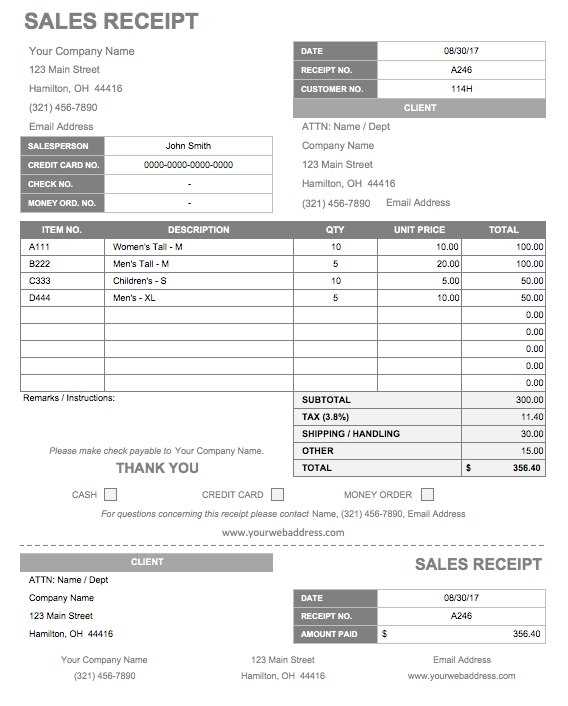

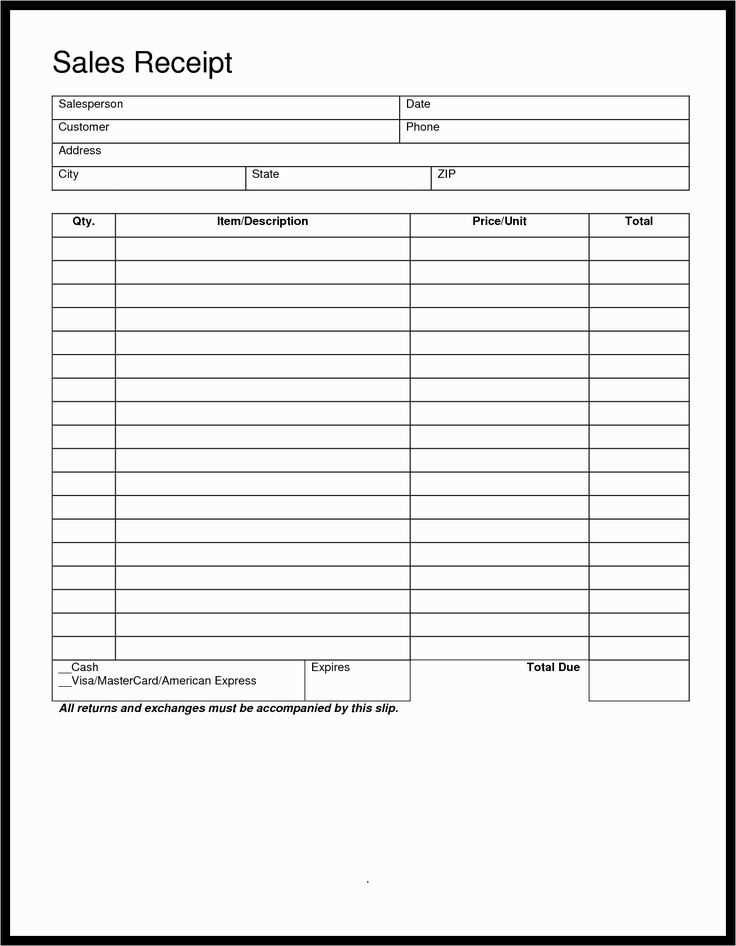

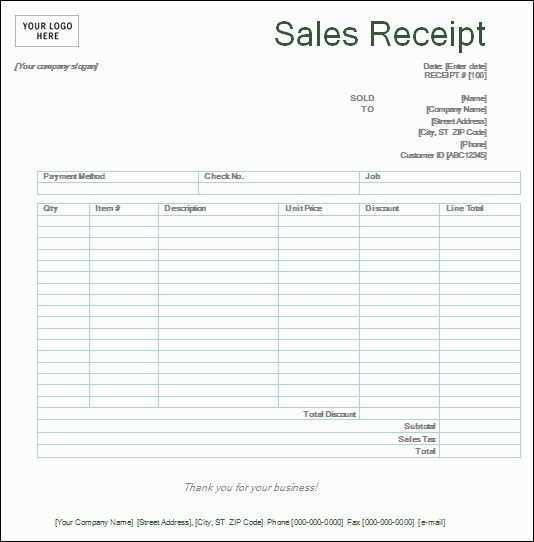

Choose a business sales receipt template that fits your needs and clearly outlines the transaction details. It should include all necessary fields like date, transaction number, buyer and seller information, items sold, quantities, prices, and applicable taxes. By using a ready-made template, you save time and ensure accuracy in your documentation.

Customize the template to match your branding and make it recognizable for your clients. Include your business logo, contact details, and payment methods to make the receipt professional and easy to follow. Ensure there is a space for both the item description and total cost so that each sale is documented comprehensively.

Accuracy matters. Double-check all figures before issuing the receipt to avoid errors that could lead to misunderstandings or disputes. Having a standardized template reduces mistakes and helps maintain consistency in your accounting records.

Here are the corrected lines:

Ensure that your business sales receipt template includes clear sections for the transaction date, items sold, quantities, unit prices, and total cost. Include a unique receipt number for easy tracking and reference. Add your business name, contact details, and logo at the top for a professional look. Always use readable fonts and a simple layout to avoid confusion. Make sure to highlight taxes, discounts, and payment methods clearly. At the bottom, include terms and conditions, if applicable, for better transparency. Double-check the alignment of all text to ensure a clean, organized presentation.

- Business Sales Receipt Template

A well-structured sales receipt is key for keeping business transactions clear and organized. It should contain all essential details such as the date, itemized list of goods or services, prices, and tax. Here’s a breakdown of the necessary components for a business sales receipt template:

Required Information

- Receipt Number: A unique identifier for each transaction.

- Business Details: Include business name, address, and contact information for customer reference.

- Customer Information: Name, address, and contact information, especially for returns or customer support.

- Date of Transaction: The exact date when the sale occurred, crucial for record-keeping and potential disputes.

- Itemized List: Clearly list each item purchased, with quantities, individual prices, and total cost per item.

- Subtotal: Sum of all items before taxes and discounts.

- Taxes: Clearly state the tax rate and the amount collected for taxes.

- Discounts: Include any applicable discounts, either as a percentage or fixed amount.

- Total Amount: The final amount due, which includes the subtotal, taxes, and any discounts applied.

- Payment Method: Indicate how the payment was made (cash, card, etc.).

Template Structure Example

Here’s a basic structure to follow when creating a sales receipt template:

- Business Name and Contact Details

- Receipt Number

- Customer Name and Information

- Date

- Itemized List with Prices

- Subtotal

- Taxes

- Discounts

- Total

- Payment Method

- Signature (optional)

Ensure your template is easy to read and includes all relevant details to avoid confusion and streamline your record-keeping process. Customizable templates can help standardize receipts across your business operations.

To customize a sales receipt for your business, begin by adding your company’s branding. This includes your logo, business name, and contact information such as your phone number and email address. These elements make your receipt look professional and help customers easily reach you if needed.

1. Include Business and Transaction Details

Next, include essential transaction details. The receipt should display the date of purchase, a unique transaction ID, and the name or ID of the employee who processed the sale. These details are critical for both customer reference and bookkeeping purposes.

2. List Purchased Items Clearly

Break down the items or services purchased with clarity. Include the item name, quantity, unit price, and the total cost for each product. If applicable, show any discounts or promotional codes that were applied. This transparency is key to avoiding misunderstandings with customers.

3. Add Payment Information

Specify the payment method used (e.g., credit card, cash, or digital payment). Include the last four digits of the payment method to further authenticate the transaction.

| Description | Quantity | Unit Price | Total |

|---|---|---|---|

| Product 1 | 2 | $10.00 | $20.00 |

| Product 2 | 1 | $15.00 | $15.00 |

| Total | $35.00 | ||

Make sure to include any applicable taxes in a separate line, clearly stating the tax rate applied. This makes the total amount paid transparent and helps customers understand their purchase cost.

Finally, provide a return or exchange policy at the bottom of the receipt. Including terms and conditions for returns, exchanges, and refunds helps manage expectations and prevents future issues.

A well-organized sales receipt should include the following key details to ensure clarity for both the seller and the buyer:

1. Business Information

Start with the name of your business, its address, phone number, and email. This helps the customer reach you easily if any issues arise. Adding a company logo or a website address can enhance brand recognition.

2. Transaction Date and Time

Clearly state the date and time the transaction took place. This helps track purchases and may be useful for warranty or return purposes.

3. Receipt Number

Each receipt should have a unique number for easy reference. This helps with organization and can be used for tracking or auditing purposes.

4. Itemized List of Products or Services

Provide a detailed breakdown of each product or service purchased, including quantities, descriptions, and individual prices. This ensures transparency and helps customers confirm their purchase details.

5. Total Amount Paid

List the total price clearly, including any applicable taxes or discounts. This amount should match the total the customer was charged.

6. Payment Method

Specify whether the customer paid by cash, credit card, or another method. If using a credit card, include the last four digits of the card number for verification purposes.

7. Return or Refund Policy

Include any relevant return, refund, or exchange policies. This protects both parties in case the customer wishes to return or exchange the purchased items.

8. Business Tax Information

Ensure your tax identification number is visible if required by law. This is particularly important for businesses that deal with VAT or sales tax.

9. Signature (Optional)

A signature, either digital or handwritten, can add an extra layer of validation to the receipt, especially in cases of larger transactions or special requests.

Tailor the sales receipt to the nature of the business for clarity and effective tracking of transactions. Make sure each receipt includes relevant details specific to the industry for accurate record-keeping and customer satisfaction.

Retail Industry

In retail, include the product description, quantity, price per item, and the total amount. Add the date, store name, and a return policy. For electronic purchases, provide details about warranties or support services. This enables customers to understand their purchase and return options.

Service Industry

For service providers, highlight the type of service, hours worked, rate, and any additional fees. Include a breakdown of labor and materials costs, if applicable. Offer a space for deposit amounts and specify terms for ongoing or future work. These details provide transparency for both parties.

Customize Your Sales Receipt Template

Choose a clean layout to ensure clarity and avoid overwhelming customers. The receipt should include all key details: business name, address, date, itemized list of products or services, and total amount. Be sure to display your tax rate and amount separately, if applicable. This allows customers to easily understand the breakdown of their purchase.

Include a unique invoice or receipt number for tracking purposes. This will help both you and your customer stay organized, particularly for returns or warranty claims. It’s also helpful to add a space for any additional notes, such as a thank-you message or instructions for after-sales service.

Ensure the font is legible, and use different font sizes to highlight the total amount. A clear distinction between the total and individual items helps prevent confusion. Stick to neutral colors that match your brand and avoid excessive design elements that might distract from the receipt’s key information.