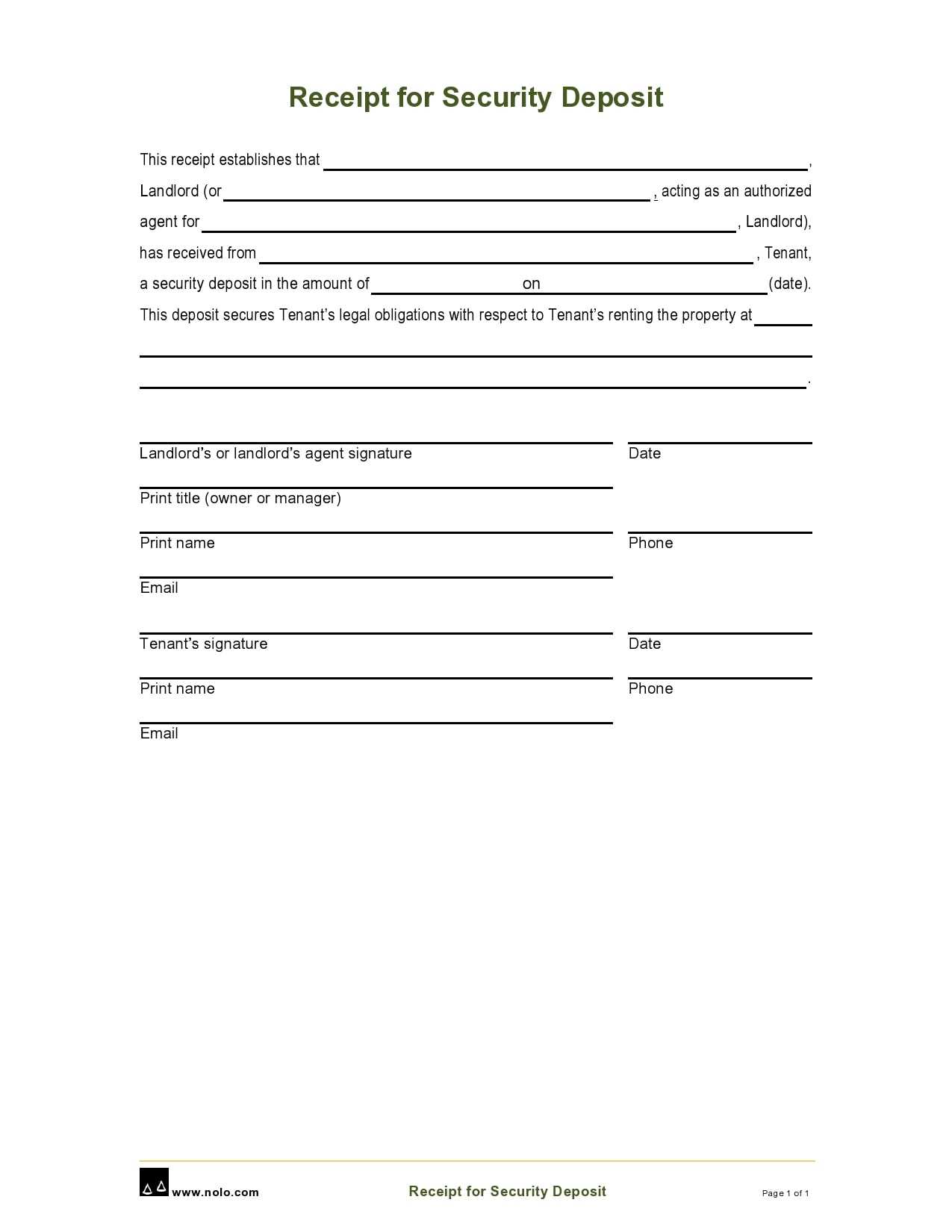

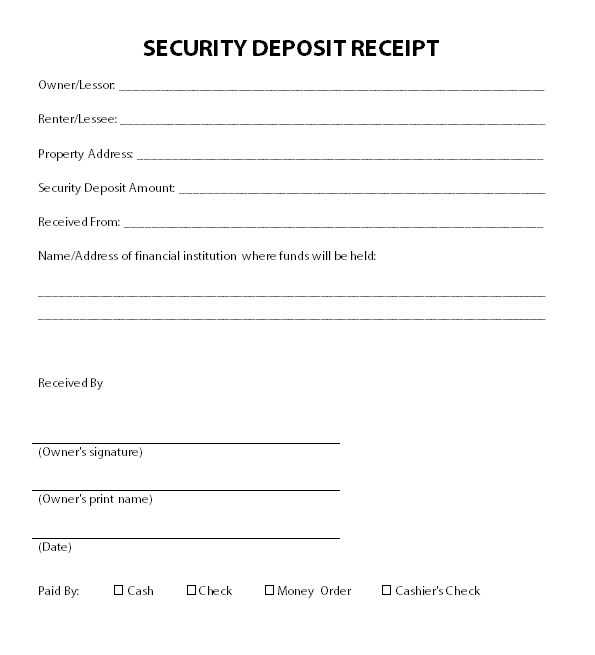

Ensure clarity and transparency when creating a security deposit receipt. This template provides a clear record of the transaction, detailing the amount, date, and terms under which the deposit was made. The receipt should include all necessary information to prevent confusion in the future.

Incorporate key elements like the name of the payer, the recipient, the property address, and the amount paid. You should also note any specific conditions regarding the refund of the deposit, as these can vary based on the lease agreement. It’s important to keep this document for both parties to avoid disputes.

Use a clean and simple format to ensure that both parties can easily understand the details. Include space for signatures to acknowledge the transaction, making it legally binding. A well-structured receipt sets the stage for an organized and professional relationship between landlord and tenant.

Here’s a detailed plan for an informational article on the topic “Security Deposit Receipt Template” in HTML format, with practical and specific headings:

A well-crafted security deposit receipt is key for both landlords and tenants. It provides proof of payment and helps avoid disputes. The receipt should include specific details to make it legally binding and clear to both parties.

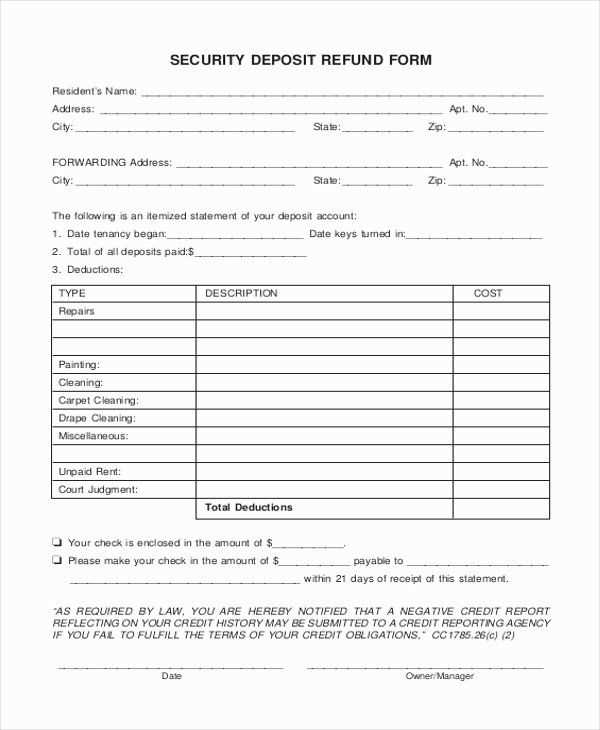

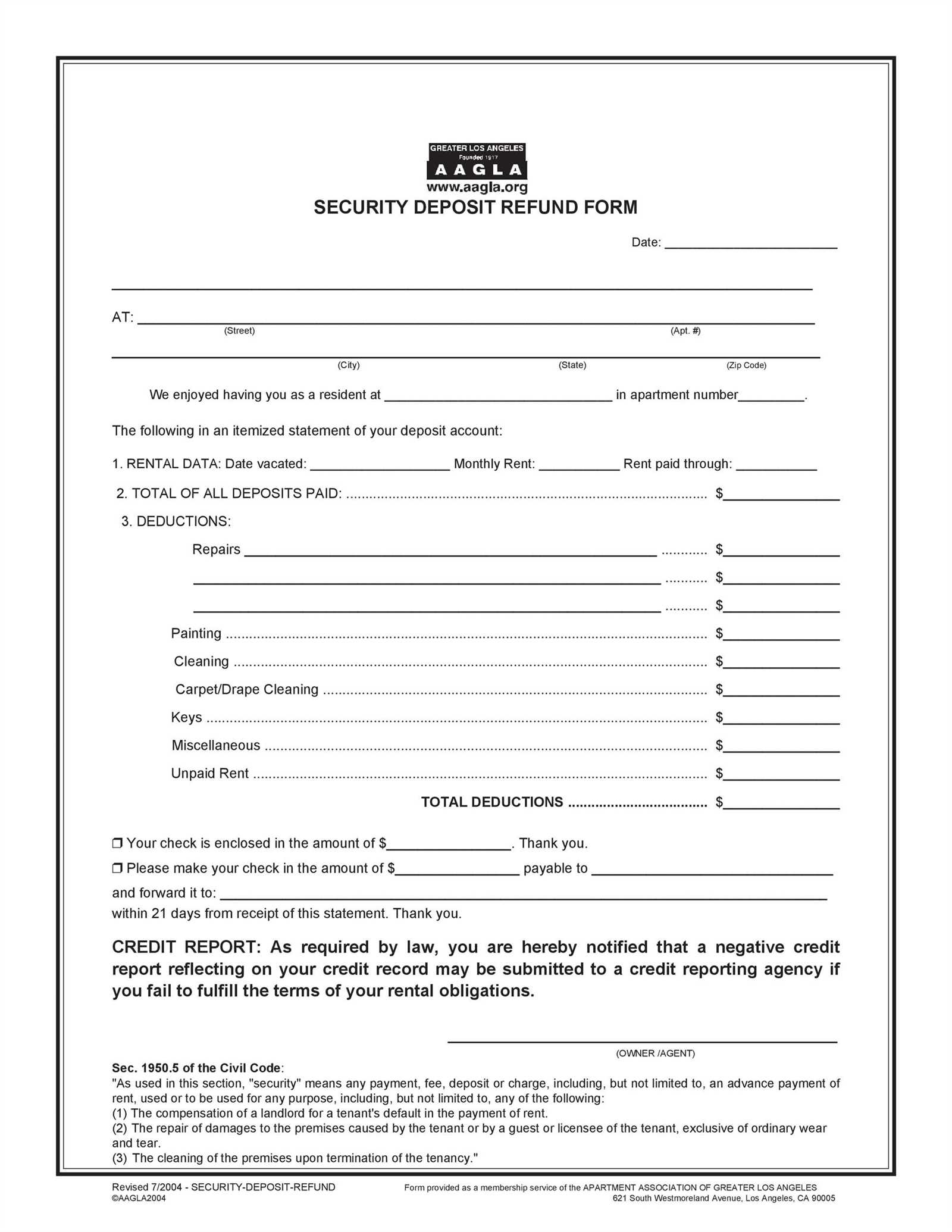

Key Components of a Security Deposit Receipt

The security deposit receipt should include the following details:

- Tenant’s Name: Full name of the tenant paying the deposit.

- Landlord’s Name: Full name of the landlord or property management.

- Amount of Deposit: Exact amount received from the tenant.

- Date of Payment: The date when the deposit was paid.

- Property Address: Full address of the rented property.

- Purpose of Deposit: A note specifying the reason for the deposit (e.g., security against damages, unpaid rent, etc.).

- Deposit Return Terms: A brief statement about the conditions under which the deposit will be refunded, including timeframes.

Why a Security Deposit Receipt Is Important

A receipt protects both the landlord and tenant. It serves as evidence of the tenant’s compliance with the rental agreement, safeguarding against any confusion or disputes over payment. Without it, there could be complications in tracking deposits or refunding the amount at the end of the lease.

- How to Create a Clear Security Deposit Receipt

To create a clear security deposit receipt, include the following key details:

- Receipt Title: Clearly label it as “Security Deposit Receipt” for quick identification.

- Deposit Amount: Specify the exact amount paid, in both numbers and words, to avoid confusion.

- Tenant and Landlord Information: Include the full names of the tenant and landlord, along with contact details such as phone numbers or email addresses.

- Property Address: Clearly state the rental property address where the deposit is being held.

- Payment Date: Mention the date the security deposit was received.

- Deposit Purpose: Briefly describe the purpose of the deposit, for example, “for security against damage to the property.”

- Conditions for Refund: Outline the terms for refunding the deposit, such as the property’s condition or any deductions for damages.

- Signatures: Both the landlord and tenant should sign the receipt to confirm agreement on the deposit amount and conditions.

Keep the language simple and direct. Avoid ambiguity in the terms and conditions to prevent any future disputes. Provide copies to both parties for their records. Make sure to keep a copy on file as well.

A deposit receipt must clearly outline the amount of the deposit, the date of the transaction, and the parties involved. It must specify the conditions under which the deposit is refundable, as well as any deductions that may be made. The receipt should also mention whether the deposit is held in trust or directly by the recipient.

Details to Include

Ensure the document includes the tenant’s and landlord’s names, contact information, and a description of the property or service. In case of disputes, both parties should have a clear understanding of what was agreed upon.

Legal Enforceability

The receipt must comply with local laws regarding deposits. In some jurisdictions, certain terms or fees may be prohibited, and the deposit amount may be capped. Review local regulations to confirm the terms meet statutory requirements.

Tailor your security deposit receipt by adjusting key details based on the situation. If you’re dealing with rental properties, include tenant information such as rental period and address, along with a breakdown of the deposit amount. This offers clarity and transparency for both parties.

For businesses providing services or products, specify the type of transaction–whether it’s a refundable deposit, non-refundable, or credit toward future purchases. Differentiate between security deposits and advance payments to avoid confusion.

If there are specific conditions tied to the refund of the deposit, such as damages or unmet requirements, clearly list them in the receipt. This ensures both parties are aware of any conditions before the deposit is returned.

| Field | Scenario 1: Rental Agreement | Scenario 2: Product/Service |

|---|---|---|

| Deposit Amount | Include full amount and currency | Clarify if deposit is refundable or non-refundable |

| Conditions for Refund | Damage-free return of the property | Return of goods in original condition |

| Additional Notes | Provide details about the rental duration and address | Include service terms or delivery details |

For temporary deposits, add a note specifying the return date. If the deposit is held for an extended period, state the reason why and outline any steps required for refund eligibility.

For a precise and accurate security deposit receipt, ensure all necessary details are included in a clear and concise manner. Follow this template structure to create a document that is both professional and legally sound.

- Tenant’s Full Name: Write the full name of the tenant who made the deposit.

- Property Address: Include the full address of the rented property.

- Deposit Amount: Clearly state the amount of the security deposit paid by the tenant.

- Date of Payment: Note the exact date when the deposit was received.

- Landlord or Agent Information: Include the name and contact details of the landlord or property manager.

- Purpose of Deposit: Briefly explain the reason for the deposit (e.g., damage protection, cleaning fees, etc.).

- Conditions for Refund: Outline the terms under which the deposit will be refunded, including any deductions that may apply.

- Signatures: Ensure that both the landlord and tenant sign the receipt, confirming the agreement.

By following this format, you ensure transparency and clarity, which can help prevent disputes in the future.