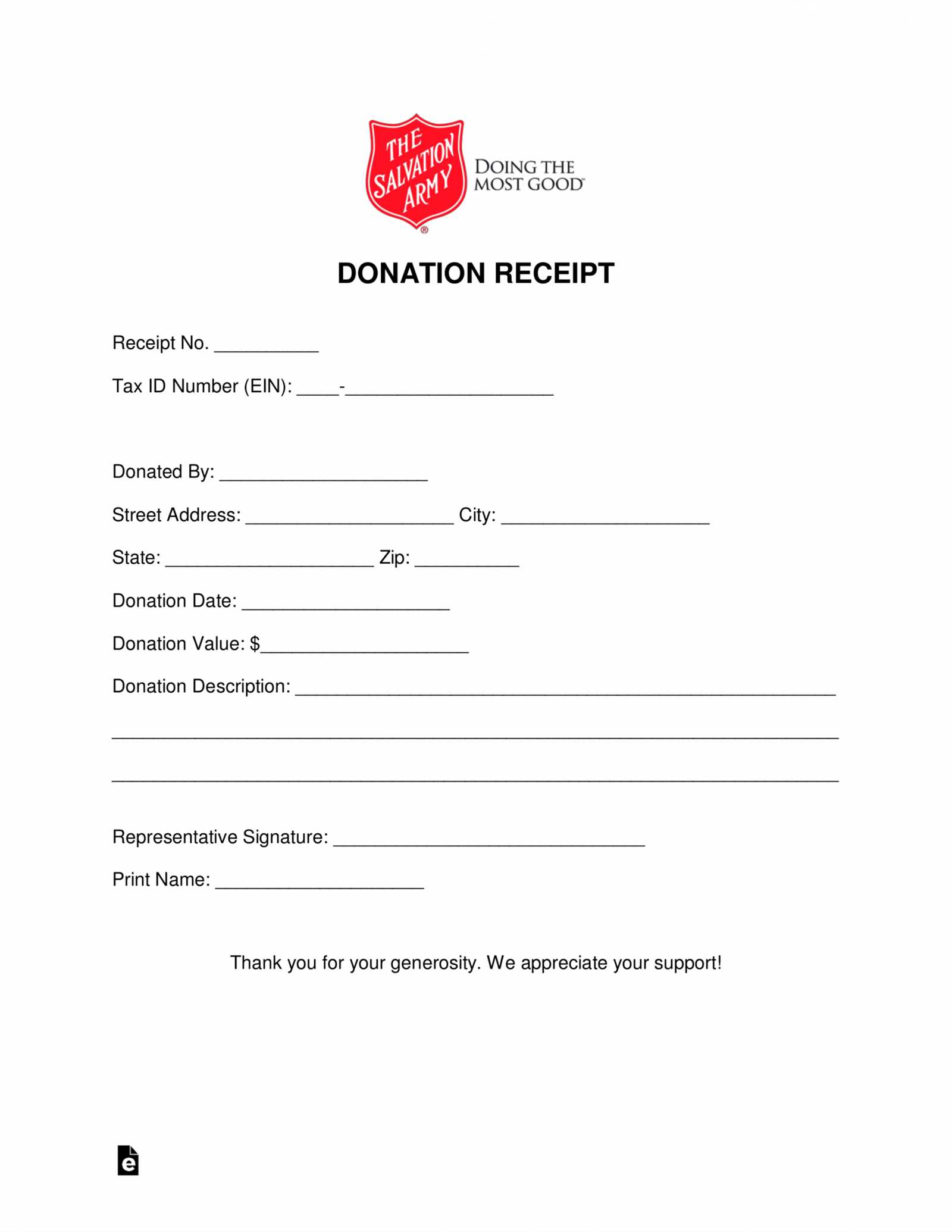

For a smooth donation process, it’s important to have a clear and concise receipt template for the Salvation Army. A well-designed template helps ensure that both donors and the organization stay organized and transparent. It provides necessary details such as the date, donor’s name, item description, and estimated value, which can be used for tax deductions.

Start with the donor’s name and address to confirm the transaction. Next, list the donated items or monetary value. Each item should be described clearly, with enough detail to avoid confusion. If donating goods, you may want to include a brief description of their condition. The receipt should also note the Salvation Army’s contact information and tax-exempt status.

Remember to include a signature field for the recipient or organization representative to verify the donation. This helps solidify the document’s authenticity for tax reporting purposes. A well-structured template simplifies the process for both donors and recipients, ensuring a positive experience for everyone involved.

Salvation Army Donation Receipt Template

To create a Salvation Army donation receipt, include the following key details:

- Donor’s Name: Clearly state the name of the person or organization making the donation.

- Date of Donation: Include the specific date the donation was received.

- Description of Items or Money Donated: List the donated items or the monetary amount. For item donations, describe the general condition and category (e.g., clothes, furniture, electronics).

- Value of Donation: If the donor has assigned a value to the items, include that information. For non-cash donations, a fair market value should be indicated. If the donor is unsure of the value, a general description suffices.

- Non-cash Donations: State that the Salvation Army does not provide appraisals for non-cash gifts. The donor is responsible for assigning a value.

- Tax Deduction Notice: Include a brief statement clarifying that donations are tax-deductible, as per applicable tax laws.

- Signature and Contact Information: The receipt should include a representative’s signature from the Salvation Army and contact details for verification.

Make sure all the necessary fields are completed for transparency and proper tax documentation.

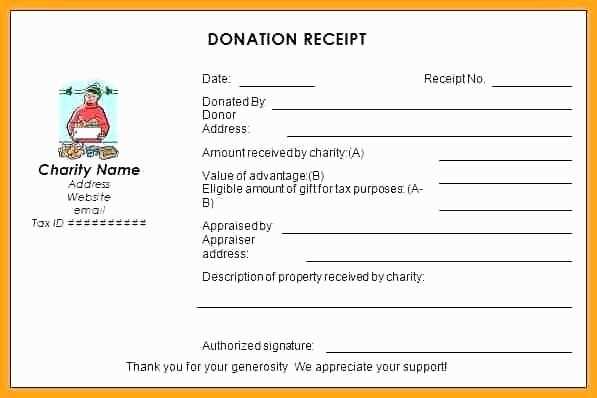

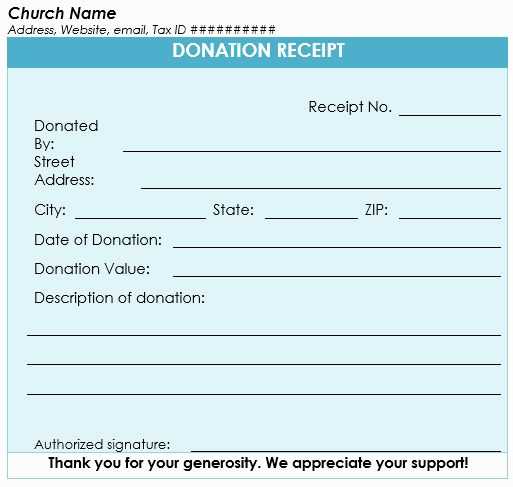

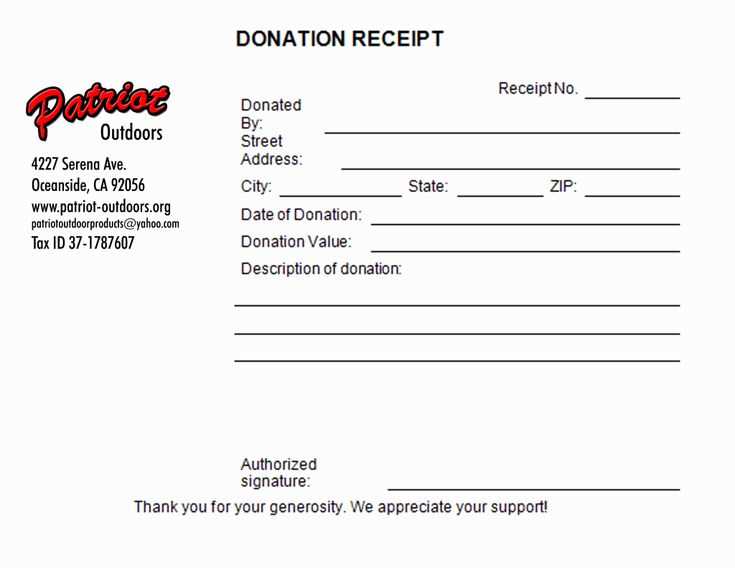

How to Create a Simple Donation Receipt

Begin by including your organization’s name, address, and contact information at the top of the receipt. This helps the donor identify the source and provides transparency. Below, list the donor’s name and address clearly, ensuring all contact details are correct.

Details of the Donation

Clearly state the donation amount, whether it’s cash, check, or in-kind. If it’s an item donation, describe the item in detail, including its condition and estimated value. If applicable, note whether any goods or services were provided in exchange for the donation, as this can impact tax deductions.

Tax Information and Legal Disclaimers

Include a brief statement confirming that no goods or services were provided in exchange for the donation if this applies. This clarifies the donor’s eligibility for tax deductions. It’s also a good idea to add any legal disclaimers specific to your region’s tax laws, ensuring the donor understands the receipt’s purpose and usage for tax purposes.

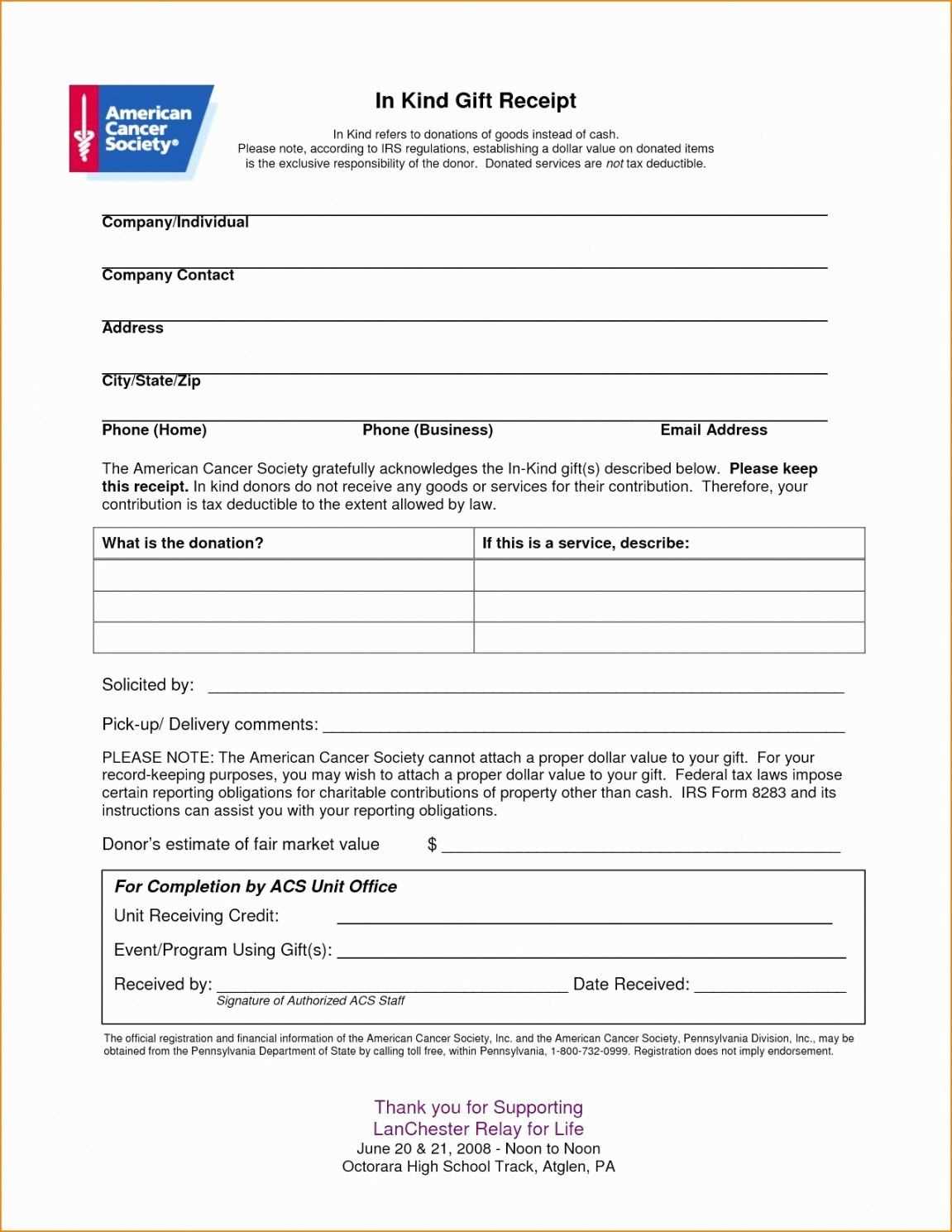

Information to Include on Your Donation Receipt

Include the date of the donation. This helps establish the timing for tax purposes. Make sure to list the donor’s name and address clearly, confirming their identity for record-keeping. The description of the donation should be accurate. If it’s an item, provide a detailed list of what was donated, noting the condition of the items if necessary. For monetary donations, state the exact amount contributed.

If the donation includes any goods, provide a statement of whether the donor received anything in return. This distinction impacts the deductible amount. Also, add the name of the organization receiving the donation and its official tax identification number. This number is needed to verify the legitimacy of the donation for tax purposes.

Lastly, include a statement confirming that the donor did not receive goods or services in exchange for their contribution, unless applicable. This helps clarify the tax implications for the donor. Keep the language straightforward and free from any ambiguity to ensure compliance with tax regulations.

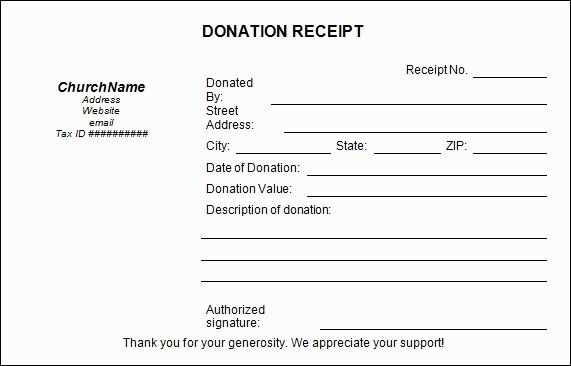

Customizing a Template for Your Needs

Adjust the layout and content of your donation receipt template by including your organization’s logo and address details. Tailor the font style and size to match your branding guidelines for a more professional appearance. Customize the donation categories to reflect the specific items or funds your charity accepts, ensuring clear descriptions for each. Modify the date format and the wording to match the preferred language or terminology your donors expect.

Include Relevant Legal Information

Ensure your template includes necessary tax-exempt status information, such as the organization’s registration number or IRS designation. This adds credibility and helps donors claim tax deductions. Also, provide a section where donors can easily check the amount of the donation, whether it is in cash, goods, or services.

Personalize Donor Acknowledgment

Personalize the message for each donor by including their name and specific donation details. A brief thank-you message can go a long way in making your donors feel appreciated, while still maintaining a formal and professional tone. You can also add a note about how their contributions directly support your mission, making the receipt more meaningful.