Providing a donation receipt that complies with legal standards helps ensure transparency and trust between donors and organizations. A well-crafted receipt includes all the necessary details to confirm the donor’s contribution and assist with tax purposes. If you’re managing a nonprofit or charity, having a standardized template for donation receipts is an effective way to streamline your processes.

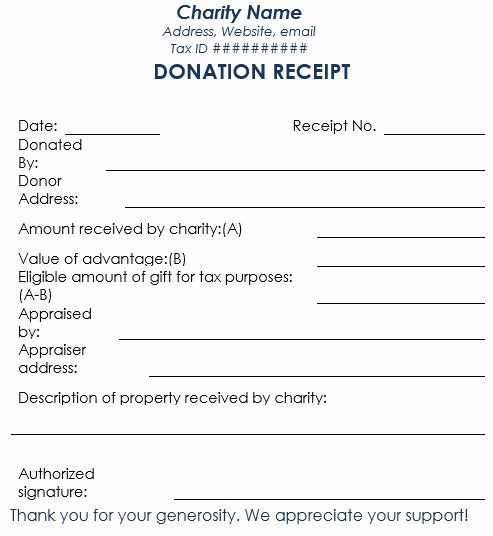

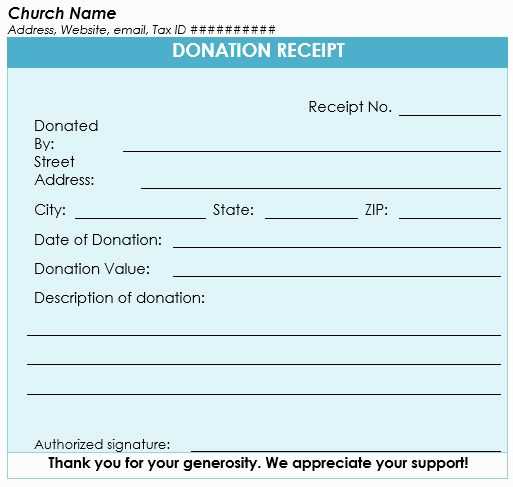

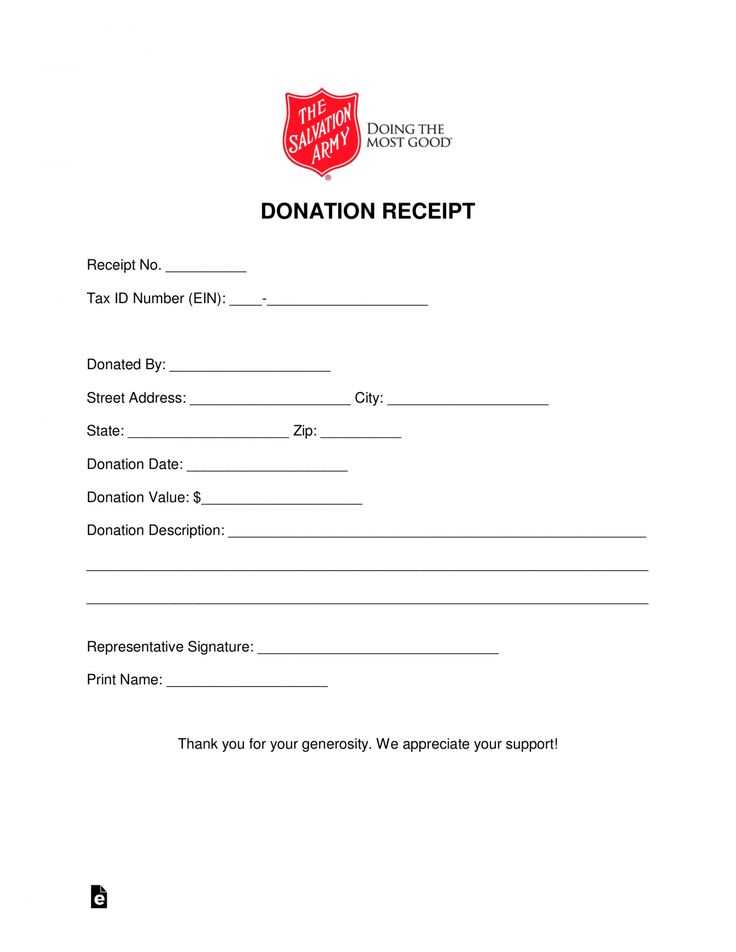

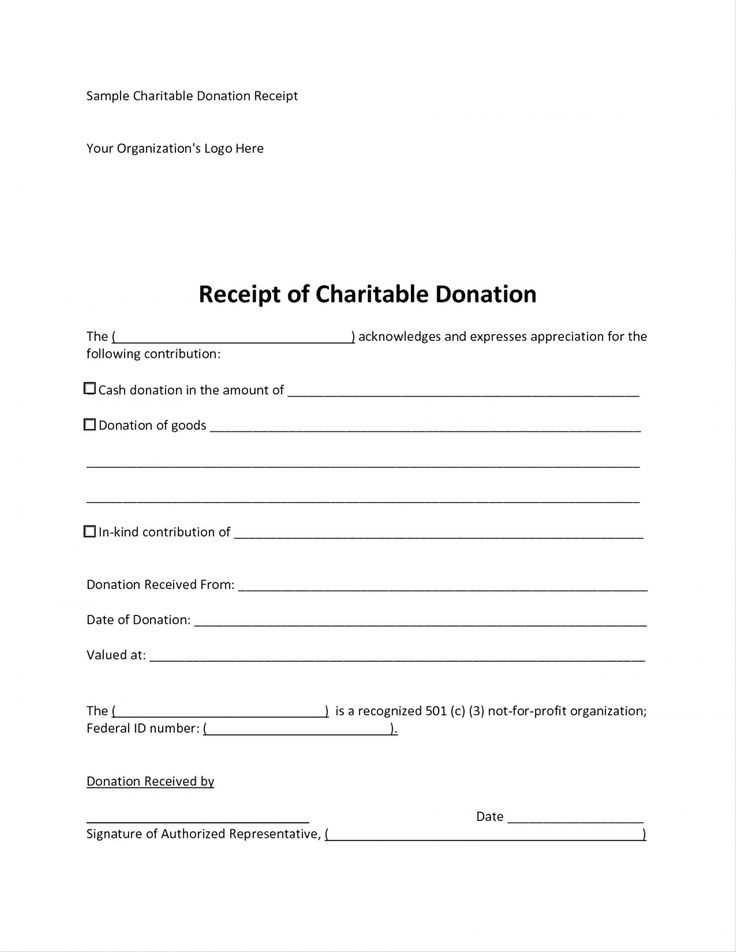

A good donation receipt should include the donor’s name, the date of the donation, the amount donated, and the organization’s details. Make sure to specify if the donation was cash, goods, or services. If the donor receives any goods or services in return, their fair market value should be noted, as it may affect the deductibility of the donation. This transparency helps both parties avoid confusion when it comes time for tax filings.

The template should be clear and professional. Include your organization’s logo, name, and contact details at the top, followed by a brief statement thanking the donor for their generosity. Ensure that the receipt includes any required legal language to comply with your local tax laws. Lastly, always remember to send receipts in a timely manner, ideally as soon as the donation is received, to maintain good relations and demonstrate reliability.

Here’s the revised version:

A donation receipt should clearly outline the necessary details to ensure compliance and provide donors with accurate records for tax purposes. Below is a template that includes key elements:

| Field | Example |

|---|---|

| Organization Name | Example Charity Foundation |

| Address | 123 Charity St., City, State, 12345 |

| Donor’s Name | John Doe |

| Donation Date | January 15, 2025 |

| Donation Amount | $100.00 |

| Description of Goods/Services (if applicable) | No goods or services were provided in exchange for this donation. |

| Tax ID Number | 12-3456789 |

| Signature | Signature of Authorized Representative |

This format includes all required elements: the donor’s name, donation details, and the charity’s tax identification number. Make sure to customize it for your specific needs and follow any local regulations for non-profit organizations.

- Template for a Donation Acknowledgment

Providing a clear and professional donation acknowledgment template builds trust and ensures the donor feels appreciated. The acknowledgment should confirm the donation amount, the purpose, and the organization’s gratitude. Below is a concise template to follow.

- Organization Name

- Organization Address

- Phone Number / Email

- Date of Donation

Donor Name

Donation Amount: $[Amount]

Donation Type: [Monetary/Non-Monetary]

Dear [Donor Name],

Thank you for your generous donation of $[Amount] to [Organization Name]. Your contribution helps further our mission to [State Mission/Goal]. Your support is invaluable and will make a lasting impact on [specific project or cause].

This donation is tax-deductible to the fullest extent allowed by law. Please keep this receipt for your records. If you have any questions, feel free to contact us at [phone number or email].

Thank you again for your commitment to [cause].

Sincerely,

[Your Name]

[Your Title]

[Organization Name]

Tax ID Number: [Tax ID Number]

Include the name of the organization, along with the tax-exempt status, at the top of the receipt. Clearly indicate that the organization is a registered charity or nonprofit. The donor should easily identify the organization receiving the donation.

Provide a specific date and donation amount. Include both the dollar amount and a brief description of the donation, such as “cash,” “check,” or “in-kind donation.” This helps establish the validity of the contribution for both the donor and the organization.

Note whether any goods or services were exchanged in return for the donation. If nothing was exchanged, explicitly state this, as donors need proof that their contribution qualifies as a deductible gift.

Always include a statement that explains the donor’s tax deduction eligibility. A simple sentence such as “No goods or services were provided in exchange for your donation” or “You have made a cash donation of $X” ensures clarity.

If applicable, include your organization’s tax identification number (EIN) for the donor’s reference. This is a helpful detail that assures them the donation is tax-deductible and aligns with IRS guidelines.

Conclude the receipt with a thank-you note that expresses appreciation for the donation. This is not only good practice but also helps maintain positive relationships with donors, encouraging continued support.

A donation receipt must contain specific information to be legally valid. First, include the donor’s full name and address, as this helps both parties with record-keeping and tax purposes. If the donor is an organization, ensure you list its legal name and address as well.

Clearly state the amount of the donation and specify whether it was cash or property. If property was donated, provide a description, including its value. Avoid listing a dollar value for property unless an official appraisal was conducted. For non-cash donations, be transparent about the process for determining value.

For donations of $250 or more, include a statement confirming that the donor received no goods or services in exchange, unless something of nominal value was provided. If something was provided, list its value and clarify that it is not a substantial gift. Be sure to reference the date of the donation for record-keeping.

In case of a contribution made through a pledge or installment payments, it’s important to include the payment schedule and the amount donated at the time the receipt is issued.

Finally, include your organization’s tax-exempt status, such as the IRS designation, so the donor can use it when claiming deductions on their taxes. Keep receipts in a clear, consistent format to avoid confusion and to meet legal standards.

Include the donor’s full name, donation amount, and donation date on the receipt to ensure clarity and relevance. Adding a personal message like “Thank you for your generous support, [Donor’s Name]” will make the donor feel appreciated. Highlight the specific purpose of their donation, such as “Your donation supports our after-school programs,” to show the impact of their contribution.

Use Your Organization’s Branding

Incorporate your organization’s logo, color scheme, and fonts in the receipt template. This keeps your communication consistent and visually appealing. It also reinforces your brand and mission to the donor every time they see it.

Provide Tax Information and Contact Details

Always include your tax-exempt status and any relevant tax identification numbers for donors who wish to claim their donation on their taxes. Adding a contact number or email for further inquiries helps establish trust and makes your organization approachable.

To ensure clarity and transparency in donation receipts, use a structured format. Begin with a clear title such as “Donation Receipt” or “Receipt for Your Contribution.” Follow this by the donor’s name, donation amount, and date. Ensure the receipt includes the organization’s name and address, including the tax identification number if relevant for tax purposes. This information will help the donor when claiming tax deductions.

Receipt Details

Include a brief description of the purpose of the donation. This helps establish the intent and use of the funds, making the donation more meaningful. Specify whether the donation is one-time or recurring, and add any special conditions that may apply to the donation.

Legal Information

Make sure to indicate whether the donation is tax-deductible. For organizations that qualify, mention their tax-exempt status and include any legal disclaimers regarding the charitable deduction. This section ensures donors are aware of their potential tax benefits.