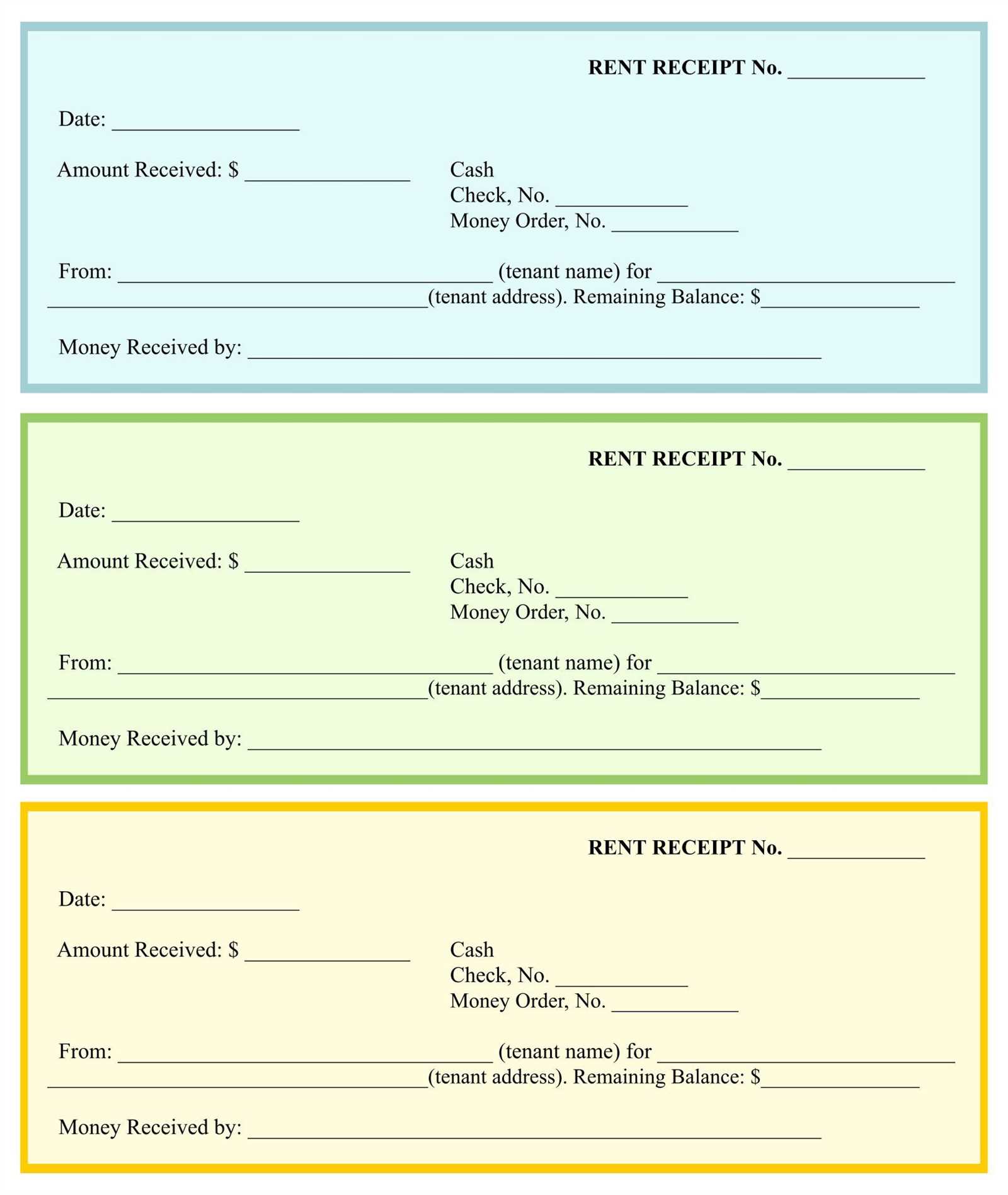

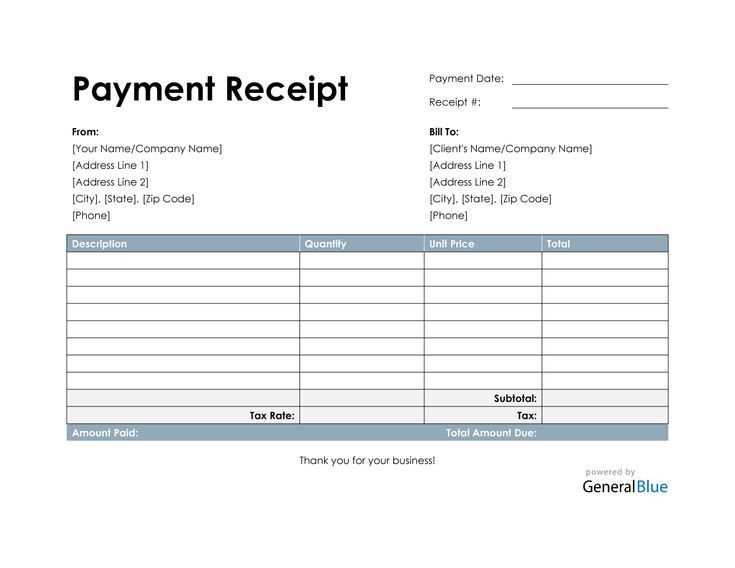

Creating a partial payment receipt is a straightforward task that ensures both parties–buyer and seller–have a clear record of payments made for a product or service. Use this template to document any amount received toward a total balance, whether it’s a down payment, installment, or part of a larger sum.

The receipt should include the transaction date, the amount paid, and the remaining balance. Be sure to specify what the payment is for, whether it’s a deposit, partial payment, or a partial settlement of an outstanding debt. This helps avoid confusion down the line and provides a clear trail for both parties involved.

To ensure accuracy, list the total amount due, the amount received, and the balance remaining. Include transaction details such as payment method–whether it’s cash, credit, or another form–and add a note if the payment applies to a larger contract or agreement. Keeping these details updated in the receipt is key for proper record-keeping and legal purposes.

Here are the corrected lines without word repetitions:

For clarity and accuracy in your partial payment receipt, avoid repeating terms unnecessarily. Be concise and straightforward. For example, instead of writing “The total amount remaining balance is,” use “Remaining balance.” This simplifies the sentence and removes redundancy.

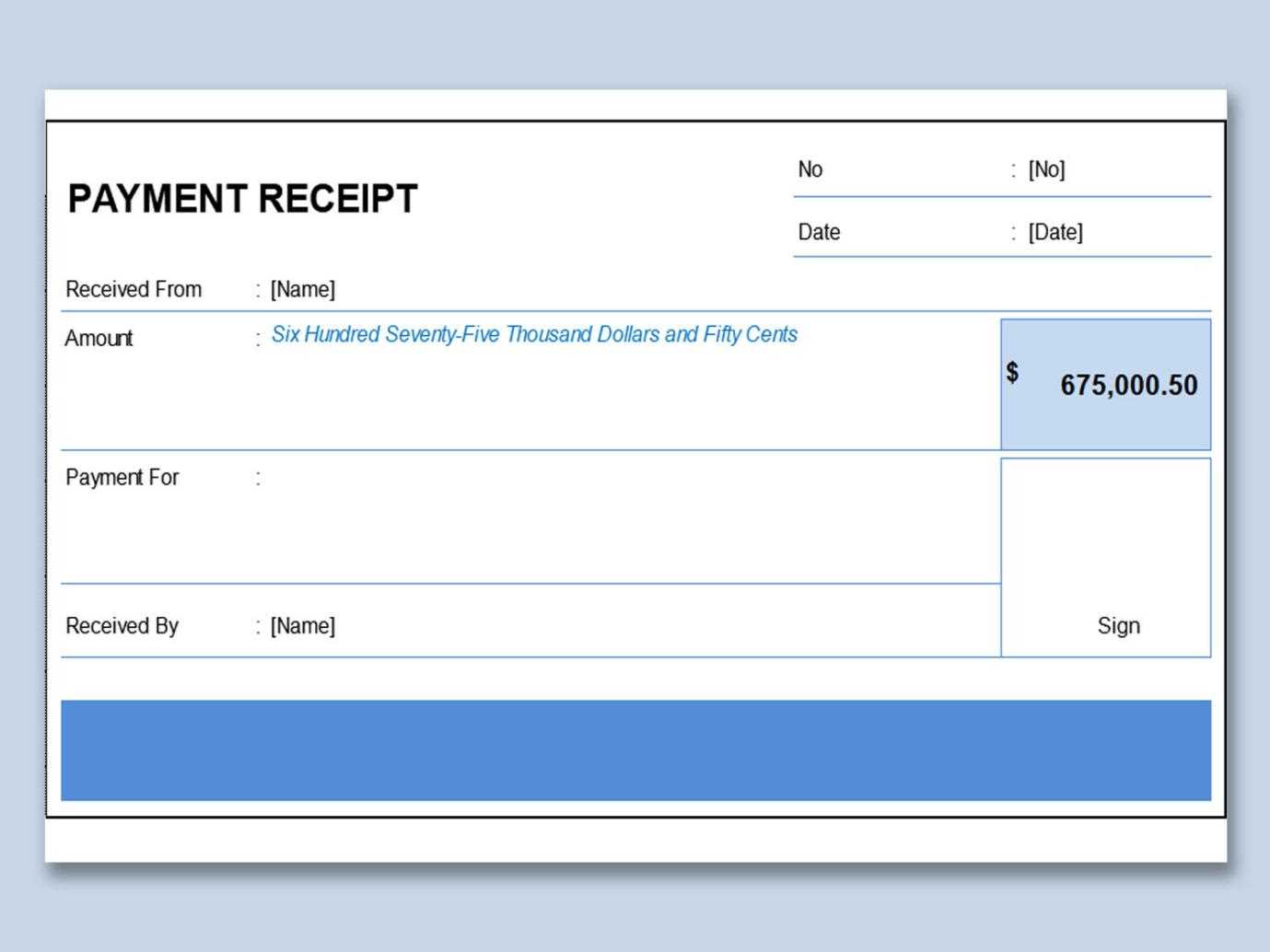

When noting the payment amount, ensure that both figures and words match. For instance, write “Paid amount: $100” rather than “Paid amount of $100 amount.” This ensures consistency and readability.

If you reference previous payments, specify the amount without repetition. For example, instead of “Previous payment amount was $50 paid,” simply write “Previous payment: $50.” This streamlines the text, making it clearer.

Tip: Always double-check your document for terms that are unnecessarily repeated and revise them. It reduces confusion and makes the receipt more professional.

- Detailed Guide on Partial Payment Receipt Template

Ensure that your partial payment receipt is clear and contains all necessary details to avoid confusion later. The document should outline the total amount due, the amount paid, and the outstanding balance. This ensures transparency for both the payer and the receiver, helping maintain a smooth transaction history.

Key Elements of a Partial Payment Receipt

Each receipt should include these details for clarity:

- Receipt Number – A unique identifier for reference.

- Payment Date – The date when the payment was made.

- Payer’s Information – The name and contact details of the person or entity making the payment.

- Amount Paid – The specific amount received on that date.

- Remaining Balance – The remaining amount due after the partial payment.

- Payment Method – Specify how the payment was made (e.g., credit card, cash, bank transfer).

- Service/Product Details – Clear reference to the goods or services the payment is associated with.

- Signature or Acknowledgment – A space for either a physical or digital signature, acknowledging the receipt of the partial payment.

Formatting Tips for a Clear Template

Formatting plays a major role in making sure the receipt is readable. Use a simple and professional layout with the following tips:

- Include headers to separate sections of the receipt.

- Bold key terms like “Amount Paid” and “Remaining Balance” for emphasis.

- Ensure the font size is readable, especially for amounts and important details.

- Use tables if needed to clearly show the payment breakdown and balance left.

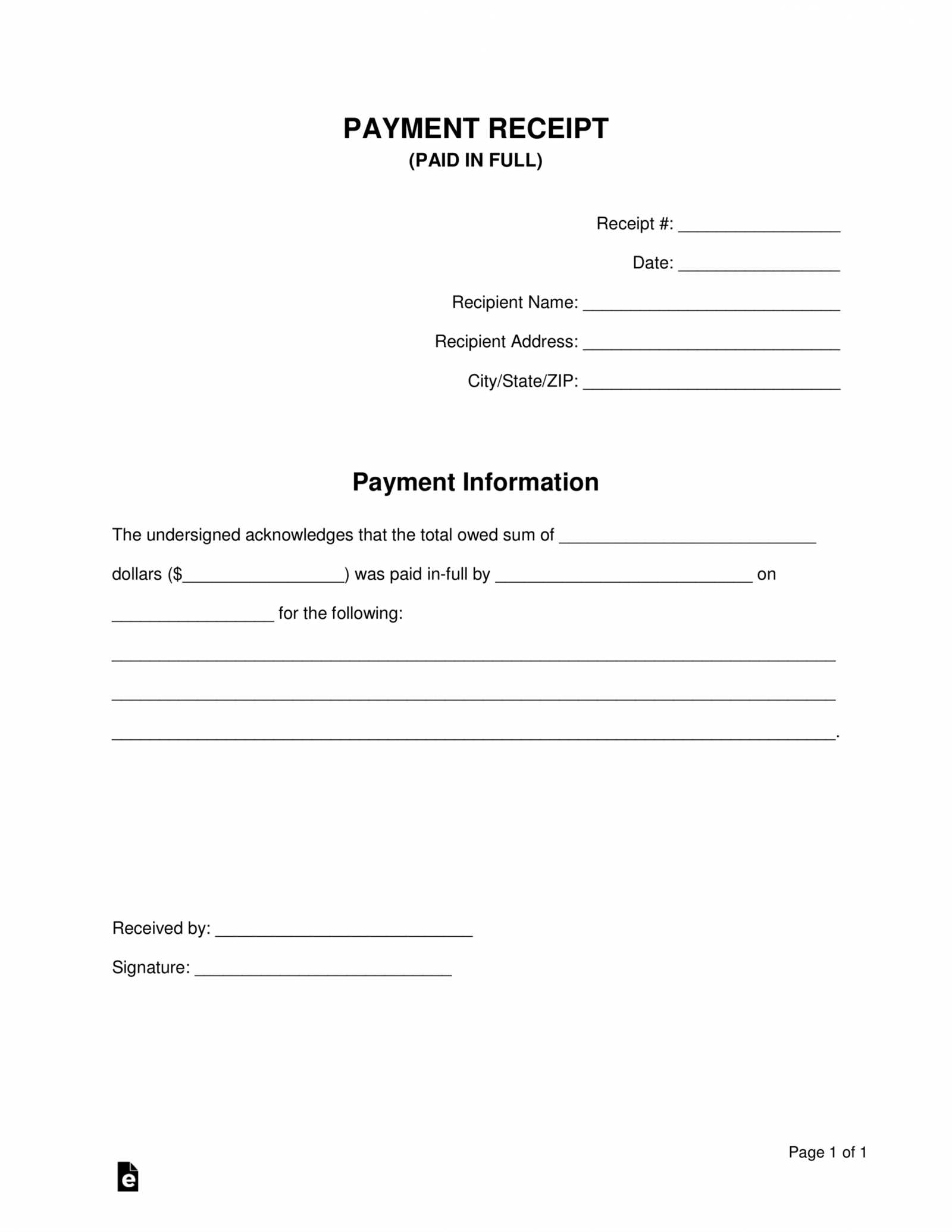

Ensure the header clearly labels the document as a “Partial Payment Receipt.” This immediately indicates the purpose of the document to both the payer and the payee.

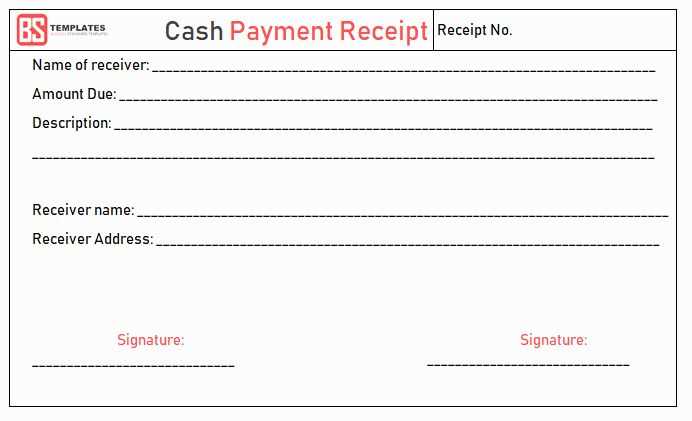

Include Basic Transaction Details

Provide specific information about the transaction, including the invoice number, date of partial payment, and the payer’s contact details. These basic identifiers help track payments and avoid confusion later.

Breakdown of Payments

List the total amount due, the partial payment made, and the remaining balance. Specify the method of payment (cash, credit, or bank transfer) and any reference number associated with the payment. This breakdown adds clarity and makes it easier to reconcile the account.

Always include a payment date and, if applicable, the next payment due date. This keeps all parties informed about future obligations.

Ensure all partial payments are clearly documented, specifying the amount paid, remaining balance, and due dates for any future payments. The agreement should clearly outline the terms of the partial payment, such as interest rates (if applicable) and any penalties for delayed payments. Both parties must sign the document to indicate mutual consent. If required by local laws, include relevant payment terms and refund policies. Record the date of the payment and any other details that may be relevant to future reference or disputes. Keep a copy of the signed agreement and the payment receipt for legal protection.

Accurate information on a payment receipt is key to maintaining clear communication and trust. Below are some critical errors to avoid:

- Incorrect Payment Amount: Double-check the amount written in both figures and words to prevent confusion or disputes.

- Missing Transaction Date: Always include the exact date the payment was made, as this provides a record for both parties.

- Omitting Payment Method: Clarify whether the payment was made in cash, by check, or via electronic transfer.

- Unclear Item Descriptions: Be specific about what the payment is for, including any applicable services or products.

- Failure to Include Receipt Number: Assign a unique receipt number to each transaction to make tracking easier for both parties.

- Missing Contact Information: Always provide your full contact details to allow for easy follow-up if needed.

- Not Providing Enough Space for Additional Notes: Include space for special remarks or references, in case more details are required later.

Avoiding these mistakes helps ensure that both the payer and the recipient have a clear, accurate, and traceable record of the payment.

Include the partial payment details in your receipt with clear line items for transparency. Start by listing the total amount due for the product or service, followed by the amount received so far. Include the outstanding balance, showing the amount remaining to be paid. Clearly state the date of payment and, if applicable, the due date for the next installment.

Payment Breakdown

List individual payments made, specifying the amount and date for each. This helps avoid confusion for both parties. For example, if the payment is split across multiple dates, break down each portion with clarity. Ensure that the balance remaining is easily understood, and always confirm any terms related to future payments, such as late fees or interest charges.

Final Confirmation

Close the receipt with a section for acknowledgment. The buyer should be able to sign or confirm that the details are correct, offering a space for both the recipient and payer to verify the record. This helps prevent disputes and ensures both parties are on the same page regarding the partial payment agreement.