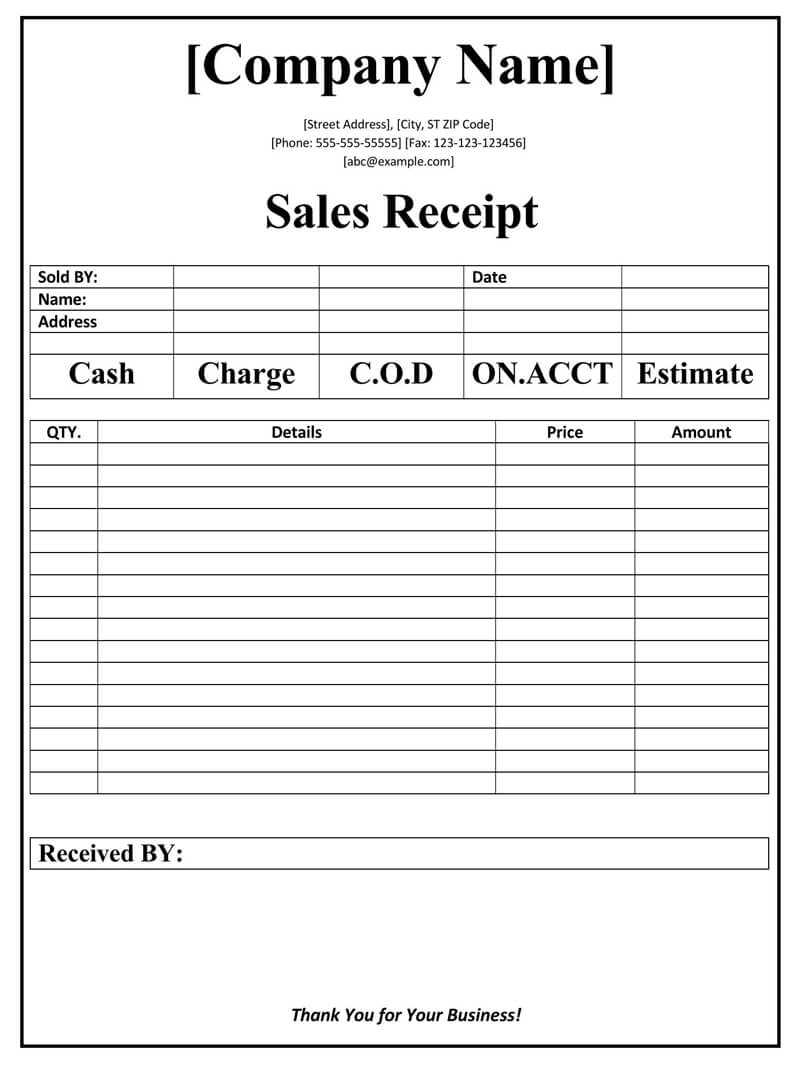

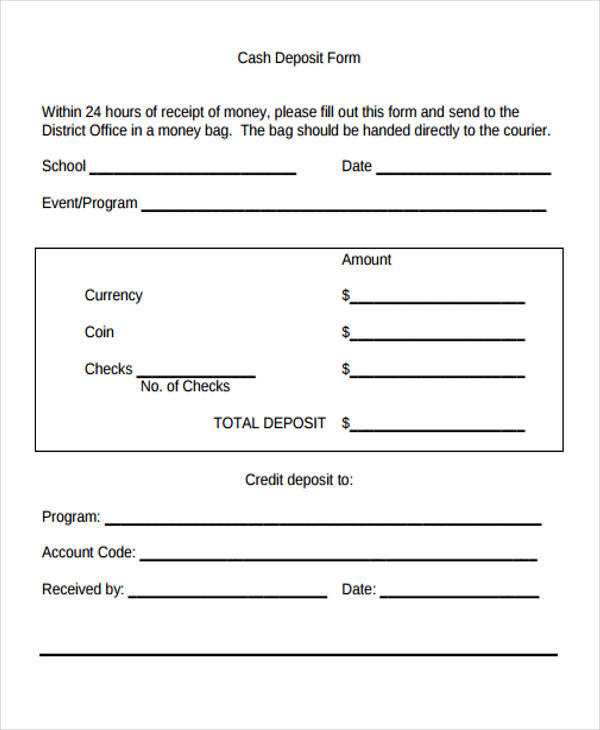

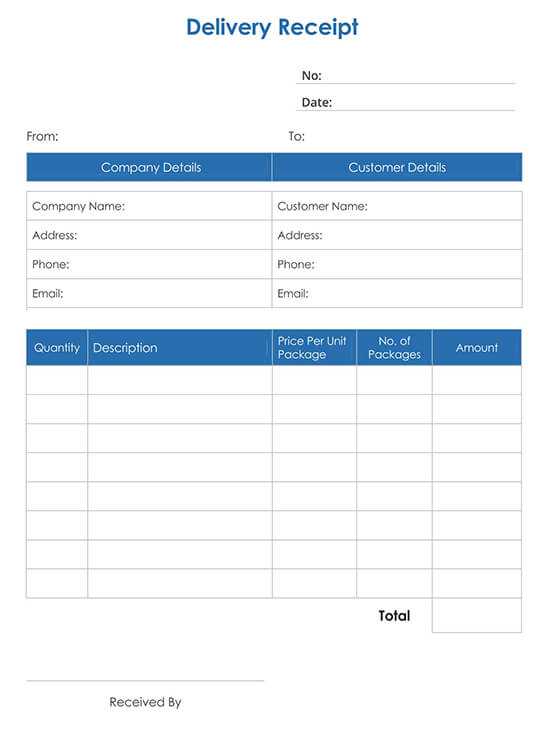

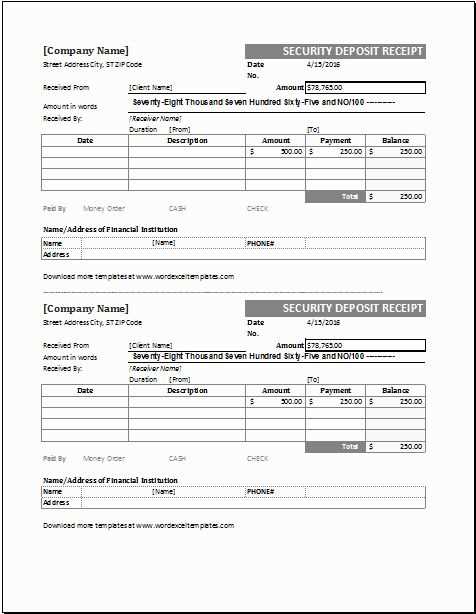

Creating a purchase deposit receipt is straightforward with the right template. A simple format ensures you capture all the necessary details to avoid confusion in any transaction. This template includes sections for the buyer’s and seller’s information, deposit amount, date, and a brief description of the goods or services involved.

Customize it to your needs by adding or removing fields based on the nature of the transaction. You may want to include the payment method, terms of the deposit, or even a reference number for easy tracking. A well-structured receipt builds trust between both parties and provides a clear record of the agreement.

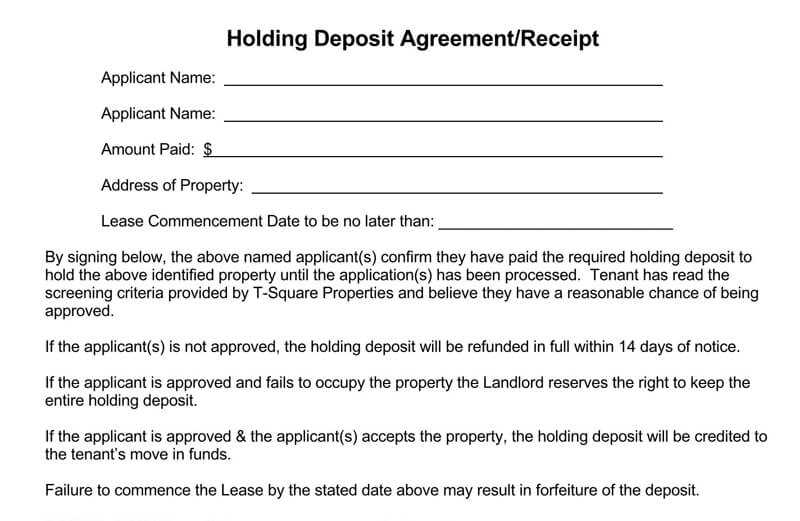

Ensure that the terms of the deposit are clearly stated. This includes the total purchase price, amount of deposit paid, and the remaining balance. Any agreement on refund policies or conditions for the deposit should be noted as well, keeping both buyer and seller protected in case of disputes.

Here’s a detailed HTML article plan with three practical headings related to the “Purchase Deposit Receipt Template” topic:

Creating a clear and well-structured deposit receipt is crucial for both businesses and customers. A deposit receipt should include the necessary details to confirm a transaction and avoid future disputes.

1. Key Components of a Purchase Deposit Receipt

Ensure that the deposit receipt includes the following elements for clarity and accuracy:

- Receipt Number: A unique identifier for tracking the transaction.

- Date of Transaction: When the deposit was made.

- Customer Information: Name and contact details of the person making the deposit.

- Deposit Amount: Clearly state the amount deposited.

- Balance Due: Specify the remaining amount owed for the full purchase.

- Purpose of Deposit: Briefly describe the item or service related to the deposit.

2. Formatting Tips for Easy Understanding

Present the information in a user-friendly format to avoid confusion:

- Use a clear and readable font, such as Arial or Times New Roman, in a standard size (12-14pt).

- Organize sections using bold text for headers and sub-headers to break down the details.

- Align text properly: Left-align customer information and transaction details for consistency.

- Include space for both the deposit and balance amounts to stand out for quick review.

3. Digital vs Paper Receipts

Consider whether a digital or paper version works best for your business:

- Digital Receipts: Provide an environmentally friendly and easily accessible option for customers. Ensure the format is compatible with all devices.

- Paper Receipts: If preferred, offer printed receipts that the customer can keep for their records. Use high-quality paper and ink to ensure legibility.

- Both versions should be equally detailed and contain the same key information.

- Creating a Clear and Concise Receipt

To create a clear and concise receipt, ensure the information is well-organized and easy to read. Begin with the basic details: the transaction date, the amount paid, and the name of the buyer or payer. Follow with the item or service description, including quantity and price. List each item separately, clearly showing the total cost. Use a simple layout with distinct sections to separate the information logically, making it easier for the recipient to understand at a glance.

Include Key Identifiers

Include a unique transaction or receipt number. This will help both parties reference the purchase in case of any future questions or issues. Also, add contact details for the seller, such as an email or phone number, to facilitate communication if needed.

Double-Check for Accuracy

Before finalizing the receipt, verify all amounts and details for accuracy. A mistake could lead to confusion or disputes. Make sure the date is correct and that the total matches the sum of the individual items.

To create a solid purchase deposit receipt, focus on clarity and precision. Include the date of the transaction, the buyer’s and seller’s full names, and a description of the item or service being purchased. Specify the deposit amount clearly, as well as the total purchase price. Include payment methods used, like cash, credit card, or bank transfer. Outline the terms for the remainder of the payment, including due dates and any applicable penalties for delays.

Buyer and Seller Information

Ensure that both parties’ full legal names and contact information are accurate. This prevents confusion in case of disputes or future communications.

Terms of Agreement

Clearly state the purpose of the deposit, whether it’s securing an item, confirming an agreement, or holding a service. Include any conditions that apply to the refund or forfeiture of the deposit, ensuring both parties are aware of their rights and responsibilities.

For a customized receipt that represents your brand, include your company logo, business name, and contact details at the top. This adds professionalism and makes it easy for customers to reach you if needed.

Include Relevant Transaction Information

Make sure the receipt captures key transaction details like the purchase date, items or services bought, prices, taxes, and any discounts applied. This ensures clarity and transparency for both you and the customer.

Design for Readability

Choose clear fonts and an organized layout. Separate sections like item details, taxes, and totals with visual breaks to avoid clutter. Use bullet points or lines to keep everything tidy. This helps your customers easily find the information they need.

Consider adding a section for return policies or warranty information. This can help reduce confusion later on. Finally, make sure the receipt is easy to print or email, depending on your business setup.

Ensure clarity by providing all key details in the purchase deposit receipt template. Include the full name of the buyer and seller, as well as the date and amount of the deposit. Specify the transaction’s purpose, referencing the product or service being purchased.

Always include the terms related to the deposit. State whether it is refundable or non-refundable, and outline any conditions for refunding or transferring the deposit if applicable. Clearly note the payment method and any remaining balance due after the deposit is made.

Make sure to have both parties sign the document to confirm agreement. If possible, include a space for witnesses or notary certification to further validate the agreement. This helps prevent disputes and ensures transparency in the transaction.

Lastly, organize the information in a simple layout. This makes it easy to understand and reduces confusion for both parties involved in the transaction.