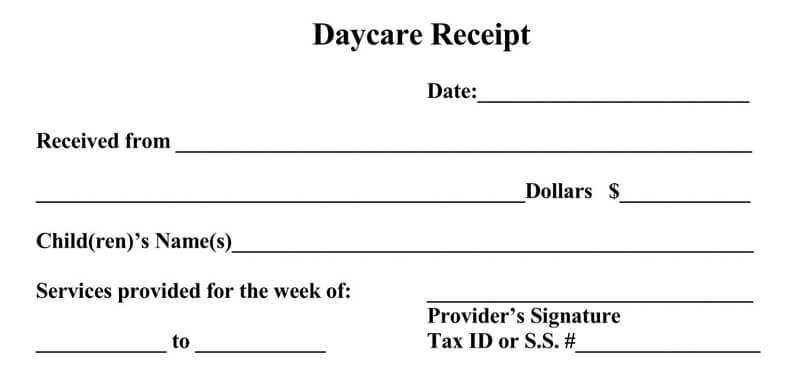

If you are claiming a tax credit for your child’s fitness activities, ensure your receipt includes all necessary details for accurate processing. The receipt should clearly state the type of activity, the child’s name, and the date(s) the activity took place. It should also include the amount paid and the name of the organization providing the service.

Specify the Activity: Be specific about the fitness activity or program. Include the program name, duration, and the age range it targets. If the fitness provider offers various services, the receipt should highlight the particular program used for your child’s participation.

Details of Payment: Include the total amount paid for the service. Ensure that the receipt reflects the full amount of your payment, as this will directly impact your claim. If applicable, make sure it specifies any tax-exempt status or discounts applied to the total.

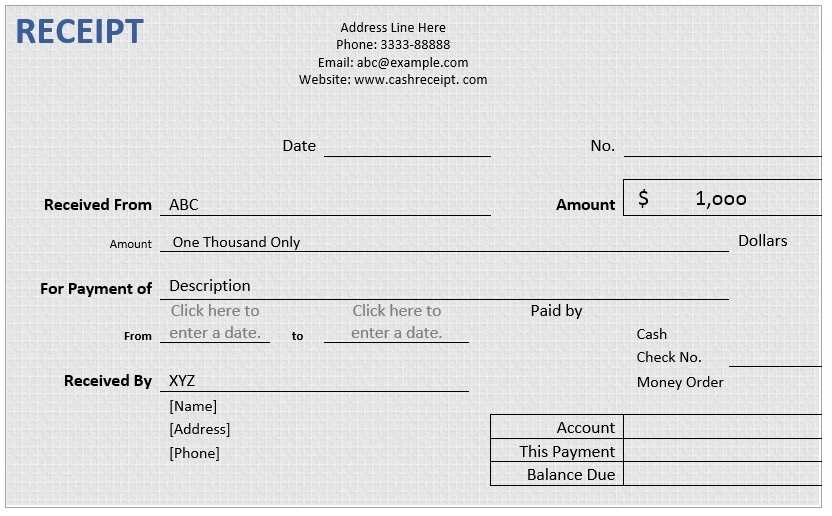

Contact Information: The receipt must contain the full contact details of the fitness provider, including the organization’s name, address, phone number, and any other necessary contact information. This helps ensure the receipt can be verified if needed.

For a smooth experience, double-check that all these elements are clearly listed before submitting your claim. A well-organized receipt reduces processing delays and helps streamline your application.

Sure! Here’s the updated version:

To create a child fitness tax credit receipt, ensure that you include the following key details: the child’s full name, date of birth, and the duration of the fitness program. Also, provide a clear breakdown of the amount paid for the program, specifying the dates and the services included. Include your contact information and the business registration details if you’re providing the receipt as a service provider. This will make it easy for tax authorities to verify the claim.

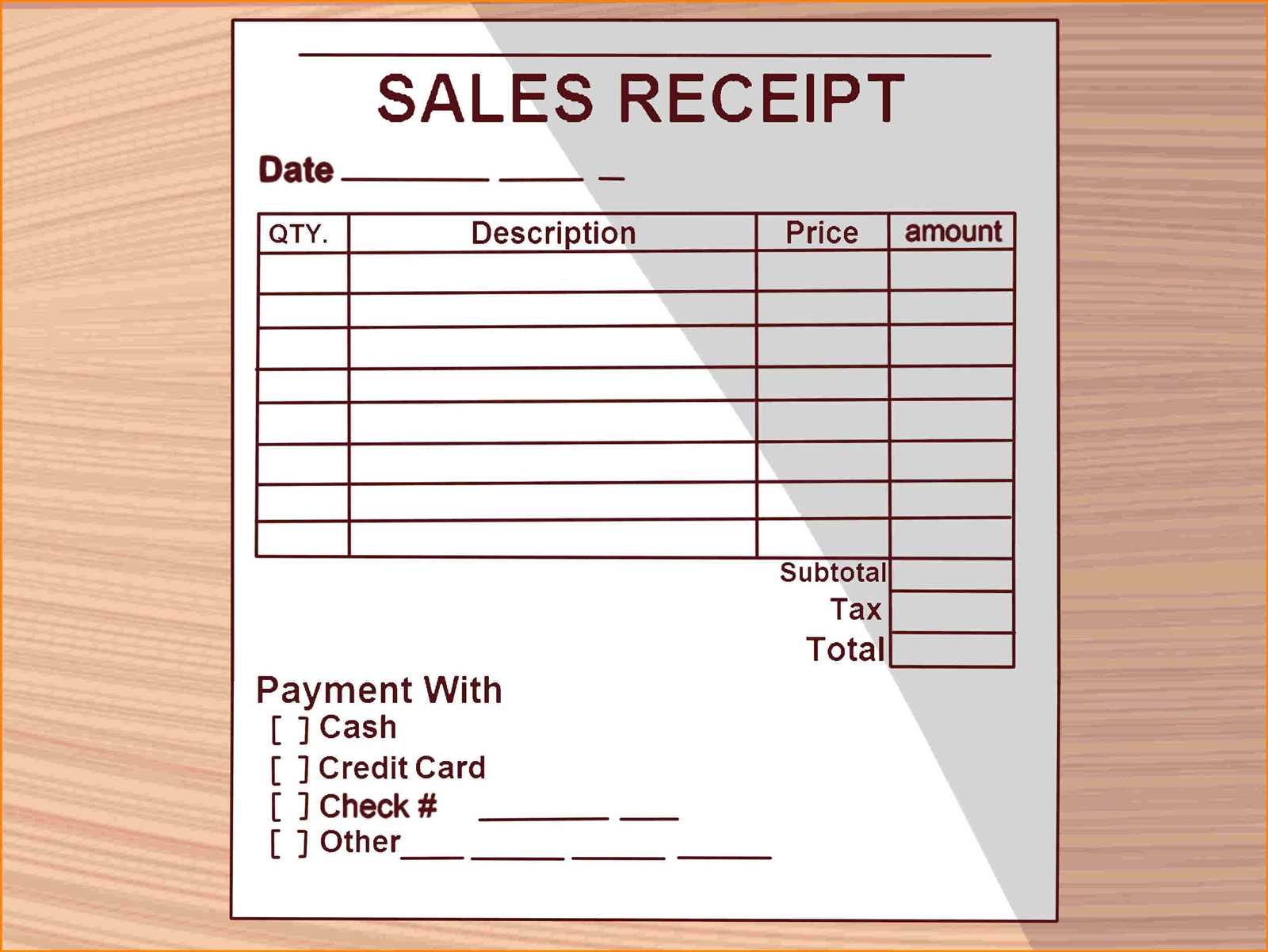

Itemized Breakdown

An itemized receipt should list the program’s cost, any associated fees (like membership or equipment rental), and the payment method. You can also add a section for any applicable discounts or subsidies provided. This level of transparency helps the taxpayer when claiming the credit on their tax return.

Additional Information

Make sure the receipt includes the program’s start and end dates. If the fitness activity is ongoing, note the frequency (e.g., weekly or monthly) and the total amount paid during the reporting period. This ensures all necessary information is readily available for tax filing purposes.

- Child Fitness Tax Credit Receipt Template

For a valid Child Fitness Tax Credit receipt, make sure it includes the following details: the child’s name, the fitness program or activity, and the duration of participation. Clearly indicate the total amount paid and any taxes applied. Include the name, contact information, and business address of the provider. The receipt should specify the payment method and contain a transaction or reference number. To finalize, ask the provider to sign or stamp the receipt to verify its authenticity. Keep this receipt for your tax filing purposes.

To create a fitness tax credit receipt for parents, include the child’s name, age, and the specific fitness program they participated in. Specify the period of participation, listing the start and end dates. Clearly state the total amount paid for the program, including any taxes or additional fees if applicable. Make sure the receipt includes the name and contact details of the fitness provider. You can also add a unique receipt or reference number for tracking purposes.

Ensure that the document is signed or stamped by the service provider. This verifies the authenticity of the receipt. Keep a copy of the receipt in case the tax authorities need to verify it during a claim.

Key details to include:

- The parent’s name and contact information

- The child’s name, age, and the program details

- Dates of participation

- Amount paid for the program

- Service provider’s name, contact details, and signature/stamp

- Any other relevant tax codes or references

Be sure to format the receipt clearly and concisely to avoid any confusion or issues during submission for tax credit claims.

A fitness tax credit receipt must contain specific details to ensure it is accepted by tax authorities. These details include:

- Provider’s Name and Address: Ensure the receipt includes the full name and address of the fitness provider, such as a gym or fitness class instructor.

- Recipient’s Name: Your name should appear as the person receiving the fitness services.

- Receipt Date: The receipt must list the date of the transaction or service provided.

- Service Description: The receipt must clearly outline the type of fitness activity or program, such as yoga classes, gym memberships, or other fitness-related services.

- Amount Paid: The exact amount you paid for the fitness services should be listed.

- Proof of Payment: A method of payment, such as a credit card, cash, or cheque, should be indicated.

- Duration of Service (if applicable): For ongoing services, such as memberships, the receipt should state the length of the service period (e.g., monthly membership or 10-session package).

Ensure that all these details are present to avoid any issues when claiming the fitness tax credit. Missing or incorrect information may lead to a denial of the claim.

One of the most common mistakes is failing to include specific details required by tax authorities. Make sure the receipt clearly lists the service provider’s full name, business address, and tax identification number (TIN). Without this information, the receipt may be rejected or questioned during the tax filing process.

Missing Date and Service Details

Another error is neglecting to specify the date(s) of the service provided. Include the exact dates or range of dates for which the fitness services were rendered. This is crucial for demonstrating the legitimacy of the expense. Similarly, list the type of service, such as “fitness classes,” “personal training,” or “gym membership,” to make the receipt easy to validate.

Incorrect or Omitted Amounts

Ensure the total amount charged for the service is accurately stated on the receipt. Some receipts omit this crucial piece of information, which can lead to confusion or rejection. Always verify that the amounts match what was actually paid and include any discounts or promotions applied, along with taxes, to present a complete picture.

Failure to Include a Payment Method

It’s important to document the payment method on the receipt. Whether the payment was made via credit card, debit card, check, or cash, this detail helps to further authenticate the transaction. If you paid in installments, specify the payment schedule and amounts for clarity.

Unclear or Incomplete Service Descriptions

Be specific when describing the fitness services on the receipt. Vague or incomplete descriptions may cause the tax authorities to question the legitimacy of the expense. Instead of a generic “fitness service,” use precise language like “3-month yoga membership” or “5 personal training sessions.”

Using Unofficial Receipt Formats

Some people use non-standard templates or handwritten receipts that don’t meet formal tax documentation requirements. Always generate receipts from a professional, automated system, or request one from your service provider. It should follow the correct format and meet the necessary legal criteria.

| Common Mistakes | How to Avoid |

|---|---|

| Lack of Tax Identification Number (TIN) | Always include the provider’s TIN and contact information on the receipt. |

| Missing Dates | Clearly list the date(s) when services were provided or paid for. |

| Incorrect Amounts | Double-check that amounts match the actual charges, including taxes. |

| Missing Payment Method | Indicate how payment was made (credit card, cash, etc.). |

| Unclear Service Descriptions | Provide detailed descriptions of the services received, including frequency and duration. |

| Non-Official Receipts | Use professionally generated receipts that comply with tax guidelines. |

Ensure all required receipts are organized and include necessary details like the name of the provider, services rendered, dates, and amounts. Make sure that each receipt is clearly legible and itemized. This will help avoid delays in processing the child fitness tax credit application. Gather supporting documents like payment confirmations or bank statements to further verify the expenses if needed.

It’s important to review the receipt template to confirm that it meets all requirements outlined by the tax authority. Check that the fitness activity is eligible for the credit, and ensure the amounts reflect actual costs for approved services.

When submitting, remember to provide the receipt alongside your tax form to ensure the credit is applied correctly. Double-check that all documents are up to date and complete, as incomplete or incorrect submissions could lead to processing delays or rejections.