It seems like you’re working on a lot of content related to pinouts and technical configurations. How’s everything coming along with your articles? If you need any help with formatting or structuring specific sections, I’m happy to help!

Non Profit Fundraiser Sale Donation Receipt Template

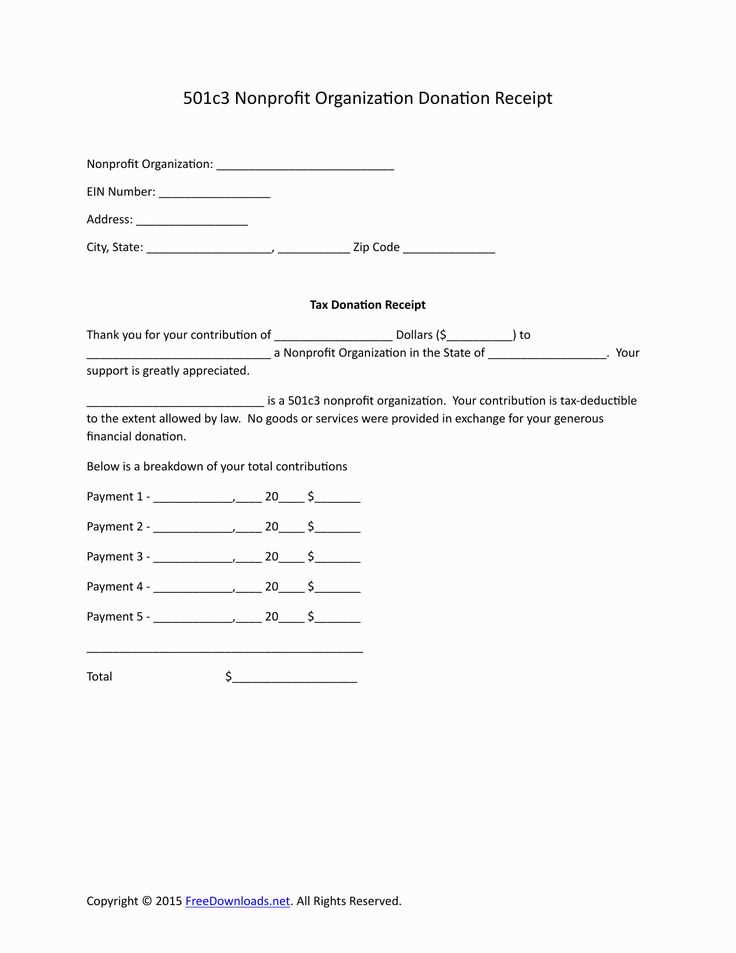

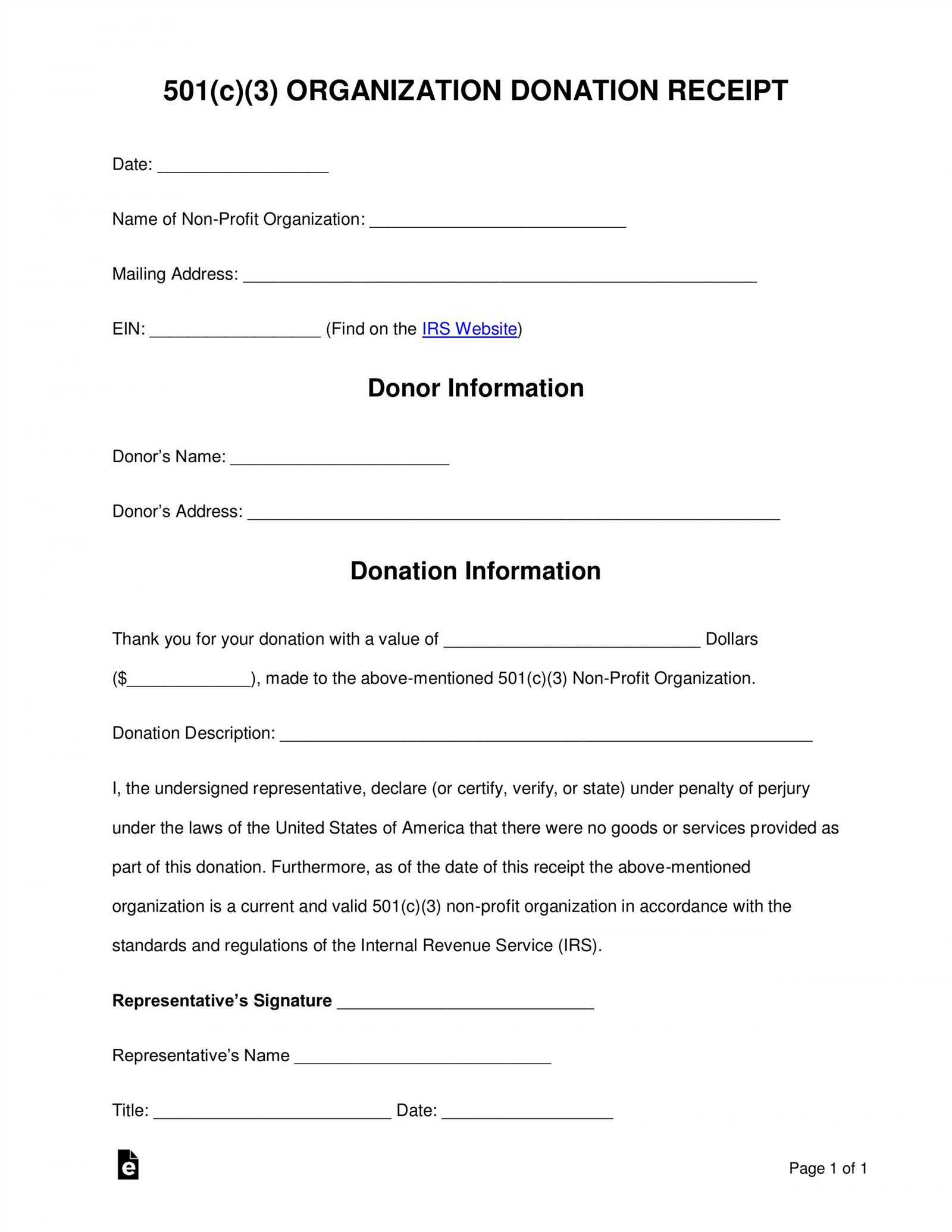

A well-structured donation receipt is key for maintaining transparency and ensuring donors receive the necessary documentation for tax purposes. A non-profit fundraiser sale donation receipt should include the donor’s details, the value of the donation, and the acknowledgment of goods or services provided in exchange for the donation.

Key Elements to Include:

- Non-Profit’s Name and Contact Information: Ensure that your organization’s name, address, and phone number are clearly visible at the top.

- Donor’s Information: List the name, address, and contact details of the donor.

- Date of Donation: Record the exact date when the donation was made.

- Description of the Donation: Provide a detailed description of the items or services donated. Be specific about the nature of the items or any merchandise exchanged.

- Value of the Donation: If applicable, include the fair market value of the donated goods or services. This helps the donor determine their tax deduction.

- Acknowledgment of No Goods or Services in Return: If no goods or services were received, make this clear. This is important for the donor’s tax claim.

- Signature and Title: Include a signature line for an authorized person from the non-profit organization to validate the receipt.

Example Format:

Organization Name: [Insert Organization Name]

Organization Address: [Insert Organization Address]

Organization Phone: [Insert Organization Phone Number]

Tax ID Number: [Insert Tax ID Number]

Donation Receipt

Donor’s Name: [Insert Donor Name]

Donor’s Address: [Insert Donor Address]

Date of Donation: [Insert Date]

Donation Description: [Insert a detailed description of the donated goods or services]

Estimated Value: [Insert the fair market value or state if the value is not applicable]

Acknowledgment: No goods or services were provided in return for this donation.

Authorized Signature: _______________________

Title: [Insert Title]

Date: [Insert Date]

Customize this template to fit your organization’s specific needs, ensuring that all relevant details are included for both transparency and proper record-keeping. Make sure your donors feel appreciated and informed about their contributions.

How to Design a Clear Donation Receipt Template for Fundraisers

A clear donation receipt template should make it easy for donors to understand their contributions and for nonprofits to stay organized. Keep it simple, well-structured, and legally compliant.

1. Include Basic Donation Information

- Donor’s Name: Include the name of the donor or the organization making the donation.

- Donation Amount: Clearly specify the total donation amount or description of in-kind donations.

- Donation Date: State the exact date the donation was received.

- Nonprofit’s Information: Provide the legal name, address, and tax identification number (TIN) of your nonprofit.

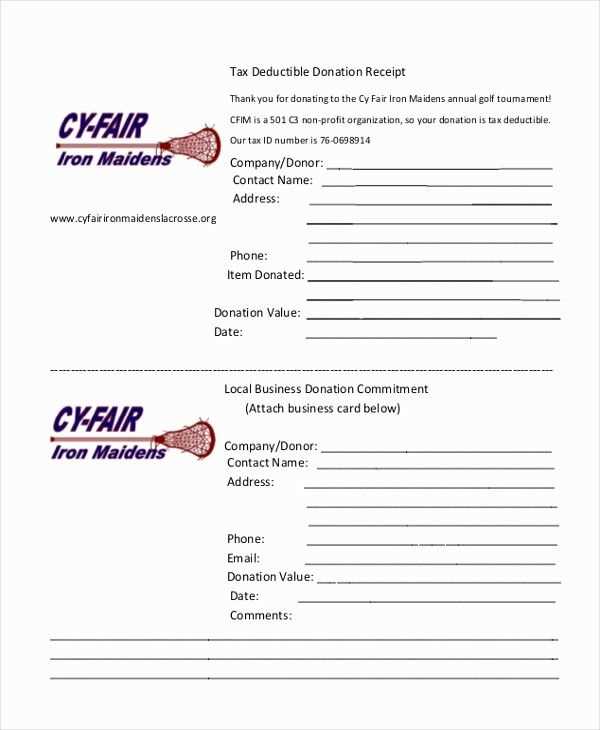

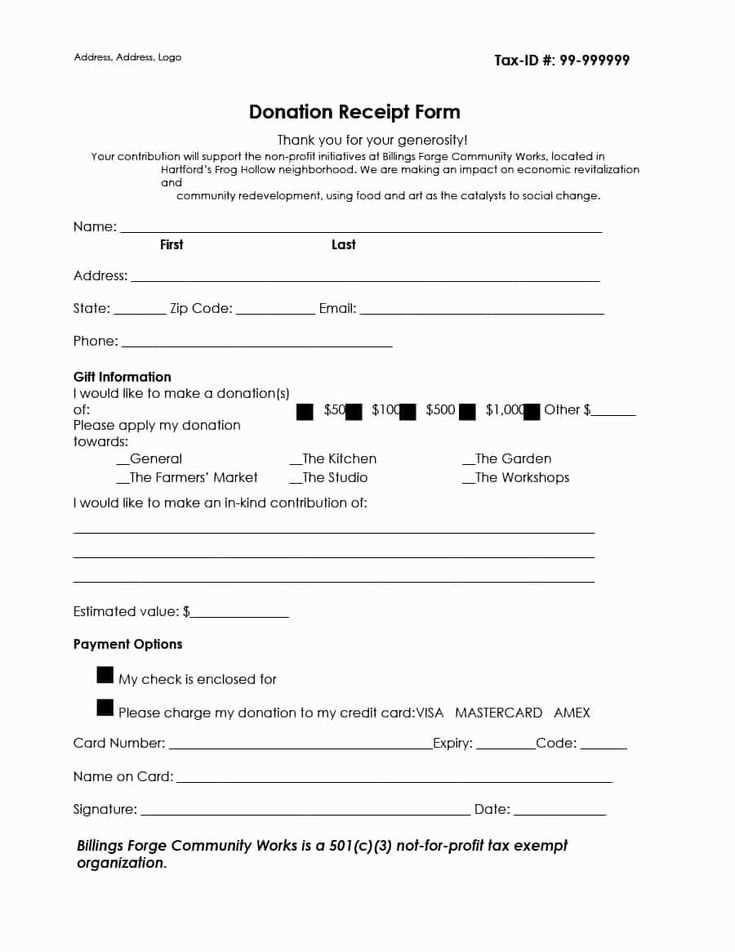

2. Acknowledge Any Goods or Services Provided

If your nonprofit offers something in return, such as event tickets or gifts, indicate the fair market value of those goods or services. Only the portion of the donation exceeding this value is tax-deductible.

- Goods/Services: List what was provided, if applicable.

- Value: Include the estimated fair market value of any goods/services received.

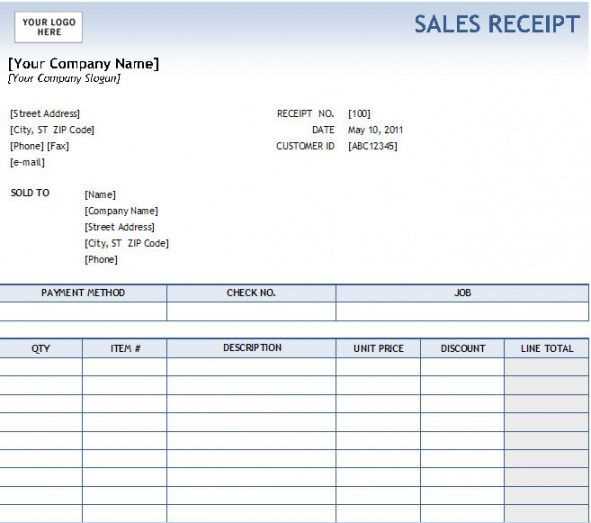

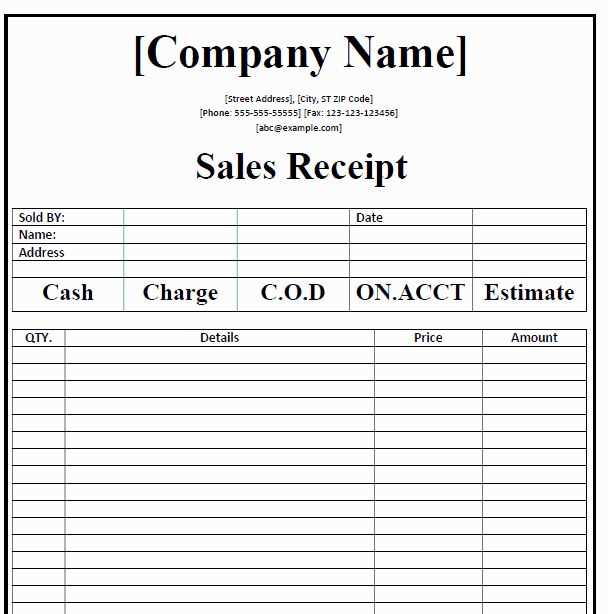

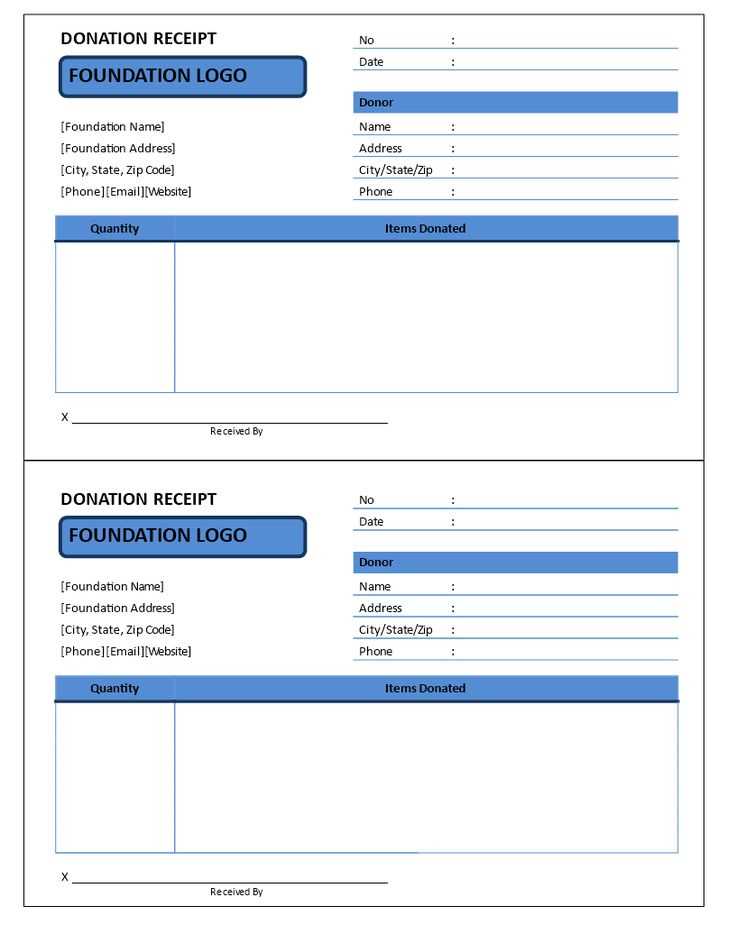

3. Make the Receipt Legible and Professional

- Readable Fonts: Use simple, easy-to-read fonts and make sure all important information stands out.

- Organized Layout: Use clear sections to separate donation details, nonprofit information, and any acknowledgment of goods or services.

- Branding: Include your organization’s logo and colors to make the receipt feel official.

Legal Requirements for Donation Receipts in Fundraisers

Donation receipts must include specific information to comply with legal standards. Ensure the donor’s name, address, and donation amount are clearly listed. If the donation involves goods or services, state their fair market value and indicate the amount that is tax-deductible.

Nonprofits must provide a written acknowledgment for any donation of $250 or more. This should include a statement that no goods or services were provided in exchange for the donation, or if they were, a description and estimated value of those goods or services.

If a donor receives goods or services in exchange for a donation, the receipt must also state that the deductible portion of the donation is reduced by the value of those goods or services. Nonprofits should provide these receipts by January 31 of the following year for donations made during the previous calendar year.

Additionally, ensure the nonprofit’s tax-exempt status is clearly noted, typically through an IRS-recognized organization number. This gives the donor the assurance that their contribution is eligible for tax deductions.

How to Integrate Customizable Fields for Different Fundraising Events

To tailor donation receipts for various events, create fields that can be adjusted according to each fundraiser’s needs. First, offer options for event names and dates. This allows receipts to reflect the specific fundraiser details. For example, a gala might include the event title, whereas a charity walk will need to show different information like location and distance covered.

Dynamic Fields for Donor Information

Include fields where donors can input specific information, such as donation amounts or whether they provided an item for auction. For flexibility, ensure these fields allow donors to add details, such as the type of item donated or any special instructions for the donation. By integrating these custom fields, you can easily track contributions and offer personalized receipts that reflect each donor’s support.

Event-Specific Customization

Allow customization based on the type of fundraiser. For a silent auction, include a field for item descriptions and bid amounts. If the event is a raffle, incorporate a section for ticket numbers and prizes. Adjust the layout and content dynamically based on event type to ensure the receipt includes all relevant details for donors, making each one specific to the fundraiser they supported.