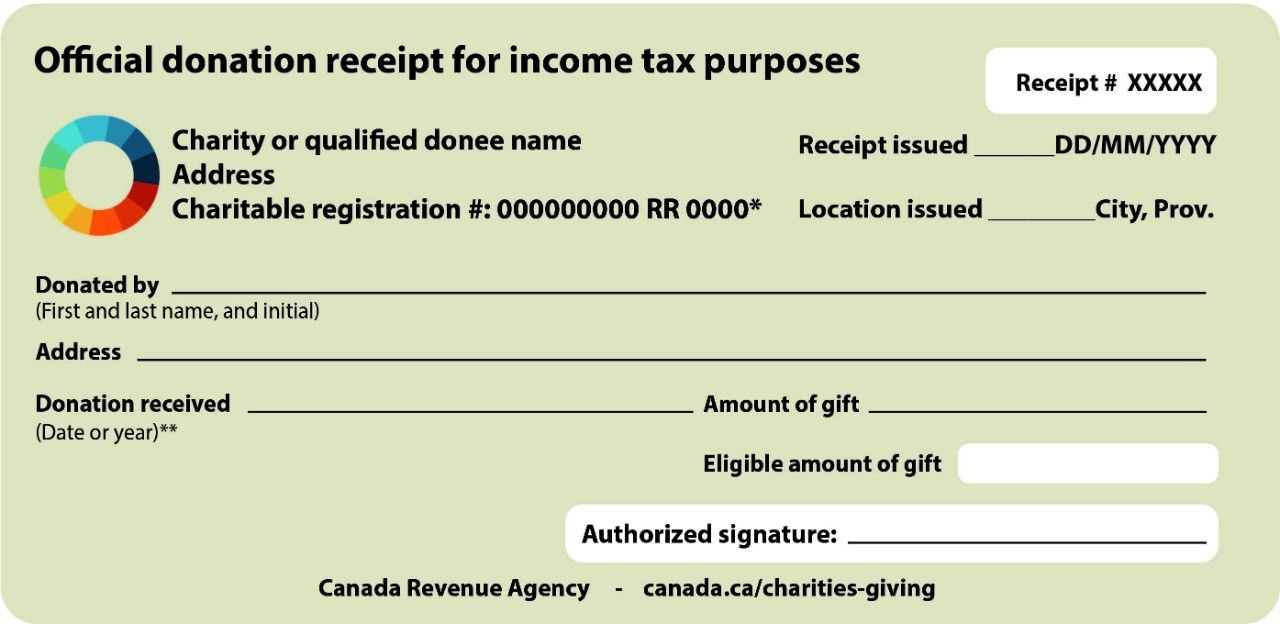

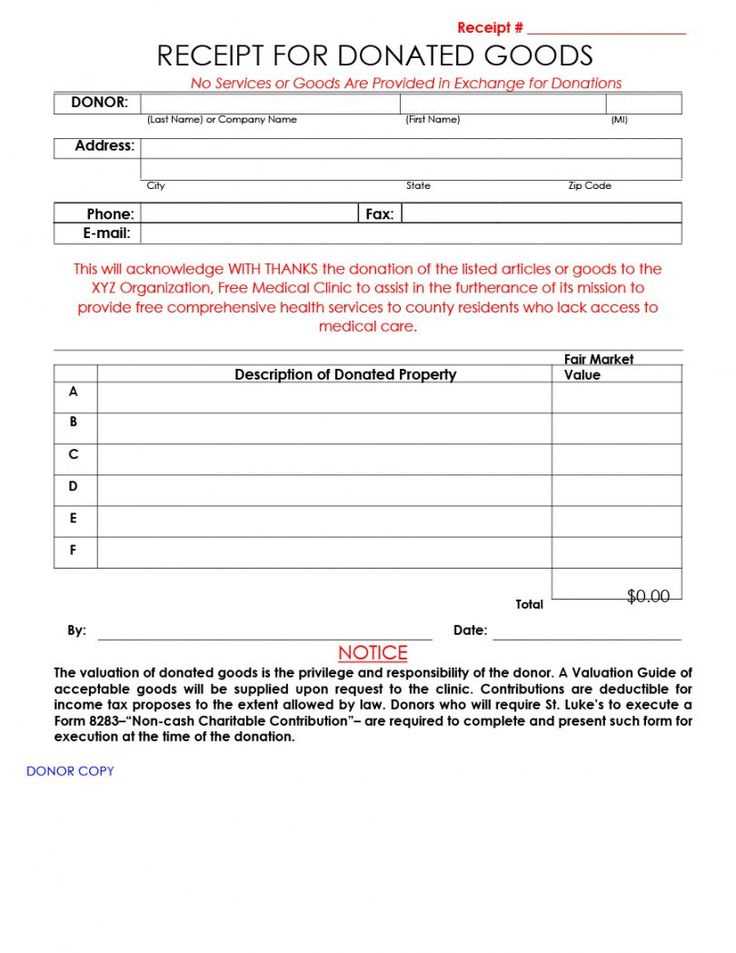

To create a charitable tax receipt in Canada, ensure it includes specific details required by the Canada Revenue Agency (CRA). The receipt must contain the charity’s official name, address, and registration number. It should also specify the donor’s name, address, and the amount donated. If the donation is non-monetary, a description of the goods or services provided should be included, along with their fair market value.

Ensure accuracy when stating the donation amount, and always provide a unique receipt number for each donation. If applicable, mention if any goods or services were received in exchange for the donation, and subtract their value from the total amount to calculate the eligible tax receipt amount. Keep a detailed record of all issued receipts for your own records.

Follow the CRA’s guidelines closely to avoid any issues during tax filing, as improperly issued receipts can lead to delays or penalties. It’s also a good practice to periodically review the CRA’s requirements, ensuring your receipts meet the latest standards. By adhering to these guidelines, you can help donors receive the tax credits they are entitled to.

Here’s the corrected version:

To create a charitable tax receipt in Canada, start by ensuring the following elements are included:

- Organization Name – Ensure the full legal name of the charity is listed as registered with the Canada Revenue Agency (CRA).

- Charity Number – Include the CRA-issued charitable registration number. This is essential for validation.

- Receipt Date – Specify the exact date the donation was received.

- Donation Amount – State the total amount donated, including a clear breakdown if multiple types of contributions were made.

- Official Donation Statement – A clear note that the receipt is for charitable tax purposes.

- Donor Information – Full name and address of the donor should be accurate and clearly displayed.

- Signature of Authorized Person – A signature from a representative of the charity should appear to authenticate the receipt.

Make sure all details align with CRA guidelines to avoid complications during tax filing.

- Charitable Tax Receipt Template for Canada

For charities in Canada, creating a tax receipt involves including specific information for it to be recognized by the Canada Revenue Agency (CRA). Below are the components that should be present in a charitable tax receipt:

Required Information

- Charity Name and Registration Number: The registered name and the CRA-issued registration number must appear on the receipt.

- Donor Information: Include the donor’s full name and address to properly identify them for tax purposes.

- Donation Amount: The total amount of the donation or a description of the goods donated, including their fair market value.

- Date of Donation: The specific date the donation was made.

- Receipt Number: A unique receipt number for tracking and record-keeping.

Additional Key Elements

- CRA Statement: The phrase “Official receipt for income tax purposes” must be present on the receipt.

- Authorized Signature: The signature of an authorized representative of the charity is required.

- In-kind Donations: If the donation is non-monetary, the receipt should provide a description of the items donated and their fair market value.

Following these guidelines will help ensure that the charitable tax receipt is valid for tax purposes, allowing donors to claim their deductions properly.

Ensure your charitable receipts comply with the Canada Revenue Agency (CRA) guidelines. Follow these requirements to avoid any issues during audits or tax filings. The CRA demands specific details to be included in each receipt for it to be considered valid for tax purposes.

Receipts must include the charity’s name, address, and registration number. The registration number must be a valid CRA-issued number for the charity to be recognized as a registered organization. Additionally, the receipt should state the amount of the donation, the date of the donation, and a clear description of the property or services donated, if applicable.

Include the fair market value of any goods or services provided in exchange for the donation. If the donation is over $25, the CRA requires that a written acknowledgment be issued to confirm the value of any goods or services received.

Ensure your receipts are signed by an authorized representative of the charity, which can be an executive or a designated individual. This signature verifies the authenticity of the receipt.

| Receipt Element | Requirement |

|---|---|

| Charity Name and Address | Must be present and accurate. |

| CRA Registration Number | Valid charity registration number from CRA. |

| Donation Amount | Must be clearly stated. |

| Date of Donation | Accurate donation date required. |

| Description of Donated Goods/Services | Clearly state if goods/services are donated. |

| Fair Market Value of Goods/Services | If applicable, value must be noted. |

| Authorized Signature | Receipt must be signed by an authorized representative. |

Verify your charity is registered with the CRA and meet all documentation standards. This guarantees donors can claim tax deductions, helping maintain the legitimacy of both the receipt and the charity’s operations.

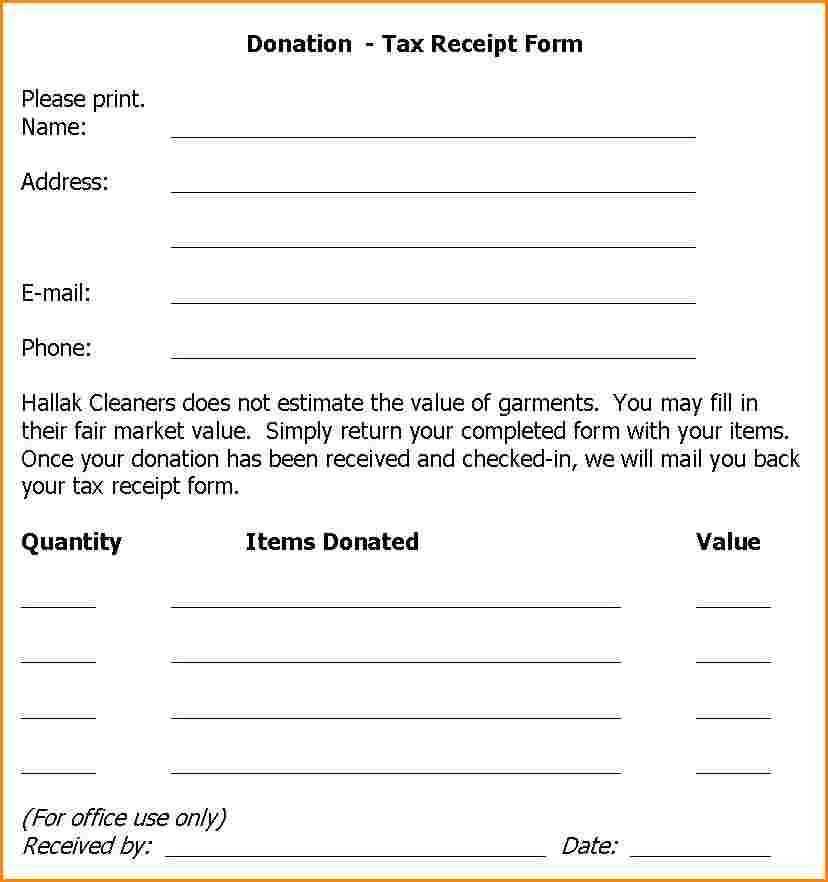

Ensure your donation receipt follows these key steps to meet compliance standards in Canada:

- Include the charity’s official name as registered with the Canada Revenue Agency (CRA).

- Provide the charity’s registration number as issued by CRA.

- List the donor’s full name as it appears in their records.

- Specify the donation date accurately.

- State the amount of the donation (or the value of goods or services donated), specifying whether it was a cash or in-kind gift.

- Describe any goods or services provided in exchange for the donation, including their fair market value.

- Issue the receipt in a timely manner and within the year the donation was made.

- Include a statement declaring that no goods or services were provided, if applicable.

- Ensure the receipt is signed by an authorized individual from the charity.

Following these steps will ensure your donation receipts meet the legal requirements and provide donors with valid documentation for tax purposes.

Ensure all necessary information is included on the receipt. Missing details, such as the donor’s full name, donation amount, and the official registration number of the charity, can make the receipt invalid for tax purposes.

Double-check the donation amount. Incorrect figures can cause confusion for both the donor and the charity. Make sure the amount is listed clearly and matches any supporting documentation.

Don’t forget to provide the date of the donation. Without the correct date, it becomes difficult for donors to claim their tax benefits for the specific tax year.

Always issue receipts for donations that qualify for tax deductions. Non-deductible donations, like event tickets or purchases, should not be included in tax receipts.

Avoid incorrect wording. The receipt should state clearly that it is a “charitable tax receipt” and indicate that no goods or services were provided in exchange for the donation, unless applicable.

Ensure that the organization’s legal name is correctly used, avoiding abbreviations that may not match official records. This helps prevent any potential issues with the Canada Revenue Agency (CRA).

Check for the correct charity registration number. Using the wrong number or leaving it off can invalidate the receipt, preventing donors from claiming their charitable tax deductions.

Charitable Tax Receipt Template Canada

Ensure your charitable tax receipt contains all required details. Include the charity’s official name, address, and registration number. Provide the donor’s name and address, as well as the donation date and amount received. If applicable, state the fair market value of any non-cash contributions. Add a clear statement that no goods or services were provided in exchange for the donation, if that applies.

It is critical to include your charity’s authorized signature, which confirms the legitimacy of the receipt. Be sure to use an official receipt number for each one issued. If donations are made through a third party, clearly mention that the donation was received by them on behalf of the charity.

Ensure all receipts comply with the Canada Revenue Agency (CRA) guidelines to avoid issues with tax claims. Double-check the format for proper documentation, ensuring the necessary elements are present and legible.