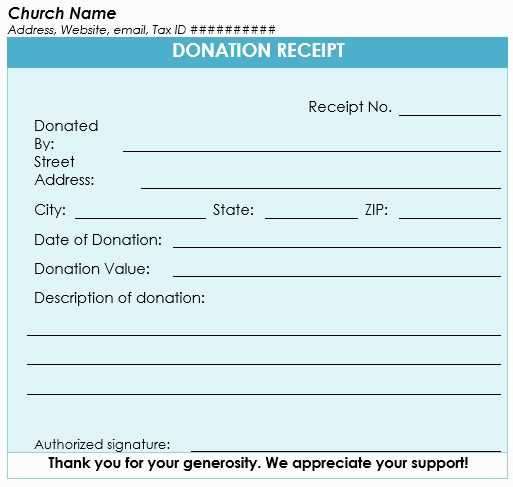

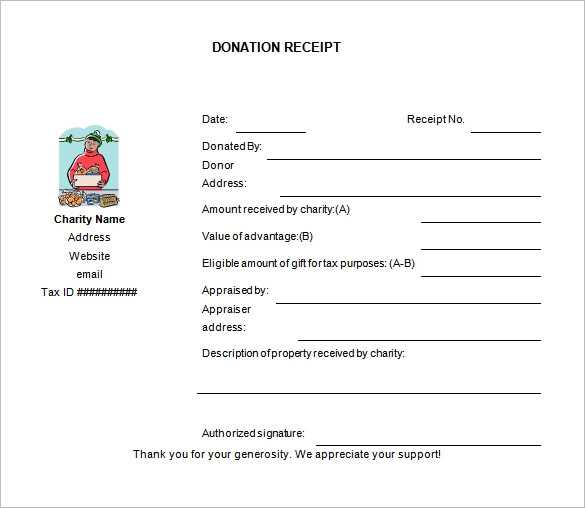

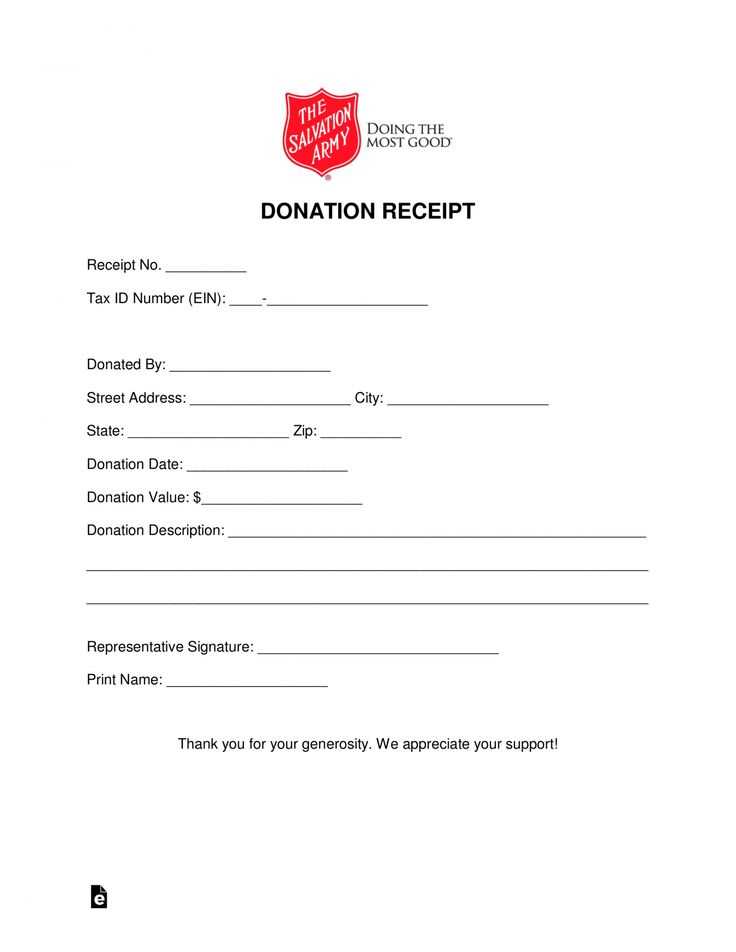

Download a free and customizable donation receipt template for the Salvation Army to streamline the process of acknowledging contributions. This template provides the necessary fields to document the donor’s name, donation amount, and date, ensuring everything is clearly recorded for tax purposes.

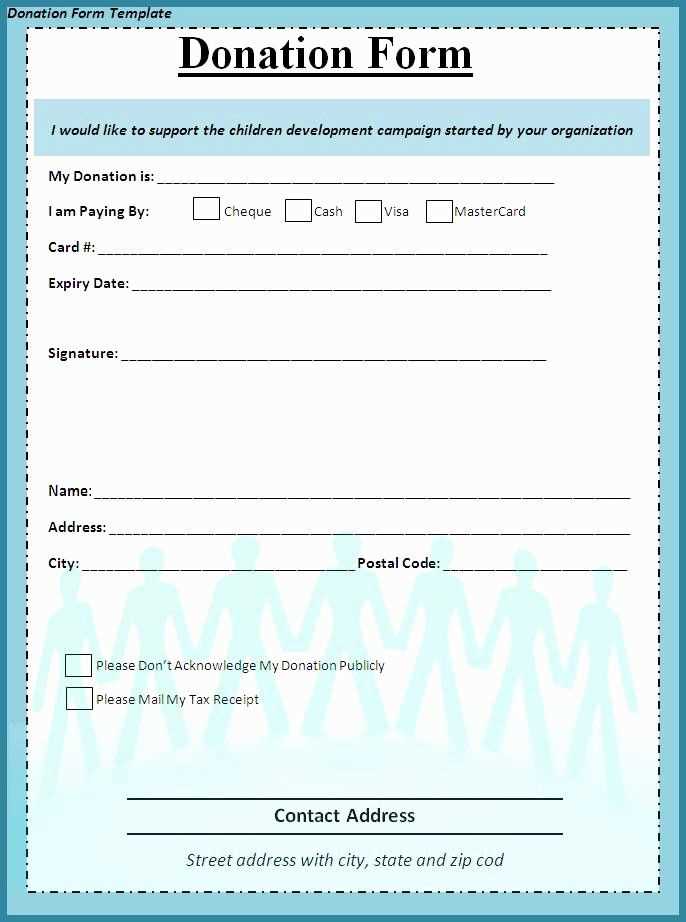

Use the template to issue professional receipts quickly. Simply fill in the required details, print, and distribute them to your donors. The template complies with IRS guidelines, offering the transparency your donors need for their tax deductions. Whether you are handling a small or large-scale donation drive, this template simplifies the receipt process.

Save time and avoid errors with this ready-made template. Its straightforward layout makes it easy to use and provides all the information needed for both the donor and the Salvation Army’s record-keeping. Personalize the template with your organization’s logo for a more professional look, and you’re set to go!

Here’s a refined version with minimal repetition of words:

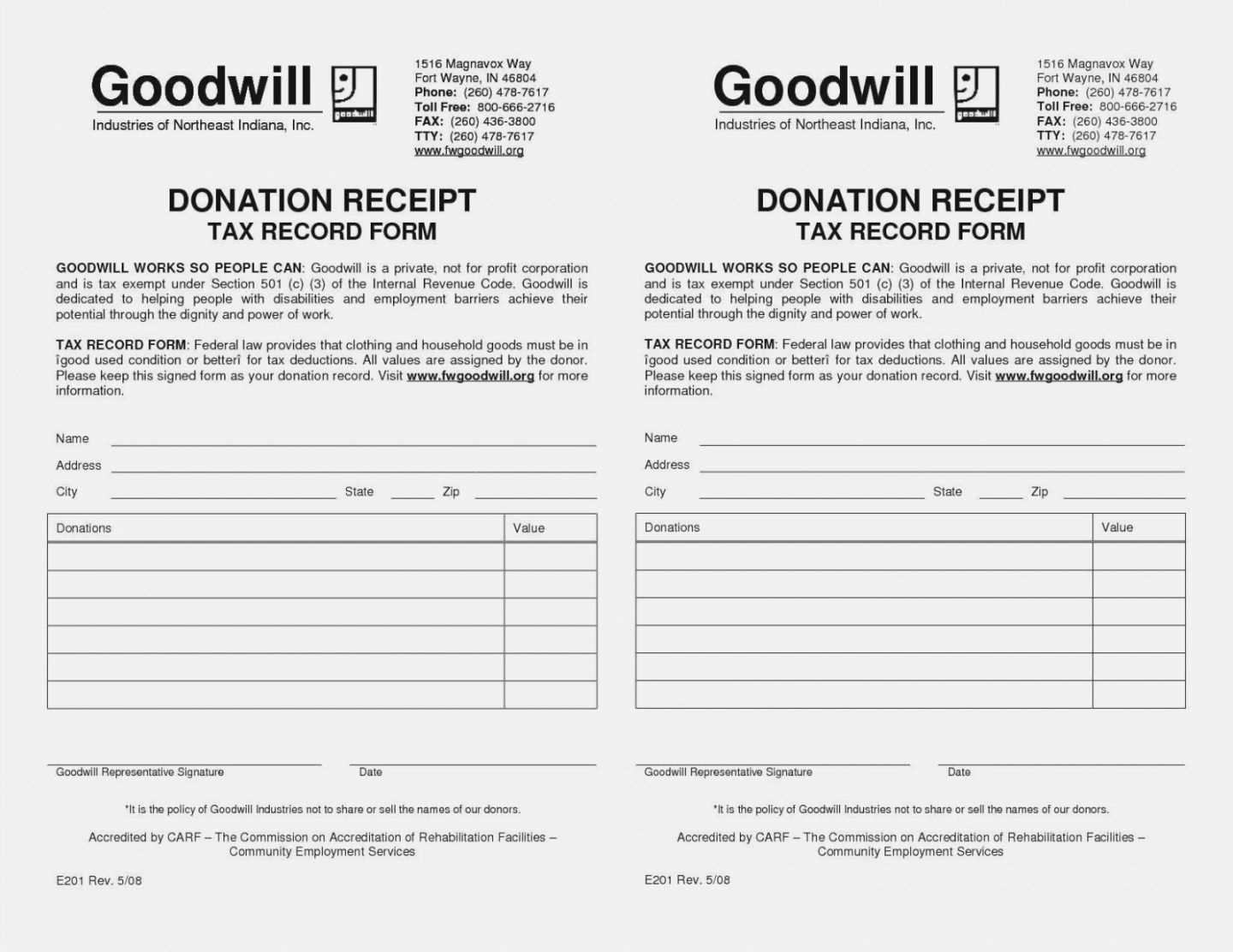

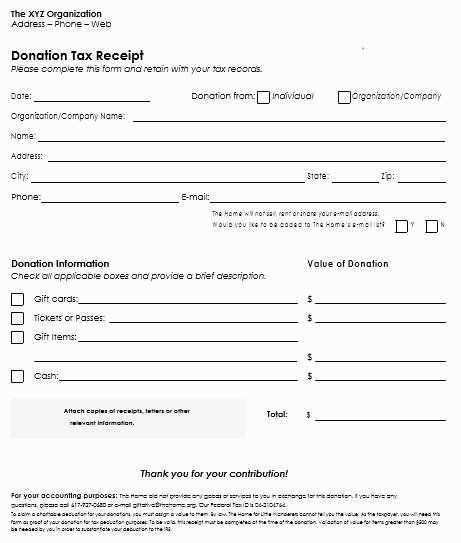

To create a clean, professional donation receipt for The Salvation Army, ensure the document includes essential details like the donor’s name, the donation amount, and the date of the transaction. Clearly state that the gift is tax-deductible, and specify whether it was a monetary or in-kind donation. Avoid lengthy explanations and keep the wording straightforward.

Donation Details

List the donation items or amounts precisely. If it’s an in-kind donation, provide a brief description of the goods and their estimated fair market value. If the donation is monetary, specify the total contribution. Include a section for the donor’s signature and the organization’s authorized representative to confirm the transaction.

Tax Information

Make it clear that The Salvation Army is a tax-exempt organization and that the receipt can be used for tax purposes. Include the tax-exempt number of the organization for reference. Ensure all details are accurate to maintain transparency and avoid any confusion for the donor.

- Free Donation Receipt Template for the Salvation Army

If you need a donation receipt for your gift to the Salvation Army, here’s a simple template that covers all the necessary details. Customize it for each donation to keep your records up to date and ensure proper documentation for tax purposes.

Template Components

- Donor Information: Full name, address, and contact information of the donor.

- Donation Details: Description of the donated items, their estimated value, and any specific conditions (if applicable).

- Salvation Army Information: Name of the organization, address, and tax identification number (TIN).

- Date of Donation: Date when the donation was made or received.

- Confirmation Statement: A brief confirmation that no goods or services were provided in exchange for the donation.

Using the Template

Fill out the sections with accurate details. For each donation, make sure to update the values and add any specific information related to the donor’s contribution. You can print and hand over the receipt to the donor or send it digitally for convenience.

Visit the official Salvation Army website or other trusted charity sites offering donation receipt templates. Most of these sites provide downloadable versions in Word or PDF formats.

- Search for “donation receipt template” in the site’s search bar or navigate to the donation page.

- Look for options labeled as “free templates” or “donation receipt templates.” These are typically offered in downloadable formats for quick access.

- Once you find the template, click the download link. The file will either download automatically or prompt you to save it to your computer or cloud storage.

After downloading, open the file and customize it with your specific donation details, such as the donor’s name, donation amount, and date. Save the completed document to print or send electronically.

Tailor your donation receipt template to match the specifics of your organization and donor preferences. Begin by including your organization’s name, logo, and contact details at the top of the receipt. This ensures that donors can easily identify your charity and reach out if needed.

Donation Details

Clearly state the type of donation (monetary or in-kind) along with the amount or estimated value. For in-kind donations, include a brief description of the item(s) received. Specify whether the donation is tax-deductible and the fair market value, as this information is necessary for the donor’s records.

Personalized Messages

Add a thank-you note to show appreciation for the donor’s support. Personalizing the message by including the donor’s name and donation date helps build rapport and fosters future contributions.

Customize the template with specific wording that aligns with your organization’s mission and tone. Whether formal or casual, your receipt should reflect your charity’s voice.

Include the name of the donor, along with their address and contact details. This information helps ensure that the donation is properly attributed to the correct individual or entity. Provide a description of the donated items, including their general condition, as well as an estimated value for each item. This is required for tax purposes and assures transparency in the process.

Donation Details

The receipt must specify the date of the donation, making it clear when the transaction took place. It’s also beneficial to include the method of donation, whether in the form of goods, money, or services. If a monetary donation was made, the exact amount should be recorded.

Salvation Army Information

Clearly state the name of the Salvation Army branch or location receiving the donation. Include the organization’s official contact details and tax-exempt status. This ensures that the donor can verify the legitimacy of the receipt for their tax records.

The Salvation Army donation receipt template can significantly simplify the process of claiming tax deductions. When you make a donation, ensure that the receipt includes specific details such as the donor’s name, donation date, and description of items donated. These details are crucial for the IRS to accept your claim. Accurate documentation increases your chances of a successful deduction claim and ensures that you comply with tax requirements.

Key Information Required on the Receipt

For the donation receipt to be valid for tax deductions, the following elements must be included:

| Information | Why It Matters |

|---|---|

| Donor’s name and address | Verifies the person making the donation. |

| Date of donation | Establishes the time frame for your tax claim. |

| Description of the donated items | Ensures proper evaluation of the item’s value. |

| Estimated value of donated items (if applicable) | Used to calculate the total donation for tax purposes. |

| Salvation Army’s name and address | Verifies the recipient of your donation. |

Tips for Maximizing Your Tax Deduction

To maximize your tax deductions, keep a record of all donations and receipts. For non-cash donations, it’s helpful to get an appraisal for higher-value items. If you’re unsure about the value of donated goods, consider researching similar items or using online valuation tools. Accurate records and well-documented receipts ensure you meet IRS requirements and avoid audit issues.

The Salvation Army provides clear guidelines for issuing donation receipts to ensure transparency and compliance with tax regulations. Donors must receive a written acknowledgment for their contributions, especially for items or cash valued at $250 or more. The receipt should detail the name of the donor, the date of donation, and the description of the items or monetary value donated. It’s important to avoid assigning a monetary value to non-cash donations, as the donor is responsible for estimating the worth of the items themselves.

Guidelines for Non-Cash Donations

For non-cash donations, the Salvation Army includes a description of the items received, but they refrain from providing any value. The IRS requires that donors who claim a deduction for non-cash gifts over $500 must complete additional forms. The Salvation Army offers a donation receipt that meets the IRS’ minimum requirements, but it is up to the donor to determine the fair market value of the donated goods.

Cash Donations and Acknowledgment

For cash donations, the Salvation Army must acknowledge the donation and provide a receipt that specifies the amount donated and the date. Donors are advised to keep a record of all receipts to support their tax filings. If a donor contributes $250 or more in cash, the receipt should also state whether any goods or services were provided in exchange for the donation.

Accurately listing the donated items is a key step. Failing to provide a detailed description, such as not specifying the quantity or condition of the items, can cause confusion later.

Don’t forget to include the donation date. Omitting the exact date of the donation is a frequent error that can cause issues with tax deductions or auditing. The date ensures that the transaction is recorded properly.

Ensure the donor’s information is clear and correct. Missing or incorrect donor names, addresses, or contact details make it hard to verify the receipt.

Another mistake is not providing a total value of the donation. Always include a reasonable estimate of the donated items’ value, especially when the donation is made in goods.

Never skip including the name of the organization. It’s essential to clearly identify the charity receiving the donation, in this case, the Salvation Army.

Avoid using vague descriptions. Listing items like “miscellaneous” or “various goods” without specific details can weaken the credibility of the receipt.

This version reduces repetition while keeping the meaning intact.

When drafting a donation receipt template for The Salvation Army, focus on clarity and conciseness. Specify the donor’s name, date of donation, description of items donated, and estimated value. Ensure to include a statement acknowledging the tax-exempt status of the organization. Make sure the receipt aligns with local regulations to guarantee its acceptance for tax purposes. Avoid unnecessary text or complex language to keep it straightforward. A clean, well-organized format helps both the donor and the organization easily track and confirm the details.