To avoid misunderstandings and ensure transparency between landlords and tenants, creating a clear tenancy deposit receipt is a practical step. This document confirms the amount of the deposit paid and outlines the conditions for its return at the end of the lease. A well-structured receipt protects both parties by detailing the terms agreed upon at the start of the tenancy.

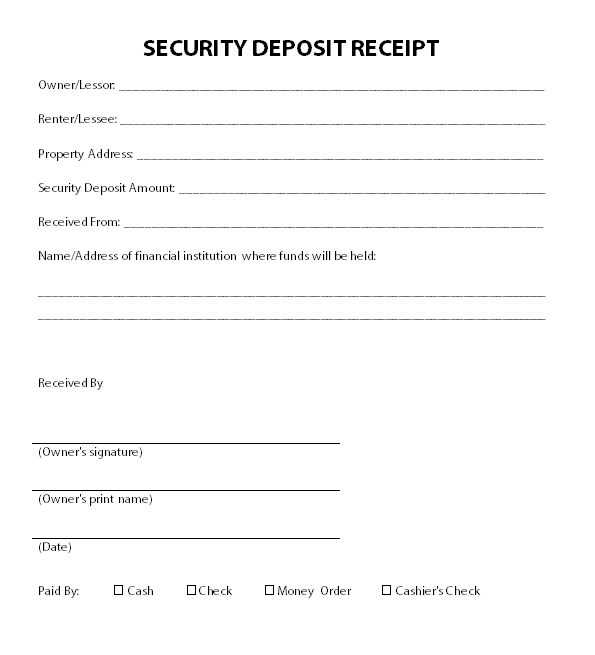

When crafting the receipt, include the tenant’s name, the rental property address, the amount of the deposit, and the date of payment. Make sure to specify whether the deposit is refundable and under what circumstances any deductions may occur, such as damage to property or unpaid rent. It’s also helpful to mention the process for returning the deposit once the tenancy concludes.

Having a properly documented tenancy deposit receipt can prevent disputes, ensuring both landlord and tenant are on the same page regarding expectations and responsibilities. The receipt serves as an official record and can be referred to in case of disagreement, making it an indispensable part of any rental agreement.

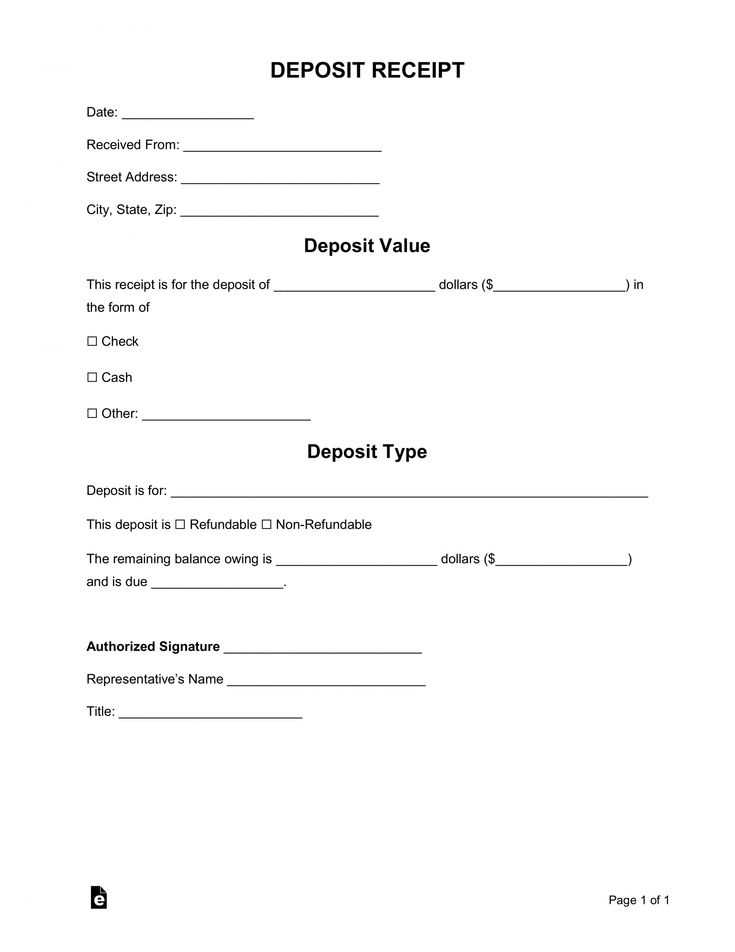

Tenancy Deposit Receipt Template

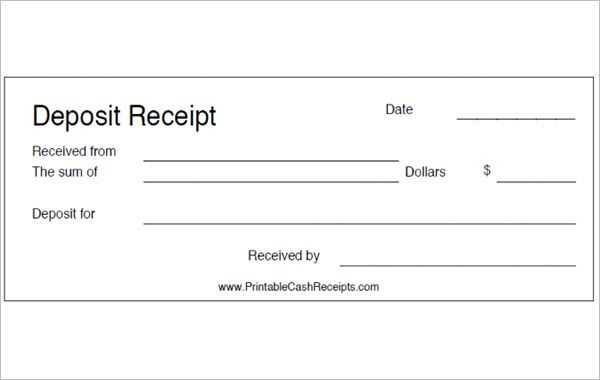

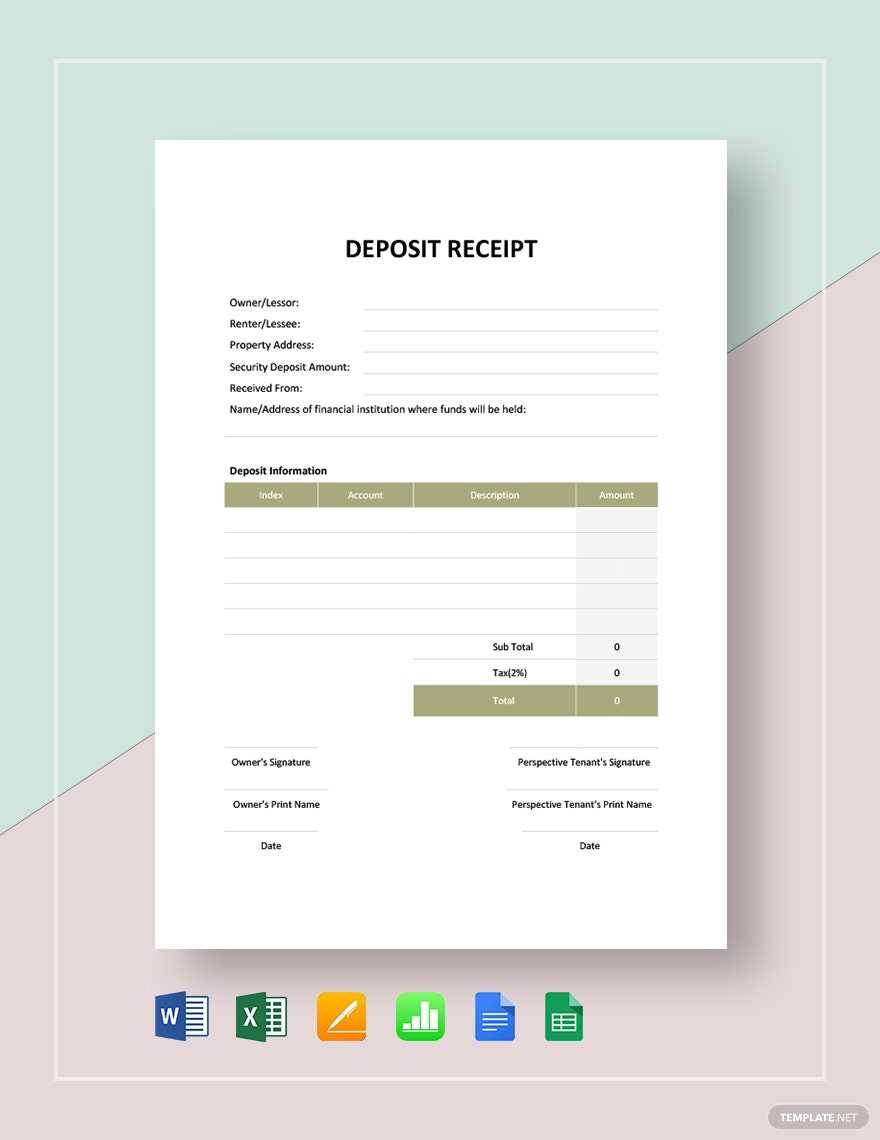

Provide a clear breakdown of the deposit received using this template. Ensure all details are accurate to avoid confusion or future disputes. Specify the amount of the deposit, the property address, and the date the payment was made. Include the tenant’s full name and any references or identification numbers that help link the receipt to the tenancy agreement.

Key Details to Include

Clearly list the total deposit amount. Mention whether the deposit is fully refundable or subject to any deductions, based on the condition of the property at the end of the tenancy. State the terms for refunding the deposit, such as timeframes or conditions for its return after the tenancy concludes.

Legal Compliance

Ensure the receipt complies with local legislation regarding tenancy deposits. If the deposit is protected in a government-backed scheme, include details of the scheme and any necessary registration information. This will give both parties assurance that the deposit is handled in accordance with the law.

How to Draft a Legally Compliant Tenancy Deposit Receipt

Include the full names and addresses of both the landlord and tenant at the top of the document. Clearly state the amount of the deposit paid, along with the date it was received. Ensure the receipt specifies the property address and the duration of the tenancy.

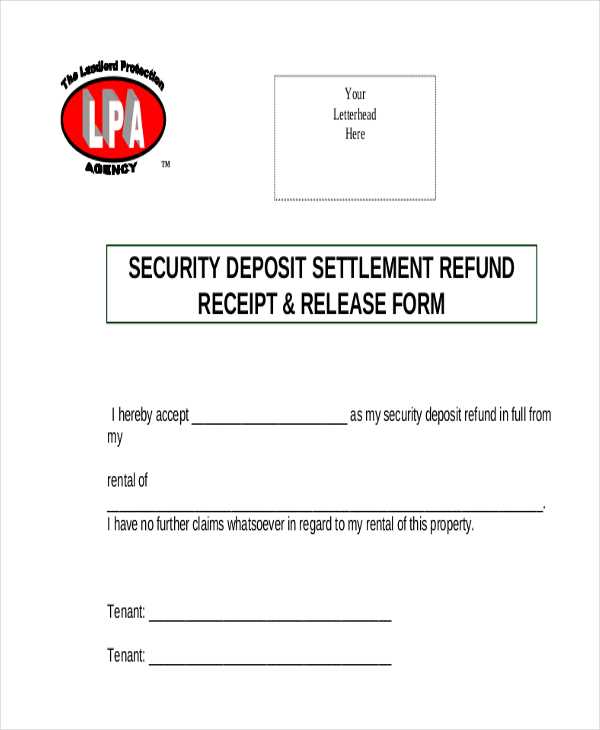

Describe the conditions under which the deposit may be withheld, such as damages or unpaid rent. Mention the specific terms under which the deposit will be returned, along with any deductions. If applicable, note the third-party deposit protection scheme where the deposit is held.

Include a statement confirming that the deposit will be returned within the legally required timeframe, often within 10 days of the tenancy’s end. Ensure the receipt is signed by both parties to validate the transaction.

Customizing the Template for Different Types of Tenancies

Adjust the tenancy deposit receipt template based on the specifics of the rental agreement. For fixed-term tenancies, ensure the start and end dates are clearly stated. Include details about the renewal process if the lease is expected to transition into another term.

For periodic tenancies, where the rental agreement rolls over after a set period, specify the notice period for either party to terminate the tenancy. Include the rent payment frequency, whether weekly, monthly, or quarterly.

For shared tenancies, such as those with multiple tenants, make it clear who is responsible for the deposit and how it will be distributed at the end of the lease. Include the agreement on what happens if any of the tenants leave before the tenancy ends.

For student tenancies, highlight any clauses related to early termination or conditions specific to students, like a guarantor requirement or restrictions on subletting. Adapt the template to reflect these terms to avoid misunderstandings later.

Always align the receipt with local legislation to avoid disputes, especially regarding deposit protection schemes or return timelines. Update the template as needed to comply with changes in tenancy laws.

Practical Considerations When Issuing a Tenancy Deposit Receipt

Clearly outline the terms of the deposit in the receipt. Specify the amount paid, the date of payment, and the reason for the deposit. This ensures both parties understand the purpose and amount involved. Be specific about whether the deposit is refundable or non-refundable, and under what circumstances it can be withheld or returned.

Provide an itemized list of conditions for refunding the deposit. Include details such as the condition of the property at the end of the tenancy and any deductions for damages, cleaning, or unpaid rent. This transparency avoids confusion later on.

- State the method of deposit return (e.g., bank transfer, cheque) and any time frame for repayment after tenancy ends.

- List any fees or charges that may apply, such as those for repairs or unpaid utilities, and explain how these will be deducted from the deposit.

Include both tenant and landlord names, as well as contact information for easy communication. This helps resolve any disputes quickly and efficiently. A receipt signed by both parties can prevent disagreements about the terms of the deposit and its return.

Keep a copy of the receipt for your records. This protects both the landlord and tenant if any issues arise, providing evidence of the agreed terms. Consider storing this document digitally for easy access in case of future disputes.

Be mindful of local regulations when drafting the receipt. Many areas have specific rules about deposit amounts, returns, and documentation requirements. Ensure your receipt complies with the applicable laws to avoid legal complications.