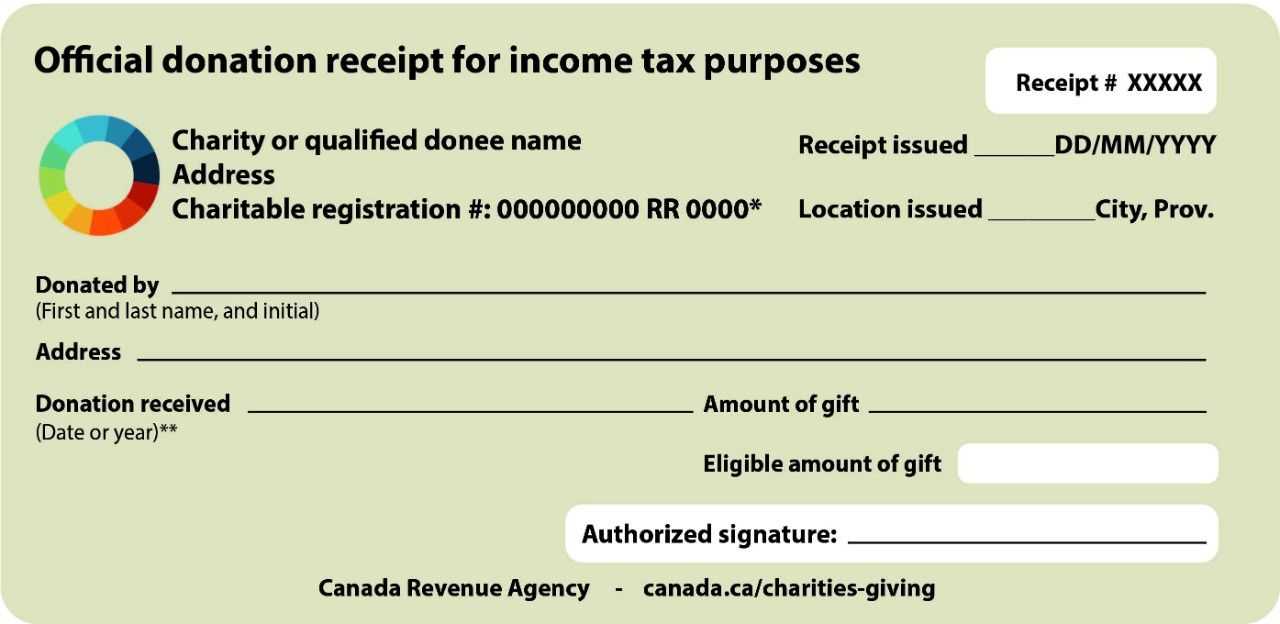

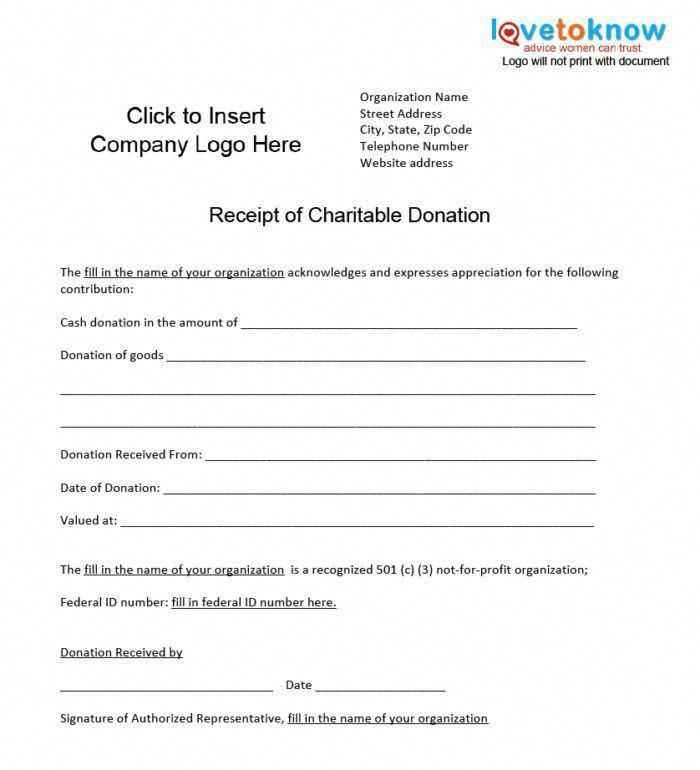

For organizations managing charitable donations, a well-structured receipt template is a must. It serves as an official record for donors and simplifies tax deductions. Create a receipt that includes the donor’s name, address, date, and amount donated, along with a description of the gift. This provides transparency and ensures that both parties are on the same page.

Include specific details to make the receipt clear and complete. The donor’s full name and contact information should be listed accurately. If the donation was in the form of goods, make sure to note the condition and general description of the items. This information is vital for tax reporting purposes.

Always thank the donor for their generosity and mention that no goods or services were provided in exchange for the donation. This will help maintain the nonprofit’s compliance with IRS rules for tax-exempt organizations. Be sure to add your nonprofit’s name and address for future reference. A well-crafted receipt not only serves a functional purpose but also strengthens the connection with your supporters.

Charitable Donations Receipt Template

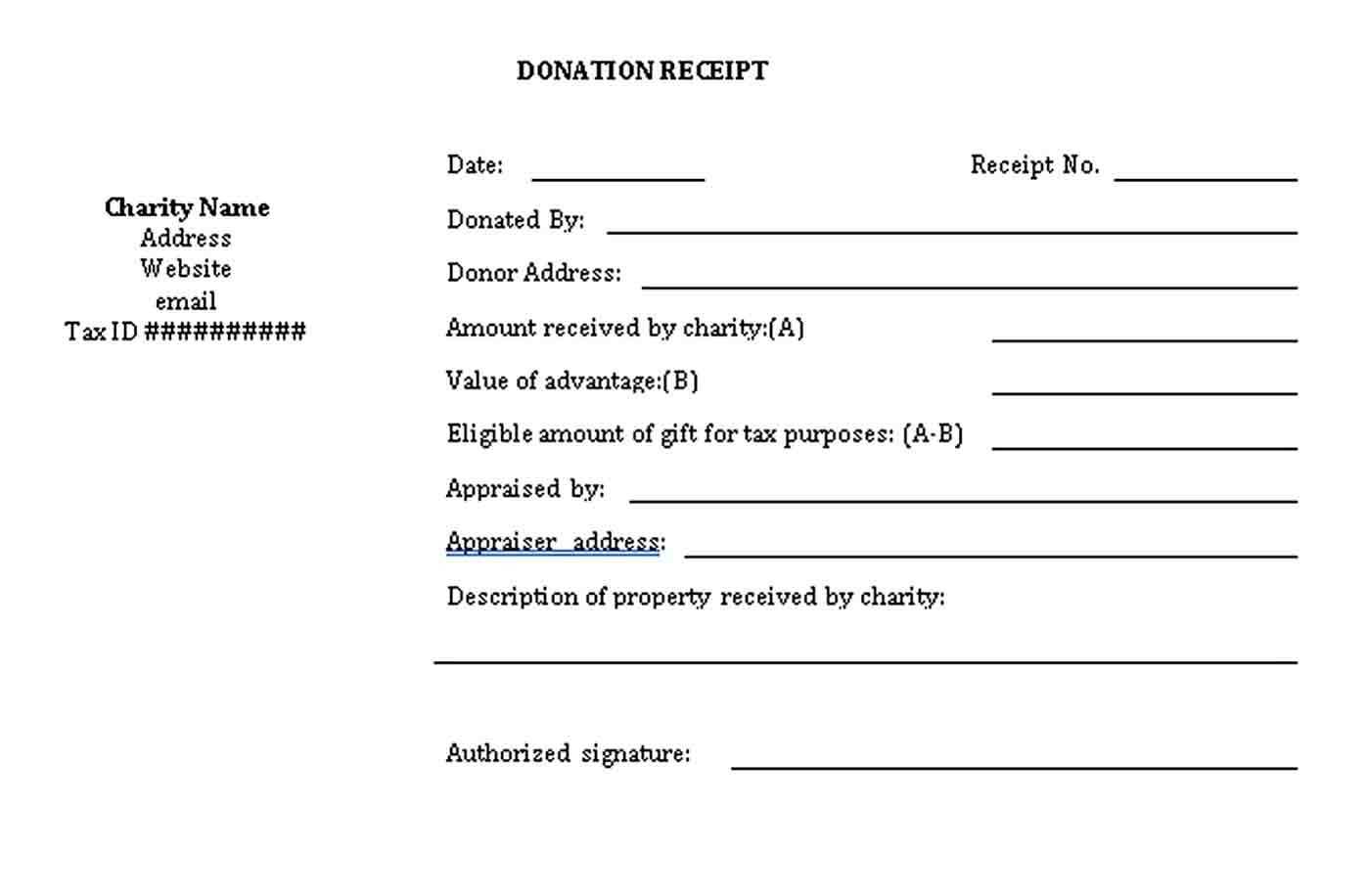

A clear and organized donation receipt ensures both the donor and charity are on the same page for tax reporting and record-keeping. Use the following details when crafting your charitable donation receipts:

Key Components of a Donation Receipt

- Charity’s Name and Address: Make sure to include the full legal name of the charity, as well as the physical address.

- Donor’s Information: Record the donor’s name and contact details, including their address. If they are a company, include the business name and contact info.

- Date of Donation: The exact date when the donation was made.

- Description of the Donation: Provide a brief description of what was donated (e.g., cash, goods, services). If goods or services were donated, include a general description rather than an estimated value.

- Estimated Value of Goods: If the donation consists of goods, list the fair market value (if available), but do not assign a value to donated services.

- Statement of Non-Compensation: A statement confirming the donor received no goods or services in exchange for the donation. This is crucial for tax purposes.

- Charity’s Tax Identification Number (TIN): For larger donations, include the charity’s TIN for easier identification by the IRS.

Template Example

- Charity’s Name

123 Charity Lane

City, State, ZIP

Tax ID: 12-3456789

- Donor’s Name

Donor’s Address

City, State, ZIP

- Date of Donation: MM/DD/YYYY

- Donation Description: $100 cash donation

- Value of Donation: $100

- Non-Compensation Statement: No goods or services were provided in exchange for this donation.

- Signature of Authorized Representative

Name of representative

Title

This template covers all required fields for a tax-deductible donation. Adjust it as needed based on the type and amount of donation received.

Creating a Simple Receipt for Monetary Contributions

Begin by clearly listing the organization’s name and contact details at the top. This ensures the donor knows who issued the receipt. Add the date of the contribution, followed by a unique receipt number for tracking purposes. Be precise about the amount donated, specifying whether it is a cash or check contribution.

Next, provide a brief description of the purpose of the donation. If applicable, mention any event or fund the donation is directed toward. For example, “Donation to support community outreach programs” makes it clear where the funds will go.

Include a statement confirming no goods or services were provided in exchange for the donation. This is necessary for tax purposes. A simple line like, “No goods or services were provided in exchange for this donation.” will suffice.

Finish with a thank-you message, acknowledging the donor’s contribution and the positive impact it has. This reinforces goodwill and encourages future support.

Incorporating Tax Deduction Information in Your Template

Include a clear section on your receipt indicating the donation’s eligibility for tax deduction. This should be a straightforward statement confirming that the donation is tax-deductible according to IRS rules (or the relevant tax authority in your region). Add a reminder that the donor should keep the receipt for their records. Ensure the donation amount is itemized and accurately reflects the donor’s contribution.

Include Donation Type and Amount

Specify whether the donation was cash, goods, or services. For non-cash donations, include a description of the items donated along with an estimated fair market value. Make sure the value is reasonable and consistent with current guidelines. This information will support the donor in claiming their tax deductions correctly.

Provide Your Organization’s Tax Identification Number

For transparency and tax purposes, list your organization’s tax ID number (EIN or equivalent). This allows the donor to verify that the organization is eligible to receive tax-deductible donations. Ensure that the number is clearly visible on the receipt.

Tip: Avoid including any wording that could suggest the donor will automatically receive a tax refund or tax benefits without confirming eligibility with their tax advisor.

Designing a Professional Layout for Donor Records

Focus on clarity and organization when creating a donor record layout. Use a grid-based design to ensure consistent alignment of information, making it easier for users to navigate. Divide the layout into clear sections, such as donor details, donation history, and receipt information. This structure will help prevent clutter and improve readability.

Utilize Clear Typography

Choose legible fonts with clear distinctions between headings, subheadings, and body text. Sans-serif fonts are a good option for a modern and clean look. Ensure sufficient spacing between lines and sections to improve overall readability. Avoid using too many font styles in one layout to maintain a professional appearance.

Highlight Key Information

Make the most important data, such as donation amount and donor name, stand out by using bold or larger text sizes. Use contrasting colors for headings and important figures to grab attention, but ensure these elements complement the overall design. The donor’s contribution should always be easy to find and understand at a glance.