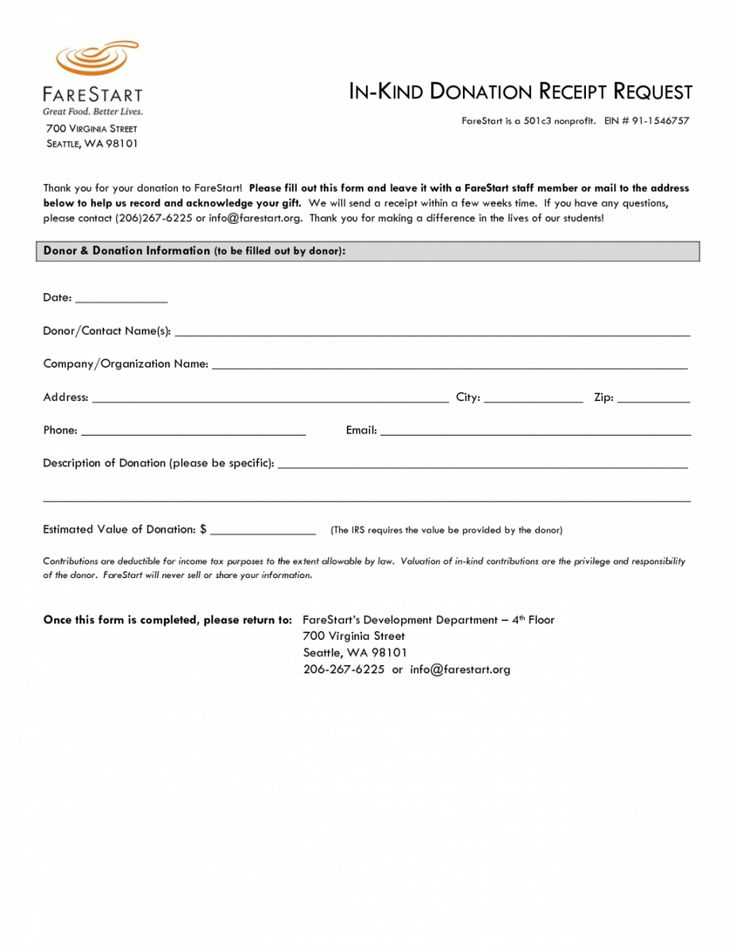

Creating a donation receipt for tax purposes requires clear documentation of both the donor’s contribution and the organization’s details. The letter should include the date of the donation, a description of the donated items or funds, and a statement that no goods or services were provided in exchange for the donation.

Ensure the letter includes the following:

- Organization name, address, and contact details

- Donor’s name and contact information

- Donation amount or description of items

- Statement confirming the donation is tax-deductible

- Date of donation

To make it easier for donors to claim their deductions, provide them with an itemized list if applicable. Additionally, avoid overcomplicating the wording of the letter to ensure it meets IRS standards. A clear, concise receipt will make the tax filing process smoother for both the donor and the receiving organization.

Here’s the corrected version:

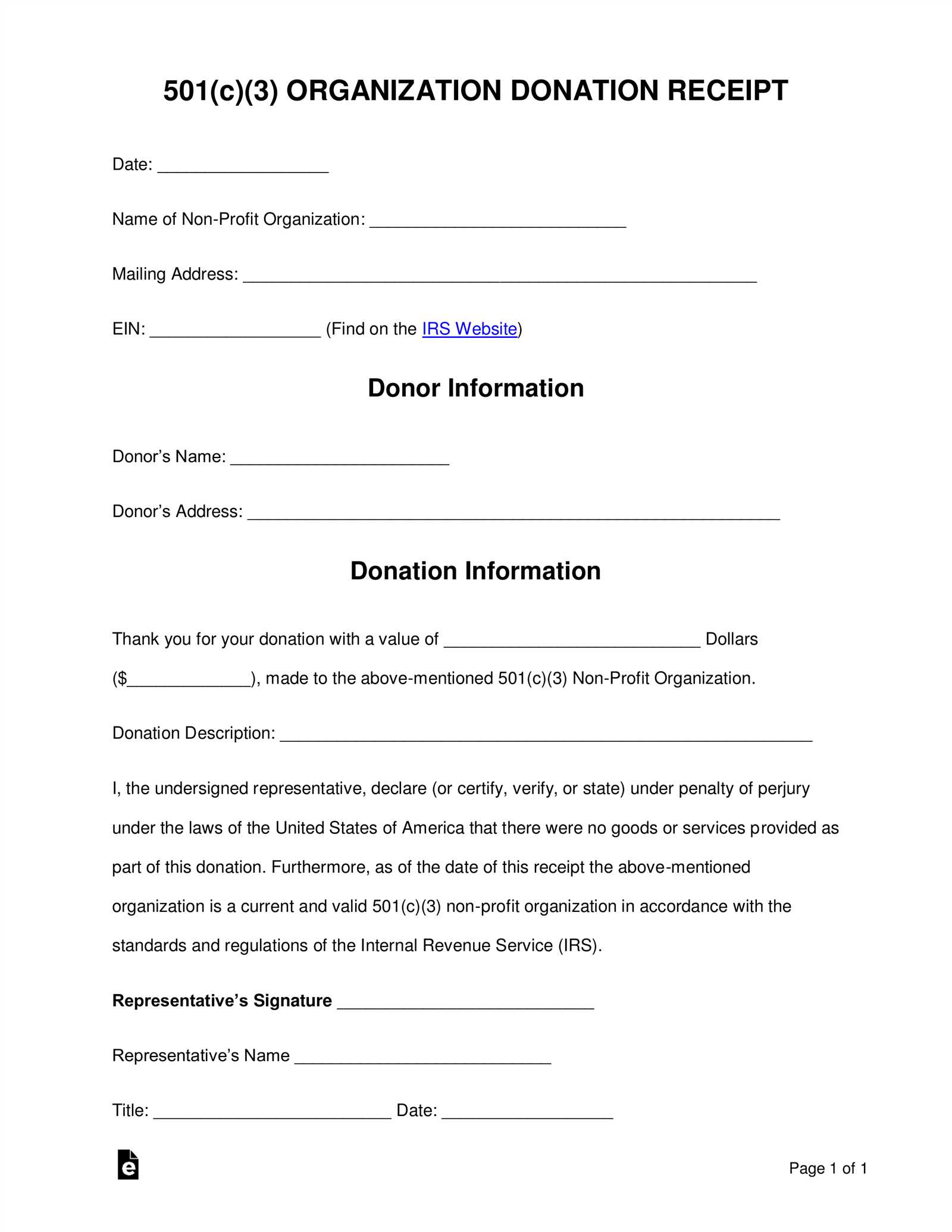

Ensure the donation receipt clearly includes the donor’s name, the amount donated, and the date of donation. Specify the organization’s details, including its name and tax-exempt status. If applicable, mention any goods or services the donor received in exchange for the contribution, as this may affect the tax-deductible value. Confirm that no goods or services were provided if that is the case. This transparency will help both parties comply with tax regulations.

Always issue receipts promptly after receiving donations. Make sure the format is easy to understand and the necessary tax details are included. This ensures that donors can claim their tax deductions without delay.

- Template for a Donation Receipt Letter for Tax Purposes

A donation receipt letter for tax purposes should clearly document the gift’s details and provide all necessary information for the donor to claim tax deductions. Use this template as a guide when drafting a donation receipt for your organization:

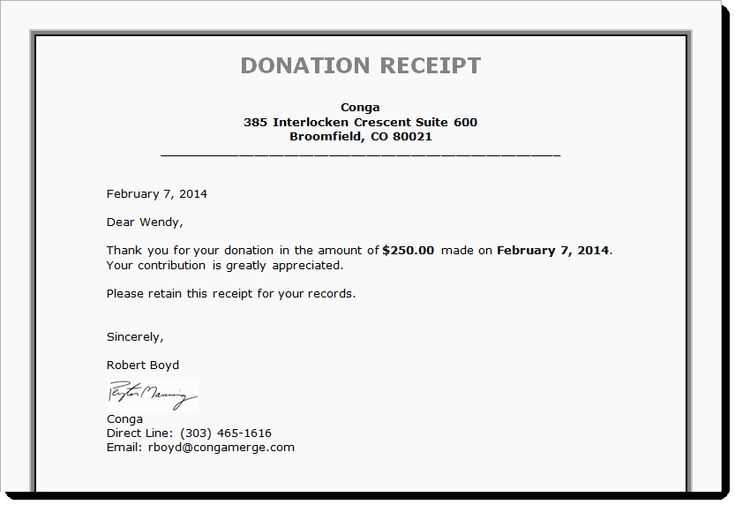

Donation Receipt Letter Template

[Your Organization’s Name]

[Address]

[City, State, Zip Code]

[Phone Number]

Date: [Insert Date]

[Donor’s Name]

[Donor’s Address]

[City, State, Zip Code]

Dear [Donor’s Name],

On behalf of [Your Organization’s Name], I would like to express our heartfelt gratitude for your generous donation. Below are the details of your contribution for your tax records:

- Amount of Donation: [Insert Donation Amount]

- Date of Donation: [Insert Date]

- Donation Type: [Monetary, Goods, Services, etc.]

Please note that [Your Organization’s Name] is a registered 501(c)(3) organization, and your donation is tax-deductible to the fullest extent permitted by law.

This letter serves as your official receipt. No goods or services were exchanged for this donation. For any further inquiries, feel free to contact us at [Phone Number] or [Email Address].

Thank you once again for your support of our mission.

Sincerely,

[Your Name]

[Your Title]

[Your Organization’s Name]

[Phone Number]

[Email Address]

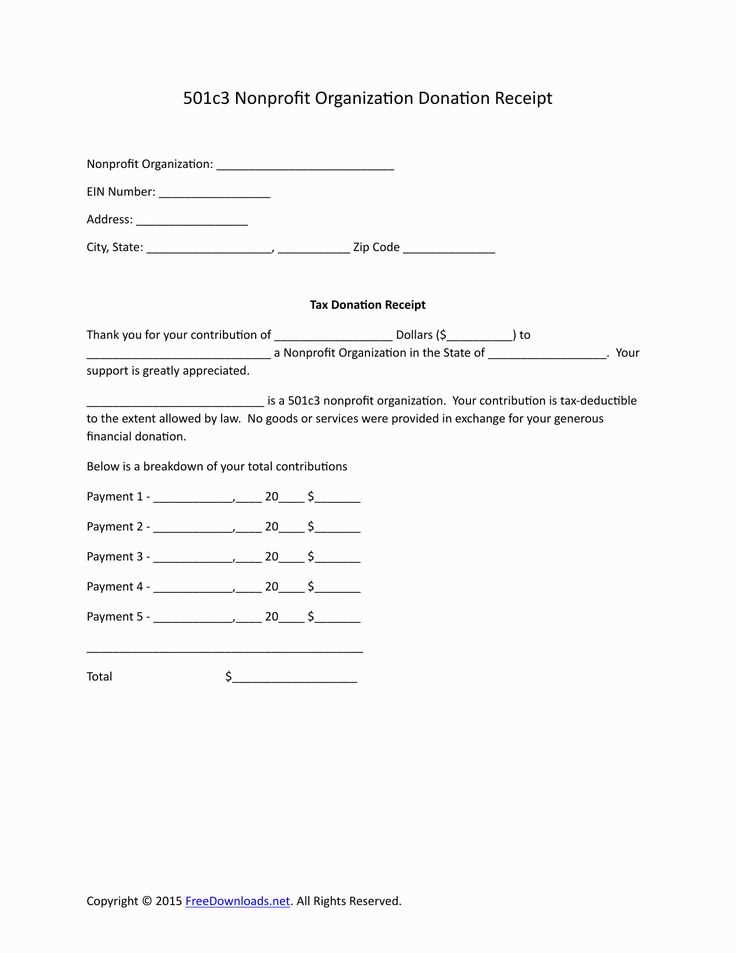

A donation acknowledgment must contain specific details to be valid for tax deduction purposes. Here’s how to structure it:

- Donor’s Name and Address: Clearly state the name and address of the donor. This provides identification for tax records.

- Organization’s Name and Address: Include your organization’s full name and address. This verifies that the donation was made to a legitimate entity.

- Donation Amount or Description: Specify the donation amount if it is monetary. For non-cash donations, provide a description of the items donated. Avoid estimating the value of non-cash contributions; the donor should determine that.

- Date of Donation: Clearly state the date the donation was made. This helps verify when the contribution was received within the tax year.

- Statement of No Goods or Services Provided: If no goods or services were provided in exchange for the donation, include a statement confirming this. If something was given in return, list those items along with their fair market value.

- Tax Deduction Disclaimer: Include a reminder that the donation is tax-deductible, as long as it meets IRS requirements.

Include a Thank You Statement

Always express gratitude to the donor. Acknowledge the importance of their contribution and reinforce the positive impact it will have on your cause.

Keep It Clear and Concise

Ensure that all relevant details are included in a clear and professional format. Don’t overcomplicate the message–focus on providing the necessary information for the donor’s tax records.

Make sure to include the full name of the organization receiving the donation. This ensures the IRS can verify the donation is going to a qualified charity. Additionally, specify the charity’s tax-exempt status. This lets the donor know their contribution qualifies for tax deductions.

Details About the Donation

Clearly state the date of the donation and its value. For cash gifts, the amount should be noted. If the donation is non-cash, include a description and the estimated value, especially for items like clothing, electronics, or artwork.

Donor Acknowledgment and Disclaimers

Include a statement confirming no goods or services were provided in exchange for the donation. If any benefits were given, the value of those benefits should be listed separately. This is necessary to ensure the donor can claim the maximum deduction possible.

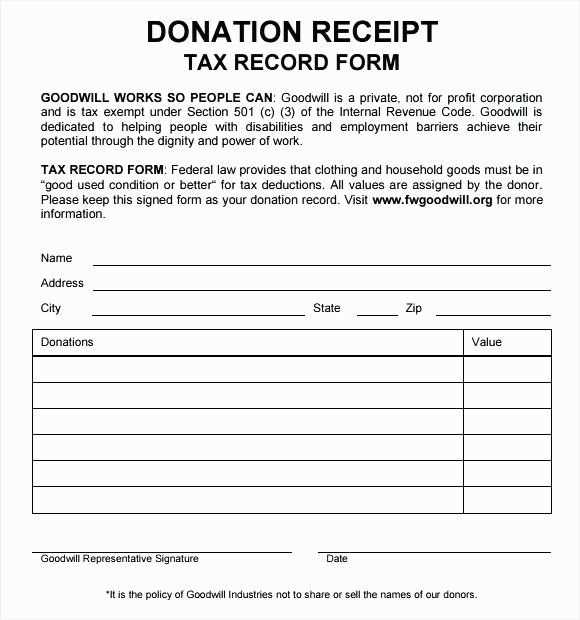

Ensure you accurately include the donor’s full name and address. Missing or incorrect details may lead to confusion and affect the tax deduction process. Double-check that the donation amount is stated clearly and matches the records. Misreporting the donation amount can lead to discrepancies and potential issues with the IRS.

Avoid vague descriptions of the donation. Be specific about the items or services donated, especially if it’s in-kind. Provide details like the condition of items and their estimated value, if applicable. This prevents misunderstandings and ensures transparency.

Don’t forget to include a statement about whether any goods or services were provided in exchange for the donation. If they were, the value of those goods or services must be deducted from the donation amount, leaving only the net contribution for tax purposes.

Make sure the date of the donation is recorded correctly. This is important for tax purposes as deductions must correspond to the year the gift was made. Missing or incorrect dates can delay or invalidate tax claims.

Avoid using ambiguous or imprecise language in your acknowledgment letter. Keep your language clear and straightforward. A well-worded acknowledgment letter will avoid potential confusion when it comes to filing taxes or referencing the donation later.

Updated Adjustments to Eliminate Redundancies While Maintaining Core Meaning

To ensure the clarity and flow of the donation receipt letter, corrections have been made to eliminate unnecessary repetition without altering the original meaning. The content now presents the necessary information in a more concise and readable format, allowing donors and recipients to understand key details without redundancy.

Key Adjustments Made

The following modifications have been implemented:

| Original Phrase | Updated Phrase |

|---|---|

| Donor’s generous contribution was greatly appreciated. | We greatly appreciate the donor’s contribution. |

| We are truly grateful for the support that has been provided. | We are grateful for your support. |

| We confirm the receipt of the funds, which were provided by the donor. | The funds from the donor have been received. |

These changes streamline the text, making it more straightforward without losing the core information. It ensures that all necessary details are clearly communicated while avoiding repetition.

Benefits of the Changes

The revised text is now more direct, making it easier for recipients to quickly understand the purpose of the letter. By eliminating redundancies, it improves both readability and professionalism, ensuring the communication is as effective as possible.