For businesses handling returns, refunds, or price adjustments, creating a credit adjustment receipt is a straightforward way to document the change in a transaction. This receipt provides a clear record of the adjustment made to the original sale and serves as proof for both the customer and the business.

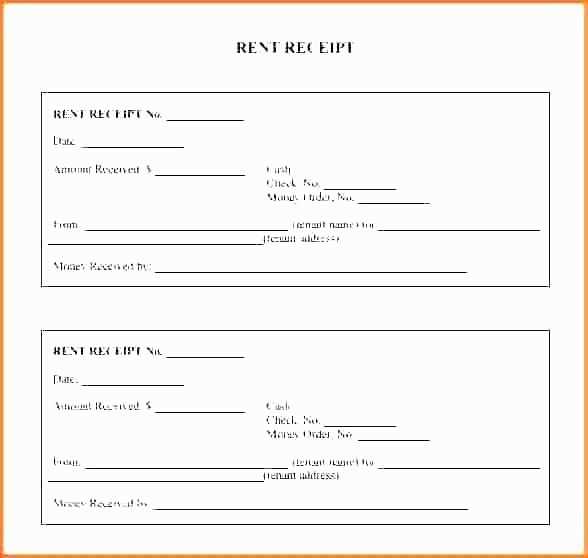

Start by including the basic transaction details, such as the original invoice number, the date of the original sale, and a description of the goods or services. The amount being credited must also be clearly stated, alongside the reason for the adjustment. Make sure to highlight the adjustment amount and mention any applicable taxes or discounts.

Next, indicate how the credit is being applied, whether through a refund, store credit, or other methods. This helps avoid confusion and clarifies the terms for the customer. Conclude by including your contact details and the business’s signature, confirming the transaction’s completion. A well-structured credit adjustment receipt ensures transparency and keeps your records organized.

Here are the corrected lines with minimal repetition:

Ensure clarity by keeping the description concise. For example, instead of repeating the same item multiple times, rephrase it with more detail. Use variations in phrasing to avoid redundancy while maintaining clear communication.

Example: “Adjust the total amount due for the invoice.” Replace it with “Correct the invoice total to reflect the adjusted amount.” This method keeps the meaning intact while varying the sentence structure.

Another tip: Keep the language professional but straightforward. Avoid over-explaining, and focus on the key points to make adjustments clear.

By reducing repetition, you ensure the document is more readable and professional.

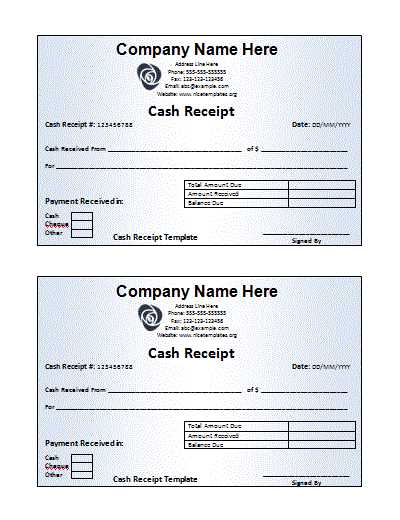

- Credit Adjustment Receipt Template

A credit adjustment receipt should include specific details to maintain clear and accurate financial records. Include the following key elements:

Basic Information

Begin by listing the business name, address, and contact details at the top. Follow this with the customer’s information: their name, address, and any relevant account number. Ensure this data is accurate and clearly visible.

Adjustment Details

Include a description of the reason for the credit adjustment. For example, you could state “Return of goods” or “Overpayment refund.” Also, specify the amount being credited and any related invoices or transactions that are being adjusted.

Clearly state the date the credit adjustment was issued. This will help track the transaction accurately in your records.

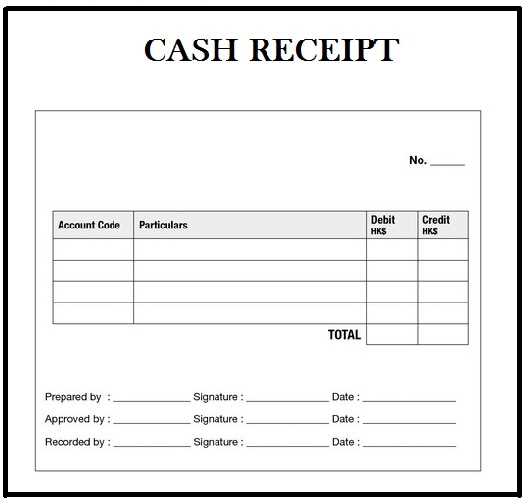

The format should be easy to understand, including a breakdown of amounts, such as taxes, fees, and the total amount adjusted. Using a table format for clarity is often a good practice.

Lastly, ensure that the credit adjustment receipt is signed by an authorized representative, providing validation to the document.

A credit adjustment receipt should include the key details for both the seller and the buyer to ensure transparency and accurate records. Start with the header containing your company name, address, and contact information. Include the date of issuance to specify when the adjustment took place.

Next, clearly identify the transaction being adjusted. List the original invoice number and the date of the original sale. This allows for easy reference to the affected transaction. Include the reason for the credit adjustment, such as a return, overcharge, or pricing error, and provide a brief description of the adjustment itself.

Ensure the amount being credited is clearly stated. Break down the adjustment, showing the total credit amount, taxes, and any applicable fees or discounts. Make it clear whether the amount is a full or partial credit.

At the bottom of the receipt, include the payment method for the credit adjustment and any notes regarding the adjustment’s application, such as whether it will be refunded or applied to future purchases. Lastly, provide contact details for any follow-up questions or disputes.

Start with the correct title to clearly identify the document as a credit adjustment receipt. The title should be specific and easy to understand, such as “Credit Adjustment Receipt” or “Credit Memo”.

Include the date the adjustment is being made. This will help both parties track the timing of the adjustment and avoid confusion regarding any changes made after the original transaction.

Clearly mention the credit amount. Specify the exact amount being credited, and ensure it’s clear whether it represents a partial or full adjustment. This avoids any ambiguity about the value of the adjustment.

Include the reference number of the original transaction. This helps link the credit adjustment to the original invoice or transaction, providing a clear connection between both documents.

Identify the reason for the credit adjustment. Briefly explain why the credit is being issued. This could be due to overcharging, returned goods, or a pricing error. Transparency helps to avoid future disputes.

List any items or services being adjusted. If the adjustment is related to specific goods or services, detail the item names, quantities, and their respective prices to make the credit clear and itemized.

Include the business or contact details of the issuing party. Make it easy for the recipient to reach out with any questions regarding the credit adjustment, so include the name, address, and contact details of your company.

Provide payment details if applicable. If the credit adjustment involves a refund, state the method of payment (e.g., bank transfer, credit card) and any other relevant payment information to finalize the adjustment process.

Ensure a clear statement that the credit is applied to the customer’s account. This will indicate whether the amount will be refunded or credited to future purchases, reducing any potential confusion.

Double-check the details before finalizing the credit receipt. Ensure the recipient’s name, address, and other relevant information match exactly what is on file. Inaccuracies can delay processing or cause confusion for both parties.

- Incorrect or Missing Credit Amount: Always verify that the amount of credit issued is correct. A common mistake is forgetting to adjust for discounts, taxes, or shipping fees. This can result in over- or under-credited amounts.

- Failure to Reference the Original Transaction: It’s crucial to include the original invoice or transaction number. Without this, the customer may not be able to trace the credit receipt to the original purchase, complicating future reconciliations.

- Not Stating the Reason for Credit: A clear explanation of why the credit is being issued helps avoid misunderstandings. Whether it’s a return, overcharge, or adjustment, always specify the reason for issuing the credit.

- Skipping Date Information: Make sure the date of the credit issuance is noted clearly. This ensures proper record-keeping and helps in case of audit or follow-up inquiries.

- Missing or Incorrect Tax Details: If applicable, include accurate tax information. This is often overlooked but can lead to confusion for both the issuer and the recipient regarding tax liabilities.

- Unclear Terms and Conditions: If the credit is subject to any limitations, such as expiration dates or specific usage conditions, state them clearly to avoid potential disputes.

Avoiding these errors will make credit receipt processing smoother and prevent future complications. Clear, accurate documentation builds trust and streamlines financial transactions for both parties.

When preparing a credit adjustment receipt, it is crucial to ensure clarity and accuracy. Always double-check the details before finalizing the document.

Key Elements to Include

Ensure you list the customer’s name, transaction date, and the reason for the credit adjustment. This helps avoid confusion and ensures the process is transparent.

Formatting Tips

Use bullet points or numbered lists to break down the credit details. This will make it easier for both you and your client to review the changes.

By following these steps, you ensure that your credit adjustment receipt is clear and concise, leaving no room for misunderstandings.