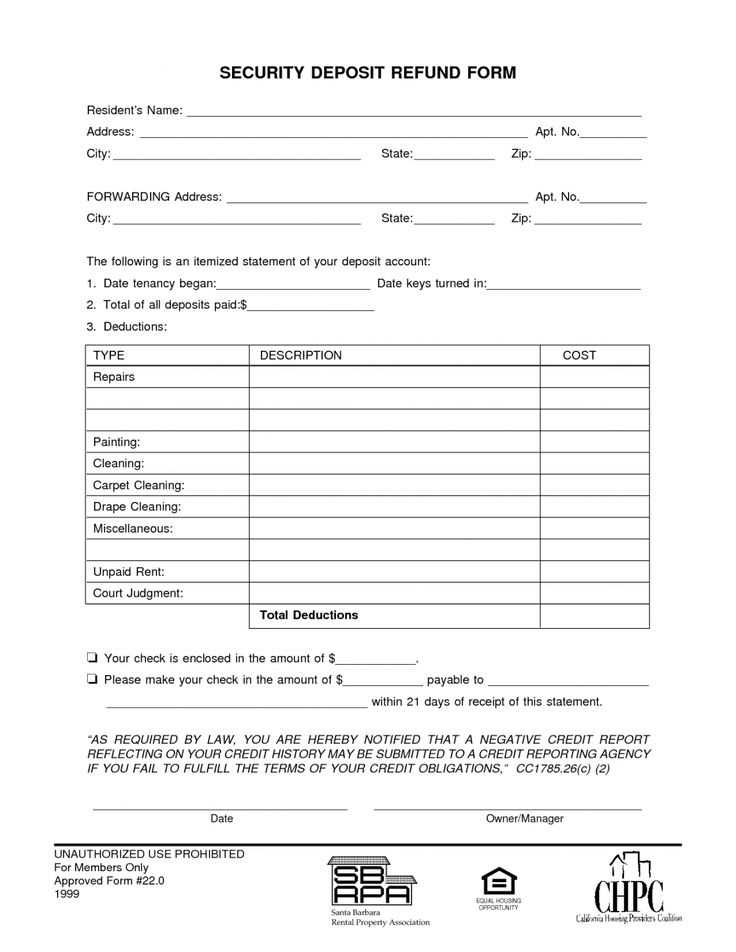

Ensure that the security deposit receipt includes key details such as the tenant’s name, the property address, and the amount of the deposit. Clearly state the purpose of the deposit, indicating whether it’s for potential damages or other charges. Be specific about the deposit’s return timeline and conditions, ensuring there’s no ambiguity regarding deductions.

Deposit Amount and Terms

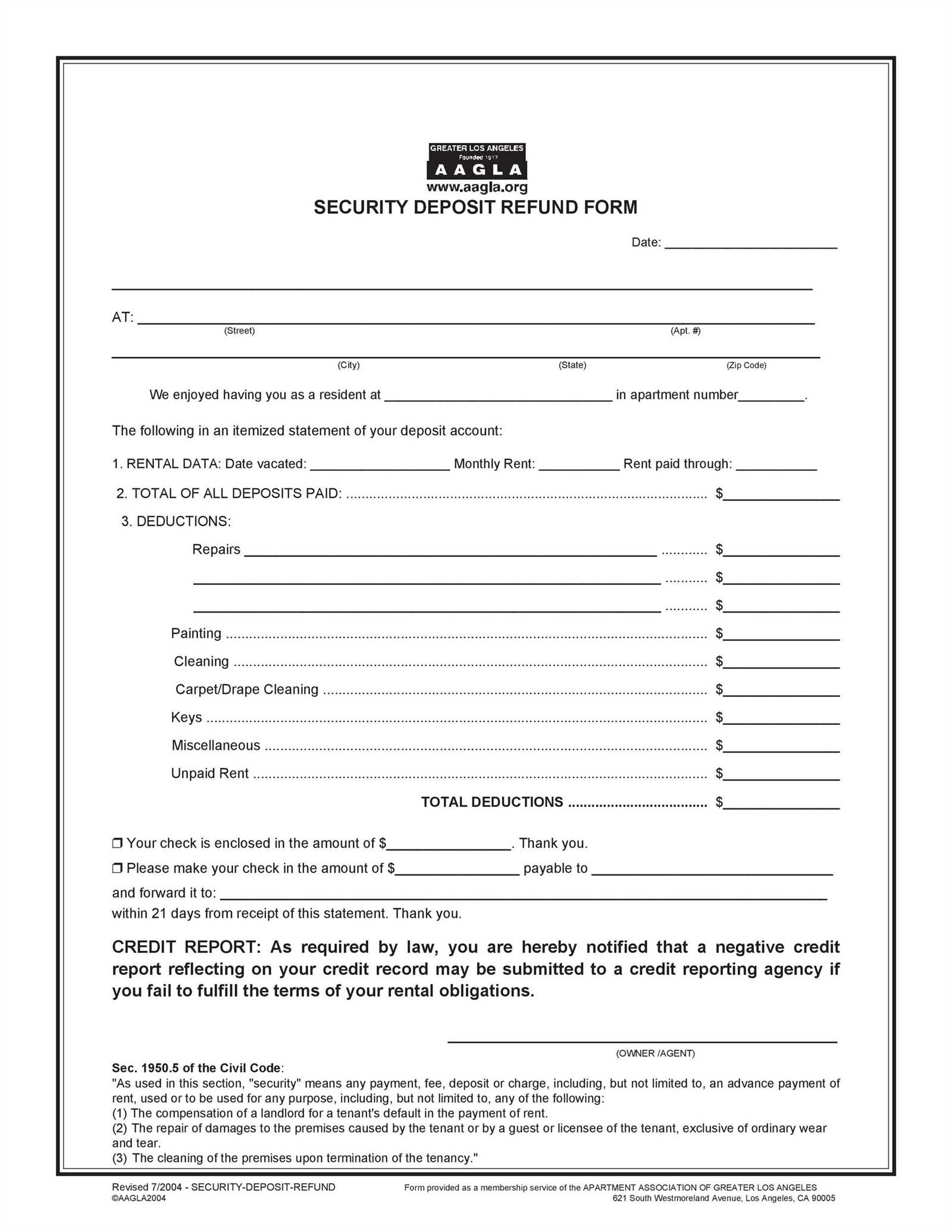

List the exact deposit amount and specify any conditions under which the deposit may be withheld. This could include damage beyond normal wear and tear or unpaid rent. Include a statement that clarifies the conditions for return, specifying the timeline for refunding the deposit after the lease ends.

Signature and Acknowledgement

Both parties must sign the receipt to confirm that the deposit terms have been understood. Ensure the landlord provides a copy of the signed receipt for the tenant’s records. This step prevents misunderstandings and serves as proof of the agreement.

Security Deposit Receipt Chicago Template: A Practical Guide

How to Format a Deposit Receipt

Legal Requirements for Security Deposits in Chicago

Common Mistakes to Avoid in Deposit Receipts

A security deposit receipt in Chicago must include specific details to comply with local regulations. To begin with, the document should state the date the deposit was received, the amount, and the name of the tenant and landlord. It’s also recommended to note the rental property address. This ensures clarity and legal accountability for both parties.

How to Format a Deposit Receipt

When creating a receipt, structure it clearly for easy reference. Start by listing the tenant’s name, the amount paid, and the rental address. Follow with the landlord’s name and contact details. Include a line that specifies the deposit is for security purposes, not for rent. Make sure to include a section outlining the conditions for return, detailing any potential deductions for damages, unpaid rent, or other charges. Lastly, both the landlord and tenant should sign and date the document.

Legal Requirements for Security Deposits in Chicago

Chicago law mandates that landlords provide a written receipt for any security deposit received, especially if the amount is $100 or more. The receipt must list the date the deposit was paid and the exact amount. Landlords are also required to return the security deposit within 45 days after the tenant moves out, minus any legitimate deductions. Any discrepancies in this process may result in penalties for the landlord.

Additionally, the landlord must inform the tenant about where the security deposit is held, whether in an interest-bearing account, and the interest rate applied. This information should be included in the lease agreement or provided in writing to the tenant.

Common Mistakes to Avoid in Deposit Receipts

One common mistake is failing to provide a receipt for the deposit, which can lead to disputes over the amount paid. Another error is neglecting to document the conditions of the property at the time of the deposit. Without clear descriptions, it’s difficult to prove whether damages were pre-existing or caused during the lease term. Avoid vague language and be specific about the terms surrounding the deposit, ensuring the conditions for refund or deductions are clearly outlined.